How to Separate Personal From Enterprise Goodwill in Divorce

How to Separate Personal From Enterprise Goodwill in Divorce

When two parties decide to divorce, the assets must be divided based upon the laws of the respective state in which the divorce is filed. However, when a business is involved (which itself cannot be divided), the result is one party essentially buying out the other’s interest. State laws add additional complexity to this process based upon the treatment of goodwill.

In simple terms, goodwill is the value of a business above the value of the hard assets and identifiable intangible assets. The IRS defines goodwill as “the value of a trade or business attributable to the expectancy of continued customer patronage” and explains that “this expectancy may be due to the name or reputation of a trade or business or any other factor.”1 The American Institute of Certified Public Accountants (AICPA) defines goodwill as an “intangible asset arising as a result of name, reputation, customer loyalty, location, products, and similar factors not separately identified.”2

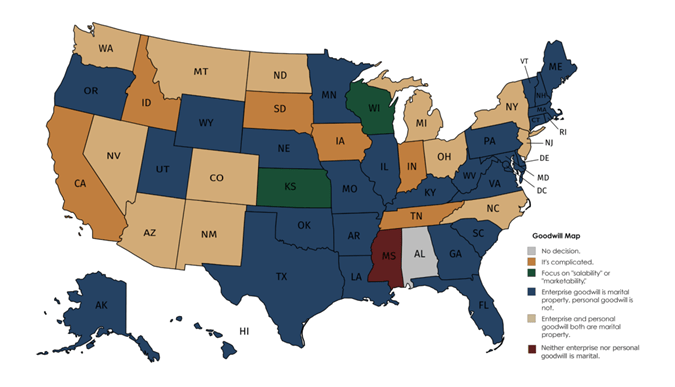

Goodwill can be separated into two components: personal (or professional) goodwill and enterprise (or commercial) goodwill. However, states have differing laws on how personal goodwill is treated. The following chart from Business Valuation Resources displays the treatment of personal goodwill across the United States.3

Charting Goodwill Jurisprudence Map

Most states treat personal goodwill as non-marital/separate property and enterprise goodwill as marital/community property. While each state has differing preceding case law that defines and establishes personal goodwill, generally speaking, personal goodwill is the goodwill that is attributable to an individual’s skills, abilities, and reputation. Alternatively, enterprise goodwill is the goodwill attributable to transferable factors such as location, brand, patents, customer base, and workforce.

Separating personal goodwill from enterprise goodwill is not a straightforward process and requires an experienced appraiser to help navigate the complexities. Below are some of the methodologies for separating personal goodwill from enterprise goodwill.

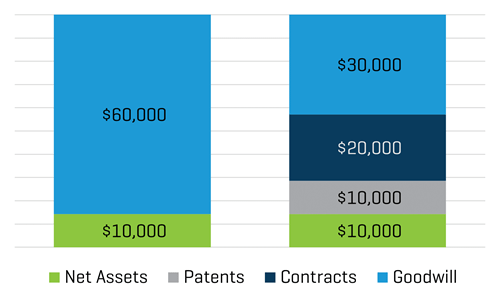

Bottom-Up (Purchase Price Allocation) Method

Under this method, the tangible net assets and identifiable intangible assets are valued and adjusted from the balance sheet as of the valuation date. Typically, private and/or closely held businesses do not value their intangible assets in the ordinary course of business due to the cost and complexity. Therefore, these assets are often not included on the financial statements or tax returns. Depending upon the type of business, this may result in a small portion of net tangible assets on the balance sheet and large unidentified intangible value. However, if there are identifiable intangible assets of the business that have not been valued, the valuation of these assets would result in a higher net asset value and correspondingly lower goodwill value. Below is an example of the valuation of a business both with and without the identifiable intangible assets valued.

Bottom-Up Method

Identifiable intangible assets come in many forms, with some of the common intangible assets consisting of contracts, customer relationships, royalties, franchise rights, patents, trademarks, databases or database information, software, and trade secrets. In addition, since there are commonly accepted methods and published guidance regarding the valuation of intangible assets, this method may hold more support in a court setting.

A downside to the Bottom-Up method is that it only adjusts for the identifiable intangible assets and does not address or allocate the remaining reduced goodwill value between personal and enterprise goodwill. Moreover, depending upon the facts and circumstances, this method can be costly to identify and value each identifiable intangible asset. However, in cases where the unidentifiable intangible asset value is substantial, this methodology may be worthwhile.

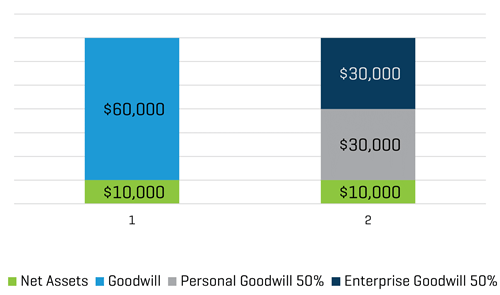

Top-Down Method

Another methodology for separating personal goodwill from enterprise goodwill is the Top-Down method. This method values the total enterprise value less the net tangible assets and then separates personal goodwill from enterprise goodwill using a Multi-Attribute Utility Model (MUM). The Multi-Attribute Utility Model is a court-accepted process that documents and weights specific attributes that allocate goodwill as either personal or enterprise. This is established in seven steps:4

- Establish the objective

- Establish outcome alternatives

- Define the attributes

- Assess the attributes’ utility

- Aggregate the results

- Fit results to alternatives (sensitivity analysis)

- Express opinion

The MUM is a qualitative analysis for classifying goodwill as either personal or enterprise. The benefit to this method is that it is typically relatively inexpensive to conduct and that it explicitly separates goodwill into its enterprise and personal components (typically expressed as a percentage). A downside to this method is that the attribute factors and the associated weightings of those factors are subjective, meaning two appraisers may arrive at significantly different results from differing attributes and weightings. Below is an example of the valuation of a business both with and without the Top-Down method applied.

Top-Down Method (MUM)

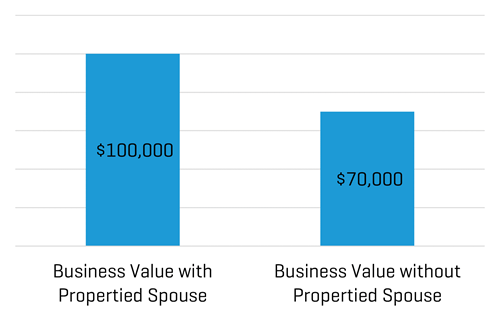

With-and-Without Method

Finally, a separate methodology for measuring personal goodwill is the With-and-Without method. Under this method, the business is valued under two scenarios: One assumes the propertied spouse remains with the business, and the other assumes the propertied spouse leaves and competes with the business. The difference in value of these two scenarios is an estimate of the personal goodwill. Below is a chart of the value of a business with the propertied spouse and without the propertied spouse.

With-and-Without Method

In performing this analysis, the appraiser needs to estimate the cash flows lost from the propertied spouse leaving and/or competing with the business. This requires identifying the lost cash flows that are directly tied to the owner and estimating the timing of when the cash flows would be lost. For an appraiser to properly estimate the lost cash flows, he/she will likely require detailed sales and/or profit information that is dependent upon the owner, such as revenue by referral source/employee, revenue by geography, product/service type, and contractual information. In addition to detailed financial information, an appraiser will also need adequate supporting facts (such as deposition testimony) to make a reasonable and supportable analysis given both financial and non-financial facts.

The downside to this method is that it may be speculative given certain facts and circumstances. Often sufficient financial information may be unavailable and/or there may be numerous “gray areas,” such as the uncertainty (or probability) of losing a key customer or contract due to the loss/competition of the propertied spouse. Accordingly, a lack of available information and/or adequate facts may make this analysis less reliable in a court setting.

Importance of Hiring an Experienced Appraiser

No single method for separating personal goodwill from enterprise goodwill may be applicable or practical in every case. That is why it is important to hire an experienced appraiser to help determine which method may best fit the facts and circumstances of the case.

- “26 § CFR 1.197-2 - Amortization of goodwill and certain other intangibles,” Electronic Code of Federal Regulations. Accessed by Legal Information Institute, Cornell Law School

- “International Glossary of Business Valuation Terms,” Statement on Standards for Valuation Services No. 1.

- “Charting Goodwill Jurisprudence Map,” Business Valuation Resources, LLC, January 2021.

- David Wood, “MUM’s the Word,” Wood Forensic / Valuation Services.