Tire Distribution & Manufacturing Industry Update - Q3 2020

Subscribe to Industry UpdatesTire Distribution & Manufacturing Industry Update - Q3 2020

Subscribe to Industry UpdatesTire M&A on the Rise After Initial Pandemic Shock

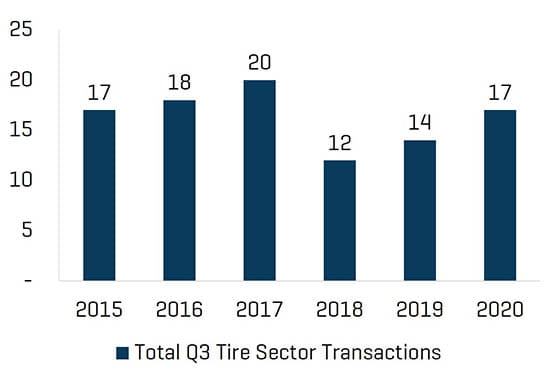

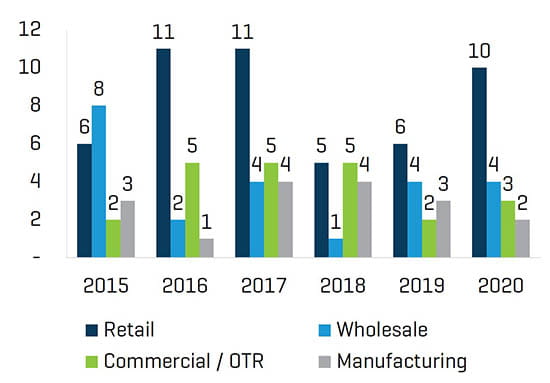

Third-quarter M&A activity broke higher from what was an extremely subdued and uncertain second quarter. Retail drove the bulk of transaction activity in a sector which saw demand return and retailers drive significant business via necessary replacement tire and maintenance service spend during the quarter.

The highlight of the quarter is Meritage Group’s – an investment advisor with over $12 billion of assets under management – acquisition of Les Schwab Tire Centers in September. Despite delays in the transaction due to COVID-19, it was anticipated within the industry that Les Schwab would have particular appeal to the family office and institutional investor universe given the business’ legacy, strength of brand, management continuity, and market position.

The Wholesale sector also showed activity with Australia’s largest independent wholesaler – Tyres4U Pty. Ltd. – acquired by publicly listed National Tyre & Wheel Limited.

Tangentially, we note meaningful upticks in activity within the electric vehicle space and the car wash segment, signaling strength throughout the broader automotive aftermarket sector. These positive trends, among others, have helped buoy valuations through an otherwise difficult M&A environment, and also underpin our expectations for continued activity into the fourth quarter, barring any shutdowns or related business closures resulting from the pandemic.

Key Takeaways:

- Retail transactions drove activity in the quarter, with the return of a “mega” transaction in Meritage’s acquisition of Les Schwab

- The third quarter saw a rapid acceleration in improving business conditions across the Retail and Wholesale sectors, as consumer purchases and vehicle maintenance delayed in the second quarter necessarily came through

- Commercial remained steady as expected, given the “essential” end markets the sector serves

Historical M&A Trends by Period / Sector

Total Transaction Count

Note: Double-count of transactions which are included in multiple industry sub-sectors/categories, have been removed.

Transactions per Sector

Note: For the 3-month period from July 1 – September 30 for each of the years listed above.

Retail

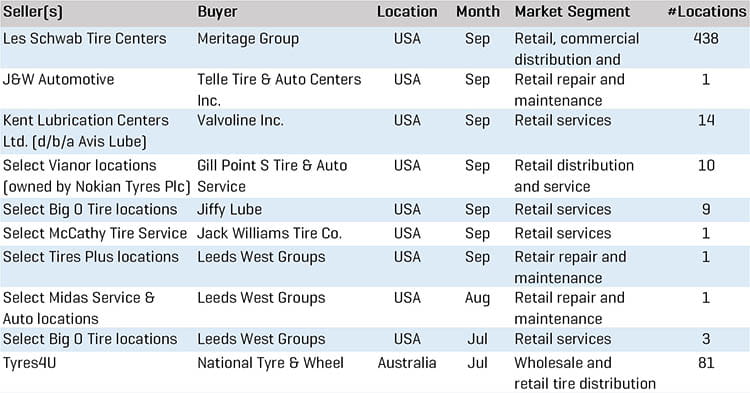

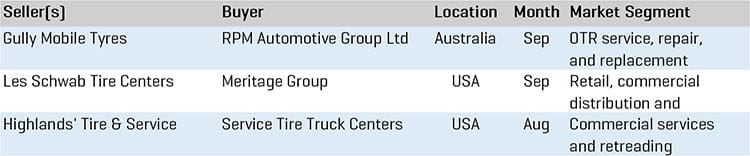

Retail M&A Transactions - Q3 2020

Meritage Group

- In September, investment firm Meritage Group L.P. announced its acquisition of Bend, OR-based Les Schwab Tire Centers. Ranked as the nation’s sixth-largest retail tire dealership with 438 locations across more than10 states, Les Schwab is not only a retail powerhouse, but is also considered one of the top U.S. commercial tire dealerships and truck tire retreaders. Both companies have indicated that the Les Schwab management team is expected to remain in place post-acquisition, positioning the acquiree for a seamless ownership transition followed by subsequent operational initiatives designed to improve profitability over the near term.

Leeds West Groups

- Greenwood Village, CO-based Leeds West Groups (LWG) announced the acquisitions of select Tires Plus, Midas Service & Auto, and Big O Tire locations throughout the third quarter. Founded in 2009, LWG operates across all segments of automotive aftermarket repair, with footholds in general repair, tire repair and services, and quick lube services. Since inception, LWG has expanded significantly and now boasts more than 105 locations across 18 states with approximately 1,000 employees across all franchises. LWG has been touted as one of the fastest-growing ownership groups in the industry. Thanks to its robust 2020 acquisition activity to-date, the group now ranks among the top 15 dealerships in North America.

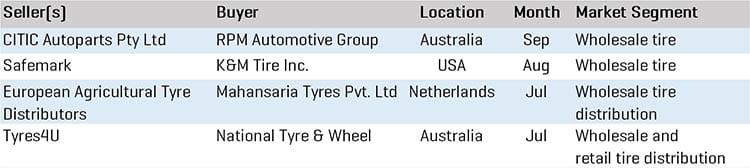

Wholesale

Wholesale M&A Transactions - Q3 2020

National Tyre & Wheel Limited (ASX:NTD)

- In July, Australia-based National Tyre & Wheel Limited announced its acquisition of the leading wholesale tire distributor Tyres4U Pty. Ltd. (“Tyres4U”) through a mix of cash and shares issuance in a deal valued at AUD $48.8 million. Tyres4U’s wholesale operations encompass 12 locations across Australia, as well as three locations in New Zealand. In addition to its wholesale business, Tyres4U also operates 32 company-owned stores and 34 licensed Tyreright locations primarily servicing the retail segment. NTD cites a broadening product mix, enhanced scale, and increased geographic reach as catalysts underpinning the acquisition. The combined operation creates one of the largest tire wholesalers in Australia and New Zealand, and the largest independent, multi-branded wholesaler in both countries.

Commercial / OTR

Commercial / OTR M&A Transactions - Q3 2020

Service Tire Truck Centers

- Service Tire Truck Centers (STTC) announced its acquisition of the commercial assets of Carlisle, PA-based Highlands’ Tire & Service (“Highlands’ Tire”), in August. Founded in 1943 and family-owned since inception, Highlands’ Tire’s commercial assets consist of three sales and service locations, as well as a Michelin Retread Technologies (MRT) retread plant. The acquisition expands STTC’s presence across the Mid-Atlantic and Northeastern region to 53 commercial service and mechanical locations and five retread plants. Bethlehem, PA-based STTC now ranks as the second-largest MRT retreader, seventh-largest commercial dealership, and ninth-largest commercial truck tire retreader in the U.S.

Manufacturing

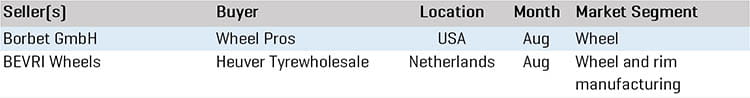

Manufacturing M&A Transactions - Q3 2020

Wheel Pros

- In August, Clearlake Capital-backed Wheel Pros LLC, an automotive aftermarket wheels manufacturer headquartered in Denver, announced its acquisition of Borbet Alabama’s alloy wheel plant, formerly operated by Borbet GmbH of Hallenberg-Hesborn, Germany. The Auburn-based facility will be converted to an aftermarket cast wheel production center and is expected to create more than 300 full-time jobs. Offering more than 300 custom wheel styles, Wheel Pros serves over 10,000 retailers with a robust distribution network spanning North America and Australia. Randy White, CEO and co-founder of Wheel Pros, believes the acquisition further positions the company as a leader within the automotive aftermarket, and “provides us with full control of the entire manufacturing process, ensuring that our customers receive nothing but the best quality products.”