Healthcare & Life Sciences Industry Update - Q3 2017

VIEW FULL PDFHealthcare & Life Sciences Industry Update - Q3 2017

VIEW FULL PDFRobust M&A Activity Continues

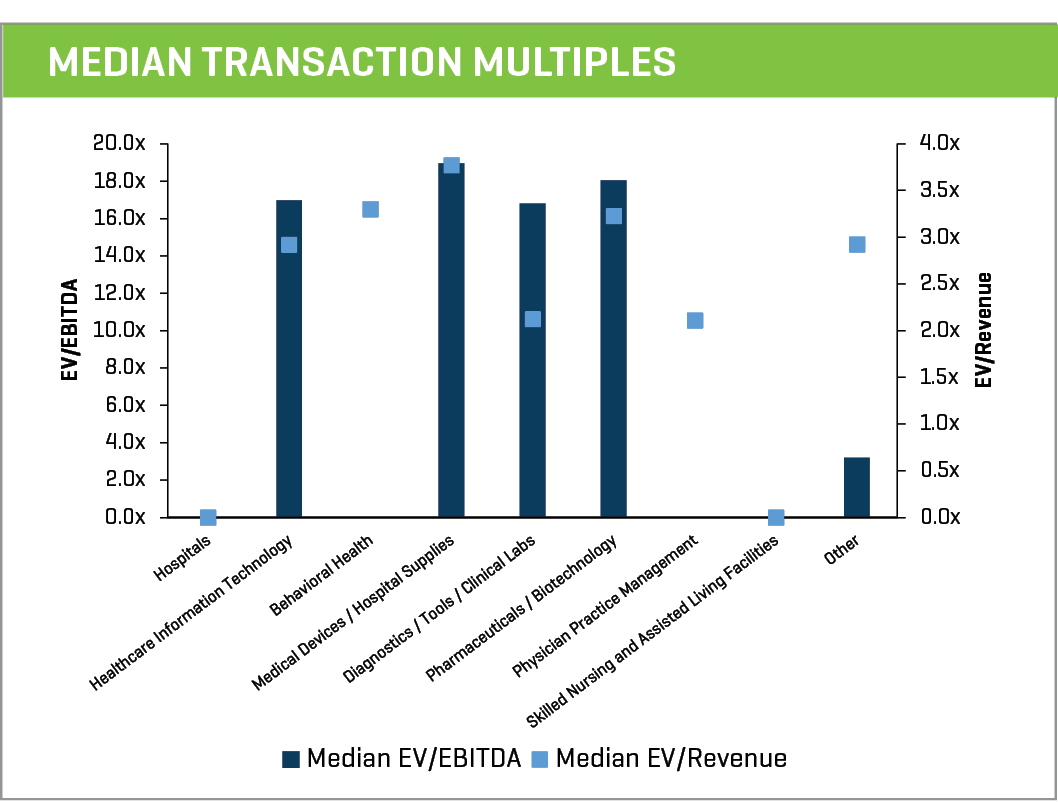

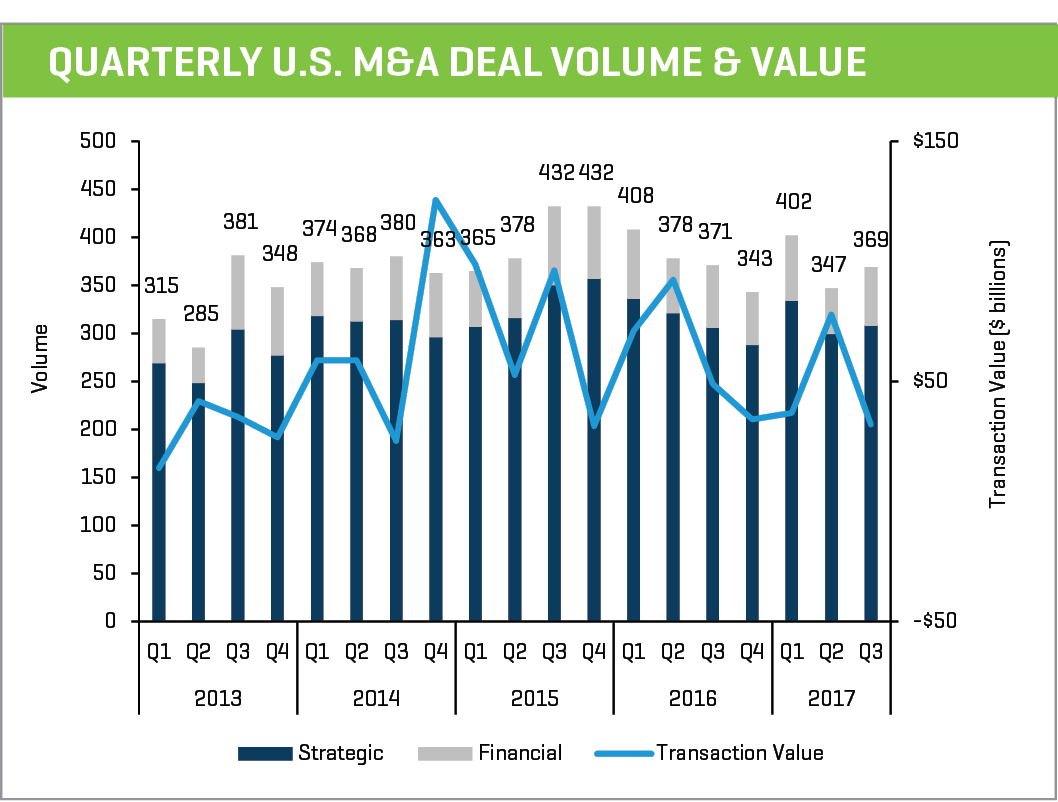

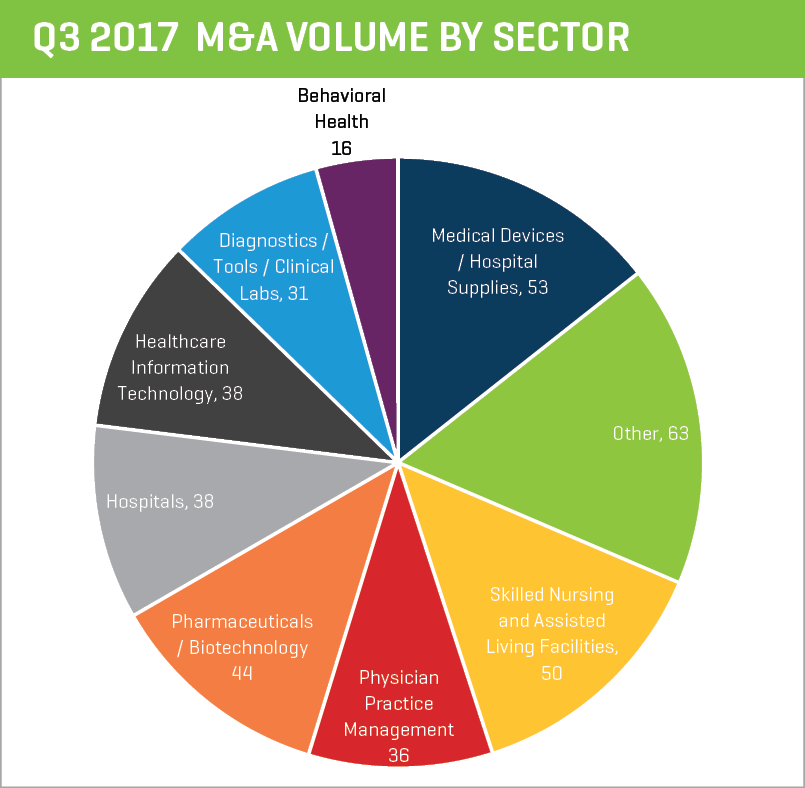

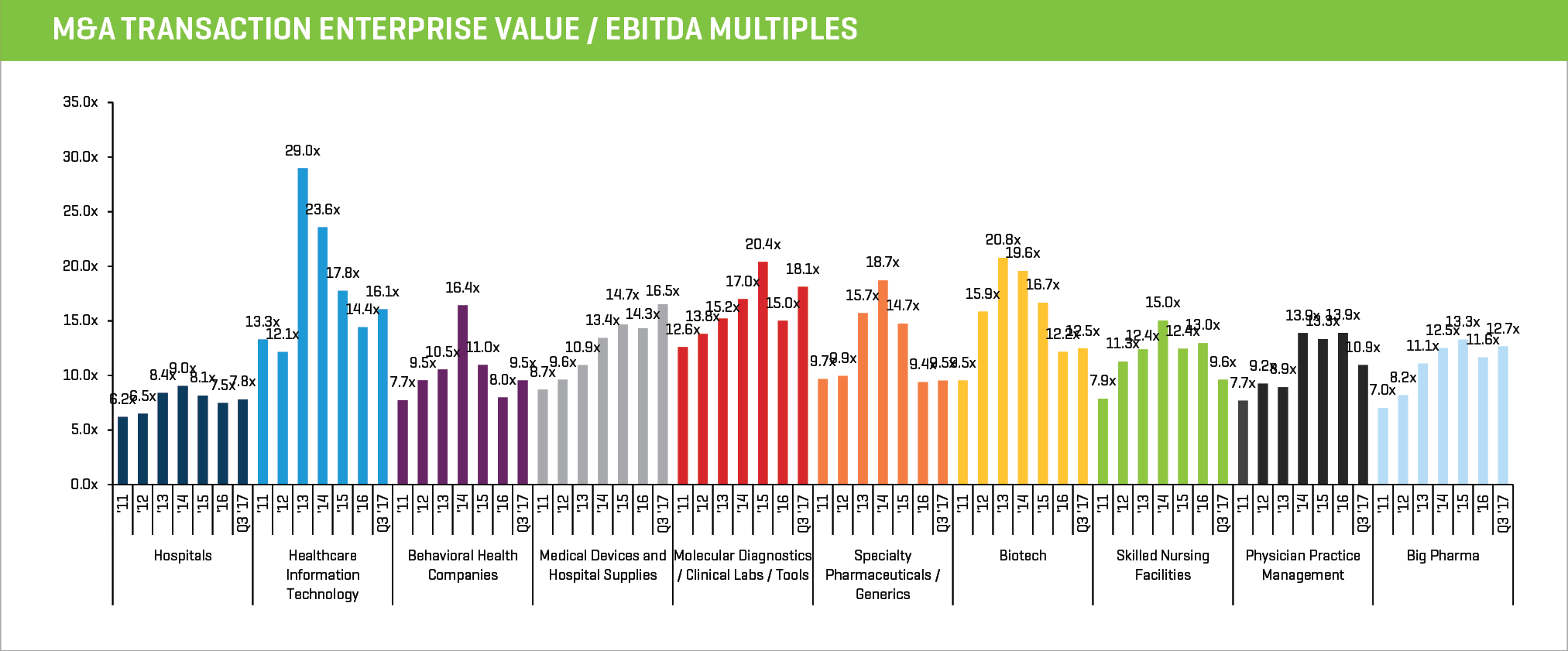

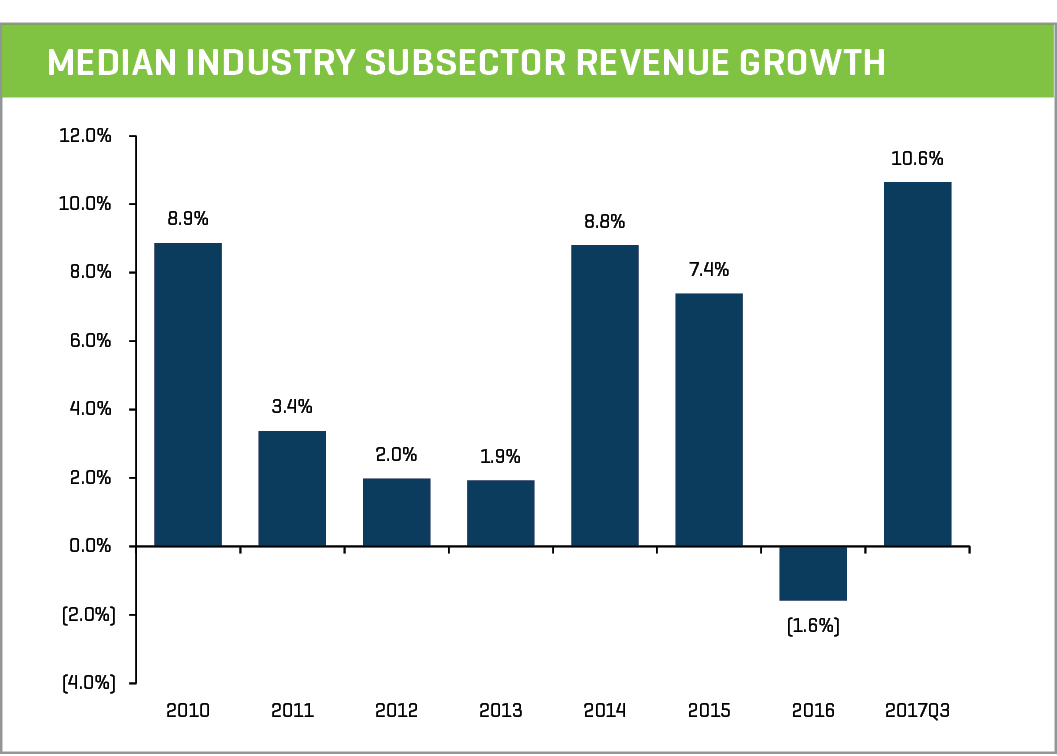

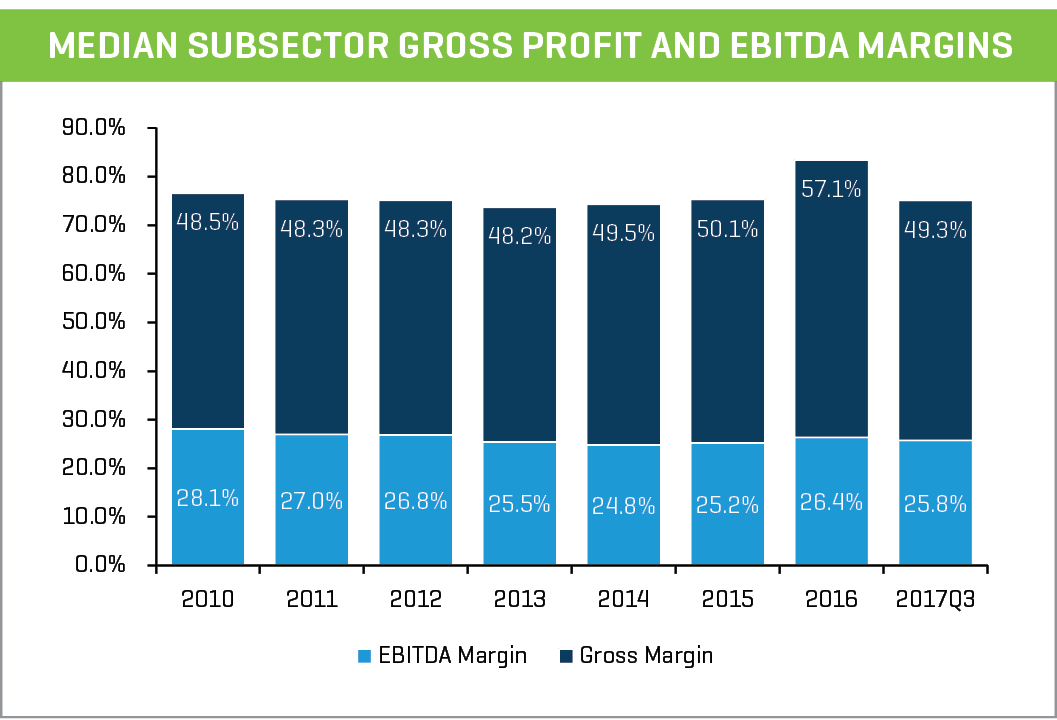

M&A Activity in healthcare services and life sciences remains robust, despite being off slightly from peak levels of 2015. Interestingly, while enterprise value to EBITDA multiples are pretty much in line with where they have been since 2011 for most healthcare subsectors, there are exceptions, such as medical devices, where multiples are at the high end of the range.

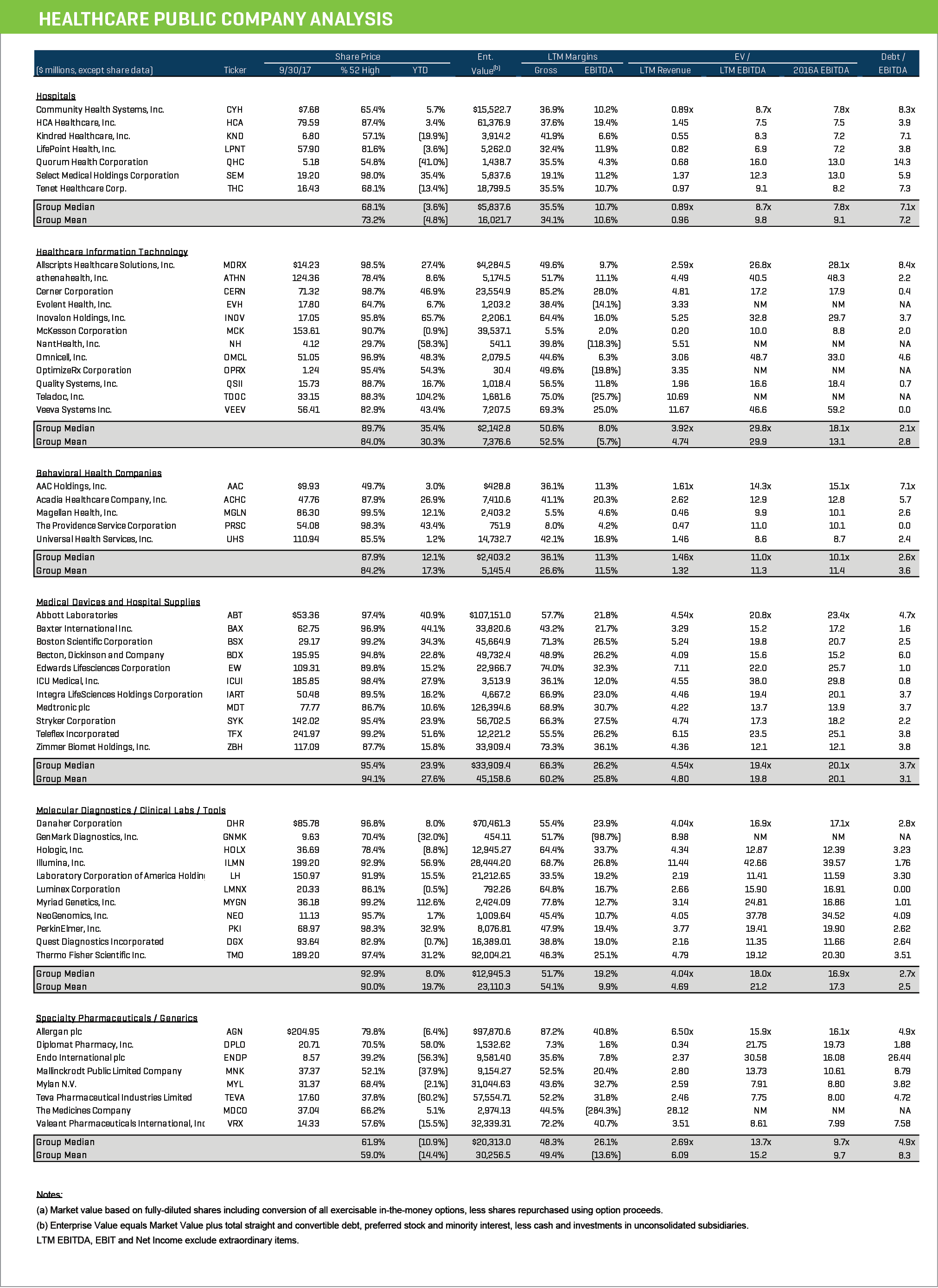

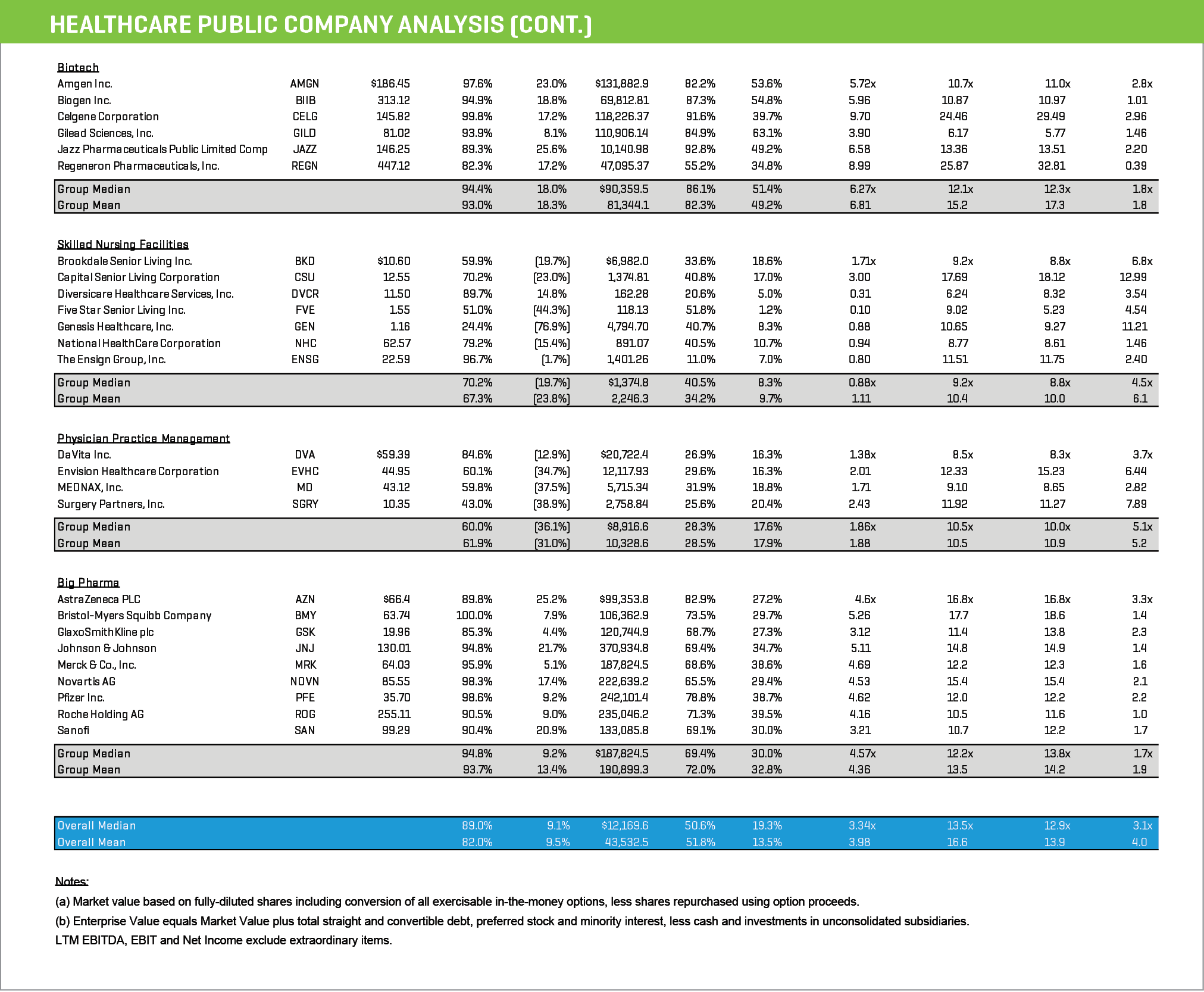

Only three of the 10 healthcare industry sectors that we monitor in this report outperformed the market year to date through nine months, and most of the trends discussed below continue to apply.

Life science stocks are once again outperforming their counterparts in healthcare services in 2017, as government budgetary pressures, Centers for Medicare and Medicaid Services (CMS) reimbursement cuts, payer pressures (moving providers to in-network contracts and cutting out of network rates), the collapse of the Obamacare exchanges and insurance mandate and the resulting impact on healthcare service utilization, presidential executive orders that defund some programs established by the Affordable Care Act (ACA), and even hurricanes have taken their toll on some of the service subsectors.

For the nine months ended September 30, 2017, the S&P 500 increased 14.2%, while healthcare information technology, medical devices and hospital supplies, biotech, Big Pharma, and molecular diagnostics and tools were up 35.4%, 23.9%, 18.0%, 9.2%, and 8.0%, respectively.

The weak link in life sciences was specialty pharma (-10.9%). Highly publicized criticisms of pricing tactics (Turing Pharmaceuticals, Mylan, and Valeant, to name a few), pharmacy benefit manager (PBM) reimbursement pressures, and growing competition have hurt pricing and revenues.

Food and Drug Administration (FDA) recalls of opioids that have safety issues or don’t have sufficient tamper resistant features and FDA approval delays have also impacted companies such as Endo Pharmaceuticals, Pain Therapeutics and Durect Corp.

Healthcare service providers all underperformed with behavioral health, hospitals, skilled nursing facilities, and the large physician practice management/ambulatory surgery center stocks increasing or decreasing 12.1%, -3.6%, -19.7% and -36.1%, respectively, the reasons explained above, such as declining utilization and reimbursement pressures.

Trump Executive Order Defunding Obamacare

President Trump signed an executive order in October to discontinue cost sharing subsidies to insurance companies that were designed by the ACA to help them cover the cost of co-payments and deductibles for low income individuals insured by plans participating in the Obamacare Exchanges. As a result, and not surprisingly, a number of insurance carriers are pulling out of those plans. The president’s strategy is clearly designed to compel Congress to get moving with respect to repeal and replace of the ACA.

The Trump Administration’s goal appears to aim at driving members who were on Obamacare plans to now sign up for Association Health Plans that can be sold across state lines and that may not cover all of the essential healthcare benefits of Obamacare, but may be cheaper. There is a lot of concern that people with pre-existing conditions would end up paying a lot more for plans with adequate coverage, while healthy people or corporations with healthy employees may be in the association plans that are cheaper.

The idea is that small businesses could join Association Health Plans, which are based on professional, trade or interest groups (SAG), and that offer insurance to members, which will allow them to get clout with insurers as a large group plan. These plans would not be encumbered by some of the Obamacare requirements to cover essential healthcare benefits, but would be certified, and would need to meet minimum standards and offer critical services to be acceptable to the members. These lower cost plans would be exempt from some of the ACA’s coverage rules, and could grab some of the healthier patients from Obamacare plans.

The issue is insurance cost versus patient protections, and even Republicans in Congress are trying to undermine President Trump’s executive order on subsidies and legislate measures to put the government subsidies back in place. This will continue to play out, and uncertainty continues.

Recent Healthcare Service & Life Sciences Industry Trends

HOSPITALS – BEARING THE BRUNT OF ACA DEFUNDING

Obamacare is dying a death of a thousand cuts as the president signed an executive order October 12, 2017, to defund Cost Sharing Reduction (CSRs) payments that the government makes to insurance plans that are passed on to healthcare providers designed to help poor Americans pay healthcare deductibles and co-payments for services such as hospital admissions. These benefits for the poor had been in addition to lower cost premiums for those that qualify and that purchased insurance through the state-sponsored Obamacare insurance exchanges, such as Covered California. This comes after many insurance providers have already withdrawn and canceled policies that had been offered on the exchanges.

The impact is expected to be an increase in uncompensated care (bad debt expense or charity care) for hospital and other service providers. Hospitals will take a double hit as they are already confronted with declining admissions, with surgeries increasingly being done in ambulatory surgery settings, shorter lengths of stay (patients being discharged to lower cost care settings sooner) and declining Medicare, Medicaid, and private payer reimbursement and insurance availability.

Ambulatory surgery centers (ASCs) and providers of physician services to hospitals are being impacted by softness in utilization, as well. Envision Healthcare (an ambulatory surgery center owner and provider of physician services to hospitals), have specifically called out in their third quarter earnings reports that they are being impacted by softness in utilization, after seeing an increase in demand the last two years following the expanded insurance availability and covered lives resulting from the Affordable Care Act. The elimination of subsidies to insurers participating in the exchanges and tax penalties on employers and employees for not participating in insurance programs will likely impact utilization going forward, as will more and more providers moving to in-network insurance contracts from out-of-network billing.

PHYSICIAN PRACTICE MANAGEMENT – OPHTHALMOLOGY RIPE FOR ROLL-UP

Physician Practice Management remains a compelling investment opportunity for private equity, especially in categories like ophthalmology where the industry is growing, fragmented, and ripe for roll-up. New technologies in cataract and refractive surgery are often supplemented by a patient cash pay component for lens technology upgrades and this area is expected to grow rapidly as lenses improve and younger and younger patients use them for vision correction. Retinal specialists will also likely benefit from advances in the treatment of wet and dry age related macular degeneration that could drive a significant increase in patient flow. A buyer of ophthalmology practices can also acquire or add an ambulatory surgery center to expand their revenue opportunity or they can add new services and/or physicians to grow the practice. Optometrists can also be trained to do more medical screening and diagnosis to drive more clinically justified referrals and an aging global population is expected to have a growing incidence and prevalence of eye conditions. All these factors described above are expected to boost growth for the industry going forward.

EBITDA multiples for ophthalmology practices have been running at 11x-16x, deservedly, in our view, given the growth opportunity relative to other areas of healthcare services. Dermatology, dental, and urgent care clinics look to be attractive growth opportunities, as well.

BEHAVIORAL HEALTH – BLURRY REIMBURSEMENT OUTLOOK, BUT GROWTH EXPECTED TO CONTINUE

We have just been out on the road in front of several companies in the substance abuse treatment segment over the last month, and what we have heard consistently is that it has been tough to keep the census up, because whether you’re an in-network or out-of-network provider, insurance companies are trying to avoid admissions and/or are negotiating lower per diem rates for detox, residential, IOP, and lab. A number of the service providers feel that the taskforces investigating the industry have diverted political attention away from the need to pressure insurers to agree to cover and allow providers to admit patients in need of care. This and Google disallowing the purchase of certain key adwords has made it more difficult for all providers to recruit patients, negatively impacting their daily census and hurting revenue growth. In other words, it appears that many providers have a lot of unfilled beds and potential cuts to Essential Healthcare benefits and curtailment of Medicaid expansion efforts (or cuts in state Medicaid programs and funding) that could have been implemented under the ACA could negatively impact Behavioral Health, as well.

Given the magnitude of the substance abuse epidemic in the U.S. and the number of persons untreated, we think that demand for treatment will continue to grow.

SKILLED NURSING FACILITIES – CAPITALIZATION RATES LOOK ATTRACTIVE IF BUSINESS STABILIZES

Enterprise value to EBITDAR Multiples and Capitalization rates appear to be tracking in the 8.5x and 12% range, respectively, in our estimation, and based on the BM Eagle Holdings acquisition of Kindred Healthcare’s 89 skilled nursing facilities. About half the acquisitions in this sector have been made by healthcare REITs, including Omega Healthcare Investors, CareTrust REIT, Inc., Summit, and others.

Reimbursement pressure, new and competing care delivery settings (LTACs, Transitional Care, and Home Care), and competition from large healthcare systems that contract to manage the post-acute continuum of care are taking market share and/or reducing length of stay. On the flip side, some of the LTAC patients that don’t qualify for the new acuity guidelines will be pushed into skilled nursing, so there are trade-offs. The Federal government budget crisis will continue to lead to a continuation of CMS trying to drive the delivery of care into the lowest possible cost setting.

Publicly traded companies within the SNF sector are currently trading at median enterprise value to revenue and EBITDA multiples of 0.9x and 9.0x, respectively.

BIOTECH – PROGRESS ON CANCER, BUT STOCK VOLATILITY CONTINUES

Our Big Biotech index was up 18% through nine months and had rallied with the market since April and May, but all the stocks in the group (with the exception of Biogen), including Amgen, Celgene, Gilead, Jazz Pharmaceuticals, and Regeneron have all fallen considerably since September quarter end, impacted by factors such as competition and downward estimate revisions. CAR-T-Cell Therapies for Adults with Advanced Lymphoma has created a lot of excitement in biotech and led Gilead to acquire Kite Pharma for $11 billion in October. Juno Therapeutics, however, has now come out and said that the latest data from its lead product candidate, called JCAR017, are stronger than the data from Novartis Pharmaceuticals and Kite Pharma, who each recently received FDA approval to start selling their CAR-T (chimeric antigen receptor T cell) treatments. Patients treated with these drugs are responding well with high cancer-free rates. M&A activity in biotech will continue selectively and we note that the average premium has been 50% to the prior day’s close with respect to a broad list of M&A transactions in biotech.

We anticipate that funding will be a growing challenge for smaller biotechs, as investors have derisked with the market at higher valuation levels and the IPO market window remains tight. In biotech, it’s all about the data, and a lot of small public biotechs don’t have data from a multi-center randomized Phase II study, which is what a lot of the healthcare funds require before even taking a look at a biotech investment.

HEALTHCARE INFORMATION TECHNOLOGY – AN EXCITING ARENA WITH MULTIPLE GROWTH AVENUES

With the healthcare payment system transitioning from volume-based fee for service to value-based reimbursement and population health management, healthcare providers will need greater and different healthcare information tools and analytics to truly understand how to get superior outcomes at the lowest cost. Healthcare Information Technology (HCIT) is where healthcare providers are spending money and, not surprisingly, this group has been the best performer in the healthcare universe we are tracking through nine months.

HCIT encompasses an eclectic group of companies, and represents an exciting segment that is destined to grow rapidly and also see a lot of consolidation activity. New coding requirements imposed by the ACA and MACRA will result in changes to billing systems and will impact revenue cycle management. Telemedicine is an exciting opportunity, where reimbursement is expanding, new business models are emerging, and companies like TelaDoc and Plushcare compete.

We are seeing a number of exciting and/or interesting business models emerge in telemedicine, including digital radiology (reading digital x-ray images remotely), digital optometry (vision screening remotely), and tele-robotics, whereby a company can consult physicians to diagnose remotely and employ robots that can move around the hospital and transmit images for physician and patient interaction.

There are also information service providers that help pharma companies evaluate post market data or payers evaluate cost outcomes with real world use of their formulary drugs. Precision medicine, where a patient’s treatment is tailored to their personal genetic profile, will grow, along with bioinformatics as sharing of data-intensive records among providers will be necessary. Electronic medical records and their security are an element of the equation, as well.

MEDICAL DEVICES AND HOSPITAL SUPPLIES – HITTING ON ALL CYLINDERS

New products, growth in emerging markets, economies of scale, and acquisition cost synergies are driving stable, predictable growth in the medical devices and hospital supplies subsector. Medical device stocks continue to perform well, up 23.9% year to date on growth in international markets, economies of scale and cost synergies resulting from acquisitions, portfolio balancing to focus on core strengths, proprietary product introductions, and strong and predictable financial performance. Recent deals include Cardinal Health buying the Covidien Patient Care business from Medtronic following Medtronic’s acquisition of Covidien, ICU Medical buying Hospira from Pfizer, BD buying C.R. BARD, Teleflex buying NeoTract, Integra LifeSciences buying Codman from JNJ, and Owens & Minor buying the surgical and infection prevention business from Halyard Health. The list goes on. Exciting and disruptive new U.S. product approvals such as Abbott’s FDA approval of the FreeStyle Libre Flash blood continuous glucose monitor (near continuous) has impacted stock prices as well, boosting Abbott shares and crushing Dexcom. There remains a lot of opportunity for growth in medical devices in structural heart disease, diabetes, ophthalmology (multi-focal lenses), spinal implant technologies, aesthetic medicine, and other areas.