How CFOs Can Leverage RPA Software to Automate Invoice Processing

How CFOs Can Leverage RPA Software to Automate Invoice Processing

Why Automating Invoice Processing Is Important

Invoice processing is a business function performed by the Accounts Payable (AP) group of the finance department. It consists of a series of steps that start when a vendor/supplier invoice is received and end when the invoice is paid and properly recorded in the general ledger (GL). There are several challenges in establishing an efficient invoice processing workflow, including:

- Matching the amount billed to the amount on the original purchase order (PO)

- Entering and verifying vendor invoice data into the Enterprise Resource Planning (ERP) system

- Sending the invoice to the authorized approvers

- Sending payments to vendors via automated clearing house (ACH), wire, or even paper checks

- Processing a large volume of invoices on time to avoid costly late payment penalties

The above challenges translate into a number of issues, such as:

- Slow invoice processing time

- High processing costs

- High employee attrition rate

- High likelihood of errors and exceptions

- Duplicate and fraudulent (by internal employees or vendors) payments to vendors

- Poor vendor management without transparency in outstanding liabilities

According to a recent Ardent Partners’ market research study,1 a single invoice takes about 10 days to be processed and costs almost $11. Additionally, nearly a quarter (25%) of all invoices are flagged for an exception, and only 56% of invoices are linked to an actual purchase order. Only 30% of invoices achieved straight-through processing (i.e., the invoice was received, approved, and ready to be paid without any manual intervention).

The Association of Certified Fraud Examiners (ACFE)2 found that fraudulent billing is one of the most common forms of asset misappropriation (20% of all fraud schemes), causing a median loss of $100,000 and taking, on average, 14 months to detect. Billing fraud is caused by fraudsters or internal employees who create fake vendors, generate fake or inflated invoices, and submit payment requests for services that were never rendered.

AP departments need to use digital automation tools to increase productivity, reduce operating costs and fraud losses, and minimize errors and invoice processing time.

What Is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) is software that allows users to create bots (digital “agents”) that automate labor-heavy, repetitive tasks. Software users develop and test a sequence of rules-based actions that replicate human operators. Bots can be “attended” or “unattended.” Attended bots are used when the entire process cannot be fully automated and the bot needs feedback from a human worker to complete all actions. Unattended bots execute tasks without any interaction with a human. According to Gartner’s 2021 Magic Quadrant for RPA,3 UIPath, Automation Anywhere, Blue Prism, and Microsoft (with Power Automate) are the four leaders in RPA technology, with Workfusion, Pegasystems, Appian, and Servicetrace being the four visionaries.

Description of Our RPA Solution

There are several leading vendors of RPA software; however, companies that purchase the solution will quickly see a need for successful implementation of that software. At Stout, we set up an RPA software prototype in the Cloud to showcase what proper implementation looks like, installing and configuring the Automation Anywhere RPA digital workforce platform. These were the four building blocks of our implementation:

- Extract text from invoices (PDF files): We had to extract data fields from all invoices, such as invoice number, total amount, invoice date, and vendor name, among others. Our solution leveraged Optical Character Recognition (OCR) software libraries and machine learning techniques that taught the bot how to extract the right data values from any invoice (whether the PDF was scanned or digitally generated). Additionally, we developed software code (in the Python programming language) that was responsible for transforming the extracted text from the invoices (for example, we had to change the format of all invoice dates before we entered these data fields in the ERP system).

- Separate invoices that need manual review: There were a small number of invoices where automation was not producing the desired results since our bot was not able to accurately decipher all needed data fields from certain invoices that were scanned. In this case, our software code sent a notification to the human operator to manually review these documents.

- Calculate fraud risk for every invoice: Based on historical fraudulent invoice data, we built a risk model that was comprised of deterministic rules and AI-based profiles. As a result, every invoice had an associated risk score, and based on the threshold of risk, the invoice was classified as (probably) fraudulent or not.

- Measure automation efficiency: It is always important to quantify how efficient the automation process is. Therefore, we developed intelligent programming scripts which captured the statistical measures (mean, median, and standard deviation) that describe the time it takes (on average) to process one invoice, the number of errors and exceptions per invoice, the percentage of invoices that need manual review, and more.

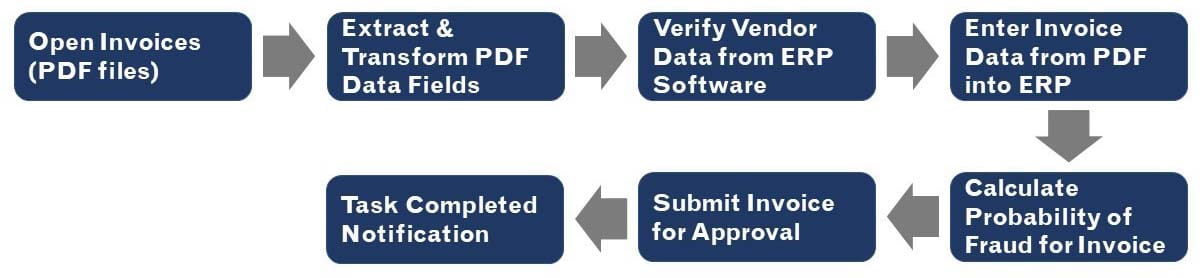

The flow below depicts the sequence of tasks that the bot executes:

Figure 1:

Steps that the bot executes to automate invoice processing.

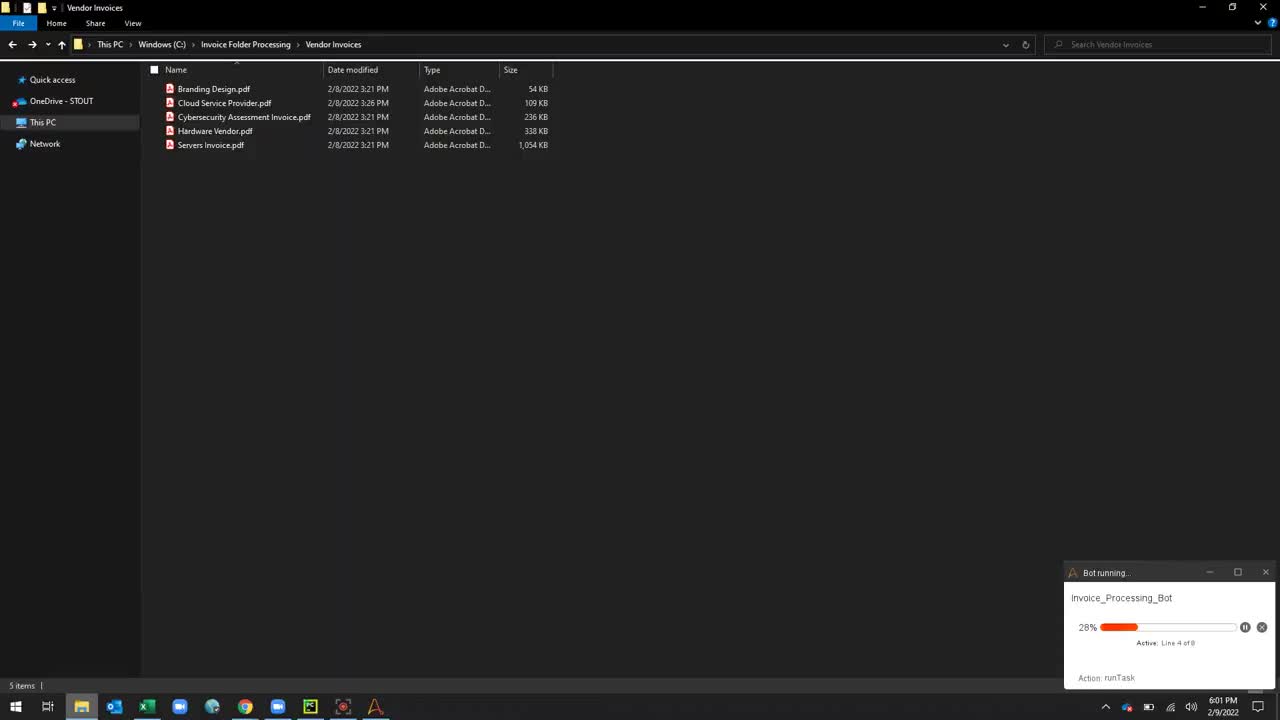

The recorded clip below shows how our bot goes to the invoice folder and opens a sample of five invoices to extract (using OCR methods), transforms the data fields, and saves them in a CSV file (first step in Fig. 1). More specifically, we had to transform the date fields (e.g., invoice date and due date) into the appropriate format as expected by the ERP system and remove special characters (e.g., dollar sign) from certain fields.

Figure 2:

Bot extracts and transforms data from a sample of five vendor invoices (Steps 1 & 2 in Fig. 1).

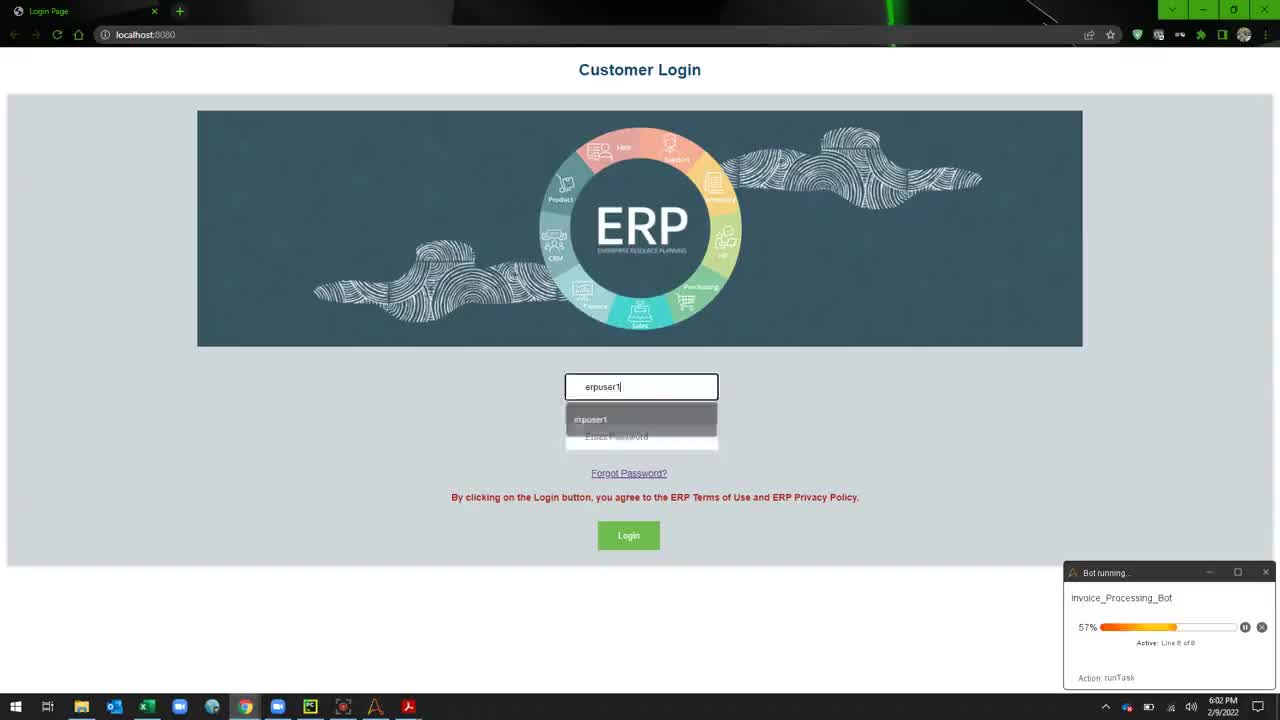

After all data is transformed, the bot logs into the ERP system, verifies the vendor information, and creates a purchase order.

Figure 3:

Bot verifies vendor and creates PO in the ERP (Steps 3 & 4 of Fig. 1).

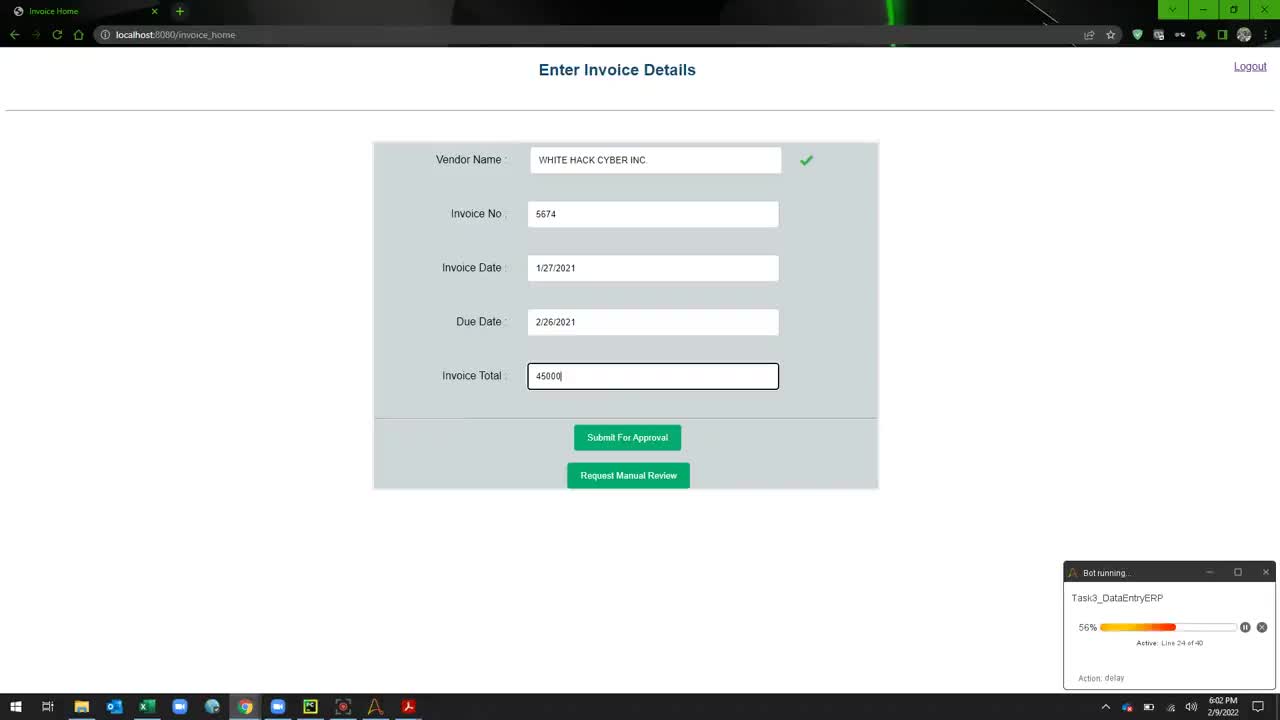

Once all invoice data fields are entered, the bot chooses the optimal machine learning method to detect anomalies (based on historical data) in the entered data and assigns a fraud risk score. If the invoice has a high risk for fraud, it is sent to the appropriate AP employees for manual review. If it is low risk, it will be submitted for approval.

Figure 4:

Bot uses machine learning to assign a risk score to every invoice (Step 5 of Fig. 1).

After the bot completed and submitted the first invoice for approval, it continued processing all remaining invoices. Once all invoices were processed, a summary email was sent containing efficiency metrics such as the total number of invoices processed, the number of invoices that required manual review, and the number of errors/exceptions encountered, among other metrics.

Results and Conclusions

Automating repetitive and error-prone tasks, such as invoice processing, translates into considerable time and cost savings with improved accuracy over human operators. After extrapolating the efficiency gains from our prototype, we expect the invoice processing time to be cut in half (from 11 minutes down to 5.5 minutes, assuming reasonable approval time) and the cost to be reduced by 80% (from $11 down to $2.2). Additionally, we expect the ERP data input time to be reduced by 60%. The error rate (i.e., the percentage of invoices the bot did not process correctly), was 1%. The bot classified 27% of invoices with a high likelihood of fraud for manual review.

Companies that invest in purchasing RPA solutions from vendors will want to ensure successful implementation to realize all the software’s benefits. Our Digital team at Stout has experienced and certified RPA developers that help chief financial officers and chief information officers automate manual, inefficient, and labor-heavy tasks to get the most out of their RPA software. Moreover, our unique combination of digital automation, data analytics, and ERP skills give us the ability to develop solutions that automate complex tasks and significantly reduce costs and increase productivity for finance and accounting departments.

- Andrew Bartolini and Bob Cohen, “The State of ePayables 2020: Ensuring Continuity, Building Resiliency, and Rising to the Challenge,” Ardent Partners, June 2020.

- “2020 Report to the Nations,” Association of Certified Fraud Examiners (ACFE), 2020.

- “Gartner Magic Quadrant for Robotic Process Automation,” Gartner Research, July 26, 2021