ASC 842 and the Impact on Business Valuation

ASC 842 and the Impact on Business Valuation

New lease accounting rules are shaking up corporate balance sheets. We examine how to adjust valuation models for the new assets and liabilities.

This article was featured in the AIRA Journal.

What is debt or debt-like? Is asset ownership binary? The Financial Accounting Standards Board (FASB) weighed in with the adoption of Accounting Standards Codification (ASC) Topic 842 – Leases (ASC 842) in 2016. Now effective for most public companies (and for all public companies by the end of 2019), the new lease rules are expected to add more than $2 trillion of assets and liabilities to corporate balance sheets.[1]

While ASC 842 may provide investors and other financial statement users with new information, and may enhance the comparability between similar businesses, the adoption of any new accounting standard should not create or destroy value. Thus, the recognition of new assets and liabilities on corporate balance sheets requires a reorientation of valuation models.

Brief Overview of ASC 842

What Hasn’t Changed?

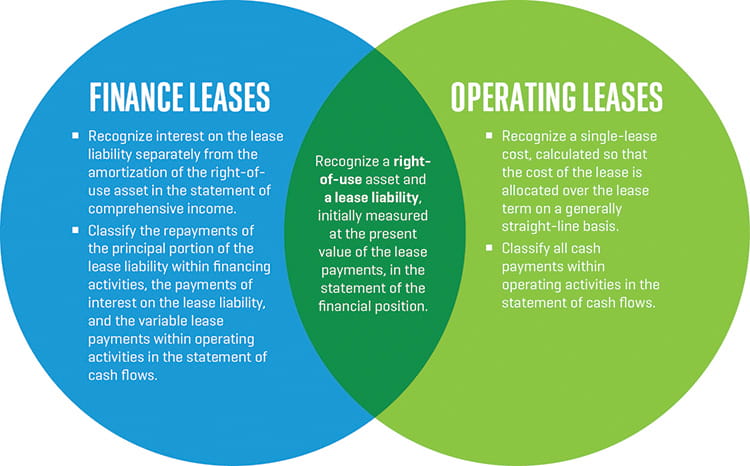

The accounting for capital leases is largely unchanged from previous generally accepted accounting principles (GAAP), with the exception that capital leases have been renamed “finance leases.” Additionally, lease accounting on income statements and statements of cash flows is largely unchanged from previous GAAP. That is, rent expense will continue to be incurred for operating leases, and finance leases will continue to be recognized as depreciation and interest on the income statement, with changes in the principal portion of the finance lease liability being classified within financing activities on the cash flow statement.

What’s Changed?

Under previous GAAP, only capital leases were recognized on the balance sheet. Operating leases, while subject to footnote disclosures outlining the future commitments, remained off the balance sheet.

The central tenet of ASC 842 is that all leases create assets and liabilities for lessees: a right-of-use (ROU) asset representing the right to use an underlying asset for the lease term, and a lease liability representing the obligation to make lease payments (Figure 1).[2] The ROU asset and lease liability, measured as the present value of the lease payments discounted at the rate implicit in the lease or the lessee’s incremental borrowing rate (IBR), will typically offset at lease inception.

Figure 1. Finance vs. Operating Leases Under ASC 842

ASC 842-20-45-1 requires finance and operating lease ROU assets and lease liabilities to be disclosed separately from each other and from other assets and liabilities. The weighted-average discount rate, segregated between those for finance and operating leases, must also be disclosed.

Effective Dates

Public companies must comply with ASC 842 for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. For private companies, the FASB initially required adoption for fiscal years beginning after December 15, 2019, and interim periods beginning after December 15, 2020. By unanimous vote in July 2019, however, the FASB has proposed to extend these dates by one year.

Reframing Enterprise Value

Investors and valuation professionals alike frequently determine a company’s value on an enterprise basis. Enterprise value represents the total invested capital of a business, including common and preferred equity and interest-bearing debt.

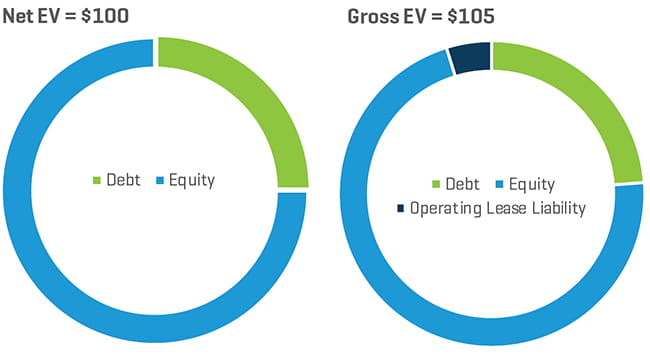

Treating operating lease liabilities as debt-like requires a reorientation in thinking. Importantly, the corporate debt and equity pie is not further subdivided but rather expanded. To distinguish between the two, the traditional definition of enterprise value is referred to hereinafter as “net EV” (NEV, net of lease liabilities), and enterprise value inclusive of operating lease liabilities is referred to as “gross EV” (GEV, gross of lease liabilities), as illustrated in Figure 2.

Figure 2. NEV vs. GEV

Valuation Multiples

A multiples-based valuation approach draws comparisons between price and performance. For example, price-to-earnings (P/E) ratios compare equity prices per share to earnings (net income) per share. From an enterprise value perspective, the most widely used valuation multiple is enterprise value to earnings before interest, taxes, depreciation, and amortization (EBITDA). Importantly, when deriving and applying valuation multiples, the numerator and denominator of the multiple equation must be presented on the same basis. That is, because enterprise value reflects a debt-free measurement, it must be divided by a debt-free measure of earnings. Similarly, because equity value is measured after the consideration of debt, it must be divided by a measure of earnings that deducts interest on that debt.

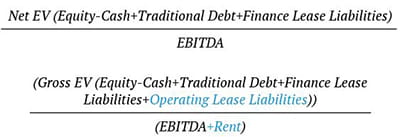

This same construct extends to analyzing leases in a valuation multiple context. Theoretically, NEV reflects a company’s value after deducting operating lease obligations, and therefore, NEV is divided by EBITDA, which includes a deduction for the rent expense. If, instead, we measure a company’s value on a GEV basis (gross of lease liabilities), the appropriate earnings metric to consider is EBITDA before rent (EBITDAR). In doing so, GEV is presented prior to the consideration of either finance or operating leases, and likewise, EBITDAR is consistently presented prior to the consideration of rent on operating leases or interest and depreciation on finance leases.

To state the obvious, NEV multiples derive NEV, and GEV multiples derive GEV. Therefore, internally consistent adjustments must be considered to determine the subject company’s equity value.

| Net EV | Gross EV |

|---|---|

| Less: Traditional Debt | Less: Traditional Debt |

| Less: Finance Leases | Less: Finance Leases |

| Add: Cash | Less: Operating Leases |

| Equals: Equity Value | Add: Cash |

| Equals: Equity Value |

Income Approach

As with valuation multiples, valuing a business based on its future cash flows requires internal consistency between cash flows and the discount rate. Equity cash flows are discounted at a required return on equity, and debt-free cash flows are discounted at a debt-free discount rate.

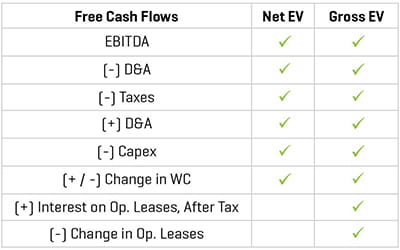

Converting an NEV cash flow model to a GEV cash flow model requires three steps.

First, the rent expense on operating leases can be deconstructed into interest and depreciation components. Adding back the rent expense, and then deducting the implied after-tax depreciation of the ROU asset, would mirror the free cash flow impact of finance leases. As a practical expedient suggested by valuation professor Aswath Damodaran, one may instead add back the imputed after-tax interest on the operating lease liabilities, calculated as the operating lease liability multiplied by the IBR. Per Damodaran, “While this approach is an approximation, it dispenses with the need for computing a depreciation number. Implicitly, we are assuming that the portion of the lease expense that is not interest is also equal to the depreciation that would have accrued on the asset.”[3]

Second, because the operating lease liability corresponds with the ROU asset, we must consider the change in the ROU asset over the projection period as a capital expenditure. These first and second steps are illustrated in Figure 3.

Figure 3.

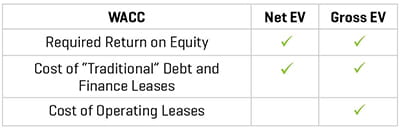

Third, the weighted average cost of capital (WACC) utilized in the valuation must be recalculated to consider operating lease liabilities as debt-like in the subject company’s capital structure (Figure 4).

Figure 4.

Illustrative Example

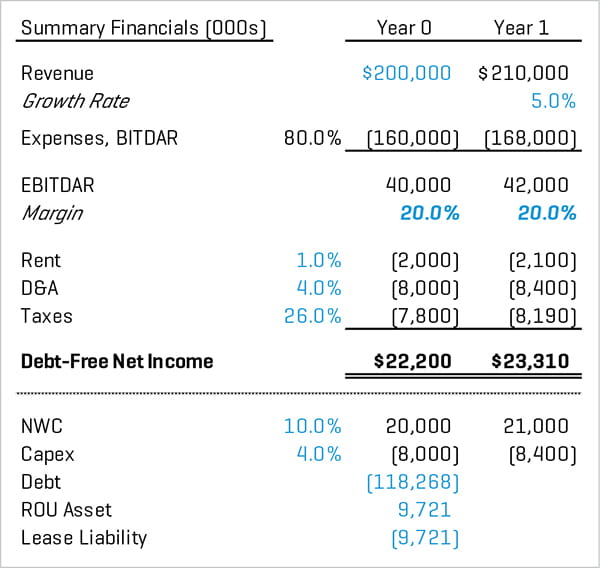

As shown in Figure 5, ABC Company, Inc. (ABC) generated $200 million in revenue with a 20.0% EBITDAR margin, and rent expense equates to 1.0% of revenue. Net working capital requirements are equal to 10.0% of revenue, and capital expenditures and depreciation are each expected to be 4.0% of revenue. ABC maintains traditional debt of approximately $118 million, and its ROU asset and operating lease liability are approximately $9.7 million; ABC does not have any finance leases. Finally, ABC expects revenue and profits to increase at a 5.0% annual growth rate into perpetuity.

Figure 5.

We then apply the capitalized cash flow (CCF) model under three separate approaches: 1) an equity model; 2) an NEV model; and 3) a GEV model. For simplicity, we have utilized the end-of-period discounting convention.

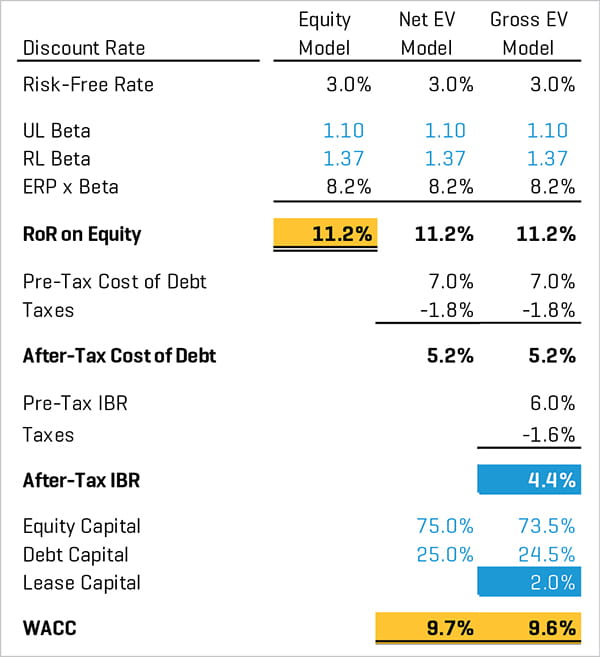

Figure 6 presents discount rates for each valuation model. The equity model will utilize the required return on equity, the NEV model will utilize a traditional WACC considering only equity and traditional debt capital, and the GEV model will include the after-tax cost of the operating lease liabilities.

Figure 6.

Note that the unlevered and relevered betas are identical across all three models. We assume that equity value, and by extension equity beta, is unchanged by the selected valuation approach. However, unlevering and relevering must be done consistently between the guideline public companies and the subject company. If betas are unlevered assuming operating leases are treated as debt, beta must be relevered assuming the same, and vice versa.

Additionally, note that the relative proportion of equity and traditional debt capital remains 75% and 25%, respectively, in the NEV and GEV models (i.e., 73.5% / (73.5% + 24.5%) = 75.0%). The operating lease capital, when included in the adjusted WACC, is incremental.

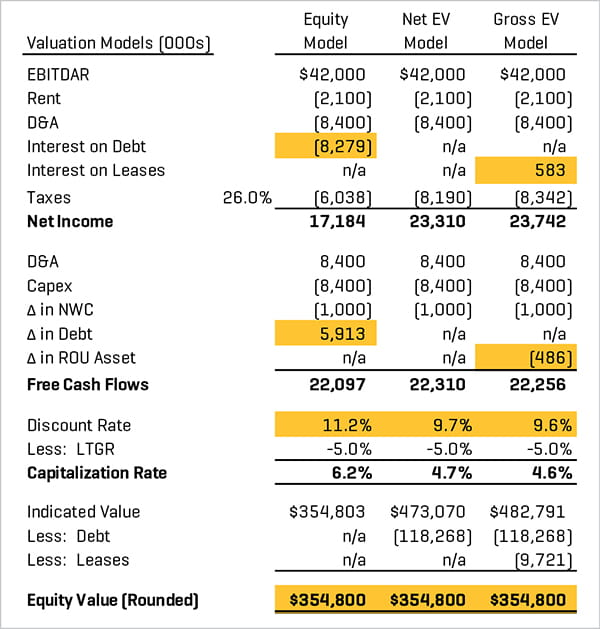

Finally, Figure 7 presents the resulting valuation models. Relative to the NEV model, we applied the following adjustments.

Figure 7.

Equity Model

First, we must account for the cost of traditional debt to derive equity cash flows. Interest on debt was deducted, and taxes were adjusted accordingly.

Second, once we select a debt-to-total capital assumption in our discount rate (either in the weighting between debt and equity in a WACC or through a relevered beta), the valuation model assumes that the level of debt remains consistent throughout the projection period. Accordingly, we derive the equity free cash flows by incorporating an inflow from debt proceeds as ABC’s borrowings scale according to its growth.

Third, because we have derived free cash flows to equity, the capitalization rate is calculated based on the required return on equity.

GEV Model

First, we add back the imputed interest on the operating lease liabilities, including the related tax effects. The imputed interest is calculated as the operating lease liability multiplied by the IBR.

Second, as ABC grows, its operating lease liabilities and ROU assets are assumed to grow, as well. Therefore, we subtract the projected change in ROU assets from free cash flows.

Third, because we have derived free cash flows to gross EV, the capitalization rate is calculated based on the adjusted WACC that includes the cost of lease capital.

Each model results in a different level of value. While the equity model directly derives equity value, traditional debt must be subtracted in the NEV model, and both traditional debt and operating lease liabilities must be subtracted in the GEV model. As shown, the value conclusions in each model are identical.

Parting Thoughts

Accounting changes should not change asset values, and the examples presented in this article are intended to highlight specific model adjustments necessary to allow for valuation comparability before and after ASC 842. That being said, the adoption of the new lease accounting rules should serve to enhance comparability across firms (particularly in industries with varying lease commitments, or in which there is variation in practice in terms of leasing versus owning operating assets). Furthermore, while future lease commitments and related disclosures have been available to users of financial statements prior to ASC 842, the recognition of these obligations on corporate balance sheets may better inform investors as to the future impact of lease commitments.

Big accounting changes can also result in big opportunities for analytical error. A Wall Street Journal article highlighted a report from Credit Suisse Group that addressed inconsistencies in data feeds as they pertain to the recognition of operating leases and the distortion of traditional metrics found in popular investor data sources, such as return on invested capital and leverage ratios. Moreover, the report expressed concern as to whether investors are aware that their data feeds have made these adjustments.[4] These comparability and data quality issues may persist for some time, particularly between public and private companies, until all reporting entities have adopted the new standard.

- Michael Rapoport, “New Rule to Shift Leases Onto Corporate Balance Sheets,” The Wall Street Journal, February 25, 2016.

- In the case of leases with a term of 12 months or less, lessees are permitted to make an accounting policy election not to recognize ROU assets or lease liabilities.

- Aswath Damodaran, “Leases, Debt and Value,” Stern School of Business, New York University, April 2009.

- Mark Maurer, “New Lease Accounting Standard May Mislead Investors, Credit Suisse Says,” The Wall Street Journal, July 10, 2019.