The Taxing Side of Divorce: Addressing the Issues During Negotiations

The Taxing Side of Divorce: Addressing the Issues During Negotiations

Addressing potential tax issues during discovery and negotiations can avoid problems both in the year of divorce and the following year and can ensure that neither party receives an unfair allocation of tax benefits. Remember – there can be significant value to tax benefits that should be considered along with other marital assets. Most divorcing couples are aware of the advantage of taking the personal exemptions for their children and address this in the Judgment of Divorce or Settlement. This article will discuss some of the other issues too often overlooked during settlement negotiations.

Income Accrued During the Marital Period

When income producing assets are divided pursuant to a divorce, the income earned during the part of the year when the parties were still married is transferred along with the asset. Whose responsibility is it to pay the taxes on this income? If the asset is jointly owned, the parties will each be responsible to report 50% of the income earned during the marital period. If the asset is owned solely by one party, that party will be responsible to report 100% of the income earned up to the date of the marriage even if the asset, along with the accrued income, is transferred to the other party.

Example: Husband and Wife each have investment accounts in their individual names. As of the date of divorce, Wife’s account contained $15,000 in dividends and interest earned in the current year. Per their agreement, Wife transferred her investment account, which included the $15,000 earned prior to the date of divorce, to her Husband. Wife will be taxed

on the $15,000 (even though she transferred the funds to Husband) and Husband will pay tax on any income generated after the transfer.

Practice Tip: Carefully review income earned prior to the date of divorce to ascertain the proper tax treatment and to make

any adjustment necessary to treat both parties fairly. Remember “tax tracks with title” and cannot be assigned by agreement of the parties.

Credits Related to Children

In addition to the deductions for personal exemptions for children, there are four child-related credits:

- Child Tax Credit

- Credit for Childcare Expenses

- Exclusion for Dependent Care Benefits

- Earned Income Credit

Unlike the personal exemption, these credits cannot be assigned by agreement of the parties. The proper tax treatment of these credits is determined by IRS regulations. Only the custodial parent, that is the parent who has the child more the 50% of the time, can take the childcare credit, the exclusion for dependent care benefits, and the earned income credit. The child tax credit can only be taken by the party claiming the personal exemption for that child.

Example: The children reside primarily with Mother who agreed to waive her right to take the personal exemptions for the children. In this case, Father would be entitled to the exemptions and the child tax credit. Mother would be eligible to the credit for childcare expenses, the exclusion for dependent care benefit, and the earned income credit, if applicable.

Practice Tip: Include a discussion of the above benefits when determining whether the custodial parent will waive the right to the personal exemptions for the children.

Mortgage Interest and Property Taxes

Most married couples are joint owners of the marital residence. If the parties divorce in the middle of a tax year, the judgment or settlement agreement should clearly define who will be entitled to take the deduction for the mortgage interest paid during the marriage, and in what proportion, to avoid filing inconsistent returns. Likewise, property taxes paid during the marriage should be allocated equitably between the parties.

Following a divorce, the marital home is often held as tenants in common. Under these circumstances, only the person who actually pays the mortgage is entitled to the deduction.

Example: Pursuant to their agreement, Husband was obligated to make 100% of the mortgage payments on the marital home which was held as tenants in common. Husband would be entitled to deduct only 50% of the qualifying mortgage interest expense. In this situation, it may be advisable to designate the other 50% of the mortgage payments as deductible alimony. Wife would then be eligible to deduct the other 50% of the payment as mortgage interest expense.

However, if the entire interest in the marital residence is transferred to one party as part of the settlement, only that person can take the mortgage interest deduction.

Property Taxes

Estimated Tax Payments and Withholding. If spouses have made estimated tax payments during the year of divorce, either party can claim all of the payments or the payments can be divided between the parties per agreement and need not be divided equally. If the spouses cannot agree on a division, each party can claim the amount of the estimated tax equal to the amount of tax shown on his or her separate return for the year of divorce, divided by the total of the tax shown on each of their separate tax returns filed for the year of divorce.

When claiming any of the payments on a tax return, the taxpayer must enter the former spouse’s social security number in the space provided on Page 1 of the 1040. If the taxpayer has remarried, the former spouse’s social security number followed by “DIV” must be entered to the left of the line on which the payments are reported.

Example: Parties made estimated payments of $5,000 each in April and June of 2011 and were divorced July 1, 2011. No agreement was reached regarding the application of the $10,000 in estimated payments. Wife’s 2011 separate return showed total tax of $10,000 and Husband’s 2011 tax return showed tax of $20,000. In the absence of an agreement, Wife would be entitled to $3,333 of the estimated payments and Husband would be entitled to $6,667.

Practice Tip: The $10,000 estimated payments were presumably made from marital funds and should be treated as a marital asset. Be sure to address the allocation of the estimated payments in the Settlement Agreement or Judgment of Divorce and, if the payments are not divided equally, consider whether there should be a compensating payment to the spouse receiving the smaller share.

Taxes withheld from wages will be reported on the taxpayer’s W-2 and can only be claimed by the taxpayer named on the W-2. If one or both of the parties has withheld taxes far in excess of the amount required to pay the current year taxes, this may be considered a “hidden” asset that could properly be considered a marital asset subject to division.

Practice Tip: Obtain copies of both parties’ most recent pay stubs showing year-to-date earnings and year-to-date withholding. A review of these documents will reveal if there has been substantial over-withholding by one of the spouses to the detriment of the other.

Refunds and Deficiencies

If the parties have not filed their final joint return at the date of divorce, be sure to ascertain if there will be a payment due with the return or whether a refund will be issued. In addition, be specific as to who will bear the responsibility for any tax due and who is entitled to the refund (any refund check will be issued in joint names). If a refund is to be applied to the subsequent tax year, the amount allocated to each party should be clearly defined during negotiations. The parties can divide the overpayment in any percentage but cannot claim more than the total overpayment on their combined separate returns in the following year.

Loss Carryovers

Net operating losses. Net operating losses (NOL) from the operation of a business may be carried back to the prior two years or carried over to the succeeding 20 years as a net operating loss deduction. If the parties filed a joint return for each year involved in figuring NOL carrybacks and carryovers, the NOL is treated as a joint NOL. Each spouse may carry over to his or her separate return his or her share of the NOL.

Capital Loss Carryovers. Losses from the sale of capital losses are allowed to offset gains from the sale of capital assets or, if there is a net loss from such sales, deductible against ordinary income to a maximum of $3,000. Any capital losses not deductible due to the $3,000 maximum may be deducted in subsequent years until fully utilized.

If separate returns are filed after a net capital loss was reported on a joint return, the carryover is allocated to each taxpayer based on his or her net losses for the preceding taxable year. If the losses were incurred jointly, the losses are divided equally. Thus, each party may carry his or her half of the loss to the following year.

Example 1 A couple reported a net short-term loss carryover of $50,000 and a net long-term loss carryover of $75,000 on their joint 2010 return. Their investments had always been held in a joint brokerage account. The parties were divorced in 2011. Each party will be entitled to carry over short-term losses of $25,000 and long-term losses of $37,500 to his or her respective 2011 return.

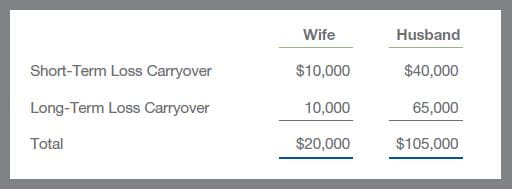

Example 2 Assume the same loss carryovers as above.

However, the parties maintained separate brokerage investment accounts. Based on a review of the capital transactions, Wife’s sales generated a net short-term loss of $10,000 and a net long-term loss of $10,000. The balance of the loss was incurred in Husband’s account. In 2011, the parties will have the following capital losses on their respective returns:

Practice Tip: Gather the necessary documents to allocate the losses between the parties. If the losses are not carried forward equally, one party will reap the benefit of the additional losses in future years. In the above example, Husband will have the benefit of an additional $80,000 to offset future gains or to deduct at the rate of $3,000 a year. You may want to figure the present value of the future benefit in reaching an equitable property settlement or take it into consideration in dividing other tax benefits.

Suspended Passive Activity Loss Carryovers. Losses from passive activities are generally deductible only to the extent of gains from other passive activities. If passive activities produce a net loss, the loss is suspended indefinitely and may be deducted from passive activity income in succeeding tax years.

If the passive activity which generated the passive activity is divided equally between the parties in the property settlement, the suspended loss is divided equally along with the underlying asset. However, if the passive activity is transferred from the owner spouse to the non-owner spouse, the transferee cannot use the suspended loss to offset passive income in subsequent years. Rather, the transferee spouse’s basis in the activity is increased by the amount of the suspended loss (IRC §469(j)(6)(A).

Example: Wife was a limited partner in a real estate development that consistently generated losses. At the time of the divorce, the total suspended losses related to the activity were $35,000. Wife’s interest was transferred to Husband who could not use the suspended losses to offset passive income but rather was required to add the suspended loss to his basis in the partnership.

Practice Tip: Under IRC §1041, no gain or loss is recognized on transfers incident to divorce and the transferee acquires the transferor’s basis in the asset. Additionally, the transferor must supply the transferee with records sufficient to determine the adjusted basis and holding period of the property as of the date of the transfer (Reg. §1.1041-1T, A-14). Determine the basis of any transferred interest during negotiations when the information should be readily available.

Suspended Loss Carryovers – Sub S Corporations. Losses which exceed a shareholder’s basis in the stock and debt of a Subchapter S corporation are not deductible, but rather suspended and carried forward to succeeding tax years (IRC §1366).

When the stock in a Subchapter S Corporation is either transferred or divided as part of a property settlement, the suspended loss carryovers associated with the stock are divided proportionately based on the number of shares owned by each spouse during the tax years. If the stock was equally owned by the parties, each spouse will receive 50% of the suspended loss carryover. However, if one party is awarded 100% of the stock in the settlement, the other spouse’s share of the suspended loss carryover is not transferred to the other spouse. The spouse receiving the stock will retain his or her share of the loss carryover, but the other half of the carryover will be lost. Unlike suspended passive activity loss carryovers, Subchapter S loss carryovers cannot be added to the basis in the transferee’s stock. The transferee spouse assumes the transferor spouse’s basis in the stock which does not include the loss carryover.

Conclusion

The proper time to address tax issues is during discovery and negotiations – not when the parties file their next tax returns. It is generally not cost efficient to spend time equalizing tax benefits to the penny, but keeping in mind each party’s eventual tax situation can result in a relatively “tax neutral” settlement.