Is the Strategic Petroleum Reserve Running on Empty?

Is the Strategic Petroleum Reserve Running on Empty?

According to a recent Seeking Alpha article, “There’s a new oil buyer coming to town, and it’s already shaking up the oil futures curve.”1 At the end of 2023, the Biden administration plans to begin replenishing the U.S. Strategic Petroleum Reserve.

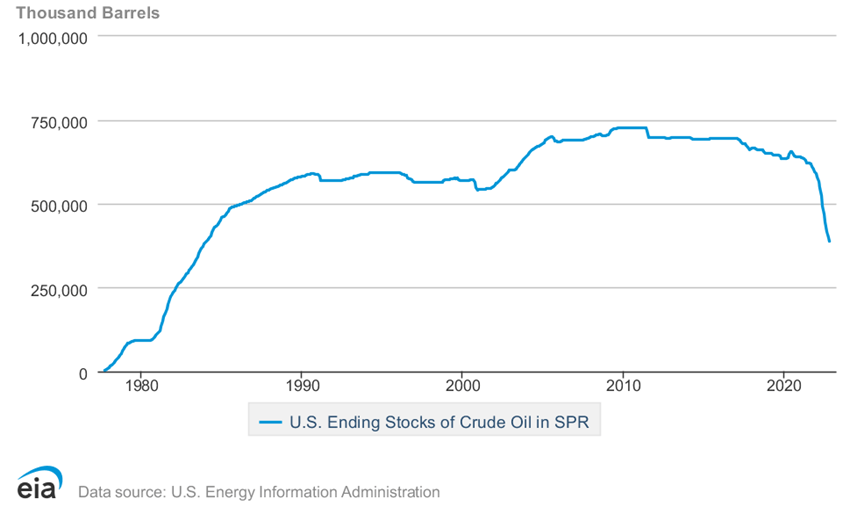

For background, President Joe Biden ordered the Energy Department to begin releases from the reserve last year, and he sharply ramped up those sales after Russia invaded Ukraine in February — sending crude oil prices soaring and driving up gasoline prices to record levels. Total releases from the reserve this year totaled more than 211 million barrels, putting the inventories at their lowest levels since 1984.2

The result of that drawdown is shown below:3

U.S. Ending Stocks of Crude Oil in SPR

The SPR Floor4

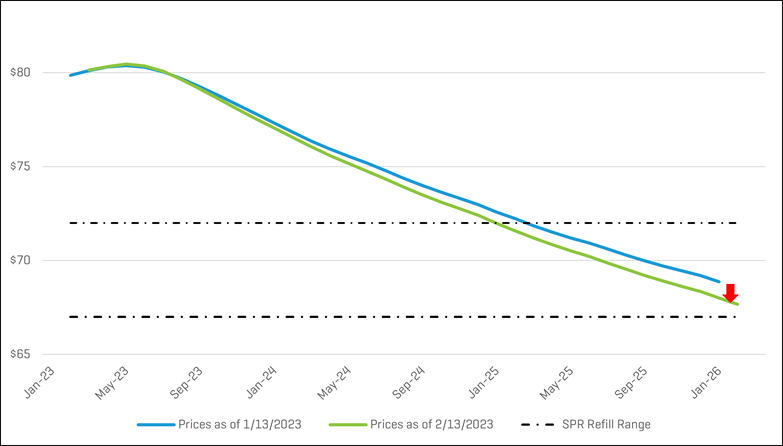

Having the U.S. government declare itself a buyer of forward crude oil in the $67 - $72 per barrel range provides a potential floor price for crude oil futures for 2024+ delivery to be well-supported, a factor that has been referred to by some as the “SPR Floor” for oil prices.

Based on a review of the current strip pricing, it appears that prices will be in this range by the third quarter of 2024. This is also confirmed by the probabilistic charts for future oil prices below, where it appears there is about a 60%+ probability there will be no additions to the SPR (given expected pricing) in the near term.

As the volumes held in the SPR continue to decrease, this increases the risk to the U.S. citizens in the event of future wars, embargoes, or other political actions.

WTI Strip Prices

Spot prices and futures prices for the WTI contract remained unchanged in the near term and decreased by approximately $1.00 per barrel over the longer term.

WTI Strip Prices - One Month Change

As shown, the oil price curve remains in a state of “backwardation,” reflecting the market’s expectation of lower future oil prices. Also shown is the Strategic Petroleum Reserve (“SPR”) refill range of $67.00 to $72.00.

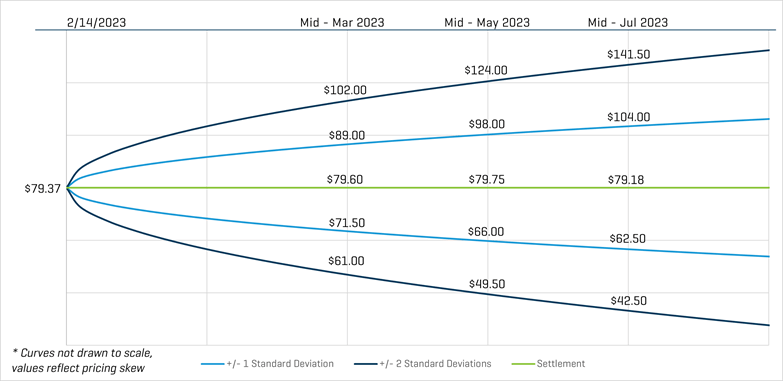

Oil Price Outlook

The price distribution below shows the crude oil spot price on February 14, 2023, as well as the predicted crude oil prices based on options and futures markets. Light blue lines are within one standard deviation (σ) of the mean, and dark blue lines are within two standard deviations.

WTI Crude Oil $/BBL

Based on these current prices, the markets indicate there is a 68% chance oil prices will range from $66.00 and $98.00 per barrel in mid-May 2023. Likewise, there is roughly a 95% chance that prices will be between $49.50 and $124.00. By mid-July 2023, the one-standard deviation (1σ) price range is $62.50 to $104.00 per barrel, and the two-standard deviation (2σ) range is $42.50 to $141.50 per barrel.

Key Takeaways

Remember that option prices and models reflect expected probabilities, not certain outcomes, but that does not make them any less useful. Oil price volatility has decreased significantly compared to the heightened volatility experienced in 2022, which is evidenced by the futures price ranges observed. While the mid-July 2023 settlement price is $79.18, the 1σ range has a spread of $41.50 per barrel, and the 2σ range has a spread of $99.00 per barrel. For comparison, in 2022 we observed 1σ and 2σ price ranges in excess of $65.00 and $150.00, respectively.

- “What The SPR Refill Means For Oil Futures,” Seeking Alpha, January 23, 2023.

- Robert Rapier, “The Strategic Petroleum Reserve Is At Its Lowest Level Since 1984,” Forbes, September 7, 2022, and Ben Lefebvre, “Biden administration set to start refilling oil reserve,” Politico, December 16, 2022.

- U.S. Energy Information Administration

- “What The SPR Refill Means For Oil Futures,” Seeking Alpha, January 23, 2023.