Paycheck Protection Program (“PPP”) Resource Center for Borrowers and Lenders

Paycheck Protection Program (“PPP”) Resource Center for Borrowers and Lenders

PPP borrowers and lenders, and their counsel, have been leveraging Stout's expertise, insights, and analysis since the program's inception to help mitigate risk.

Stout has been helping both borrowers and lenders prepare for SBA audits, comply with data requests and bank regulatory requirements (AML) since the CARES Act was established. Our experience with the PPP rules detailed in the related releases and guidance has been honed by our work with hundreds of PPP borrowers, lenders, and leading law firms/attorneys. We know the red flags, risks, and mitigations to assist clients in preparation for successful interaction with government investigators and auditors.

The Stout PPP Advisory Services team is comprised of highly experienced financial professionals including (Certified Public Accountants (CPA), Chartered Financial Analysts (CFA), Certified Fraud Examiners (CFE), individuals Certified in Financial Forensics (CFF), Certified Anti-Money Laundering Specialists (CAMS), Certified Anti-Money Laundering & Fraud Professionals (CAFP), former regulators, and financial services auditors, and compliance professionals) with collectively more than 50 years of experience, including on similar types of government programs, with agencies such as the FDIC, OCC, NCUA, HUD, and Special Inspectors General, relative to lending program compliance and enforcement.

Remember how we got here?

The CARES Act of March 2020 authorized the Small Business Administration (“SBA”) to provide guarantees for potentially fully forgivable loans of up to $10 million to eligible borrowers as part of the Paycheck Protection Program and nearly 12 million loans totaling $800 billion were originated. Given the extremely tight timeline between creation of the PPP and when loans could start being originated, lenders and borrowers alike were scrambling. Specifically, borrowers were trying to determine eligibility and digest the SBA’s interim rules, understand the program requirements and nuances to determine if the program was a good fit, and complete and submit an application with a lender accepting applications. Meanwhile, lenders had to establish new processes, were inundated with applications, and between the need to process applications and get the money out to small businesses fast, coupled with many of the stay-at-home and social distancing orders in many locales, lenders, and their staff were overwhelmed. Now borrowers and lenders are preparing for further government scrutiny of all PPP loans; and the policies, procedures, and processes that lenders had in place while originating those loans.

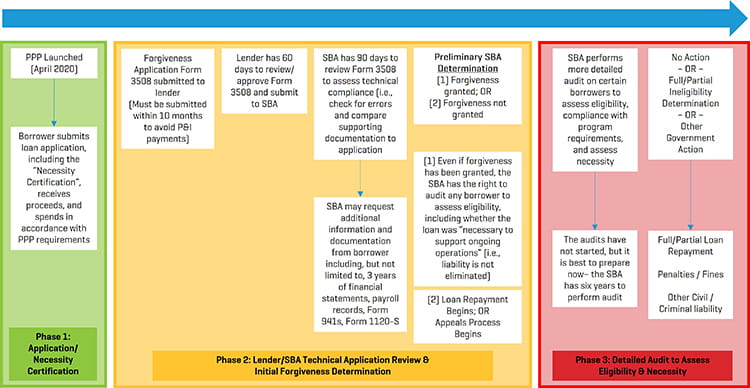

Paycheck Protection Program (“PPP”) Timeline

(click image below to enlarge)

Given the uncertainty, nuances, and complexities around many aspects of the PPP, the advice, counsel, and recommendations attorneys can provide to clients on these issues is frequently complicated. Practically every aspect of the services attorneys provide clients on PPP related issues is impacted by the frequently changing PPP guidance, not to mention complexities in various contexts related to contract compliance, regulatory compliance, employment and labor law, tax issues, mergers and acquisitions, other business transactions, and litigation, among other things.

Indeed, in addition to the central issues including, but not limited to, loan eligibility, eligible loan amount, affiliation rules, forgiveness eligibility and navigating the forgiveness application and submission process, the lender and SBA loan review process and accompanying challenges, the impending audits of all loans greater than $2 million, PPP loan issues can manifest in ways that should be carefully considered by an experienced team of advisors that can help with issues such as:

- SBA information requests and other agency inquiries

- Requirements for SBA approval of M&A transactions, associated escrows and successor liability

- Post-acquisition disputes

- Government contracts and cost reimbursement compliance

- Financial reporting considerations

- The impact of other CARES Act grants and loans

- Tax-related issues including Employee Retention Credits

- Government enforcement actions

- Civil litigation, including whistleblower/qui tam complaints

Stout can help attorneys

Stout regularly works with attorneys advising their clients on PPP issues, including:

- Providing an independent analysis, report, and opinion evaluating/supporting need certification. A comprehensive report and expert opinion on whether we, as independent financial experts, believe (based on the specific facts and circumstances of the business) that economic uncertainty existed that impacted the ongoing operations of the business both (1) at the time of the business’s loan application; and (2) through May 18, 2020, the SBA’s ‘grace period’ deadline for returning PPP funds.

- Audit preparation and performing a mock audit.

- Risk assessments and PPP consulting services to help borrowers respond to information requests and SBA audit. We can review and critique your client’s prepared file and work with you to strengthen it.

- Pre-case assessments and other consultation related to issues of necessity.

- Government enforcement action, and criminal or civil litigation assistance, including expert witness and testifying services.

- Other PPP and CARES Act related consulting and litigation assistance.

The SBA has stated that they will be performing some level of review over every PPP loan, and that all PPP loans greater than $2 million will be “audited” by the SBA/Treasury. Indeed, the SBA has started reviewing loans, and in many cases granting forgiveness. However, forgiven does not necessarily mean forgotten. To be sure, some borrowers have already been “challenged” with the SBA denying, either partially or fully, the borrower’s forgiveness application based on ineligibility and/or lack of ‘necessity’.

Despite the SBA’s self-imposed 90-day timeline for reviewing forgiveness applications, the SBA has six years to conduct its audits. For borrowers that have achieved the preliminary step of “forgiveness”, the primary focus of a subsequent audit is likely to be the borrower’s self-certification of need (i.e., the ‘necessity’ certification). Additionally, the SBA audits can include affiliates and may focus scrutiny on higher-risk borrowers such as:

- Public companies;

- Private equity and venture capital-owned businesses;

- Foreign-owned businesses;

- Businesses in higher-risk industries; and,

- Businesses that performed better than expected in 2020.

These audits are expected to be designed to assess eligibility and evaluate the good-faith certification that was made on the loan application that economic uncertainty made the loan request necessary to support the ongoing operations of the borrower. The implications of the audit may include:

- A determination of initial ineligibility;

- A determination of partial or complete forgiveness ineligibility;

- Mandatory return of some or all loan proceeds, including interest and fees;

- Government investigation, enforcement action resulting in fines and penalties or debarment, and/or potential criminal liability; or

- Civil litigation, including whistleblower (i.e., qui tam) cases.

Stout can help borrowers

Our PPP Borrower services are specifically designed to help mitigate risks related to SBA audits, related litigation, non-compliance, allegations of fraud, or misstatement. We assist our PPP borrower clients with a range of services including:

- Providing an independent analysis, report, and opinion evaluating/supporting need certification. A comprehensive report and expert opinion on whether we, as independent financial experts, believe (based on the specific facts and circumstances of the business) that economic uncertainty existed that impacted the ongoing operations of the business both (1) at the time of the business’s loan application; and (2) through May 18, 2020, the SBA’s ‘grace period’ deadline for returning PPP funds.

- Audit preparation and performing a mock audit.

- Government enforcement action and litigation assistance, including expert witness testimony.

- Risk assessments and PPP consulting services to help borrowers respond to information requests and SBA audit. We can review and critique your prepared file and work with you to strengthen it.

After being inundated with loan applications, changing rules and guidance, and some borrowers trying to take advantage of the PPP, many lenders need help mitigating their after-the-fact risks. A study released by University of Texas, Austin, estimated that nearly 10%, or $76 billion, of the PPP loans originated were fraudulent and/or contained material misrepresentations. This information is consistent with the slew of Department of Justice indictments, data released by the Pandemic Response Accountability Committee (PRAC), and other information available in the public record related to widespread and systemic fraud in COVID-related relief programs. Accordingly, even the most diligent PPP originators could have inadvertently originated fraudulent and/or misrepresented loans that should be reported to both comply with their AML obligations and help mitigate downstream regulatory and legal risk.

Now that the PPP has closed, many lenders are proactively reviewing their PPP processes and portfolio to help determine whether there may be potential downstream risks and/or liability. While the SBA guidance allowed lenders to originate loans using a streamlined process, there were still BSA/AML requirements that needed to be met, including, but not limited to:

- Confirming borrower certifications were made on the application;

- Reviewing employee and payroll documentation, included with the application, to ensure support for loan amounts; and,

- Adhering to Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements for new and existing customers, including verifying customer identity (i.e., performing CIP/KYC/CDD), obtaining information related to beneficial ownership, developing a customer profile (i.e., CDD), and monitoring for and reporting potentially suspicious activities.

Stout can help lenders

- Performing post-origination enhanced loan review procedures to help mitigate the risk of borrower fraud and misrepresentation, including reviewing borrower loan applications and supporting documentation

- Providing outsourced BSA/AML assistance including performing borrower CIP/KYC/CDD procedures including beneficial ownership, monitoring for potentially suspicious activities including alert reviews and investigations, suspicious activity report drafting, and many other BSA/AML needs

- Conducting various types of loan portfolio analysis

- Providing other assistance related to loan origination, servicing, BSA/AML, and other regulatory compliance

- Government enforcement action and litigation assistance, including expert witness testimony.

Stout operates globally, providing corporate finance and valuation advisory, dispute consulting, expert testimony, and investment banking services. For more than 30 years we have helped our clients successfully pursue their greatest opportunities and address their most significant challenges. We currently perform more than 3,000 client engagements each year.

- [Webinar] Paycheck Protection Program: Practical Advice for Completing the Form 3509/3510 & Preparing for the SBA Audit

- [Webinar] PPP Borrower Concerns: Form 3509/3510, SBA Audit, and Litigation

- [Webinar] CARES Act Paycheck Protection Program (PPP): Understanding the Requirements and Mitigating Risks

- [Webinar] Paycheck Protection Program Webinar hosted by Dykema and Stout

- [Video] PPP Loan Insights: Forgiveness Does Not Mean Forgotten—Part I

- [Article] PPP Loan Insights: Forgiveness Does Not Mean Forgotten—Part I

- [Video]PPP Loan Insights: Forgiveness Does Not Mean Forgotten—Part II

- [Article] PPP Loan Insights: Forgiveness Does Not Mean Forgotten—Part II

- [Article] PPP Loan Insights: Forgiveness Does Not Mean Forgotten—Part III

- [Article] Fraud Enforcement Risk Mitigation Steps For PPP Lenders

- Reality TV star sentenced for PPP fraud and for operating a multimillion-dollar Ponzi scheme

- Small Business Administration (SBA) guidance and statistics

- Online financial companies' processes facilitated fraud in PPP loans, Texas university study finds

- Did FinTech Lenders Facilitate PPP Fraud? University of Texas at Austin study

- Pandemic Response Accountability Committee (PRAC) Paycheck Protection Program

- Special Inspector General for Pandemic Recovery

- Department of Justice CARES Act resource page

- Congressional Oversight Commission

- Bakersfield Medical Practice Agrees to Resolve False Claims Act Allegations Involving Cares Act Paycheck Protection Program

- Eastern District of California Obtains Nation’s First Civil Settlement for Fraud on Cares Act Paycheck Protection Program

- Virginia Company Agrees to Settle Civil Fraud Allegations for Paycheck Protection Program Loans

Webinars and Insights

Program Research and Guidance

How can we help you?

Related Professionals

Related Experience

Related Insights

-

Webinar (On-Demand)

Paycheck Protection Program: Practical Advice for Completing the Form 3509/3510 & Preparing for the SBA Audit

-

Webinar (On-Demand)

Paycheck Protection Program: Preparing for SBA Review

-

Article

Community Banks and the Opportunity to Benefit From Resource Sharing

-

Commentary

COVID-19 and Accounting for Loan Modifications

-

Article

Innovation in a Time of Crisis

-

Article

Paycheck Protection Program (PPP): Lender Risks & Mitigation Strategies