Environmental, Social, and Governance Reporting: What ESG Is, Why It’s Important, and Where It Might Be Going

Environmental, Social, and Governance Reporting: What ESG Is, Why It’s Important, and Where It Might Be Going

ESG reporting is of growing importance to regulators, investors, and companies. Further developments in this space are extremely likely as the emphasis on ESG grows in the marketplace.

Until recently, many companies viewed maximization of profits for shareholders as a primary goal. Recent shifts in perspective, however, are challenging this long-held notion and starting to place more emphasis on the business’s role as a member of society. Companies are increasingly aware that their decisions impact more than just immediate stakeholders. The result is an increasing focus from both investors and businesses on environmental, social, and governance (ESG) reporting.

What is ESG Reporting?

Environmental Reporting

An environmental report is an assessment of how a company interacts with its environment to mitigate environmental risks for ecosystems, water, air, and human health. Finance departments may look to quantify the return on sustainable investments while looking for cost-saving opportunities that align with the company’s long-term environmental goals and strategy. Examples of this include company commitments to reduce carbon emissions, energy providers relying on solar power, or the tech industry shifting to data center power that is derived from renewable energy sources.

Societal Investments

Societal investments examine how a company manages its relationships with its workforce, the societies in which it operates, and the political environment. A company may evaluate its strengths and weaknesses in light of social trends, labor, and politics, and it will look to establish goals that increase both profit and corporate responsibility through establishing a social presence in the community. For example, a company may take steps to ensure the good or service it sells does not pose safety risks, or they may look to minimize the exposure to geopolitical conflicts within its supply chain. This too influences the financial future of the company, as the business could calculate an ROI on company decisions that target social dynamics which could affect long-term shifts in consumer preferences.

Corporate Governance

Corporate governance is establishing a structure within a company where the role and makeup of the board of directors, as well as the compensation and oversight of top executives, are seen as core issues. Many institutional shareholders are demanding better representation of women and people of color on corporate boards, and they look for equal executive ranks, compensation, and mobility. In 2021, the US Securities and Exchange Commission (SEC) approved Nasdaq’s proposed rule changes that required companies to have at least two diverse board members or to explain the reasons for not meeting that diversity objective. There is also a requirement to disclose certain diversity metrics.

ESG Importance and Standard-Setting Groups

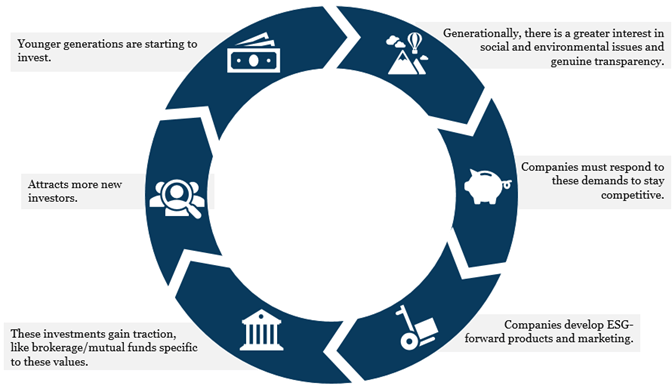

ESG is growing in importance largely because of younger generations beginning to invest. Millennials in particular are known for seeking out honesty, reliability, and transparency, as well as using technology creatively to solve complex problems. As investors, they are looking to support companies that share those same core values and motivations. Therefore, for businesses to attract those younger generations, they must work to align with the same moral standards through ESG-forward products and marketing. Since consumers are so willing to support these socially and environmentally friendly initiatives, such decisions also create opportunities for lower costs of capital.

Currently, there are a significant number of standard-setting bodies in the ESG space, including the CDP (formerly the Carbon Disclosure Project), the Climate Disclosure Standards Board, the Global Reporting Initiative, and the Value Reporting Foundation. With so many standard setters and the recognition that ESG is an international issue, it is currently unclear who exactly will emerge as the authoritative ESG rule-setter. This presents obstacles to companies that want to act on the ESG front but do not know the best place to begin due to conflicting sources of information. In addition, without a clear set of broadly accepted standards and reporting requirements, investors are beginning to find it difficult to assess company performance due to the limited availability of comparable data.

SEC Proposed Rule

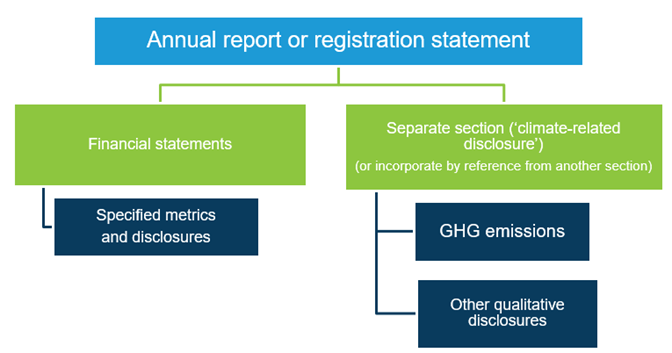

On March 21, the SEC proposed a rule to enhance and standardize climate-related disclosures for investors. The proposal is effective for all domestic and foreign companies that file financial statements with the SEC. The proposal would impact disclosures in both annual reports (Form 10-K) and registration statements. If the rule becomes effective in December 2022, a phased-in approach would begin depending on the registrant’s filing status, beginning with fiscal year 2023.

Under the current proposal, ESG disclosure requirements would be located in two areas of the public filings noted above the financial statements and a separate section outside the financial statements with an appropriate title such as “climate-related disclosures.”

Financial Statements

ESG metrics and disclosures specified in the financial statements would fall broadly into three categories:

- Impact related to severe weather events and other natural conditions and transition activities (for example, impairment charges, increased loss reserves, changes in salvage values or useful lives).

- Expenditures related to mitigating the risk of severe weather events or other natural conditions and transition activities.

- Qualitative description of how climate-related events impact estimates and assumptions that are used to produce the financial statements.

Because this information would be found in the financial statements section, it would be subject to both audit and internal controls over financial reporting.

Climate-Related Disclosure Section

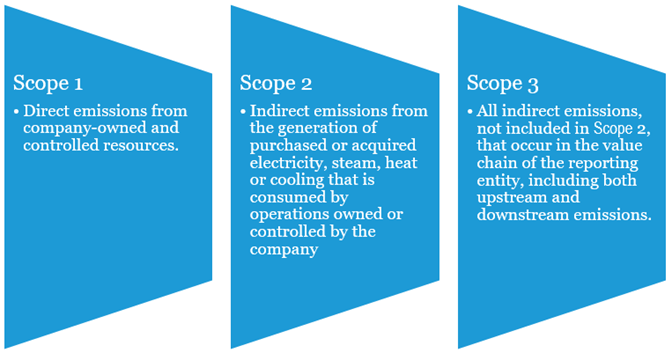

The separate, climate-related disclosure section would include GHG, or greenhouse gas, emissions disclosures along with other qualitative disclosures. Qualitative disclosures could include governance and risk management processes, physical and transition risks, and carbon offsets, among others. Companies would be required to disclose the following three scopes of GHG emissions.

What’s Next?

The proposed rule would considerably change the climate-related disclosure requirements for public companies and, for many organizations, would necessitate the development of robust practices to collect and manage a new set of data, including applying existing disclosure and financial controls to ensure the data is complete and accurate. The effort required to comply with the disclosure requirements will be significant for many organizations, so companies should not wait to begin thinking about the impact this will have on their systems, processes, and control environments.

As evidenced by the SEC’s proposed rule, ESG reporting is of growing importance to regulators, investors, and companies, and further developments in this space are extremely likely as the emphasis on ESG grows in the marketplace.

Originally published in Bloomberg Tax

Stout Vice President Ashley Ross contributed to the development of this article.

Stout Associate Anthony Sommer contributed to the development of this article.