Plastics Industry Update - Q1 2020

Subscribe to Industry UpdatesPlastics Industry Update - Q1 2020

Subscribe to Industry UpdatesPlastics M&A Activity Holds Up During Q1 2020, Although Headwinds are Likely Ahead

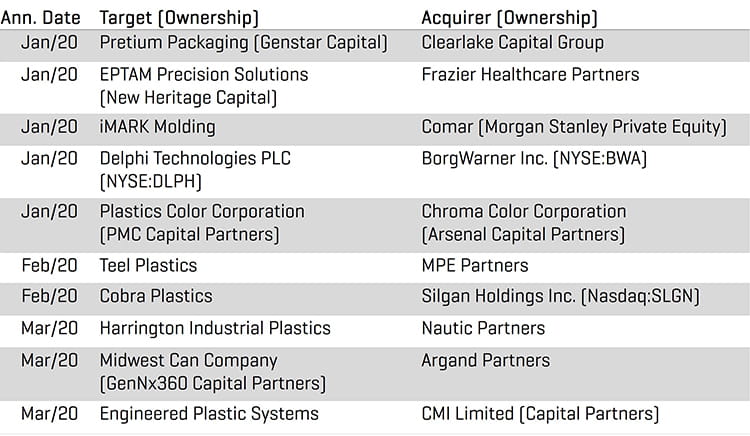

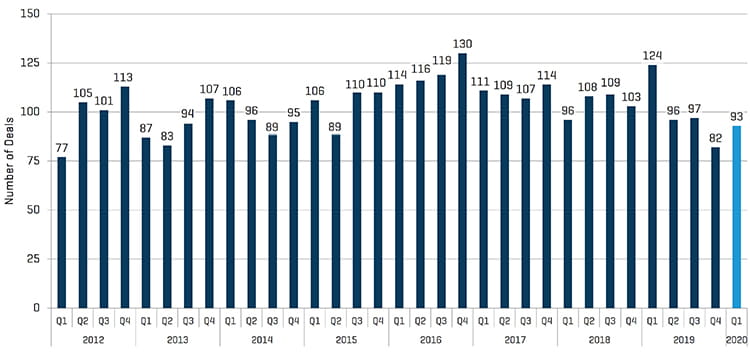

Despite the COVID-19 crisis, there were 93 plastics industry M&A transactions during the first quarter of 2020, which is generally in line with the average over the past several quarters and a 13% increase over the fourth quarter of 2019. That said, a number of factors are likely to result in a decline in M&A activity during second quarter of 2020 and possibly beyond. These factors include declining company performance in certain sectors and resulting valuation implications, as well as challenging logistics surrounding transaction due diligence, such as inability to travel. From a buyer’s perspective, there continues to be significant equity capital available for transactions from private equity groups and certain strategic buyers, although many will likely be sidelined until there is clarity on the long-term economic impact of the COVID-19 crisis before jumping back into M&A. In addition, there is currently disruption in the credit markets, which may result in reduced availability of debt financing for transactions in certain cases. Finally, we are likely to see an increase in special situation transactions involving companies struggling with liquidity, debt maturities, covenant issues, and overall performance declines.

Key Q1 2020 Themes

- Significant disruption on all levels of business and society due to the COVID-19 crisis

- Relatively strong plastics industry M&A activity in the first quarter, although headwinds are likely for the remainder of 2020

- Many private equity and strategic buyers are open for business with capital to invest, although certain groups may be on the sidelines in the near-term

- Continued low cost of capital for transactions, although uncertainty exists around availability of debt financing

- Special situations M&A is expected to increase

- Most plastics industry manufacturers are expected to experience some level of financial performance disruption, with consumable medical and consumer faring better than discretionary products

- Historic declines occurred in the stock market and with crude oil prices

- Possible downward pressure on certain resin prices given lower demand for certain products and lower feedstock costs

- Significant negative impact on key macroeconomic indicators, including consumer confidence and unemployment

Stout Proprietary M&A Database Highlights

Buyer and Seller Trends: Strategic and hybrid buyer activity led the charge in the first quarter of 2020, with a 42% and 10% increase, respectively, compared with the fourth quarter of 2019, while financial buyer activity decreased 36%. On the sell side, private seller transactions represented the vast majority of activity in the first quarter of 2020, increasing 49% as compared with the fourth quarter 2019, while private equity and corporate seller activity decreased 50% and 5%, respectively.

End Market Activity: M&A activity within industrial plastics, the largest end market segment, increased 17% during first quarter of 2020 versus the fourth quarter of 2019, while the second largest segment, plastic packaging, was flat. Within the industrial plastics segment, extrusion and resin/compounding were particular bright spots. While smaller segments within plastics M&A, medical and automotive activity also increased 40% and 25%, respectively, during the first quarter of 2020 versus the fourth quarter of 2019.

Activity by Process: M&A activity involving seven out of the 10 plastic processes tracked by Stout were flat or up during the first quarter of 2020 versus the fourth quarter of 2019. Bright spots for the quarter included resin/compounding, extrusion, rotational molding, machinery, and tool & die.

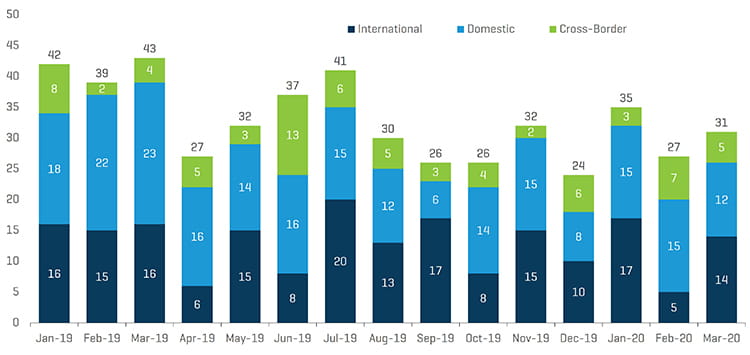

Activity by Geography: All three geographic categories saw an increase in plastics M&A activity during the first quarter of 2020 with cross-border, domestic, and international activity increasing 25%, 13%, and 9%, respectively, as compared with the fourth quarter of 2019. Within the U.S. market, plastics M&A activity saw the biggest gains in the industrial and medical end markets, as well as the resin/compounding and extrusion segments.

Quarterly Plastics M&A Volume

Source: Stout and various sources

Monthly Plastics M&A Volume by Geography

Source: Stout and various sources

Market Trends

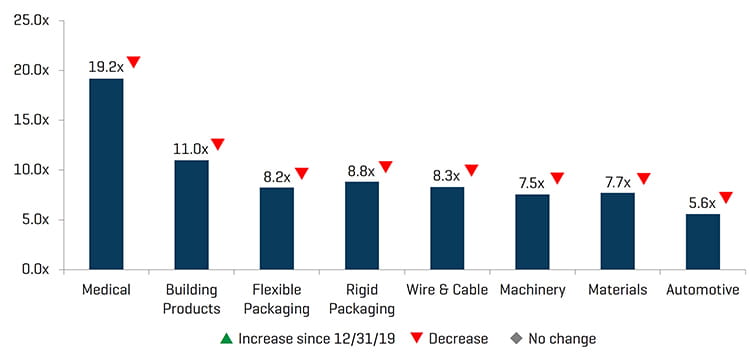

Plastics Industry Multiples: After a bull market that has lasted for over 10 years, the U.S. stock market saw one of the worst quarterly declines in history. For the first three months of 2020, the Dow was down approximately 23%, while the S&P 500 and Nasdaq were down 20% and 14%, respectively. Within the plastics industry, all eight plastics industry sectors that Stout tracks were down for first quarter of 2020. Automotive and building products saw the largest decline in value (approx. 39% each), while medical saw a smaller 15% decline. Generally speaking, plastic sectors that manufacture consumable products for medical or consumer fared better than sectors that manufacture discretionary products.

Commodity Prices: Large historical price drops also occurred for crude oil and natural gas, which declined 67% and 25%, respectively, during the first quarter 2020. Pricing for both commodity and engineering grade resins was mixed during the first quarter, although the market could see downward pressure on prices over the next few quarters given lower feedstock costs and lower demand for certain plastic products.

Macroeconomic Metrics: Key macroeconomic indicators such as GDP, consumer confidence, and unemployment also were severely impacted during first quarter of 2020. The long-term impact continues to be unclear given the uncertainties surrounding the COVID-19 crisis.

EBITDA MULTIPLES (MEAN)

Source: Capital IQ and Proprietary Stout Indices

Q1 2020 TRANSACTION HIGHLIGHTS