Identification, Documentation, and Valuation of Personal Goodwill Mergers & Acquisitions: An Integrated Theory

Identification, Documentation, and Valuation of Personal Goodwill Mergers & Acquisitions: An Integrated Theory

The sale of a business warrants some of the most important tax and estate planning an owner (‘‘Seller’’ or ‘‘Shareholder’’ as used interchangeably herein) may ever need. This is especially true for a closely held C corporation when the proposed deal structure is an asset sale (the ‘‘Transaction’’). If not planned appropriately, Seller may be liable for taxes based on the proceeds from sale that are double taxed. However, if certain criteria are met before the Transaction closes, Seller can often significantly reduce the tax liability from the sale of the business by selling the personal goodwill associated with the business separately from the business’s assets. In order to take advantage of such potential tax savings, Seller needs to take steps before and during the Transaction to identify personal goodwill, and ensure that Seller has rights to sell it and that such asset has been valued and documented appropriately to support any claims with the IRS and the Tax Court.

Goodwill Defined

The International Glossary of Business Valuation Terms defines goodwill as ‘‘that intangible asset arising as a result of name, reputation, customer loyalty, location, products, and similar factor not separately identified.’’1 Intangible assets separable from good-will generally fall within five categories shown below, along with examples of each:

- Marketing-related: trademarks and brands

- Customer-related: customer lists and relationships

- Artistic-related: copyrights

- Contract-related: supply agreements

- Technology-related: patents, developed technology, in-process research and development (IPR&D)

Goodwill for tax purposes can be delineated further, between enterprise goodwill (also known as corporate, institutional, or business goodwill) and personal goodwill (professional, individual, or celebrity goodwill). Hereinafter, this discussion will refer to goodwill as, (1) attributable to a company as enterprise goodwill, and (2) attributable to an individual as personal goodwill. It’s important to note that goodwill for financial reporting under U.S. Generally Accepted Accounting Principles (GAAP) Accounting Standards Codification 805, Business Combinations (‘‘ASC 805’’), does not separate (or delineate between) enterprise and personal goodwill.

Enterprise goodwill is a set of business entity-owned characteristics that is transferable to a new owner upon a merger or sale. Most common examples include yet-to-come technology, yet-to-come customers, synergies with buyers, and, within a financial reporting context of a business combination, the assembled and trained workforce. Essentially, enterprise goodwill exists regardless of who owns or operates the business, and therefore can be transferred to any buyer.

Personal goodwill is a set of characteristics owned by an individual — usually the business owner or key employee/shareholder of the company — including but not limited to personal relationships, personality, reputation, experience, industry knowledge, and skills. These personal characteristics and relationships help create a customer base, drive revenues, and give the business the ability to profit. Essentially, personal goodwill is an asset owned by the individual, not the business itself, for tax purposes.

Personal Goodwill In Family Law

In the context of marital dissolution (divorce), the assessment of personal versus enterprise goodwill has historically been common, as such assessment was used to segregate and quantify the marital (community) versus separate (personal) assets. Such an exercise is extremely valuable if the personal goodwill of a spouse was acquired or accumulated prior to marriage (e.g., inheritance). However, it is essential to be familiar with the laws of the state in which the business valuation is performed. In many states, personal goodwill may not be separable from enterprise goodwill.

Personal Goodwill In Mergers And Acquisitions (M&A)

In the context of M&A, personal goodwill is more than likely to exist:

- In a closely held business that is either:

- a C corporation

- an S corporation still within §13742 built-in gain recognition period

- Where the value of intangible assets outside of goodwill is limited

- Where the effect of double taxation on corporate earnings is a concern

The consideration of personal goodwill in the context of M&A is important for both Buyer and Seller.

Seller Benefits

- Seller gets a reduced tax rate because personal goodwill is typically considered long-term capital gains and receives a preferential capital gains tax rate (assuming the goodwill has been held by the taxpayer for more than 12 months), as opposed to the higher ordinary income tax rate

- Creditors of the company have no ability to go after personal goodwill in order to satisfy any outstanding debts

- Seller may be able to reduce business-level state income and other taxes

- Buyer may prefer, and therefore may be willing to pay more for, assets of the business versus stock, given the stepped-up basis of the assets received in an asset transaction or a stock transaction with an §338 election (or a deemed asset transaction)

Buyer Benefits

- The above tax advantages make the Transaction more attractive to Seller, resulting in a higher probability of closing

- Buyer may be entitled to amortize personal goodwill over a period of 15 years under §197, resulting in reduction of the tax liabilities associated with the Transaction

Potential Tax Savings

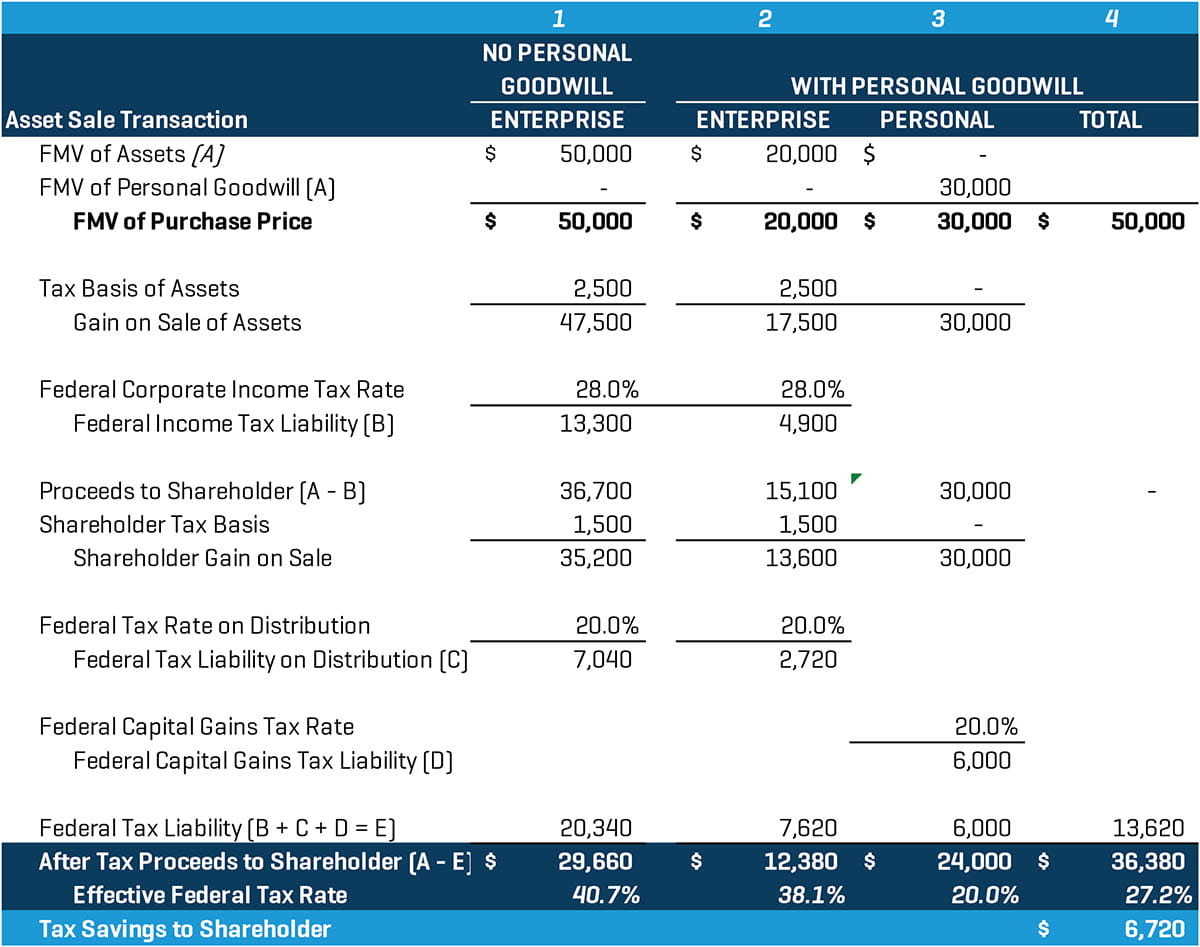

Let’s discuss a fictional transaction. Chart 1 below illustrates the potential tax savings available for transactions that are structured as asset sales where personal goodwill assets are recognized.

Column 1 depicts a private company transaction with a fair market value (FMV) of $50 million with no personal goodwill election upon sale, and the following assumptions: corporate tax basis of assets, $2.5 million; shareholder basis, $1.5 million; federal corporate tax rate, 28%; and federal tax rate on distributions, 20%. The result is a corporate and shareholder tax liability of $20.3 million, resulting in an effective federal tax rate of 40.7%. As shown, the proceeds from sale are double taxed: first, 28% on the corporate-level gain from the sale of assets; second, 20% on the shareholder-level gain from their basis. Columns 2 through 4 depict the same transaction where personal goodwill assets are recognized at $30 million. While the corporate proceeds (FMV of $20 million) from sale are still double taxed, the personal goodwill is taxed at a long-term capital gains rate of 20%. As a result of the personal goodwill election, the corporate and shareholder tax liability is significantly reduced to $13.6 million (for a savings of more than $6.7 million), representing an effective federal tax rate of 27.2%. The tax savings is entirely due to the personal goodwill election and, therefore, is not subject to double taxation.

Key Tax Court Case Law

A number of court cases have set precedents for the distinguishment of personal versus enterprise goodwill, as well as defined the appropriate application of and limits on Sellers that claim personal goodwill in connection with the sale of a private company. One of the most influential Tax Court cases dealing with the separation of personal versus enterprise goodwill is Martin Ice Cream Co. v. Commissioner.3 Martin reaffirmed that when a corporation has no employment contract or non-compete agreements with key employees/shareholders, the employees’ personal relationships with suppliers or customers cannot be considered corporate assets. This position has been reaffirmed through multiple Tax Court decisions. Specifically, Bross Trucking, Inc. v. Commissioner,4 and Estate of Adell v. Commissioner.5 The Tax Court followed a similar line of reasoning in Norwalk v. Commissioner,6 to reach the same personal goodwill conclusion as in Martin. Norwalk focused on the tax implications of the liquidation and subsequent distribution of assets of an accounting firm (a C corporation) because it was unprofitable. The Tax Court held that the firm had realized a gain on the liquidation of its goodwill, and that the shareholders had realized a capital gain from the distribution of goodwill from their accounting firm to them. While the shareholders had employment agreements with the firm prior to its dissolution, the agreements expired at time of the firm’s liquidation. Since they were not restricted from leaving the company and essentially serving the same clients elsewhere, the customer relationships had no meaningful value to the corporation. This was reinforced by the fact that many of Norwalk’s clients followed the corporation’s non-shareholder professionals to their own practices after the corporate liquidation.

Other recent court cases relevant to personal goodwill include:

- Solomon v. Commissioner7

- Muskat v. United States8

- Kennedy v. Commissioner9

- H&M, Inc. v. Commissioner10

Personal Goodwill Qualifications

Given the tax advantages of personal goodwill, the IRS and Tax Court will more than likely scrutinize any transaction where Seller has elected such tax treatment. Therefore, in order for Seller to qualify for such advantages, all of the following criteria must be met:

- Seller can prove that personal goodwill exists independent from enterprise goodwill

- Seller has the right to sell, transfer or convey said personal goodwill to Buyer

- Personal goodwill has quantifiable value

Let’s discuss each criterion in turn.

Existence Criterion: Existence of Personal Goodwill

The process of distinguishing personal goodwill from enterprise goodwill is often complex and always fact-specific to Seller and ‘‘Company.’’

Best practices for the identification of personal goodwill occurs when the following conditions are met:

- Shareholder(s) are significantly involved in day-to-day operations of Company

- Intangible assets (including goodwill) drive a significant portion of enterprise value

- Limited contractual arrangements with customers and/or suppliers are present

- Company does not have a right by contract or otherwise to such individuals’ future services or engagement11

- Shareholder(s) have a strong professional reputation, deep personal relationships with customers and/or suppliers, and superior technical skills and expertise within industry

For Seller’s claim of personal goodwill to withstand IRS and Tax Court scrutiny, it’s important that such claim be:

- Asserted early on in discussions between Buyer and Seller by referencing personal goodwill in the deal negotiations

- Documented from both sides of the Transaction by formally recognizing it with separate purchase agreements — one for the purchase of the company assets and one for the purchase of the personal goodwill asset of the shareholder

- Acknowledged by both sides in the aforementioned supporting documentation that the presence of personal goodwill is a feature of the Transaction

It should be noted that in a number of cases, a Seller has attempted to assert the existence of personal goodwill late in the sales process or even after the Transaction closed in amended tax filings. The IRS and the Tax Court have rejected such claims due to a lack of supporting contractual documentation.12

Right-to-Sell Criterion: Right to Sell, Transfer or Convey Personal Goodwill to Buyer

Meeting the right-to-sell criterion depends on the following conditions:

- The personal goodwill identified must be Shareholder’s individual asset and not that of the enterprise

- Shareholder cannot have previously transferred the asset to Company at any time prior

- Shareholder has the right to sell, transfer or convey said personal goodwill asset to Buyer

In general, Shareholders who successfully claim personal goodwill have not entered into contractual agreements such as employment agreements or non-compete agreements (also referred to as covenant not to compete) at any time prior to the Transaction.13 (If contractual agreements are in place, it is imperative to discuss with Seller’s counsel, and determine if canceling these agreements before a proposed transaction occurs will meet the right-to-sell criterion herein. In addition, contractual agreements such as employment agreements and noncompete agreements entered into with a Buyer as part of the Transaction can bolster assertion of personal goodwill, as it corroborates the idea that the Shareholder in question is a significant and unique source of value. Furthermore, in TAM 200244009, involving a physician practice management company, the IRS National Office Advised that the goodwill associated with shareholder professionals cannot be a corporate asset in the absence of an employment/noncompete agreement between corporation and shareholder. Tax Court precedent establishes that personal goodwill is transferred when the individual cannot personally benefit from such without the employer. The transfer of personal goodwill occurs most often through contractual agreements such as employment contracts or noncompete agreements. Once such an agreement is in place, any existing goodwill more than likely belongs to the corporation, as does any goodwill generated after said agreements have been entered into. Therefore, in the absence of such contractual agreement, there can be no transfer of personal goodwill.

It should be noted that if Shareholder’s contacts or relationships with customers or suppliers form the basis for personal goodwill, the contractual agreements entered into with Buyer should obligate Shareholder to provide introductions and facilitate a smooth transition of such to Buyer. On the other hand, if Shareholder’s expertise, knowledge or skills form the basis for personal goodwill, the contractual agreements should obligate Shareholder to teach, institutionalize or transfer these skills or knowledge to Buyer. In either case, the contractual agreement should provide a sufficient period of time to transfer said personal goodwill from Shareholder to Buyer.

Quantifiable Value-Criterion: Personal Goodwill Has Quantifiable Value

If personal goodwill has been appropriately identified (and documented) to exist separate and apart from enterprise goodwill, and Shareholder has the right to sell, transfer, or convey it to Buyer, the final hurdle is to establish the value of personal goodwill. It is a best practice and highly recommended that personal goodwill be appraised by an independent third party, and that Buyer and Seller agree upon the allocation of personal versus enterprise goodwill prior to closing the Transaction.

In Kennedy,14 the Tax Court found that although James Kennedy owned personal goodwill in the sale of his consulting company, the identification of personal goodwill was not enough to conclude that the goodwill was sold to Buyer. The Tax Court noted that the lack of an independent third-party appraisal was a primary factor in its decision. Therefore, Kennedy illustrates the critical importance of hiring a third party to appraise personal goodwill to support the documentation of value and purchase price allocations. Such third-party appraisal also helps support the intention of both parties in the Transaction.

Goodwill Allocation

Under §1060, the purchase price must be allocated to the assets under the residual method per §338(b)(5). The purchase price is allocated, first to the most liquid assets in accordance with FMV, to each of the following asset classes (along with examples of the types of assets):

- Class I: Cash and cash equivalents;

- Class II: Actively traded securities;

- Class III: Mark-to-market financial assets (including accounts receivables);

- Class IV: Inventory;

- Class V: Depreciable assets such as land, building and equipment, and stock of target affiliates;

- Class VI: Identifiable intangibles (§197), except goodwill and going concern; and

- Class VII: Goodwill and going concern.

As noted, goodwill is considered a residual, therefore it is important that all assets to be acquired and liabilities to be assumed in a transaction are identified and valued at FMV. Identifiable intangible assets include, but not are limited to, the following:

- Software

- Customer relationships

- Trade names and brands

- Patents

- Assembled workforce

Each identifiable asset present in the Transaction should be valued using an appropriate methodology based on its unique merits. The remaining value, or residual, will represent total goodwill, consisting of both personal and enterprise goodwill for tax purposes.

Therefore, the basic premise of the valuation and allocation detailed above will be very similar to the techniques commonly used for the valuation and allocation of acquired assets and assumed liabilities tax reporting purposes under §1060 and for financial reporting purposes under ASC 805, with some nuanced differences (such nuances are beyond the scope herein).

It is important to note that if Company in the Transaction includes multiple legal entities or subsidiaries (often referred to as multi-tiered group of corporations), Reg. §1.338-6 requires ‘‘top down’’ application of the purchase price allocation methods to each legal entity. For example, Company A is being purchased in an asset transaction and consists of Sub 1 and Sub 2, wherein Sub 1 is focused on the manufacture and sale of technical products and Sub 2 is focused on consulting services related to the products. In this case, Reg. §1.338-6 would require an allocation of purchase price for Sub 1 and Sub 2 that aggregates to Company A.

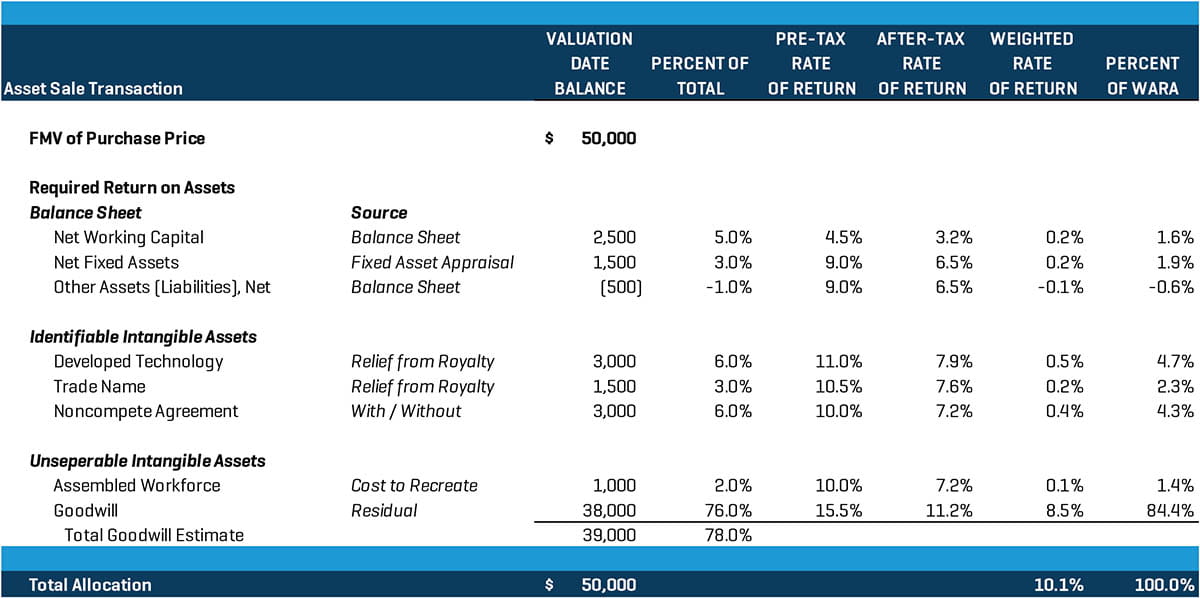

Once goodwill has been established and valued (an example is shown in Chart 2, below), the next issue will be to delineate the portion attributable to personal versus enterprise goodwill.

While various attribution and allocation techniques exist, the two most commonly used methodologies to assess and delineate personal goodwill from enterprise goodwill are the Multi-Attribute Utility Model (MUM) method and the With/Without (WWO) method, and each methodology will be addressed in turn. Each method should be evaluated by the facts and circumstances present in the Transaction and weighted accordingly in any analysis of personal goodwill as each has its own strengths and weaknesses.

MUM Method

The MUM method is a mathematical technique to assess alternatives and assist in decision making in distinguishing between types of intangible assets and goodwill, principally the delineation of personal and enterprise goodwill.

Under the MUM method, various attributes of personal goodwill are identified and then weighted on its existence and relative importance. Thus, the MUM method allocates alternative percentage ranges between personal goodwill and enterprise goodwill. The alternatives are defined as a range of percentages of personal goodwill.

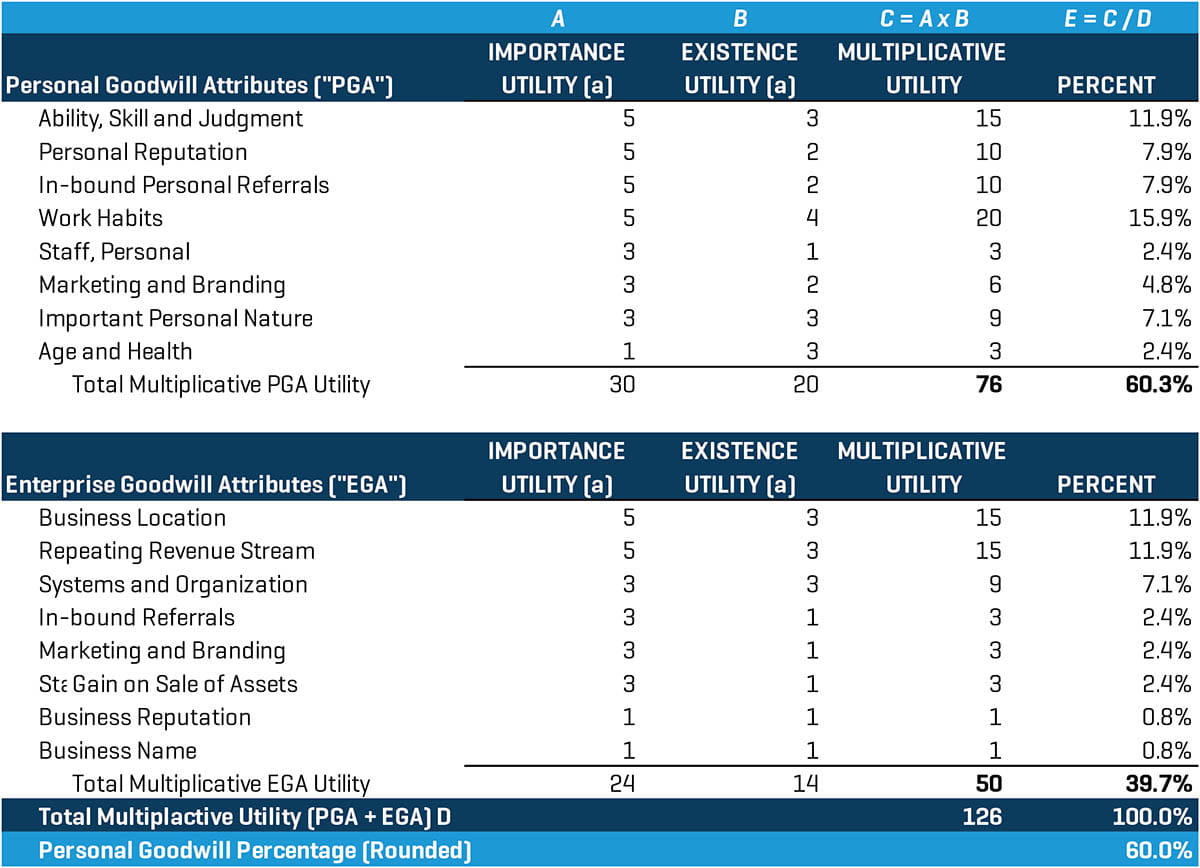

The enterprise goodwill is the reciprocal percentage of the personal goodwill outcome. Each attribute under the personal and enterprise goodwill is given a separate score for Importance and existence. A score of zero means there is no importance or existence; whereas a score of five means it is highly important or very prevalent.

Typical attributes considered in the MUM method are further delineated between Personal Goodwill Attributes and Enterprise Goodwill Attributes as shown in the tables below.

Table 1: Personal Goodwill Attributes (PGA):

|

PGA |

|

|---|---|

|

Ability, skill, judgment |

The individual’s ability, skill, and judgment demonstrate the personal traits that increase personal goodwill. |

|

Personal reputation |

Positive and strong reputation of the individual increases the likelihood that the resulting goodwill is personal. |

|

In-bound personal referrals |

A referral from an outside source that has been made to a particular individual, not directly to the business, increases personal goodwill. |

|

Work habits |

The individual’s work habits (e.g., regular schedule of long hours, commitment to continuing training and education) that increase revenue and/or earnings may increase personal goodwill. |

|

Marketing and branding |

Name recognition for the individual, as opposed to the product or service, may indicate a higher level of personal goodwill. |

|

Important personal nature |

Based on the premise that consumers generally are more concerned with the level of service when that service is of a very important personal nature. |

|

Personal staff relationships |

Personal staff employees work for the business because of the personal reputation or knowledge of the individual whose personal goodwill is being assessed. |

|

Age and health |

The age and health of the individual is closely correlated with personal goodwill. |

Table 2: Enterprise Goodwill Attributes (EGA):

|

EGA |

|

|---|---|

|

Business location |

A business that is easily accessible; an ideal location may represent more enterprise goodwill. |

|

Repeating revenue stream |

The nature of some businesses where consumer buys on a regular or even scheduled basis. |

|

Systems and organization |

Represents all of the decisions made by management that create the structure of the business. |

|

In-bound referrals |

A referral from an outside source that has been made to the business, but not to a specific individual, increases enterprise goodwill. |

|

Marketing and branding |

Name recognition for a product or service may indicate a higher level of enterprise goodwill. |

|

Enterprise staff |

A staff or workforce that is in place, properly trained, and effectively managed is an indication of enterprise goodwill. |

|

Business reputation |

Determines the attraction of new business and a consumer’s likelihood to return for future business. |

|

Business name |

If the business has a name that is not personal, there may be a greater level of enterprise goodwill present. |

An example of the application of the MUM method is shown in Chart 3 (below) where the goodwill attributable to personal goodwill was estimated to be approximately 60%, or $22.8 million from the residual goodwill previously shown above in Chart 2.

While the MUM method is a mathematical technique to attribute and allocate between personal and enterprise goodwill, the attributes and weightings can be seen as somewhat subjective. Therefore, the MUM method may be best used as a corroborative or reasonableness test of the WWO method.

WWO Method

The WWO method can be used to value an intangible asset by comparing the cash flows of the business to a hypothetical situation where the company does not have the benefit of the intangible asset. In other words, the value of a business with all of the assets is compared to the value of the same business without the subject intangible asset, in this case, personal goodwill. The ‘‘Without’’ scenario assumes lower revenue and profits than the ‘‘With’’ scenario due to the loss of the key individual. Furthermore, the Without scenario assumes it will take the company a period of time to regenerate similar revenue and profits that are lost from the absence of this individual; therefore, the cash flows are adjusted downward to incorporate these factors.

The ‘‘With cash flows’’ and the ‘‘Without cash flows’’ are compared on an after-tax basis, the differential is then discounted to present value, and a tax amortization benefit (TAB) is added to determine the FMV of personal goodwill.

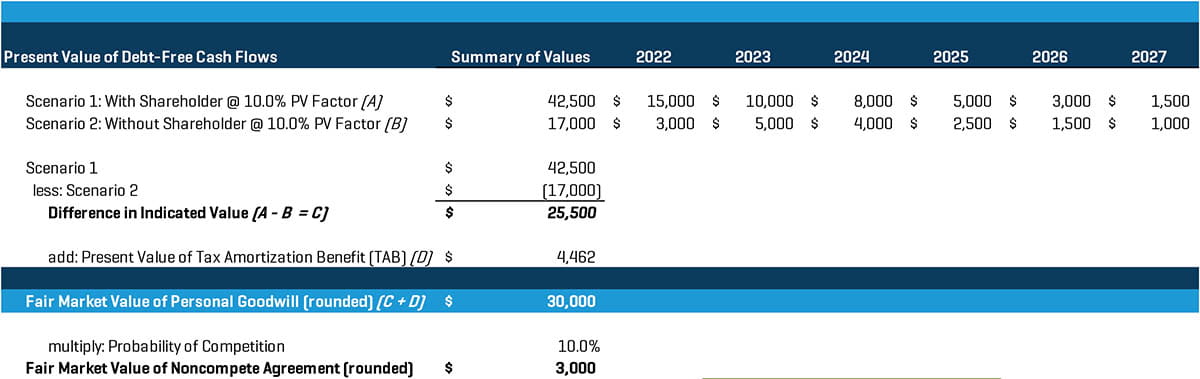

Continuing with our example from Chart 2 above, the net present value of cash flows with shareholder in place is estimated at $42.5 million over an assumed term of six years, while the net present value of cash flows without shareholder in place is estimated at $17 million over same term, as shown in Chart 4 below. The difference is $25.5 million, to which a TAB is added, resulting in a personal goodwill FMV of $30 million, or 78.9% of the residual goodwill previously shown in Chart 2.

It should be noted that multiplying the indicated value of personal goodwill by an assumed probability of competition of 10% equals the FMV of the non-compete agreement previously shown above in Chart 2. While the WWO method provides a less subjective solution than the MUM method, it is considered to be more analytically complicated and requires more time and information to implement. As previously described, the WWO method is a direct measure of an intangible asset’s value via future expected cash flows, whereas the MUM method is an indirect methodology and best used as a corroborative or reasonableness test.

Conclusion

The identification and documentation of personal goodwill in deal negotiations and purchase agreements prior to the Transaction, and ultimately the valuation of personal goodwill, is a complex process that involves multiple service providers working in parallel with Sellers in order to take advantage of this unique tax treatment. No matter the economic climate, businesses will be purchased and sold in M&A, so why should the Seller pay more in taxes than they need to?

Originally published in Bloomberg Tax

- International Glossary of Business Valuation Terms

- All section references herein are to the Internal Revenue Code of 1986, as amended (the Code), or the Treasury regulations promulgated thereunder, unless otherwise indicated.

- 110 T.C. 189 (1998).

- T.C. Memo 2014-107.

- T.C. Memo 2014-155.

- T.C. Memo 1998-279.

- T.C. Memo 2008-102.

- 554 F.3d 183 (1st Cir. 2009).

- T.C. Memo 2010-206.

- T.C. Memo 2012-290.

- See Martin, 110 T.C. 189; Norwalk, T.C. Memo 1998-279.

- See Muskat, 554 F.3d 183; Kennedy, T.C. Memo 2010-206; Solomon, T.C. Memo 2008-102.

- See Martin Ice Cream Co., 110 T.C. 189 (1998); Norwalk, T.C. Memo 1998-279; H&M, Inc., T.C. Memo 2012-290; Bross Trucking, Inc., T.C. Memo 2014-107.

- T.C. Memo 2010-206.