Following the Money

Following the Money

What investment activity can foretell about the future of the tire industry.

To say that the tire industry has experienced a period of disruption is a vast understatement. For the past three years, the industry has seen a torrid pace of mergers and acquisitions (M&A) and a few choice mega-deals radically transform market dynamics. While the pace of overall M&A activity has regressed to its historic mean this year, the impact of past transactions is felt today.

Following the money can serve as a valuable barometer to help predict where the industry is headed. Interest in the tire segment from private equity, institutional investors, and strategic acquirers remains high. The opportunities to achieve economies of scale through consolidation and to streamline processes and operations by modernizing the customer experience that drove market activity in 2017 and 2018 have yet to evaporate.

Retail, wholesale, commercial, and manufacturing channels are still experiencing unprecedented transformation, as a new integrated, electronic, and innovative global tire industry emerges.

Looking Back to Look Forward

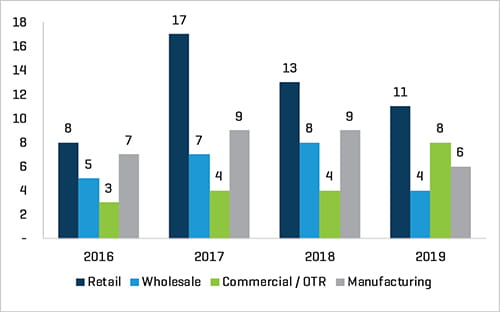

Both 2017 and 2018 were record years of M&A activity within the tire industry as large institutional investors – Bain Capital, Icahn Automotive Holdings, Golden Gate Capital, and Berkshire Hathaway, among others – made aggressive moves to consolidate a fragmented market across retail, wholesale, and commercial segments. This heavy investment foretold a period of consolidation that continues to this day.

For private, family, and entrepreneur business owners, healthy – even elevated – valuations coupled with a challenging reinvestment market (high stock prices, low interest rates, and bond yields) made for a unique selling proposition. EBITDA [earnings before interest, taxes, depreciation, and amortization] multiples were high enough to provide sellers with upfront cash versus extended payouts and compensate for lost income over time. The result was some 130 transactions in 2017 and 2018 across all tire sectors.

While the pace of investment and consolidation slowed a little in 2018, two tectonic moves shuddered the wholesale market, the aftershocks of which can still be felt today. Bucking conventional wisdom at the time, Michelin and TBC (Sumitomo) first, then Goodyear and Bridgestone, forged new alliances and launched homegrown wholesale operations, abruptly driving wholesale industry leader American Tire Distributors into restructuring mode later in the year.

This cataclysmic shakeup created opportunities for regional wholesalers to establish new relationships with manufacturing partners and customers alike. In response, retailers rethought their supplier relationships – adding new suppliers or consolidating existing relationships, and seeking ways to stay ahead of the technology curve, enhance margin, and enhance control of the channel and pricing. Several key retailers made the move, either directly or as an installer partner, into the burgeoning retail e-commerce marketplace.

Figure 1. Transactions Per Sector

Source: Stout Research

For private, family and entrepreneur business owners, healthy — even elevated — valuations coupled with a challenging reinvestment market (high stock prices, low interest rates, and bond yields) make for a unique selling proposition. With investment interest high, the opportunity for retail, commercial, and wholesale operators to cash out is still well above historic norms.

What Comes Next

If past can be considered prologue, the global market is still ripe for investment, consolidation, and modernization across retail, wholesale, commercial and manufacturing sectors. While the pace of change has normalized, the fundamentals that attracted private equity, institutional investors, and strategic acquirers to the segment in record numbers the past three years remain intact.

Retail Consolidation

Despite a booming economy, organic growth in the retail tire market remains soft. These slow-growth market conditions continue to attract investment interest. The opportunity for consolidators to build and grow contiguous retail networks to attain synergies and scale makes almost any retail operation a potential acquisition target.

Furthermore, we expect continued integration of e-commerce into both the physical retail and wholesale segments, as total market access integrates with the regional install base streamlining the purchase, delivery, and install process for customers.

The potential for large, transformative deals remains, as the major retailers look to expand and consolidate footprints, and regional, privately held companies take advantage of the current M&A environment. This may be driven further by the lack of succession planning in many family- and entrepreneur-owned retailers combined with a favorable deal environment.

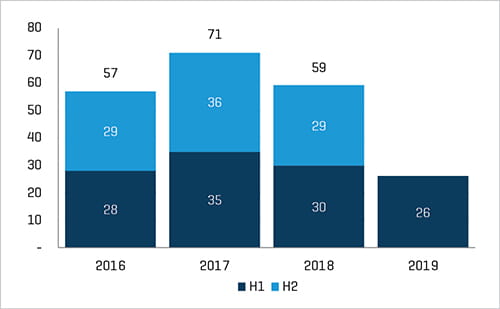

Figure 2. Total Transaction Count

Source: Stout Research

Surging interest from large institutional investors and strategic acquirers to consolidate a fragmented market have driven transaction activity within the tire industry to unprecedented levels.

Wholesale Alliances

The impact of major global transaction activity in the wholesale sector in 2018 is still being felt today. Growing regional players and joint ventures between former competitors have changed the landscape significantly. Financial sponsors continue to seek opportunities to capitalize on these macro shifts.

We anticipate regional consolidation activity to continue in North America as wholesalers with $150 million in revenue or less continue to be absorbed into larger wholesale networks. There remains potential for transformative transactions (more than $150 million in revenue) as the larger regionals and the upper end of the market seek opportunities to offset flat-to-slow organic growth, attain the benefits of added scale, and take advantage of the segment upheaval experienced over the past 18 months.

We also expect manufacturers will continue to stick with their core business and create alliances, joint ventures, and other arrangements to increase branded product availability and achieve greater scale and control over the wholesale channel.

Commercial/OTR Focus on Fleets

In 2018, the commercial/OTR segment activity was defined by the continued spin-off of Michelin’s TCi Tire Centers to regional partners in the U.S. Bridgestone’s GCR operation is following a similar track in 2019. Look for travel center operators to continue to actively expand retreading, commercial distribution and service offerings organically and via acquisition, in addition to regional consolidation by the strong mid-size players.

Manufacturing Moves

Following a year in which Michelin acquired Camso, and Kumho sold a significant equity stake in its business to avoid bankruptcy, we expect manufacturers to focus on improving core operations and picking up product lines and brands where possible. Therefore, specialty manufacturers will continue to be prime targets for acquisition by their larger global brethren, while initiating and expanding partnerships with large distribution networks becomes a top priority to maintain and build market share.

The Bottom Line

As an active participant in scores of tire industry transactions for the past decade, we believe there has never been as much interest or activity as we have today. As the automotive industry in general transforms, the opportunity exists for many industry players to become innovation platforms.

The consolidation we are seeing today, the evolution of tire technologies, the rapid adoption of e-commerce by both consumers and the industry as a streamlined delivery method, and the investment interest in the industry portends a healthy future for the tire segment. Smart investors don’t sink money into shrinking industries. Rather, they try to catch lightning in a bottle. Judging by the investment activity in the tire market over the past several years, the storm is coming.

This article originally appeared in the “2019 State of the Industry” supplement published by Tire Review magazine.