What's Your Dairy Farm Worth?

What's Your Dairy Farm Worth?

Knowledge and comprehension of automation and technologies is necessary to understand the operations of a dairy farm and create an independent valuation.

The typical dairy buyer lives in an urban area or a suburb, and may believe that milk comes from cows on a farm surrounded by horses, pigs, and goats, all of which are cared for by a farmer named Mr. MacDonald. In this imagination, this farmer wakes up in the early hours, puts on a pair of overalls and goes inside a red barn to individually milk each cow into a metal pail. In reality, the typical dairy buyer likely does not comprehend the highly automated and efficient nature of a dairy farm, the rising use of improved technologies for milking and pregnancies, the impact of declining commodity prices, particularly milk and beef prices, on the profits of a dairy farm, and principles of accounting used to prepare the financial statements. Knowledge and comprehension of these items is necessary to understand the operations of a dairy farm and to ultimately prepare an independent valuation.

Overview of a Dairy Farm’s Valuation

A valuation of a dairy farm is unique relative to valuations of a standard manufacturing or retail business due to the differing nature of financial statements, the specific nomenclature used in the dairy industry, and the unique operations of an agri-operation business. As a going concern, the valuation should consider both the tangible and intangible value of the business. As a dairy farm does not operate as an asset holding company, the Income and Market Approaches are better suited to capture both tangible and intangible value. Thus, while a cash flow driven approach is the most appropriate for a dairy farm, an asset based approach can be utilized to set a floor value. In theory, the intangible value of a commodity based business is minimized when commodity prices (in this case milk and beef prices) are lower, as commodity prices have a higher impact on the cash flows of a dairy farm relative to the underlying assets of the dairy farm. As milk prices were low as of the date of this article, the intangible value of a dairy farm is likely much lower compared to two years ago when dairy prices were almost double their current level.

Financial Statement Analysis

Many family-owned business are organized as pass-through entities (such as a subchapter S corporation, LLC, or limited partnership), which utilize the accrual method of accounting in accordance with generally accepted accounting principles for their financial statements. As a pass-through entity, all income and losses flow directly to the equity interest owners, and report such income or loss on their individual tax returns. Although pass-through entities are not subject to federal income tax returns, state franchise tax based on revenue or gross profit levels still apply.

In analyzing the financial statements of a dairy farm, it is important to understand the composition of the individual line items. For example, in GAAP financial statements, many times the ‘milk sales’ line item is simply not a function of production and price. The amount of milk sales is adjusted by the quantity of protein in the milk, as higher amounts of butterfat and other solids receive a higher price. Additionally, if a dairy farm is under an agreement to sell all of its milk to a cooperative, the price the farm receives is often adjusted so that profitability is shared between other cooperative members (known as the basis adjustment). Lastly, expenses of the dairy farm that are passed to customers such has hauling expenses and creamery association chargers are also included in milk sales and listed again as an expense (effectively netting against each other).

Another important distinction between the financial statement analysis of a dairy farm and other businesses is the unique adjustments required to calculate net cash flow. In the valuation of a standard manufacturing company, an appraiser could employ an income approach in which earnings before interest, taxes, depreciation, and amortization (“EBITDA”) is calculated based on the income statement, and the balance sheet and cash flow statement are used to make adjustments for working capital and capital expenditures. On the financial statements of a dairy farm, one major source of income that may not appear (or appears understated) includes the proceeds from the sale of livestock. For example, an income statement may present the sale of livestock net of the cost basis (feed costs that were capitalized). As an income approach is based on cash inflows and outflows, a valuation should separately account for the cash inflow from the sale of an animal and the cash outflows for the feed costs allocated to each animal. Another distinction between the financial statements of dairy farms is deprecation. Deprecation is split in two ways, with the first being deprecation of the dairy herd and the other for capital expenditures such as property and equipment.

Drivers of a Dairy Farm Valuation

The primarily cash inflows and outflows of a dairy farm are as follows:

1. Milk Sales

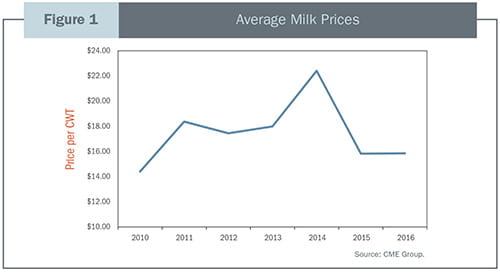

The obvious and largest cash inflow of a dairy business is milk sales, which is primarily a function of prices and milk production. As a commodity-based business, a dairy farmer experiences large fluctuations in dairy prices, resulting in a volatile level of revenue and earnings of the business (although some volatility is controlled through hedging). As is the case with most commodity-based businesses, the predictability of milk prices going forward is low at best. Milk prices are impacted by government subsidies, cost of feed, trade agreements, the strength of the U.S. dollar, and weather issues, among other factors. For example, much of the United States faced an oversupply of milk in 2015, partly from dairy farms expanding their herds during the high prices in 2014. This has led some operators to take dramatic steps to bring supply back in line with demand. Milk prices are often times a mix of Class I, II, III, and IV milk prices. The ultimate price received by a dairy farm is dependent upon the largest customers (often times a cooperative) and the end use of the milk (whether for fluid products, cream products, cheese, or butter or dried products). As valuation is forward looking, a normalized milk price should consider both projected and historical prices, with a higher emphasis on futures prices over the next twelve to eighteen months. As futures prices are low as of the date of this article relative to historical levels, a normalized level of milk sales would likely be lower for a current valuation compared to historical levels assuming a similar sized dairy herd. See Figure 1.

A normalized level of production on a going concern basis should be based on the expected size of the milking herd, the herd turnover ratio, and the average number of self-raised heifers transferring over to the milking herd annually. The average production per cow should be analyzed by examining historical production and consideration of whether any growth hormones were used (which may be prohibited by the dairy farm’s customers). Production levels should also be adjusted for dry cows (cows within one to two months of being birth to a calf) as well.

2. Proceeds from Dairy Herd Sales

Every given year, cows in the milking herd are sold because they can no longer be milked efficiently. The primary driver of proceeds from the dairy herd sales are beef prices. If beef prices are high, as they were in 2013 and 2014 due to the droughts throughout the country in 2011 and 2012, coupled with a shortage of supply of cows for beef, a dairy farmer may be motivated to sell less efficient cows of the dairy herd. The dairy farmer would try to maximize pregnancies in order to replace the less efficient milking cows sold for beef in order to also maintain milk sales.

3. Calf Income

Based on capacity constraints and milk and beef prices, dairy farmers often times sell calves (mostly male calves) shortly after birth. Through the use of sexed semen technology, dairy farmers are able to better control the number of female births, allowing for a larger heifer inventory and eventual milking herd. If the calves are born males, they are often times castrated and raised as steers for higher quality beef production or veal.

4. Other Income

Dairy farmers also receive cash flows through patronage dividends (paid through the cooperative of which the dairy farmer is a member), rental income of any property leased to a third party, hospital milk (milk from ill cows that is not suitable for human consumption but fed to calves), USDA program payments, etc. Total income received from these sources is usually less than 10% of total revenue and can be normalized based on historical averages for valuation purposes.

5. Feed Expense

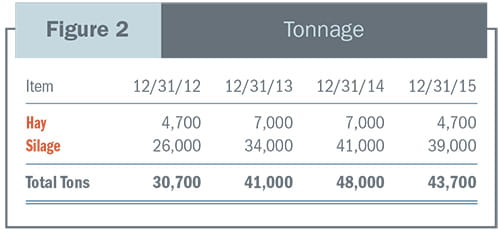

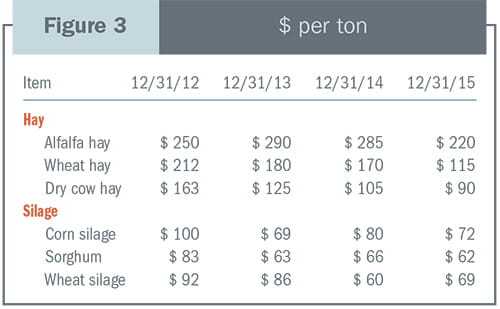

The largest expense of a dairy farm is feed expense. This expense is typically listed separately as each cow consumes differing quantities of food. Typically, milking cows will consume more than double of dry cows and bulls. Similar to milk prices, feed prices must also be normalized by considering historical, current, and expected future prices. While examining historical feed expenses, it is important to consider the inventory accounting method of the dairy farm. For example, Figures 2 and 3 show that it is clear that feed costs declined in 2014 and 2015 from their peak levels in 2013. However, if the dairy farm is utilizing a first in, first out (“FIFO”) inventory accounting method, it is likely that the feed cost on the 2015 income statement will not reflect the decline in feed costs as a dairy farm typically keeps more than one year’s worth of inventory onsite. A valuation analysis should focus more on the actual cash outflow a dairy farm will incur over the foreseeable future rather than historical costs already incurred. As of the date of this article, lower feed prices were the saving grace of a dairy farmer’s bottom line, as the lower prices help offset the lower revenue levels due to low milk prices.

6. Labor Costs

Although this is also a large cost of a dairy farm, the management of a dairy farm is mostly able to closely predict this cost based on expected production levels and wages. Often times, recent historical levels serve as a reasonable proxy for this cost in the near future.

7. Capital Expenditures and Depreciation

The capital expenditures of a dairy farm can be split into two types: property and equipment purchases and heifer raising costs. Property and equipment purchases for a dairy farm primarily include the construction, expansion, or renovation of its buildings and other facilities, tractors, trucks, loaders, and feed transporters. These purchases are capitalized and depreciated similar to any other operating company. Some of these capital items need to be purchased every five to seven years, so a determination of an average annual capital expenditure level may be necessary. As mentioned earlier, many dairy farms have their own heifer program of calves from birth to approximately 23 months of age. All costs of feed and raising of the heifers are capitalized. Thus, although this feed expense is not captured on the income statement (the feed expense line item on the income statement only captures feed costs of the dairy herd, dry cows, and bulls), the valuation analysis needs to capture the cash outflow of the heifer raising costs separately, along with depreciation expense (which is typically included in cost of goods sold). The depreciation expense related to the dairy herd is split into two classifications: depreciation expense and cost of dairy herd sold. Cost of dairy herd sold represents the depreciation expense of any cows of the dairy herd that were sold in that given year, while depreciation expense represents the annual depreciation of cows still in the dairy herd at the end of a given fiscal year. In order for a valuation analysis under an Income Approach to be accurate, it is important for a valuation to adjust for cash expenditures included on the income statement and exclude non-cash expenses.

8. Other Operating Expenses

The other operating expenses of a dairy farm, except for fuel costs and wages of hourly employees, are mostly fixed expenses that should increase over time in line with inflation.

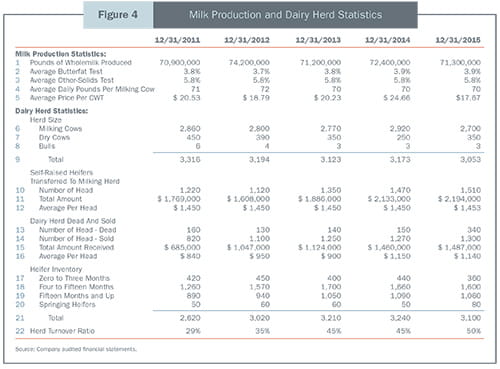

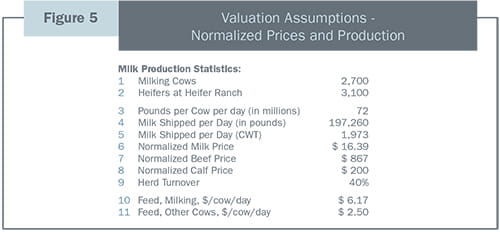

A dairy farm’s audited or reviewed financial statements may include milk production and dairy herd statistics that would assist in forming assumptions to determine normalized free cash flow for a dairy farm. An example set of data, and the normalization assumptions that was derived using the data, is provided in Figures 4 and 5.

Non-Operating Assets and Other Adjustments

The determination of the operating equity value of a dairy farm involves the calculation of projected or normalized free cash flows and an appropriate discount rate that captures the market, industry, size, and company specific risks of such dairy farm. In the event that the dairy farm owns cash and other non-operating assets (i.e., assets not required in the business operations of the dairy farm), it may be necessary to make adjustments to the operating equity value to incorporate the value of these assets. Specifically for dairy farms, it’s important to also make adjustments to capture the seasonality of the business. As cows consume more feed in the spring and fall, dairy farms typically purchase higher levels of feed for such seasons, which theoretically implies lower levels of cash and/or a higher line of credit balance. On the other hand, the summer and winter months typically have lower feed levels, which implies a higher cash balance and/or a lower line of credit balance. However, a lower level of feed in the summer and winter months may require an adjustment for a working capital deficit. Overall, a dairy farm’s cash and inventory levels less the line of credit balance should roughly be the same at any given time. Other adjustments to operating equity value also include the addition of any interests in cooperatives or other investments, and the adjustment for the balance of the hedging account of the dairy farm on the given valuation date.

Valuation Corroboration

The Net Asset Value method under the Asset Approach is a valuation technique whereby the equity value of a company is determined by developing a market value balance sheet. All assets and liabilities are marked-to-market, and the net asset value of the company represents the equity value on a controlling basis. For a dairy farm, the three largest asset categories usually include its dairy herd, property and equipment, and inventory. The market values of the dairy herd can be determined based the amount a milking cow or heifer could be sold for in the open market. The market values of the dairy farm’s facilities can be obtained from a recent appraisal or from its tax-assessed value, and the value of the inventory is based on its purchase price as dairy farms typically keep feed onsite for the next twelve to eighteen months. The remaining market values of the assets can usually be estimated by their book values.

As most dairy farms operate as profitable, going-concern business enterprises, we typically do not utilize an Asset Approach to determine the Fair Market Value of interests in dairy farms. A pitfall of the Asset Approach is that the intangible value of a business is not captured. Thus, although we do not utilize the Asset Approach directly, this method can serve to set a floor value of the business since at worst a dairy farmer can simply liquidate his assets, pay off liabilities, and keep the remainder as equity. We do acknowledge, however, that if a dairy farm is not generating a sufficient level of cash flow relative to its asset mix, or the land has more value for real estate development, there is a possibility that an asset based approach could yield the highest and best value.