Have You Gotten What You've Bargained For? Allowable Net Sales Deductions

Have You Gotten What You've Bargained For? Allowable Net Sales Deductions

Licensors need to ensure they are on the same page with licensees to receive their obligated royalty payments.

Most, if not all, license agreements with ongoing royalty obligations have the royalties calculated based on either a percentage of net sales or a per unit royalty. For licenses with the percentage of net sales payment term, it is very important to ensure that both parties are on the same page regarding what constitutes “net sales.”

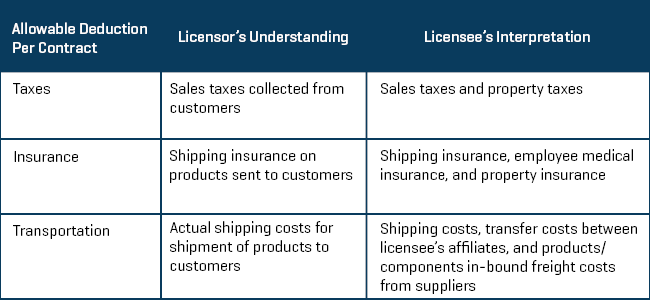

One common definition of net sales allows for deductions such as taxes, insurance, and transportation. While the deductible items may seem straightforward, our experience has shown a more liberal interpretation of these terms by some licensees, as shown in the table below.

Do you know what your licensee’s understanding and interpretation of these items are? Here are some tips to help answer that question:

- Periodic communications with your licensee are a good way to clarify any misunderstanding

- If these deductions make up a large portion compared with the total reported net sales, it would be prudent to ask the licensee for underlying supporting materials regarding each deduction item

- When the production of underlying supporting materials is not forthcoming or the scope is large, with extended issues, it would be beneficial to retain an independent auditor to conduct a field audit

Bear in mind that many of the license agreements have a limited look-back period. Therefore, a delay in tending to these issues would likely result in getting less than what you have bargained for due to the inability to recover underpayment for periods outside of the look-back period.