Industrial Supply 2017 Year in Review

Industrial Supply 2017 Year in Review

Strong Valuations Coupled With Consistent Transaction Activity Capped a Solid Year for M&A

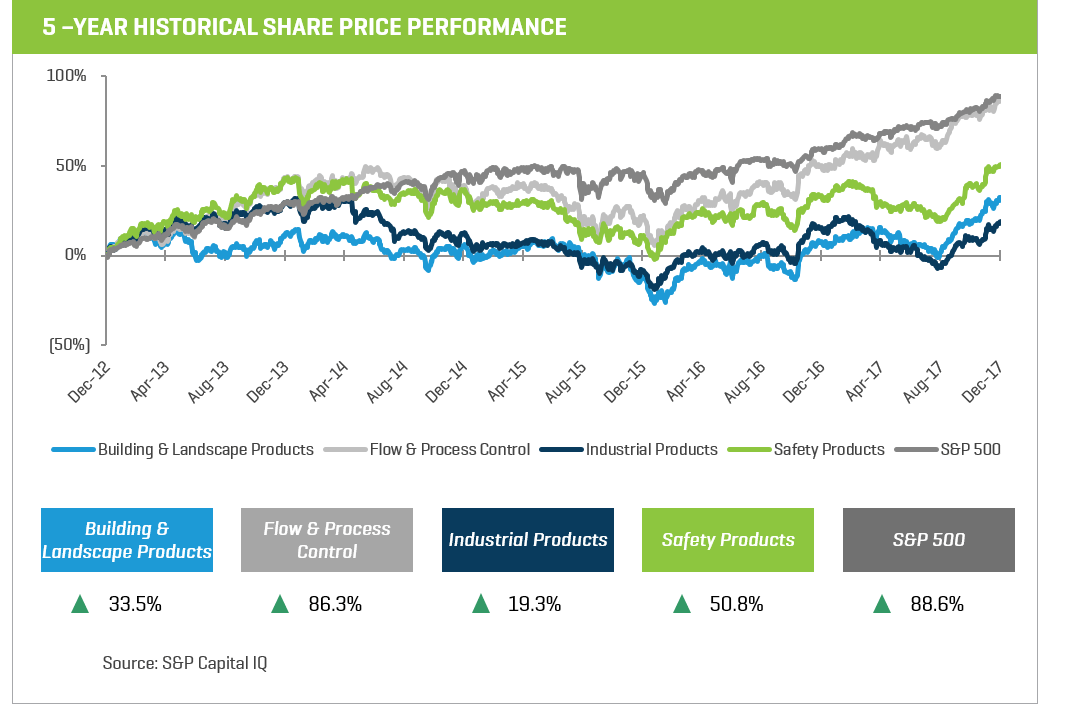

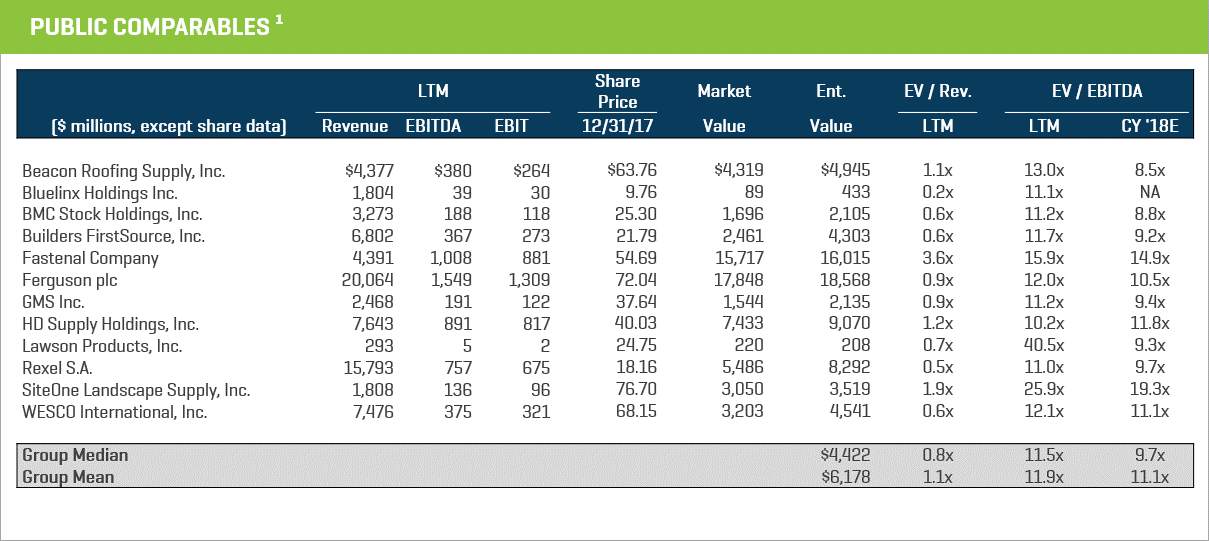

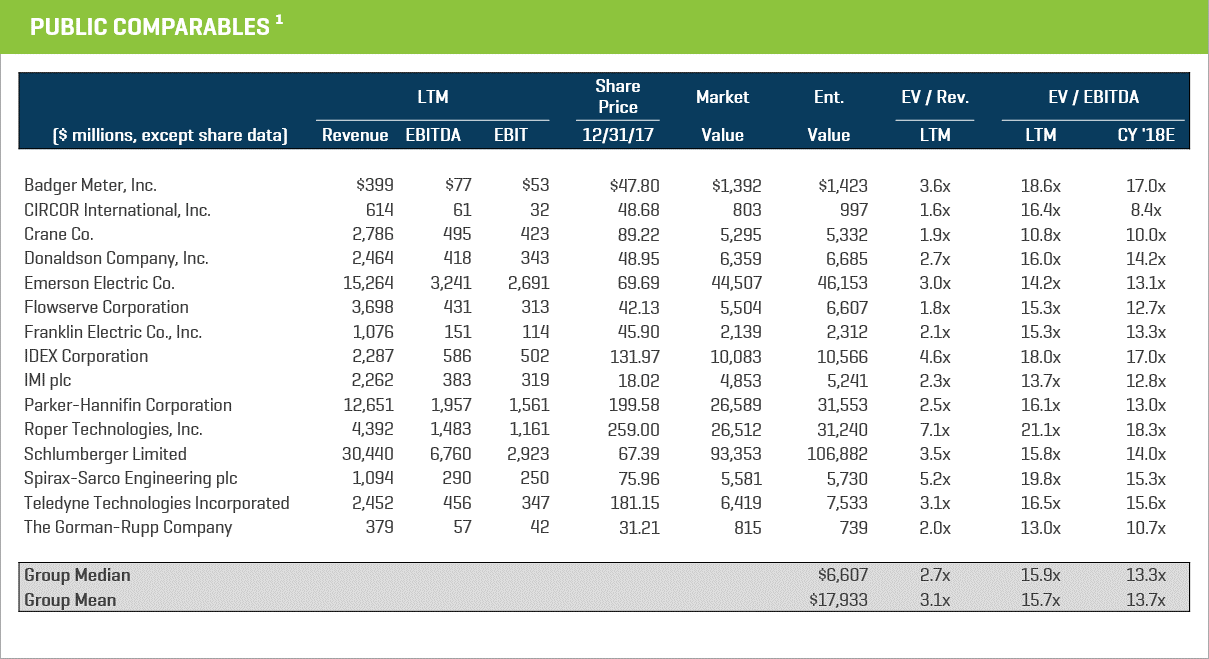

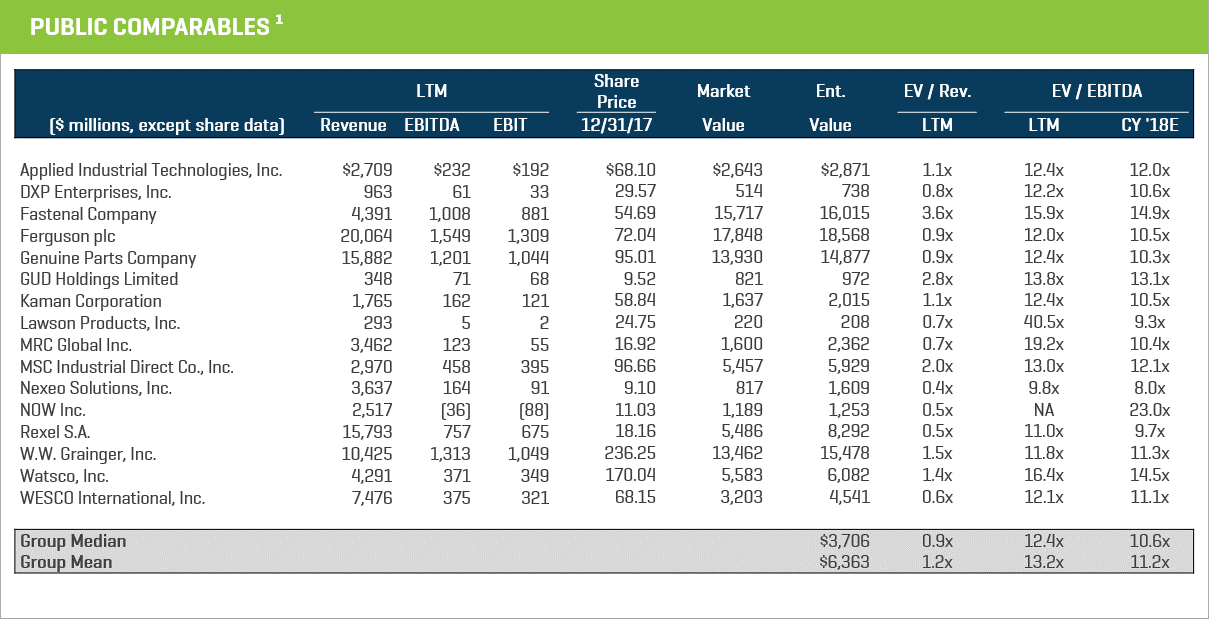

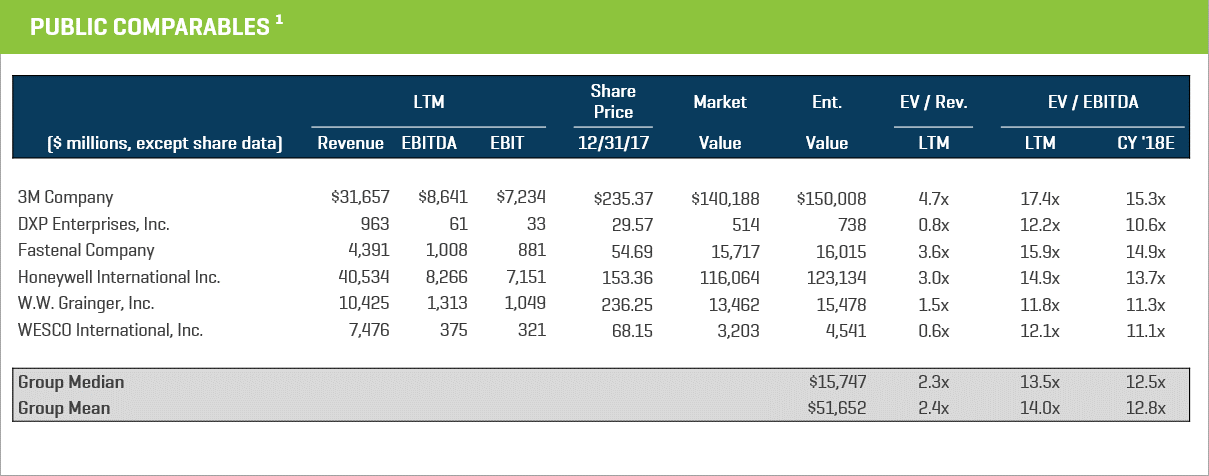

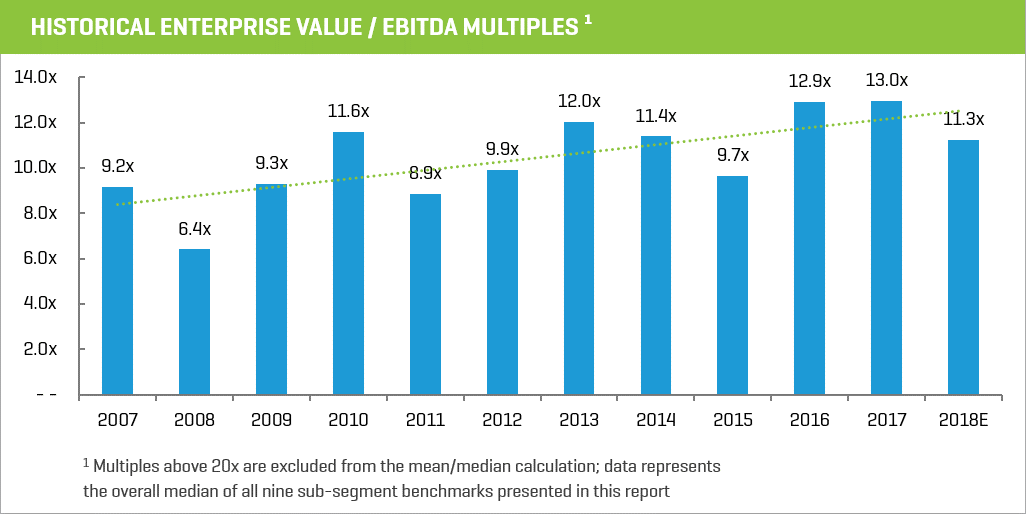

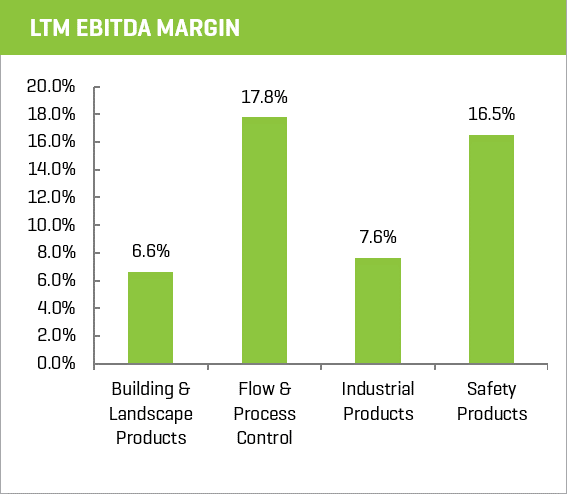

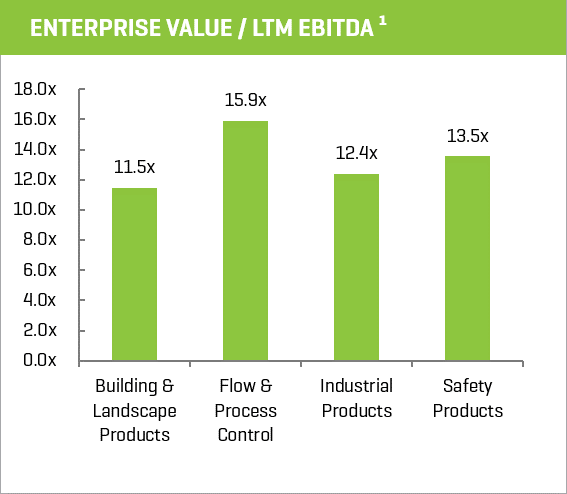

Historical EV / EBITDA multiples traded at their highest point in 2017 at a median of 13.0x, slightly up from 2016. Our Flow and Process Control segment is trading at the highest multiple

(median of 16.1x) among the Industrial Supply categories, in part attributable to the overweighting of manufacturers in the index and the high precision/high value applications in which the product set is utilized. We note that our Building and Landscape Products segment has seen the strongest year-over-year growth (median 5.2% three-year revenue CAGR and 13.2% three-year EBITDA CAGR), and has shown only modest equity gains over the past five years (33.5%); resulting in its trading at the lowest median multiple in our group (11.5x). A positive outlook across the broader group selection as the U.S. and global economies continue to strengthen has resulted in an increase in construction spending to i) replace aging infrastructure and ii) home renovation and remodeling – sections of the economy of which our groups are well exposed. Overall, we saw a majority of strategic buyers looking to ramp growth opportunities with consistent private equity investment – a trend to key in on as we move into 2018.

2017 Key Takeaways

- Strong consolidation trends seen in the Building and Landscape Products segment as industry leaders look to expand their geographical footprint and overall product offering

- Private equity interest in add-on acquisitions and portfolio optimization

- High capital availability and low borrowing costs buttress an already positive M&A environment

- Trading multiples among public companies remain strong

- Active M&A engagement both domestically and internationally

- Positive macroeconomic tailwinds

Industry Statistics

Operating and Market Performance

Building & Landscape Products

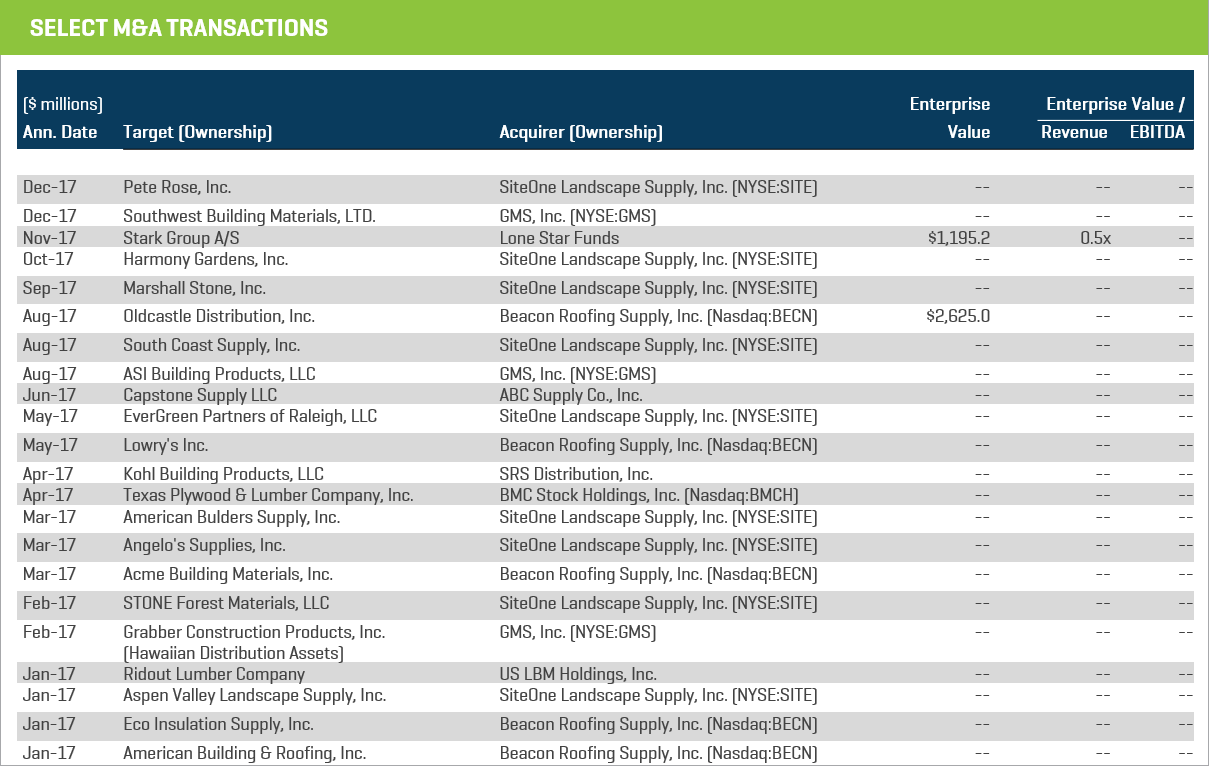

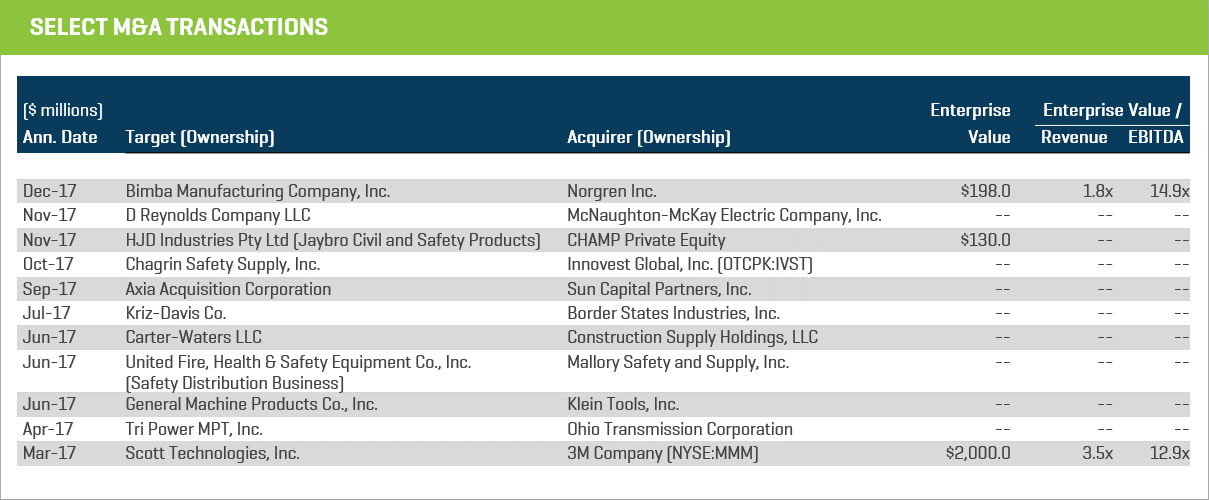

The Building and Landscape Products segment contained two mega deals, one of which was a strategic add and the other a private equity acquisition. Aside from the aforementioned private equity transaction, the majority of deal activity in this segment came from strategic acquirers seeking growth at a greater pace than organic opportunities present. Notable transactions include:

- Beacon’s acquisition of U.S.-based Oldcastle Distribution, in a deal valued in excess of $2.6 billion that management expects will be immediately accretive to adjusted EPS

- Lone Star, a private equity firm, agreeing to acquire Denmark-based Stark Group from Ferguson, for approximately €1.03 billion in a deal expected to close in the first quarter of 2018

- BMC acquiring U.S.-based Texas Plywood & Lumber Company, Inc., enhancing its presence in the Dallas/Fort Worth market

- SiteOne’s acquisition of American Builders Supply, Inc. which complements its existing hardscape offerings and adds depth to its presence in California and Las Vegas

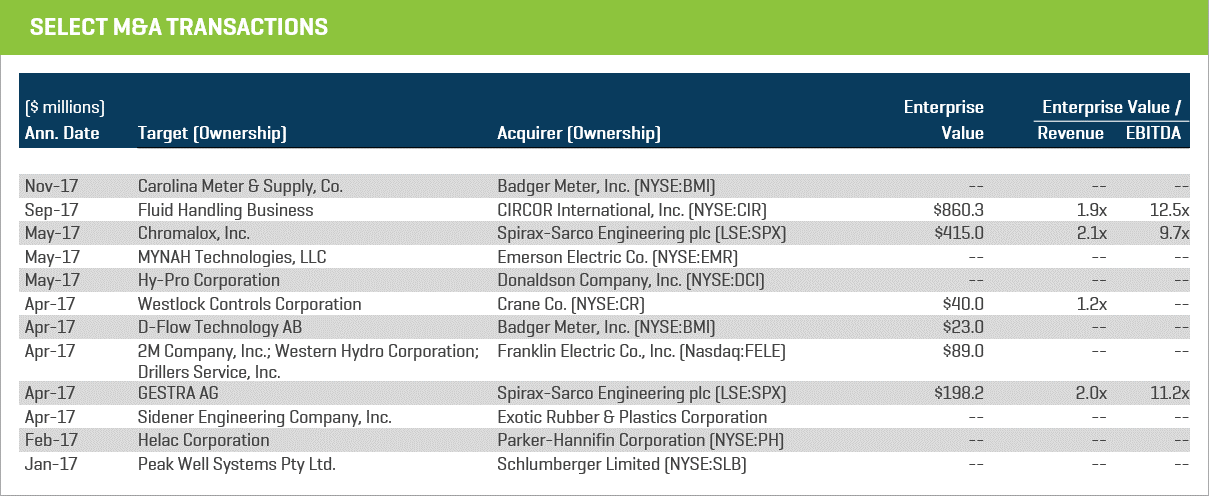

Flow & Process Control

The Flow and Process Control segment exhibited the highest trading multiples of the group in terms of EV / EBITDA. Notable transactions in this segment include:

- CIRCOR’s agreement to acquire Colfax’s Fluid Handling Business from Colfax Corporation (NYSE: CFX), diversifying its end markets and adding significant aftermarket exposure

- Spirax-Sarco’s acquisitions of Germany-based GESTRA AG for approximately $200 million and U.S.-based Chromalox for approximately $415 million, with each acquisition strengthening its worldwide footprint

- Badger Meter’s acquisition of D-Flow Technology for approximately $23 million in cash, enabling further enhancement of their E-Series Ultrasonic line which helps in servicing a growing municipal water market

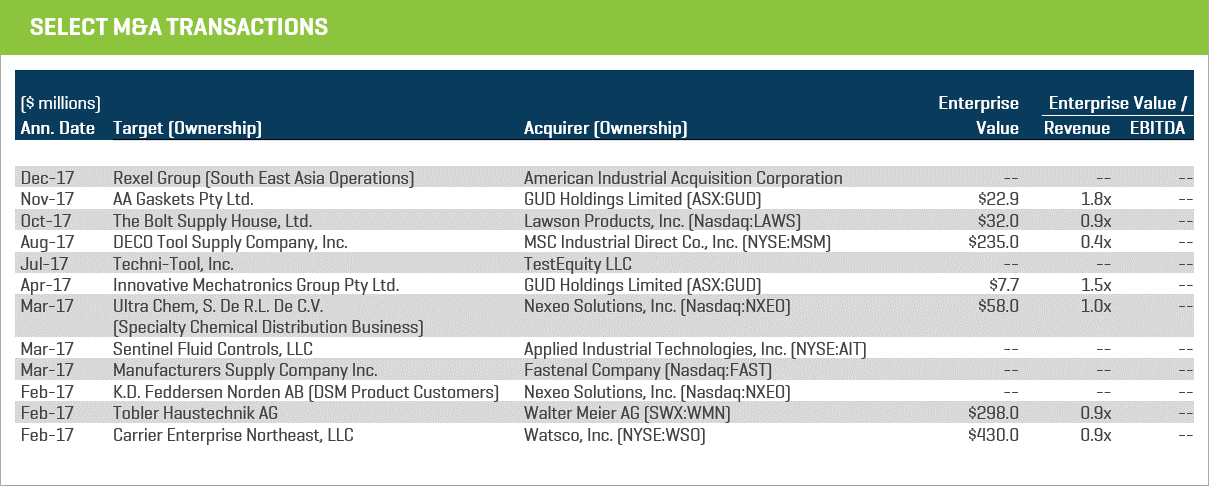

Industrial Products

The Industrial Products segment contained a number of strategic transactions, furthering an industry-wide theme of continued consolidation. Notable transactions include:

- MSC, a premier distributor of MRO products and services to industrial customers, acquiring U.S.-based DECO Tool Supply for approximately $40 million, enhancing its metalworking business and strengthening its presence in key areas throughout the Midwest

- AIT, a leading industrial distributor that serves MRO and OEM customers, acquiring U.S.-based Sentinel Fluid Controls, a distributor of hydraulic and lubrication components, systems, and solutions

- Watsco acquiring an additional 10% stake in U.S.-based Carrier Corporation, for about $43 million; totaling its entire stake in the company at 80%, with an estimated enterprise value topping $430 million

Safety Products

The Safety Products segment saw activity from large conglomerates as well as a handful of midmarket PE and strategic players. Three transactions of note include:

- CHAMP signing a definitive agreement to acquire Australian-based HJD Industries (Jaybro) for approximately $130 million, which complements RSEA, a portfolio company of CHAMP that provides personal, workplace, and road safety equipment

- Mallory acquiring the safety distribution business of U.S.-based United Fire Health and Safety, which is now re-launching as United Fire, marking Mallory’s 16th acquisition in the industrial and safety space

- 3M acquiring U.S.-based Scott Technologies from Johnson Controls for approximately $2 billion, furthering its personal safety product portfolio

(1) Multiples above 20x are excluded from the mean/median calculation