Auction Addiction or Alternative Deal Making Avenues?

Auction Addiction or Alternative Deal Making Avenues?

We look at the surge in M&A auction volume and when alternatives may better serve business owners looking to sell.

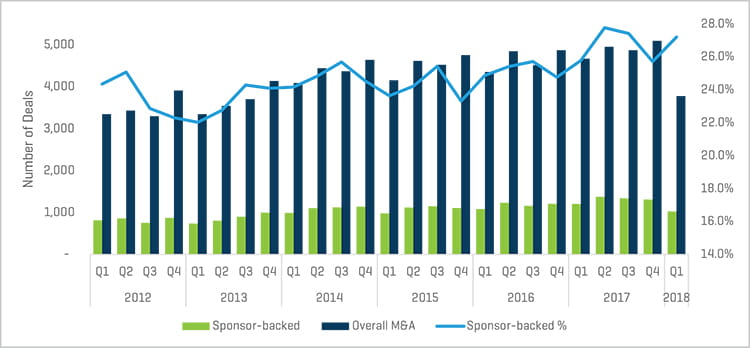

The broad, cleanly executed, deadline-driven auction sale process is now synonymous with merger and acquisition (M&A) investment banking in the middle market. And as evidenced by recent data, private equity (PE) is controlling a growing share of the middle market each year (Figure 1).

Figure 1. Sponsor-Backed Percentage of Total M&A

Source: White & Case M&A Explorer

Auctions Are Hot, but Are They the Best Option?

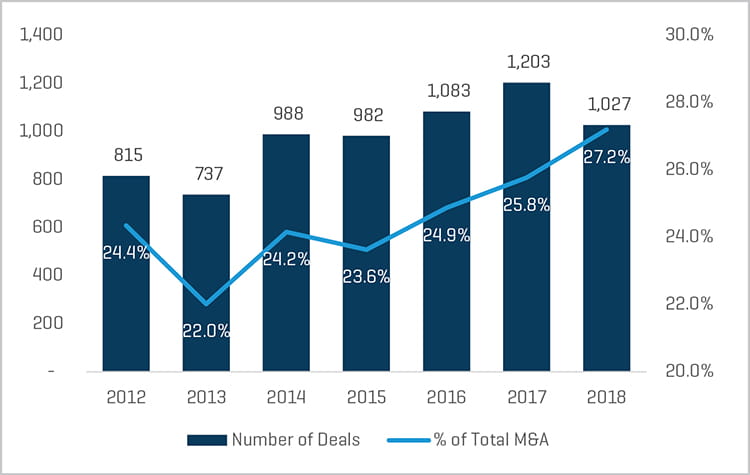

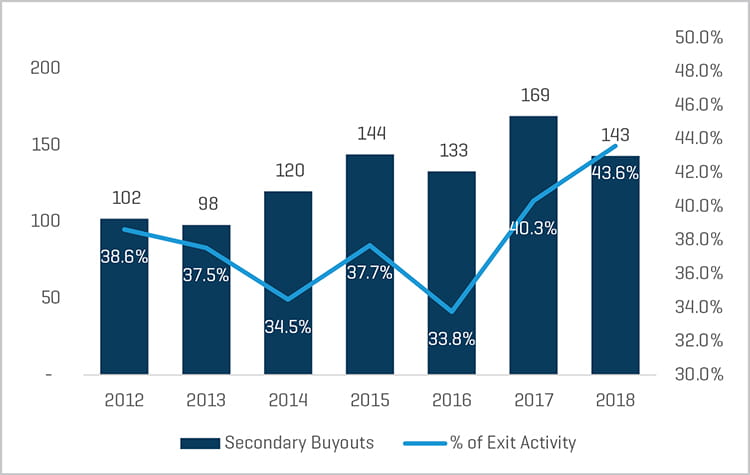

In the first quarter of 2018, PE accounted for 27.2% of all M&A transactions (Figure 2). During this time, PE also played a significant role in secondary transactions; PE firms were the acquiring parties of over 40% of companies backed by other PE firms pursuing a sale process (Figure 3). With the increase in PE participation, an auction is often the preferred process for most PE exits.

Figure 2. Q1 Sponsor-Backed M&A

Source: White & Case M&A Explorer

Figure 3. Q1 Secondary Buyouts – Percentage of Total Exits

Source: White & Case M&A Explorer

Generally, the high volume of auction processes means that the middle market is becoming more efficient and streamlined. In addition, as PE firms with excess dry powder look for quality deals, information memorandums are being compiled to a higher standard, and companies are being more thoroughly reviewed before being taken to market (as evidenced by the large increase in sell-side diligence over the past few years). Buyers are also encouraged and often able to provide quicker, more concise feedback to investment bankers and sellers after reviewing the target business inside the bounds of the auction process. We believe each of these factors carry weight, where appropriate.

As a result of the popularity of the auction process, bankers may be taking a more routine approach to the sale of a company, using less creativity in designing and executing a sale process. Or they may be simply operating under the assumption that the way to win a mandate is to convince a seller that “broad is best” and pin a traditional pitch to this mantra.

In the vast majority of company exits from PE portfolios, institutional sellers expect their banker to execute the auction professionally and efficiently, and in turn, pay retainers and success fees for this service. Similarly, investment bankers in touch with the market pitch a broad auction as a fait accompli and as the optimal way to achieve:

- The generation of adequate competitive tension for market-clearing value

- Maximum efficiency

- Optimal structure

In a PE-sponsored sale process, the company being sold typically has been groomed for sale by the sponsor over a period during which necessary changes or improvements were implemented. At a high level, these changes may include upgrading or optimizing the financial reporting function, a brand accounting firm conducting annual audits, implementing necessary management moves, performing a quality-of-earnings analysis, and directing the business’ strategy to suit either a set of known strategic buyers or a larger PE firm that can acquire and continue to squeeze returns out of the company.

With the right setup, seller profile, and motivation, an auction makes a lot of sense as a strategy for optimizing the sale process outcome.

Alternative Strategies to Auctions

When conditions are not ripe, or seller goals and resources do not allow for an effective auction process, an advisor must possess the foresight and skill to consider alternative strategies for pursuing and successfully completing a transaction on behalf of the client. The conditions driving a strategic change may include the following:

- A seller who has no intention of meeting or the desire to meet more than a few buyers and sit through multiple management meetings and presentations

- A seller who does not wish to hire a sell-side investment banker, despite the potential benefits associated with doing so

- A company that is not optimized, or is not optimizable, to be auctioned

- A resource-constrained company (there could be many conditions, including financial reporting, management, systems, and time resources)

- A seller who was burned in a previous attempted sale and is gun-shy about dedicating further resources and time to a sale in the absence of a buyer being brought to his or her door

- A company that clearly and obviously has very few natural buyers, possibly including permanent structural factors that may not only prohibit the business appealing to a broader market but also could inflict damage upon the company if it is broadly exposed via an auction

- Sellers who are very conscious of confidentiality and the potential breaches that may occur in a broad auction process

These situations are perhaps some of the most frequently encountered. Many apply to family- and entrepreneur-owned businesses, longer-held businesses owned by PE firms in vintage funds, certain family office investments, carve-outs, unique businesses, or businesses in specific industries that may not be conducive to auctions.

In the cases above, business owners should, in conjunction with their advisors, explore alternative sale strategies, which may include the following:

The limited auction. This is a tightly controlled sale process that is typically deadline-driven, but involves only a select group of buyers hand-picked by the seller and the seller’s advisor. Often, the buyer group involves strategic and PE buyers; however, there is usually an angle or rationale why a party is short-listed when such a strategy is employed. Relevant for situations 1, 3, 4, 6, and 7 above.

Proprietary negotiation. This is an approach in which the seller and the seller’s advisor position the business and tailor the marketing materials (if any) and narrative to a specific buyer (possibly more than one buyer, but typically fewer than a handful). The seller and the seller’s advisor engage the buyer(s) directly, look to build a relationship (or build upon an existing relationship), and partake in detailed discussions about the seller’s needs and why the buyer is the right fit. In this approach, time is often spent on negotiating the details directly between the parties instead of the market driving the process. Relevant for situations 3, 4, 5, 6, and 7 above.

Utilization of an investment banker’s buy-side relationships. In a situation when the seller does not want to go to market or engage an advisor but still wants to opportunistically or otherwise explore a sale of the company, an investment banker with deep industry relationships may propose advising the buyer and subsequently initiating discussions between the buyer and the seller. Relevant for situations 1, 2, and 5 above.

Multiphase, flexible sale process. A situation may at first call for a specific sale strategy and then require the seller and the seller’s advisor to switch gears partway through the process. This may be due to changing market conditions, changing circumstances within the subject business, a better gauge of the market once a process is begun, or an initial misdiagnosis of the original strategy employed. What begins as an auction may become a proprietary negotiation and vice versa depending on the conditions affecting the sale process. Relevant in any situation above.

Actions for Business Owners

Ultimately, sellers should take the time to properly assess the factors driving their decision to sell, in line with their goals and deployable resources, before choosing the right strategy for the optimal result. This assessment should be conducted internally and in conjunction with their investment banker to ensure that all bases are covered, all primary goals can be met, and the strategy tailored and employed is the right one for the situation.

The right investment banker can offer invaluable market knowledge and experience as part of the planning process and can help gauge the full spectrum of options available to a seller. A quality banker should also be flexible enough to shift or redeploy the strategy if the original process needs to change direction, or market forces dictate a necessary shift in strategy.