The Use of Personal Goodwill as a Tax Savings Opportunity in a Transaction: Recent Case Law Highlights the Importance of Good Facts and Economic Support

The Use of Personal Goodwill as a Tax Savings Opportunity in a Transaction: Recent Case Law Highlights the Importance of Good Facts and Economic Support

The concept of personal goodwill from an income tax planning perspective has been the source of controversy with the Internal Revenue Service for well over a decade, since the seminal Martin Ice Cream and Norwalk cases were decided in 1998, with favorable outcomes for the taxpayers.1 In more recent years, a few court cases resulting in taxpayer losses have highlighted the issue.

Personal goodwill exists when the shareholder’s reputation, expertise, or contacts contribute significantly to the company’s value and future income stream. Personal goodwill can be manifested in the close personal relationships that exist between certain shareholders or another party and key decision-makers at customers or suppliers. It is most likely to be associated with businesses that are technical, specialized, or professional in nature or have a few customers and suppliers.

A sale transaction involving closely held businesses often involves many complex tax and valuation considerations. This article revisits the benefits associated with allocating value to personal goodwill in an acquisition of a closely held C corporation. If personal goodwill is treated as property that can be sold in conjunction with a company’s assets or stock, it can produce a favorable tax result for both the buyer and the seller. From a tax planning perspective, advisors can play an important role in assisting their clients with respect to advantageous deal structures associated with personal goodwill.

Recent Court Cases

Solomon - In Solomon, the case involved the sale of a corporate division of Solomon Colors, Inc. that mined, milled, and sold a particular type of iron ore to the foundry, fertilizer, and cement industries.2 The total purchase price paid by Prince Manufacturing Co. was $1.5 million, with $1.4 million allocated to a customer list and a covenant not to compete. The remaining $100,000 was allocated to the sale of the ore business and equaled the value of the equipment. The terms of the non-compete agreement stated that Solomon Colors and the individual signatories (Robert and Richard Solomon and their wives) would not compete with Prince. Of the $1.5 million purchase price, $700,000 was paid directly to the corporation’s majority shareholders, a father and son who were the company’s chief executives. The taxpayers claimed that a portion of the asset labeled “customer list” in the agreement represented relationships with customers, with whom they had built relationships over many decades, and personal goodwill belonging to Robert Solomon and Richard Solomon. The IRS claimed they sold assets that were customer lists distributed from the company.

The Tax Court ruled against the taxpayers noting the following. First, nothing in the agreement between the parties made reference to the sale of personal goodwill. The asset purchase agreement contained conflicting provisions as to whether payments to shareholders were for customer lists or non-compete payments. Second, the Tax Court did not find that the value of Solomon Colors in the market was attributable to the quality of service and customer relationships developed by Robert and Richard Solomon. Rather, since the company was a processing and manufacturing business, as opposed to a personal services business, the business did not depend on the employee/owners for its success. Finally, although the taxpayers entered into non-compete agreements, they did not sign employment or consulting agreements. Since the shareholders were not hired by the buyer, their personal attributes were not available to the purchaser after the sale. These facts prompted the Tax Court to conclude that it was unlikely Prince was purchasing personal goodwill of the individuals. The Tax Court concluded that the proceeds paid directly to the shareholders were actually attributable to their covenant not to compete rather than for a customer list or personal goodwill.

Kennedy - In Kennedy, the key issue revolved around whether payments received were from proceeds from the sale of personal goodwill and therefore taxable as capital gain, or payments for services and therefore taxed as ordinary income.3

James Kennedy was engaged in an employee benefits consulting business since 1990. In 1995, the sole proprietorship was incorporated as KCG International, a C corporation. In 2000, the business was sold to Mack & Parker (“M&P”). The parties executed a final purchase-and-sale agreement that consisted of a goodwill agreement, consulting agreement, and asset purchase agreement. Under the agreements, Kennedy would work with M&P as a consultant, without salary, and continue to provide services to his former clients for the next five years, after which he planned to retire. Also, under the agreements, Kennedy and KCG would not compete with M&P for five years. M&P would make a lump-sum payment of $10,000 to KCG and annual payments to KCG and Kennedy for five years. The annual payment amounts would depend on revenue received from Kennedy’s former clients and were allocated 75% to Kennedy in exchange for the “personal goodwill” associated with his customer relationships, his know-how, and his promise not to compete or otherwise engage independently in employee benefits consulting. The other 25% was designated as payment for consulting services. The asset purchase agreement required that KCG convey its relationships with 46 clients. The goodwill agreement required Kennedy to convey his personal relationships with the same 46 clients. Almost all of them had been long-time clients of Kennedy even before he incorporated.

Kennedy began work with M&P and devoted far more time in his new role than he anticipated. During the first year after the transaction, 46% of M&P’s revenue was traceable to time billed personally by Kennedy. Kennedy did not receive any wages or fees from M&P other than payments under the sale documents. After 18 months of this arrangement, Kennedy negotiated a salary in addition to the payments.

First, the IRS argued that KCG, not Kennedy, owned the customer list and without the customer list, Kennedy could not transfer goodwill. Second, the IRS argued that Kennedy had no proof of the existence of any goodwill asset since no appraisal of the personal goodwill was provided to the court. Third, the IRS contended that even if Kennedy was the owner of personal goodwill, this asset should not be considered a saleable asset. Any personal goodwill would be based upon the value of Kennedy’s relationships with his customers, which the IRS maintains would have no value unless Kennedy continued to perform services to the clients.

The Tax Court agreed with the IRS that Kennedy did not sell personal goodwill to M&P, but not for the same reasons. First, the Tax Court acknowledged that a payment to an individual who provides ongoing services could be considered a payment for goodwill. However, in the instant case, the Tax Court was convinced the payments to Kennedy were for services rather than personal goodwill since he worked for M&P for five years, received little compensation for his services for 18 months, and agreed not to compete for five years.

The opinion also alluded to the facts in other cases that supported the existence of personal goodwill. To the extent the contractual allocation to personal goodwill is presented in a manner to reflect the relative value of the seller’s customer relationships distinctly from the value of the seller’s ongoing personal services, and is grounded on economic reality, a greater chance of success is likely.

Prior Taxpayer Wins — Martin and Norwalk4

Martin - In Martin Ice Cream, the Tax Court ruled that unless the key individual employee stockholders had previously entered into a non-compete agreement with the corporation (or some other agreement whereby the personal relationships with clients become the property of the corporation), then there is no saleable business goodwill in such a corporation where its “excess” earnings are tied to these key individual employees.5

The basic facts of this case are that Arnold, one of the shareholders of the Martin Ice Cream Company (“MIC”), exchanged his stock for 100% of the stock of a subsidiary formed by MIC called Strassberg Ice Cream Company (“SIC”). MIC transferred its supermarket distribution business to SIC. Shortly thereafter, Pillsbury Co. paid $300,000 to SIC for “records” and $1.2 million to Arnold personally for “seller’s rights.” The issue underlying the case was whether the assets purchased by Pillsbury were corporate assets owned by SIC or personal assets owned by Arnold. In finding on behalf of the taxpayer on this latter issue, the Tax Court cited the following facts:

- Over the years, Arnold formed close personal relationships with supermarket owners and managers

- Neither Arnold, MIC, nor SIC entered into a written agreement with Haagen-Dazs for the rights to distribute premier ice cream to supermarkets; it was an oral agreement entered into by Arnold

- At no time during his tenure at MIC did Arnold have an employment agreement or non-compete agreement

- The success of SIC’s business with supermarkets was highly dependent on the personal relationships of Arnold

- The earnings of MIC, prior to the split-off, did not support the aggregate purchase price implied by the transaction

In summary, the combination of the value of Arnold’s oral distribution agreement with Haagen-Dazs and his relationships with owners and managers of supermarkets formed the basis of his ability to direct the wholesale distribution of super-premium ice cream to supermarkets. The ability was essentially the foundation and primary asset of the business. The Tax Court determined that the business records of SIC that had been created during Arnold’s development of the supermarket business were much less valuable. Accordingly, the Tax Court supported the vast majority of the transaction proceeds to the personal assets of Arnold, as opposed to business assets, in its determination of the value of the assets transferred from MIC to SIC.

Norwalk - In Norwalk, the Tax Court followed a similar line of reasoning to reach the same conclusion with regard to personal goodwill as in the Martin Ice Cream case. The owners of a CPA firm, organized as a C corporation, decided to liquidate and distribute all of the corporation’s assets to themselves. The IRS argued that in addition to the value of fixed assets, “customer-based” intangibles were also distributed, resulting in a taxable gain to the corporation as well as to the shareholders.

The taxpayers argued that because they were not restricted from leaving the company and essentially serving the same clients elsewhere, the client relationships had no meaningful value to the corporation. The Tax Court agreed with the taxpayer stating that the “personal ability, personality, and reputation of the individual accountants had no contracted obligation to continue their connection with it.” The fact that many of the clients actually followed the corporation’s non-shareholder CPAs to their own practices following the corporate liquidation further bolstered the taxpayer’s position.

Tax Planning Opportunity

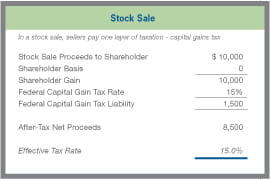

Often, deal structure is a primary factor impacting whether a transaction gets done given the impact of taxes on value to a buyer and a seller. In a stock sale of a C corporation, only a single layer of tax exists – capital gains on the amount that the purchase price exceeds the selling shareholder’s basis in the stock.

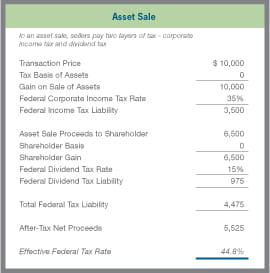

In an asset sale, the selling shareholders are subject to two layers of taxes. First, the selling corporation would be subject to corporate income tax on the excess of the purchase price less the net book value of the depreciated assets. Second, the selling shareholders would be subject to dividend tax upon the distribution of the proceeds from the asset sale to the shareholders.

Buyers typically prefer to structure transactions as asset acquisitions because it provides a tax basis step-up. A step-up results in higher tax deductions for tangible and intangible assets, resulting in lower taxes. In addition, buyers prefer asset acquisitions to avoid acquiring any contingent liabilities that may materialize. Sellers, preferring a stock sale, are often forced to structure a transaction as an asset sale, which significantly increases the cost of selling due to the double layer of taxation.

When a business is acquired in a transaction structured as an asset sale for income tax purposes, the buyer and seller are required to allocate the purchase price to the assets acquired or sold. The primary asset categories typically include working capital, fixed assets, and intangible assets, such as customer lists and relationships, supplier relationships, etc.

The value of intangible assets of the business (including goodwill) is related to the market advantage that gives rise to expected earnings in excess of a normal return on the other operating assets of the business. Business goodwill value is evident to the extent that these advantages relate to assets owned by the business (i.e., patents, trademarks, etc.). On the other hand, to the extent that these advantages relate to the seller’s individual name, personal relationships, or personal reputation, then personal goodwill is evident.

Oftentimes, no matter what the structure of the transaction for income tax purposes, a buyer requires that the individual sellers enter into non-compete agreements or consulting/employment agreements. While the amount allocated to this type of asset avoids the double taxation inherent in an asset sale of a C corporation, the individual seller is still typically taxed at ordinary income tax rates on such amounts.

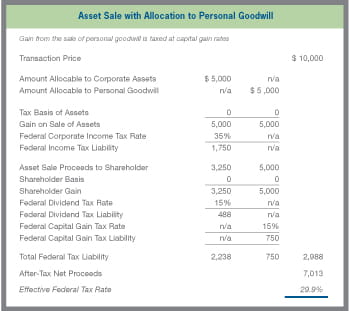

If a portion of the purchase price can be allocated to personal goodwill, the buyer can benefit from the tax amortization resulting from this amount, which is amortized over 15 years, the same period over which business enterprise goodwill, intangible assets, or a non-compete agreement would be amortized.

In situations whereby the buyer and seller have directly adverse tax consequences related to an allocation of purchase price, the Tax Court will typically defer to the parties’ agreed-upon allocation.6 If the parties’ tax interests are not adverse, the court must determine whether the allocation is grounded in economic reality.

Summary of Tax Attributes

If personal goodwill exists, structuring the transaction with a separate purchase agreement for the business and for the shareholders’ personal goodwill may produce the following tax benefits.

- The selling shareholders’ gain from the sale of personal goodwill is taxed at capital gain rates

- The acquired business does not trigger entity-level gain on the sale of personal goodwill

- The buyer of personal goodwill may be entitled to amortization deductions under IRC Section 197

Characteristics of Personal Goodwill Versus Business Goodwill

The allocation of value to personal goodwill is dependent on the individual’s direct impact on the business through their personal relationships, reputation, know-how, etc.

Personal Goodwill Characteristics

- No non-compete agreement exists between the selling shareholder and the company

- Business is highly dependent on individual’s personal relationships, reputation, skills, know-how

- Individual’s service is important to the sales process

- Operations in which shareholders are highly involved

- Businesses with few and high-volume customers

- Companies that are highly technical, specialized, or engaged in professional services

- Companies that have contracts that are terminable at will

- More common in companies with higher portion of intangible assets

- Loss of key individual would negatively impact the revenue and/or profitability of the company

Business Goodwill Characteristics

- Non-compete agreement exists between the selling shareholder and the company

- Larger business with formal organizational structure, processes, and controls

- Sales are generated from company brand name recognition, company sales team

- Businesses with diversified customer base

- Manufacturing businesses or companies that are asset intensive

- Selling shareholder is not intimately involved with the business

- Companies that have deep management teams

- Companies that have long-term contracts with customers

- Loss of key individual would not materially impact the revenue and/or profitability of the company, or the individual could be replaced easily

Valuation Considerations

Typically, when planning for transactions involving personal goodwill, an exploratory phase is necessary to determine the existence of personal goodwill by assessing the facts and circumstances. To the extent personal goodwill is likely to exist, subsequent phases may be warranted to estimate the value of the tangible assets, identifiable intangible assets, and personal goodwill to be acquired.

While each case is unique, a basic approach to the valuation process usually includes an assessment of the aggregate value of the business and the personal goodwill is captured by considering the “as-is” aggregate cash flows being generated. The value derived in this scenario is contrasted with the value in a scenario in which the key person is no longer participating in the business or, taken to an extreme, directly competes with the existing business. In this scenario, to the extent personal goodwill exists, the “as-is” aggregate cash flows would be negatively impacted. The difference in value between these two scenarios can be characterized as the value of the personal goodwill.

Conclusion

As evidenced by recent case law, the use of personal goodwill as a tax planning strategy remains a controversial topic with

the IRS. However, in the Solomon and Kennedy cases, the taxpayers were subject to either a poor fact pattern and/or no compelling economic analysis to support the allocation. These cases remind us that:

- Non-compete agreements that exist prior to the transaction have the impact of transferring personal goodwill to business goodwill

- Employment and non-compete agreements entered into during the transaction process support the allocation to personal goodwill

- The documents should clearly state that personal goodwill is being acquired and exactly what the seller’s role/duties are post transaction to ensure that the seller’s personal goodwill becomes the acquirer’s business goodwill

Each situation is unique and, in instances where the existence of personal goodwill is thought to exist, an extensive examination of the facts and circumstances and detailed financial analysis are warranted to determine appropriate allocations to personal goodwill versus corporate goodwill.

To withstand scrutiny from the IRS, planning for personal goodwill should occur at the forefront of any negotiations with potential buyers and should be properly documented. In addition, a contemporaneous valuation report presenting a compelling analysis with sound economic support should be obtained.

1 Martin Ice Cream Company v. Commissioner 110 T.C. No. 18 (1998), William Norwalk, et. al. v. Commissioner, TC Memo 1998-279.

2 Solomon v. Commissioner, TC Memo 2008-102.

3 Kennedy v. Commissioner, TC Memo 2010-206.

4 For additional relevant cases refer to: MacDonald v. Commissioner, 3 TC 720 (1944); Schilbach v. Commissioner, TC Memo 1991-556; Estate of Taracido v. Commissioner, 72 TC 1014 (1979); Wilmot Fleming Engineering Co. v. Commissioner, 65 T.C. 847 (1976); Bryden v. Commissioner, TCM 1959-184; Longo v. Commissioner, TCM 1968-217; Cullen v. Commissioner, 14 TC 368, 372 (1950); and Providence Mill Supply Co., 2 B.T.A. 791(1925).

5 It should be noted that the Tax Court’s conclusion is alluding to historical agreements entered into by the individual with the selling corporation prior to the actual transaction, not agreements entered into between the individual seller and the buyer of the corporation. Thus, an individual seller, who contemporaneously with the transaction enters into an employment or non-compete agreement with the buyer, would not be precluded by this fact alone from allocating a significant portion of the transaction proceeds to personal goodwill

6 See Danielson v. Commissioner, 378 F.2d 771, 778 (3rd Cir. 1967). The Danielson Rule provides that a party can challenge the tax consequences of his agreement as construed by the Commissioner only by sharing proof that the terms were ambiguous or to show that the agreement is unenforceable due to the existence of undue influence, fraud, or duress.