Have Your Cake and Eat It Too The Benefits of an Up-C IPO to PE Firms

Have Your Cake and Eat It Too The Benefits of an Up-C IPO to PE Firms

With this unique public offering structure, private equity firms may find an attractive exit strategy for portfolio companies as well as several tax advantages.

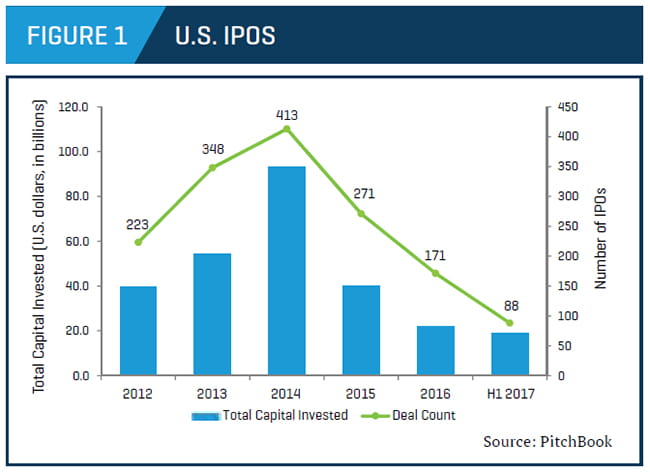

The number of domestic initial public offerings (IPOs) steadily climbed following the Great Recession, reaching a peak in 2014.

While the IPO market experienced a sharp retraction in the two years that followed, annualized results for the first half of 2017 suggest growth of approximately 3% over 2016 filings (Figure 1).

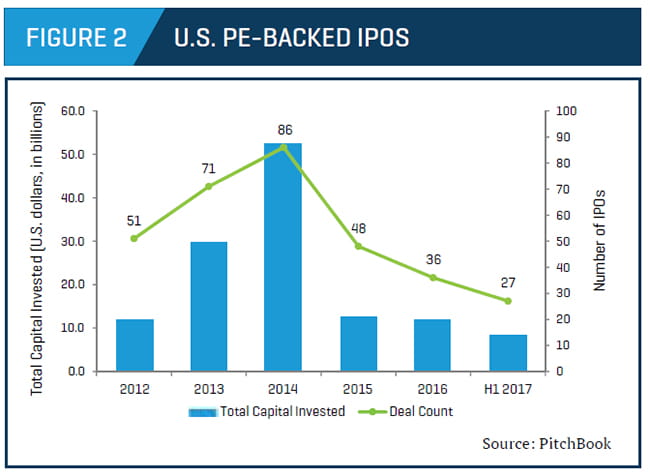

The state of the IPO market has a particular impact on private equity (PE) firms. PE owners use the IPO market as one means to realize investment returns from their portfolio companies. IPOs of PE-backed companies, which represented approximately 21% of IPO filers since 2014, has generally followed trends of the broader IPO market (Figure 2). If investor sentiment wanes for IPOs, investment returns for PE owners using this exit strategy come under pressure.

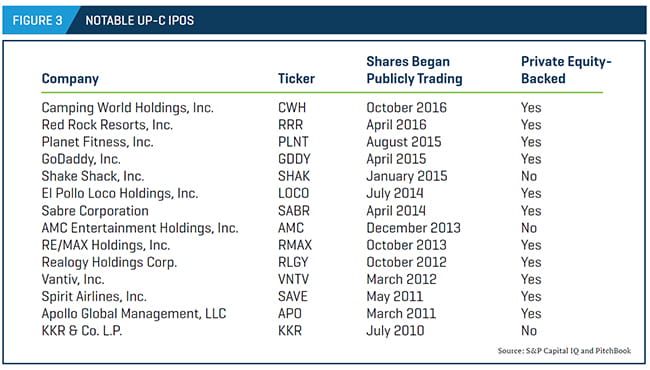

Several PE owners have responded to this pressure by using an “Up-C” IPO structure. This structure provides a PE owner of a pass-through entity (e.g., partnership, limited liability company, S corporation) with a means to enhance its investment returns in an IPO exit. Figure 3 provides a list of notable companies that used the Up-C structure in their IPOs, a number of which were PE-backed.

While the Up-C IPO structure is available to other owners beside financial sponsors, the characteristics of PE-backed companies can make the structure attractive in those public offerings.

Up-C Structure

Owners undertaking a “traditional” IPO of a pass-through entity (a “partnership”) would convert the partnership as a C corporation (“C corp”) and then sell C corp shares to public investors. The reorganization requires the partnership to relinquish its advantageous tax structure. That is, the partnership will no longer be subject to a single layer of income tax paid at the owner level, but instead the corporation will be subject to a double layer of income tax – first on C corp earnings paid at the corporate level and then again on dividends paid to shareholders at the owner level.

Owners using an Up-C IPO structure form a new C corp holding company, which then sells the C corp shares to public investors and uses the offering proceeds to purchase partnership units from the owners. Because the partnership continues to exist following the IPO, its advantageous tax structure is preserved. The payment of only a single layer of income tax increases the aftertax cash flow of the enterprise and generally enhances its value.

While sounding simple in theory, implementing an Up-C IPO structure is not without complexity.

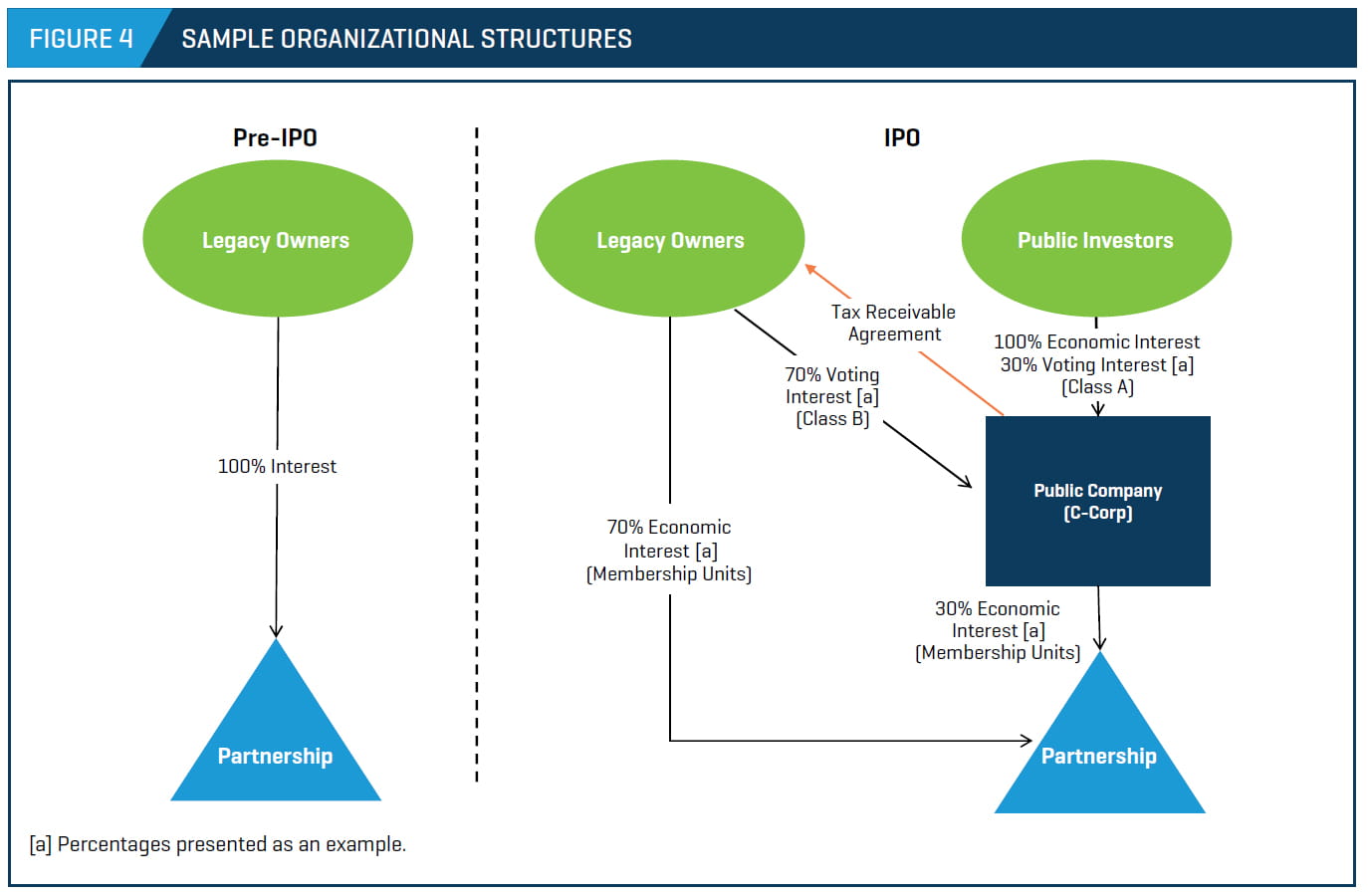

Figure 4 provides an example of a PE owner undertaking an Up-C IPO by selling 30% of its portfolio company to the public. The newly formed C corp is created with two classes of equity: Class A shares that contain both economic and voting rights, and Class B shares that contain only voting rights.

The Class A shares are sold to public investors in the IPO, which transfers economic and voting rights to public investors as in a traditional IPO. The C corp uses the offering proceeds to purchase partnership units from the PE owners at the same price per share. Although the C corp is the managing member of the partnership directing its daily operations and affairs, ultimate voting control remains with the PE owners through their holdings of the Class B shares. Subsequent to the IPO, the PE owners can achieve additional liquidity by exchanging their partnership interests for C corp shares (an “exchange”) and then selling the C corp shares in the public market.

Enhanced Returns Achieved Through Tax Benefits

In addition to PE owners preserving the advantageous single layer of taxation on partnership income following the IPO,[1] the Up-C IPO structure provides additional tax advantages by allowing for a step-up in the tax basis of the C corp’s assets. Specifically, upon the C corp’s initial purchase of partnership units from the owners, as well with subsequent exchanges, the C corp receives a step-up in the tax basis of the proportionate share of the underlying assets of the C corp.[2] The step-up in tax basis can result in material levels of goodwill and intangible assets that can be amortized by the C corp. This future amortization, in turn, reduces C corp income taxes, improves the company’s cash flow-generating capacity, and otherwise increases the value of the enterprise. Importantly, tax amortization benefits generated from exchanges subsequent to the IPO are incremental to tax amortization benefits that may exist related to the PE firm’s original acquisition of the partnership (or its predecessor).

Because both the PE owners and company shareholders have claims on this increase in enterprise value, the C corp executes a tax receivable agreement (TRA) as a mechanism to share it among the parties.

Tax Receivable Agreement

The TRA stipulates that the C corp will pay a portion of the income tax savings to the PE owners resulting from 1) the amortization of the goodwill and 2) intangible assets created from the initial purchase of partnership units from the owners as well subsequent exchanges of partnership units. The TRA is typically negotiated such that 85% of these incremental tax savings are payable to the PE owners, with 15% remaining with the C corp for the benefit of its shareholders (albeit somewhat indirectly).

Because the TRA creates an obligation of the C corp, it records a liability on its balance sheet based on the fair value of the expected payments to the PE owners. However, the C corp also records a deferred tax asset related to the additional tax savings from the basis increase generated from expected future payments under the TRA. The fair values of these accounts will change over time as payments are made to the PE owners or as projections of future taxable income (and therefore the amount of tax savings) are modified by company management. Importantly, particularly from the perspective of a public company, the TRA does not impact the operating earnings of the C corp. Furthermore, the C corp records a noncontrolling interest on its balance sheet to reflect the partnership interest maintained by the legacy owners.

Essentially, the step-up in the tax basis of goodwill and intangible assets created from the initial purchase of partnership units from the owners and from subsequent exchanges has the potential to create substantial incremental value for legacy owners via the Up-C IPO, relative to a traditional IPO. While the majority of this incremental value accrues to the benefit of the PE owner by virtue of the TRA, the C corp and its shareholders also benefit from increased cash flow associated with its (albeit smaller) share of the income tax savings.

Additionally, because the TRA is a component of the original purchase of the legacy owners’ interest, payments made to the legacy owners in accordance with the TRA constitute contingent installment sale proceeds, such that there is an additional step-up on these payments and additional amortization with which to shield income, compounding the overall tax benefits and the returns to the legacy owners.[3]

Up-C as an Exit Strategy

While the Up-C IPO structure may be an attractive option to all owners of pass-through entities, it is particularly appealing to PE firms as an exit alternative for portfolio companies organized as partnerships. The Up-C IPO structure offers several advantages:

- Allows the PE firm to monetize part of its interest in the portfolio company without sacrificing its advantageous tax structure

- Offers an ongoing exit strategy for the PE owner’s remaining interest (i.e., the Up-C structure creates flexible liquidity)

- Potentially provides the PE firm with material ongoing cash payments through the TRA

- Allows the PE owner to continue maintaining a degree of control over the C corp via its ownership of Class B voting shares

Although PE owners generally prefer to monetize their portfolio companies through a sale transaction, if interest rates continue to rise and equity contributions to PE buyout transactions continue to grow, then PE investment returns may erode. These factors, coupled with the benefits afforded by the Up-C structure, could make an exit through the IPO market more attractive in the years ahead.

Involve Appropriate Advisors

The main drawback to the Up-C IPO structure is the added complexity, not only in the legal and tax aspects of structuring the organization for the IPO and preparing the necessary disclosures and documentation, but also in certain financial matters. PE owners and company management should involve appropriate legal, tax, and financial advisors to mitigate this added complexity of the Up-C structure. A qualified valuation firm is needed to accurately measure the fair values of the TRA liability and related deferred tax assets, at both initial recognition and subsequent exchange dates, as the accounts can have a material impact on the C corp’s balance sheet.

- The publicly traded C corp is taxed as a corporation and pays corporate federal, state, and local taxes on income allocated to it by the partnership based upon the C corp’s economic interest held in the partnership.

- The step-up in the tax basis of the partnership’s assets occurs pursuant to Internal Revenue Code (IRC) Section 743 (b), provided that the partnership has made the IRC Section 754 election.

- The additional step-up is amortized over the remaining number of years from the original purchase of the legacy owners’ interests, such that if a TRA payment is made three years after the original purchase, the additional step-up is amortized over 12 years.