Replacing LIBOR

Replacing LIBOR

LIBOR caught the eye of global regulators in recent years as manipulation scandals and the opaque application of expert judgement led to a decline in its perceived integrity.

Every weekday for the past 35 years, 17 banks included in the Intercontinental Exchange (ICE) Benchmark Administration (IBA) have reported the rate at which they could borrow funds from other banks in the London interbank market. The four highest and four lowest rates were removed, and the average of the remainder was the London Interbank Offered Rate (LIBOR). This was completed for seven maturities and across six currencies. However, as of December 31, 2021, the governing regulator that oversees LIBOR, the Financial Conduct Authority (FCA), will no longer force banks to report their rate submissions. While USD LIBOR will be quoted until June 2023, all new originations starting in 2022 will be unable to utilize LIBOR as a reference rate. This will effectively be the end of this daily rate submission routine and LIBOR will no longer stand as the global benchmark reference rate.

With the FCA no longer enforcing participation among the 17 large banks, the index is expected to be deemed unrepresentative of a guideline index rate shortly after year-end. After the announcement of LIBORs demise, the Secured Overnight Financing Rate (SOFR) emerged as the replacement front-runner. As the revised deadline approaches, additional challengers to SOFR have gained support amongst lenders.

Issues with SOFR

SOFR is based on the overnight Treasury repo rate, the rate at which the central bank lends to commercial banks to satisfy short-term funding needs and differs from LIBOR in two key respects. First, as SOFR represents a rate index collateralized by US Treasuries, credit risk is essentially non-existent. LIBOR, however, includes credit risk associated with the participating banks of the London interbank market. This implies an additional spread adjustment for credit risk will be needed to appropriately compare SOFR, a risk-free rate, and LIBOR, a credit-sensitive rate. Second, SOFR reflects an overnight, daily rate and lacks a forward-looking term structure. LIBOR includes a seven-maturity term structure and exhibits strong liquidity in the widely used one-month and three-month tenors.

Many lenders supported Term SOFR, a forward-looking SOFR curve built in a similar manner to the LIBOR curve with one-month and three-month tenors known in advance of the interest period. Although most were reluctant to formally adopt Term SOFR due to hesitancy of the Alternative Reference Rates Committee (ARRC), the group appointed to ensure a successful transition from LIBOR, to formally recommend Term SOFR for new originations. The ARRC justified its delay by citing a lack of sufficient transactions and data. In July 2021, the ARRC finally formally recommended Term SOFR as the official LIBOR replacement, but the delay led market participants to take matters into their own hands, sparking interest in Credit Sensitive Rates (CSR).

New Contenders

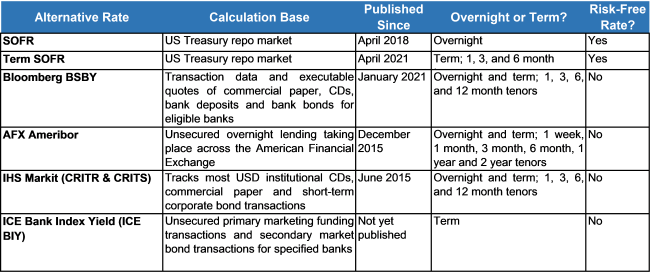

Some large banks in the US and headline mortgage lenders such as Fannie Mae already adopted SOFR, but many lenders held off in hopes of a better replacement. The delay in the ARRCs endorsement of Term SOFR gave life to competing CSRs, with multiple providers racing to propose their alternatives. Bloomberg, Markit, AFX, and ICE emerged as the primary CSR developers, compiling reference rates that include an inherent credit risk element and a forward-looking term structure. These CSRs are highly correlated with LIBOR and would bypass operational headaches by offering a turn-key replacement solution.

Of the new CSR alternatives offered, the Bloomberg Short-Term Bank Yield Index (BSBY) appears to be the favorite. In early May of 2021, Bank of America Corp. and JP Morgan Chase & Co. traded the first derivative using BSBY in LIBORs stead. Regional banks adopted AFXs Ameribor index, as it better tracks funding costs associated with the banking industry. ICEs Bank Yield Index also includes a credit component, is forward-looking, and is overseen by the IBA, the same governing body that currently oversees LIBOR.

Leveraged Loans

The leveraged loan market reflects a sub-investment-grade portion of the overall credit lending space. The vast majority of the nearly $1.2 trillion leveraged loan marketplace is based on a floating rate supported by LIBOR, making the transition to a new benchmark rate of the utmost importance for many lenders and borrowers alike. Hardwired SOFR fallbacks made some progress through amendments incorporated during the COVID-19 pandemic repricing wave, but many existing credit agreements lack sufficient contingency language to appropriately address a LIBOR successor. Many credit agreements contemplate an inability to utilize LIBOR, but unless the contract was executed in recent months, most lack a specific assignment to a LIBOR replacement. Most contracts reference future borrower and lender discussions to determine the appropriate replacement index if LIBOR becomes unavailable.

New York State governs most of these contracts and in early April of 2021 passed legislation to remedy contracts referencing USD LIBOR but not including effective fallback provisions. The New York LIBOR Legislation states the recommended benchmark replacement shall be based on SOFR and be selected or recommended by the Federal Reserve Board, the Federal Reserve Bank of New York, or the ARRC for the applicable type of contract, security, or instrument. The recommended benchmark replacement will include any applicable spread adjustment and any conforming changes selected or recommended by the Federal Reserve Board, the Federal Reserve Bank of New York, or the ARRC. With its formal recommendation in July, the ARRC is likely to propose Term SOFR to New York as the recommended benchmark replacement. The legislation does not impact contracts governed outside New York, and parties to a contract not governed by New York law remain free to agree to a fallback rate that is not based on SOFR. The new law does not override a fallback to a non-USD LIBOR-based rate (e.g., the Prime rate) agreed to by the parties to a contract. The legislation is not meant as a substitute for amending legacy USD LIBOR contracts. Rather, it is a backstop in the event that counterparties are unwilling or unable to agree to adequate fallback language prior to the cessation date or date of non-representativeness.

Derivative markets and mortgage lenders transitioned away from LIBOR faster than the leveraged loan market. Much of the leveraged loan market's hesitancy in replacing LIBOR has been driven by the aforementioned lack of a forward-looking term structure and inherent credit component. The impacts of these concerns were explicitly exhibited in March 2020, when the spread between SOFR and LIBOR widened rapidly.

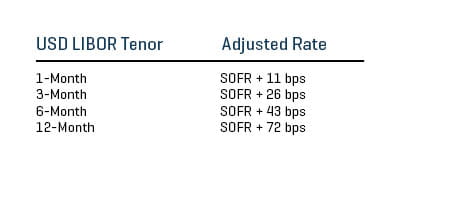

The ARRC's formal replacement recommendations for LIBOR-backed cash and derivative products are forms of SOFR plus a fixed spread adjustment at the point of transition for legacy contracts. The applied fixed spread adjustment is meant to convert SOFR to a fair and reasonable LIBOR replacement, while also minimizing the impact to borrowers and lenders. The ARRC stated it will provide recommended spread adjustments for a one-year period and the starting adjustments will be based on a historical two-week average LIBOR-SOFR spread. The below table reflects preliminary initial ARRC recommended spread adjustments, reflecting the fair all-in rate and exclude current market factor considerations.

Source: Bloomberg Finance, L.P. as of March 5, 2021

Timing

The developing saga of LIBOR's excision continues to cause confusion and uncertainty regarding the final timeline of the LIBOR transition. Currently, for USD LIBOR, the lesser used one-week and two-month tenors will cease on December 31, 2021. US regulators expressed more leniency for other, more widely used USD LIBOR tenors, such as the one-month and three-month. According to the FCA and IBA, more widely used USD LIBOR tenors will be quoted until at least June 30, 2023, but only pre-existing legacy contracts can utilize them as a reference rate. Synthetic USD LIBOR rates for the most commonly used tenors may remain available afterwards. Regarding the sterling, Swiss franc, euro and yen LIBORs, these indices will officially close at year-end. In short, new originations will no longer be able to use LIBOR after year-end, but existing LIBOR contracts will not be required to transition until June 2023.

Valuation Considerations

Despite the aforementioned differences between SOFR and LIBOR, the two indices typically trend in the same direction. The key difference between LIBOR and a risk-free index is the magnitude of index movements during times of elevated volatility. For example, in times of duress SOFR would be expected to move at a fraction of LIBOR as it excludes additional risk factors that must be considered during unstable periods in the market. On the rare occasion of extreme market disruptions, the trend relationships between LIBOR and SOFR could even become inverse, with LIBOR widening and SOFR tightening. While the likelihood of this situation is considered remote, it still poses a threat and demands adjustments to SOFR to seamlessly replace LIBOR.

Ideally, the valuation impact of the LIBOR cessation will be minimal. In reality, the impact may materialize as very bespoke to individual loans, dependent on the transition mechanism deployed. The ARRC's spread adjustments are expected to help minimize valuation changes, but time will tell if the LIBOR-SOFR relationship will hold.

Outlook

Despite the bevy of available CSRs, the ARRC's formal recommendation is likely to persuade the market majority to adopt Term SOFR as their LIBOR replacement. The ARRC has made an effort in recent months to publish longer-dated Term SOFR tenors in a bid to pump market support. Some lenders believe a multitude of options provides a more prudent solution that lenders can more closely tailor to their specific needs. Others remain skeptical and believe a wide array of reference rates provides an unsustainable long-term solution to replacing LIBOR. Several available rates may further fragment the market and insufficient transaction data may erode index reliability. The ARRC has publicly encouraged all involved to fully comprehend their chosen benchmark rates to avoid an additional transition that could be both costly and risky.

Many lenders are expected to choose their LIBOR replacement based on their own funding costs and what best represents their industry. Collateralized Loan Obligations for instance could see considerable basis risk if assets are tied to CSRs and liabilities are underpinned by SOFR. Some banks and credit markets may lean towards CSRs in order to forego the application of an additional credit spread adjustment.

Given the ARRC recommendation, our expectation is to see most middle market floating loans move to Term SOFR with a premium. We also expect some variations to remain in the market over the near-term.

Contributing author: Chris McCann of Stout