Bank Goodwill Impairment: Assessing Balance Sheet Profitability

Bank Goodwill Impairment: Assessing Balance Sheet Profitability

Commercial banks faced several challenges in the past year, including a liquidity crisis, deposit outflows, and increases in deposit interest costs. This environment represented a sharp contrast to the immediate post-pandemic period when banks were flooded with deposit inflows and offered near-zero interest rates on consumer deposits. For many banks, earnings declined due to a compression of net interest margins (NIM), and equity capital levels diminished owing to unrealized losses on long-duration fixed-rate securities and increased credit loss allowances for commercial real estate loans.

The combination of lower yielding assets, higher deposit costs, increased credit reserves, and dampened loan originations led to lower profitability. Decreased bank earnings are characterized by a decline in the rate of return earned on balance sheet assets and a corresponding reduction in the return on equity for shareholders.

For publicly listed banks, diminished return expectations drive down stock prices, with many institutions trading below tangible book value. Financial institutions that currently carry goodwill on balance sheet (primarily generated from prior whole bank acquisitions) will need to assess the core bank profitability measures when testing this intangible asset for impairment. In this article, we review the main drivers of bank earnings and provide a sector-specific overview of the annual goodwill impairment test for financial reporting.

The Link Between Bank Profitability and Balance Sheet Composition

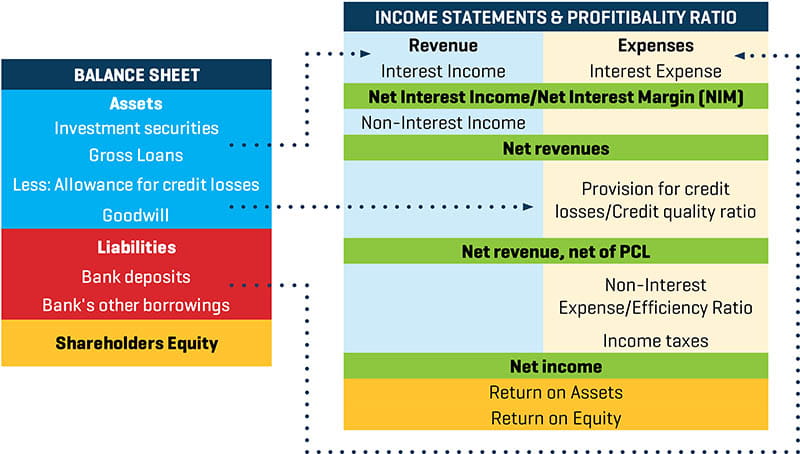

A bank’s profitability is directly tied to its balance sheet, as illustrated in the table below:

The interplay between a bank’s profitability and its balance sheet is best understood by reviewing the main drivers of performance:

-

Net interest margin measures the spread between the interest earned on balance sheet assets and the interest paid on the liabilities that fund a bank’s investments in loans and securities. This metric captures the margin between interest income and interest expense. All else equal, a higher NIM results in a commensurate increase in return on equity. NIM is determined by the dynamic relationship between the yield banks earn on their financial assets and the interest costs of funds provided by customer deposits and other borrowings.

Additionally, cross-sectional variations in NIM are caused by differences in banks’ investment portfolios (loan composition, commercial versus consumer lending, fixed vs. floating rate, securities book, asset portfolio duration), funding sources (core and insured deposits, wholesale deposits, Federal Home Loan Bank advances), and asset liability management.

-

Credit quality of bank balance sheet assets has a significant impact on profitability as well as the amount of equity or regulatory capital a bank is required to maintain. Incurred losses and write downs on defaulted loans will directly and immediately impact a bank’s liquidity and cash flows.

Bank balance sheets are also highly sensitive to expectations for future credit losses. With the recent implementation of the Current Expected Credit Loss (CECL) standard, credit loss projections (calculated over the life of the asset) determine loan loss provisions that are subtracted from asset principal balances. Therefore, higher credit loss expectations act to reduce regulatory assets, which reduces effective leverage. Finally, market participants’ perception of asset credit quality will be reflected in the trading prices of public banks and the values observed in M&A deals and secondary market loan sales.

-

Efficiency ratio measures how efficiently a bank manages its operations. The efficiency ratio captures the non-interest expenses incurred by institutions in their lending and investing activities and in maintaining their deposit customer base. A higher efficiency ratio indicates that the bank is spending a larger proportion of total income on operating expenses, which causes a decline in overall earnings.

-

Capital requirements for banks are mandated by regulators based on the risk of their lending portfolios. The riskier the assets, the higher the required common equity ratios and associated regulatory capital requirements.

Overall, the capital requirements for regional and community banks are relatively uniform, and these institutions have much less capital structure flexibility than non-financial firms. Bank performance objectives can be summarized as delivering strong NIM while minimizing credit losses and managing operational expenses subject to constraints imposed by the regulatory framework.

Successful commercial banks will deliver favorable returns to equity holders by executing on each of the drivers of profitability. As discussed in the next sections, bank M&A is predicated on expectations of future performance for the metrics outlined above. The buyer typically pays a premium above the net asset value of the target bank based on the belief that management will be able to generate strong returns from the financial assets and liabilities, operations and human capital, and franchise/brand acquired in the business combination.

Goodwill Impairment Testing – Accounting Guidance and Implementation

In a challenging economic environment, commercial banks conducting their annual goodwill impairment test under Accounting Standards Codification (ASC) Topic 350, Intangibles – Goodwill and Other, will face heightened scrutiny from their auditors, regulators, and shareholders.

Goodwill is defined as the amount of the purchase price that is greater than the net fair value of all acquired assets and assumed liabilities. Goodwill is recognized only through an acquisition and cannot be self-created. Goodwill conceptually represents a market participant buyer’s ability to create value through new services or products and/or customer acquisitions that are not otherwise attributable to brand name recognition, contractual arrangements, retention of existing customer business, or other specific factors. The acquiring bank may expect to achieve greater profitability through increases in lending volumes, competitive pricing, expanded geographic locations, cheaper and larger deposit funding sources, enhanced operating efficiencies, and more effective risk management.

The carrying amount of goodwill is subject to annual impairment testing as per ASC 350. This intangible asset on the balance sheet is a historical cost-based measure that reflects the expectations for profitability at the time of the business combination(s).

In the remainer of this article, we summarize the steps involved in qualitative and quantitative assessment of goodwill impairment and consider the case of banks that have multiple reporting units.

Qualitative Factors Assessment

For publicly traded banks operating as a single reporting unit, the qualitative assessment for ASC 350 compliance is a reasonable starting point. Under this approach, banks must consider several qualitative factors when assessing potential goodwill impairment. These factors are intended to cover all relevant events or circumstances that affect the fair value of the reporting unit. The following factors may be used in the qualitative assessment:

- Macroeconomic conditions: Evaluate the likelihood and impact of economic and financial events and circumstances such as further changes in interest rates, as these affect a bank’s financial performance.

- Industry and market conditions: Assess the overall stability and growth prospects of the banking industry, including liquidity, credit quality, and deposit stability.

- Cost factors: Analyze interest cost for deposits and liabilities that impact net interest margins, trends affecting operating costs, Federal Deposit Insurance Corporation insurance costs, and regulatory requirements that dictate required capital levels.

- Financial performance: Review financial metrics that impact return on assets, NIM, net profit margin (after accounting for credit losses and operational expenses), and, ultimately, return on equity.

- Events specific to the company: Consider recent mergers and acquisitions, restructurings, changes in lending programs, or liability strategy that may cause significant modifications in the corporate structure.

- Stock Price: Monitor stock price trends and analyze how the bank’s stock performance compares to historical prices and to peer institutions. If the ratio of the stock price to a bank’s book value or tangible book value drops below 1.0x, analyze the implied premium that would bring these ratios above 1.0x. Next, analyze whether such premiums fall within a reasonable range of deal value premiums observed in recent M&A bank transactions.

In performing the qualitative assessment using factors described above, the bank must evaluate whether it is more likely than not that the fair value of the reporting unit is less than its carrying amount. If so, a quantitative analysis must be conducted.

Quantitative Analysis

When the qualitative assessment indicates potential goodwill impairment, a more formal quantitative analysis is required. The quantitative analysis typically involves performing a valuation to estimate the fair value of the bank (reporting unit). In the valuation model, assumptions regarding the drivers of bank profitability are significant inputs to the Income Approach via a form of discounted cash flows (DCF) available to be distributed to shareholders. The valuation process includes multiple steps:

- Discounted cash flow analysis: Develop contemporaneous financial projections that explicitly link the bank’s balance sheet and income statement forecasts. This prospective financial information (PFI) will consider trends in NIM, efficiency ratios, credit provisioning, net income profitability margins, and capital requirements that jointly determine equity cash flows or dividends (returns) that can be distributed to shareholders.

- Analyze historical performance and prospective financial information (PFI) trends: Review and analyze historical financial results in relation to PFI trends to assess the achievability of the PFI. The PFI review should include an evaluation of balance sheet growth potential, an examination of each of the drivers of profitability, and recognition of the financial and operational risks inherent in the forecast.

- Determine discount rates: Select the discount rate used to calculate the present value of future cash flows. Note that given the regulatory driven capital structure for banks, the DCF should be structured as a free cash flow to equity model, and the applicable discount rate represents the cost of equity.

- Control premium reconciliation (publicly listed banks): Perform a market capitalization reconciliation to ensure that the implied control premium is reasonable and appropriate. The implied control premium is calculated by comparing the concluded value from the DCF analysis to the bank’s market capitalization on the measurement date.

Impairment Testing for Multiple Reporting Units

For banks with multiple reporting units, performing a qualitative assessment will likely be insufficient, especially in a challenging environment for bank performance and profitability. Since each reporting unit must be tested individually, the market capitalization of the consolidated bank equity cannot be used to directly test the goodwill balance for each unit.

In this case, banks should conduct a valuation analysis for each reporting unit. In implementing the quantitative analysis, traditional valuation methods are used in the form of the Income Approach and Market Approach. The application of the Income Approach is discussed in the section above.

The guideline public company method (GPCM) is most often employed in the application of the market approach. Under the GPCM, the valuation analysis includes the following steps:

- For each reporting unit, identify comparable guideline public banks: The publicly traded banks selected should be similar to the subject bank reporting unit with reference to multiple criteria including size, geographic location, loan portfolio, securities portfolio, deposit mix, capital structure and regulatory framework, and growth prospects.

- Comparison of the subject reporting unit to guideline public banks: Performance metrics used in the analysis cover profitability, asset quality, return on assets and equity, growth, and other bank financial ratios and profitability measures.

- Selection of appropriate pricing multiples: This includes (net) asset-based measures such as price to tangible book value multiples and income-based measures such as price to earnings multiples.

- Consideration of applicable control premiums: Determine if the selected control premiums are supported by recent M&A transactions as well as the subject bank’s financial metrics (for example, achieving a certain efficiency ratio and return on equity).

- Corroborate concluded value using different valuation methods: This provides support for the assertion that the fair value estimates derived from the income approach and market approach are reasonable.

- Reconcile the sum of reporting unit values to the bank market capitalization: Check that the implied premium, in aggregate, for the reporting units over the market capitalization falls within a reasonable range.

Documentation for Auditor and Regulator Review

The goodwill impairment process should be documented thoroughly, as enhanced auditor and regulator scrutiny is to be expected during a difficult time for bank performance. We highlight several documentation points for consideration:

- Management’s assessment process: Highlight management’s oversight role in the goodwill impairment assessment process. Clearly describe the testing procedures performed (including qualitative factors) and the assumptions and methodologies used to determine the value of the reporting unit.

- Data accuracy and reliability: Verify the accuracy and reliability of the data used in the impairment assessment. Assess the quality of data sources and ensure that they are appropriate for the use case, and that the data environment is amenable to model validation testing requirements.

- Assumption documentation and consistency: Confirm there is appropriate support for significant assumptions used in the analysis. Check for consistency in the application of inputs used across the impairment assessment (e.g., discount rate, control premium, long-term growth rate), and ensure that assumptions are reasonable, supportable, and align with industry and economic conditions.

- Financial statement disclosures: Review the completeness and accuracy of disclosures pertaining to goodwill impairment in the financial statements.

- Review controls over reporting units: Ensure there are controls in place to identify and evaluate changes in reporting units, as changes in the composition of reporting units may impact the impairment assessment.

Compliance with ASC 350 is essential for commercial banks because consolidation through whole bank acquisitions has been a primary mechanism for growth in the industry. The residual goodwill created from these transactions, and recorded on current balances sheets, represents a historical view on the profitability of the institution.

When testing goodwill for impairment, banks are required to assess the carrying value of a significant balance sheet asset by applying the discipline of fair value measurement. The valuation exercise requires a detailed analysis of each of the drivers of bank profitability. The bank’s financial forecast is a critical element in the valuation analysis that captures the interconnection between a bank’s earnings and its balance sheet. By conducting a robust analysis for goodwill testing, banks can provide reliable and transparent financial statements to stakeholders.