Plastics & Packaging Industry Update - 1H 2018

Subscribe to Industry UpdatesPlastics & Packaging Industry Update - 1H 2018

Subscribe to Industry UpdatesPlastics Industry M&A Activity Remains Solid in 1H 2018

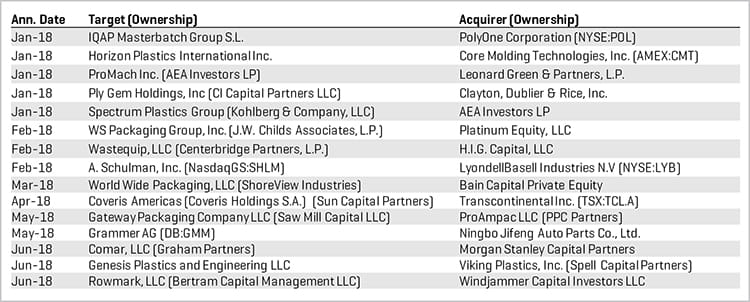

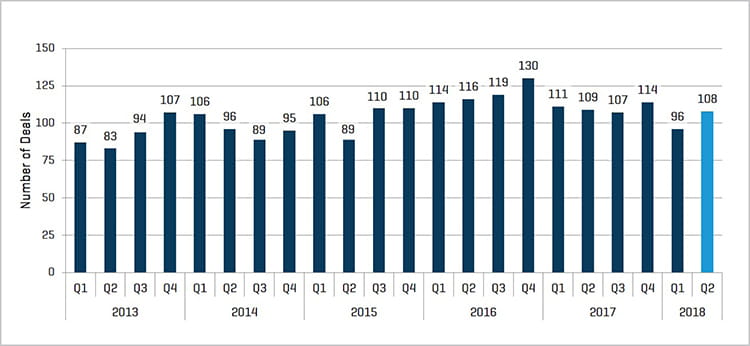

Medical plastics and plastic packaging M&A activity led the charge during the first half of 2018, increasing 28% and 11%, respectively, year over year (YOY). Other bright spots included an increase in tool and die, thermoforming, and machinery transactions, which all increased YOY. In addition, there was a significant increase in overall plastics transactions involving hybrid buyers (strategic buyers owned by private equity firms), which increased 45% YOY. Overall, global plastics industry M&A activity declined 7% during the first half of 2018, YOY, driven primarily by fewer industrial plastics transactions and lower M&A volume for three of the key process segments – injection molding, extrusion, and resin/compounding. There were also fewer domestic and cross-border transactions during the first half of 2018. Most of the decline occurred in the first quarter, which had 96 total transactions, while second quarter rebounded with 108 transactions, which is more in line with the previous 10 quarters.

Key 1H 2018 Themes

- Continued strong overall plastics industry M&A activity and demand

- Stock market and overall valuation levels remain at or near all-time highs

- Continued low cost of capital and high level of availability

- Key macroeconomic indicators remain strong

- Medical plastics and plastic packaging transactions increased

- Private equity sales and corporate carveouts of plastics businesses increased

- Tool and die, thermoforming, and machinery saw increased M&A activity

- International plastics M&A activity increased

Stout Proprietary M&A Database Highlights

Buyer and Seller Trends:

Hybrid buyers led the charge during the first half of 2018, posting a 45% YOY increase in plastics M&A activity. Both strategic and private equity buyer activity was lower during the first half, decreasing 20% and 15%, respectively, YOY. On the sell side, private equity firms continue to be active with sales of plastics companies increasing 17% YOY during the first half. Private seller (the largest seller segment) and corporate carveout activity was down 14% and 5%, respectively, YOY during the first half.

End Market Activity:

Medical plastics and plastic packaging M&A activity increased 28% and 11%, respectively, YOY. There continues to be strong demand for medical plastics businesses, while plastic packaging M&A activity continues the positive momentum achieved during 2017. Industrial plastics, the largest end-market segment, and automotive plastics M&A activity decreased 21% and 11%, respectively, YOY.

Activity by Process:

M&A activity involving seven out of the 10 plastic processes tracked by Stout were flat or declined. Bright spots for the first half included tool and die, thermoforming, and machinery transactions, which increased 35%, 15%, and 10%, respectively, YOY.

Activity by Geography:

International plastics M&A activity increased 5% YOY during the first half, while cross-border and domestic activity decreased 29% and 9%, respectively, YOY. Within the U.S. market, plastics M&A activity increased for medical plastics and tool and die transactions, while private equity sellers and hybrid buyers were active.

PLASTICS M&A VOLUME

Source: Stout and various sources

Market Trends

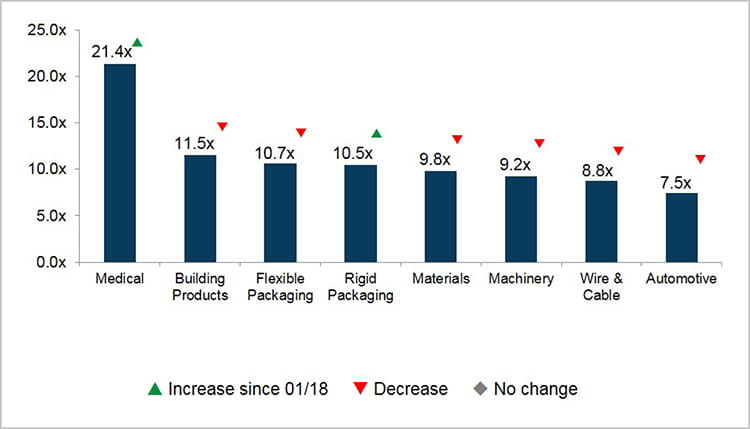

Plastics Industry Multiples:

Overall stock market performance continued to be at or near all-time highs during the first half of 2018, though performance of the major market indices was mixed. For the first six months of 2018, the Dow Jones Industrial Average was down 1.8%, while the S&P 500 and Nasdaq were up 1.7% and 8.8%, respectively. Within the plastics industry, all public company segments continue to maintain relatively high valuation levels, though six out of eight plastics industry sectors that Stout tracks ended slightly down for the first half.

Macroeconomic Metrics:

Key macroeconomic indicators, including gross domestic product, consumer confidence, unemployment, and other metrics remained strong during the first half. Capital markets continue to be favorable for M&A activity, and there remains a relatively low cost of capital environment. Crude oil prices increased 23% during the first half, while natural gas prices were down 20%. Resin pricing in general has shown mixed results for the year.

EBITDA MULTIPLES (MEAN)

Source: CapitalIQ and Proprietary Stout Indices

1H TRANSACTION HIGHLIGHTS