Metals Industry Update - Q3 2019

Subscribe to Industry UpdatesMetals Industry Update - Q3 2019

Subscribe to Industry UpdatesRecord M&A Activity Continues Among Metals Businesses

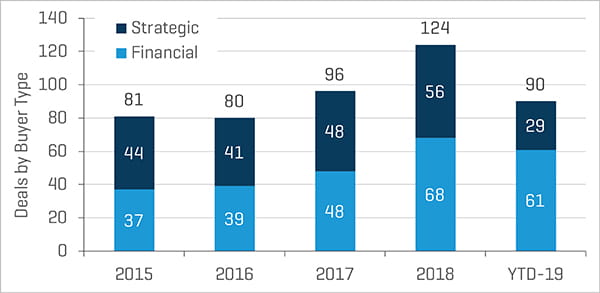

Year-to-date metal forming merger and acquisition (M&A) activity has continued at last year’s frenetic pace. Supported by accommodating debt markets, private equity buyers have dominated M&A activity in 2019. Valuations for target companies have been consistently strong over the past several years. Meanwhile, public company valuations have rebounded slightly from year-end 2018 despite volatile equity market conditions.

Key Takeaways:

- With 90 North American transactions announced so far in 2019, M&A activity remains on pace with last year’s record 124 transactions announced

- The Aerospace, Building/Infrastructure, and Industrial sectors accounted for the majority of transactions announced year-to-date

- Aerospace and Medical M&A targets have generally achieved premium valuations relative to other metal forming sectors

- Abundant private equity and debt capital continue to drive M&A volume

- Public company valuations and margins have remained resilient despite broader economic concerns

Stout Proprietary Metal Forming M&A Database Highlights

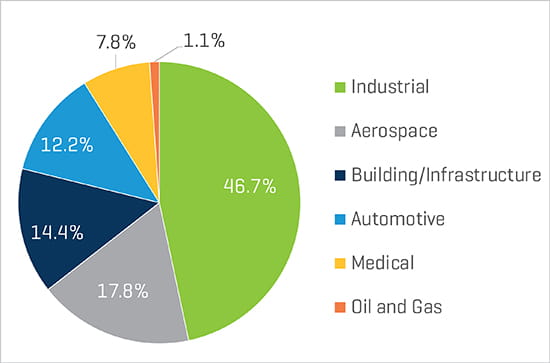

Last year saw a record 124 announced metal forming M&A transactions. Robust activity has continued in 2019 with 90 transactions announced year-to-date. Private equity buyers have dominated M&A in 2019 accounting for two-thirds of deals. Activity has been particularly strong in the Aerospace, Building/Infrastructure, and Industrial sectors.

Share of Transactions by Buyer Type

Year-to Date Transaction Volume by Sector

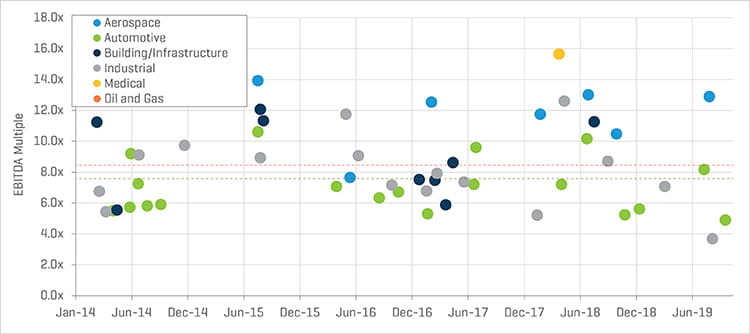

Mean and median enterprise value-to-EBITDA (EV/EBITDA) multiples over the past five years were 8.4x and 7.6x, respectively. Aerospace and Medical targets have generally achieved higher valuations than other metal forming sectors. Notable transactions announced in 2019 include:

- Gamut Capital Management, L.P.’s announced acquisition of American Axle & Manufacturing Holdings, Inc.’s U.S. Iron Casting Operations (Grede)

- Parker-Hannifin Corporation’s (NYSE:PH) acquisition of Exotic Metals Forming Company LLC

- Autokiniton Global Group, backed by KPS Capital Partners, acquisition of Tower International, Inc. (NYSE:TOWR)

- Hanwha Aerospace Co., Ltd.’s (KOSE:A012450) acquisition of EDAC Technologies Corporation from Greenbriar Equity Group

- Consolidated Precision Products Corp., owned by Berkshire Partners and Warburg Pincus, acquisition of the Cast Products business of Allegheny Technologies Incorporated

- Atlas Holdings acquisition of International Wire Group Holdings, Inc.

Select Transaction EV/EBITDA Multiples

Public Company Performance

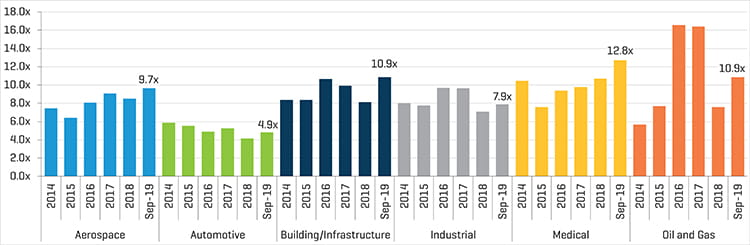

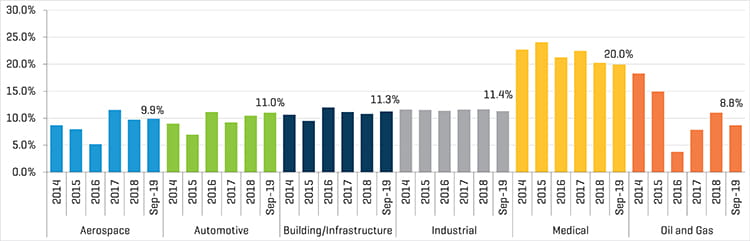

Public company valuations and margins have remained strong despite metal price volatility and broader economic concerns. The Aerospace, Building/Infrastructure, and Medical sectors have fared particularly well while Automotive and Industrial valuations have compressed slightly over the past several years. Oil & Gas valuations spiked in 2016 and 2017 as earnings and margins contracted – both margins and valuations have since normalized.

Public Companies: Forward EBITDA Multiples (December 31, 2014 to September 30, 2019)

Public Companies: LTM EBITDA Margins (December 31, 2014 to September 30, 2019)

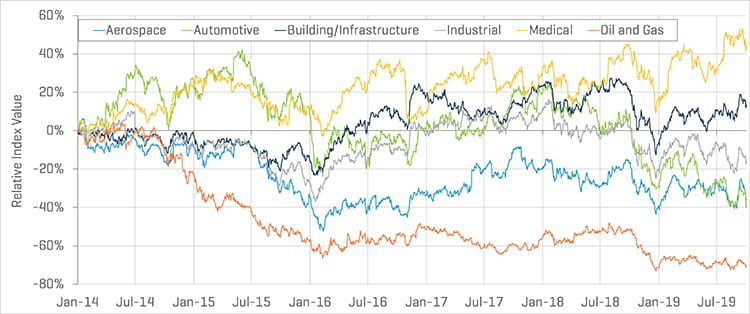

Public company share prices for most metal forming sectors are below levels achieved five years ago, except for the Building/Infrastructure and Medical sectors. The Aerospace and Industrial sector indices have retreated to December 2015 levels while the Automotive index is at a five-year low. Publicly traded Oil & Gas companies have experienced the largest declines as energy prices remain well below 2014 highs.

Public Companies: Relative Share Price Performance (January 1, 2014 to September 30, 2019)

Sources for all charts: Capital IQ and Stout Research

This industry update analyzes Stout’s custom public company indices and proprietary M&A transaction database of North American metal forming transactions. Targeted companies include casting, extrusion, finishing, forging, machining, stamping, and various other processing and fabrication businesses across a wide range of end markets.