Corporate Inversions: The End... Again?

Corporate Inversions: The End... Again?

Nearly 50 U.S. companies have completed a corporate inversion transaction in the last 30 years and the trend for these transactions has increased over the past two years with at least 15 publicly traded U.S. companies taking steps to reincorporate abroad in lower-tax jurisdictions in an effort to significantly reduce their income tax obligations. As corporate inversion transactions and the subsequent amount removed from the U.S. tax base continue to increase, U.S. legislators and tax officials have responded with a recent proposal to revise the current anti-inversion regulations and make these transactions even more difficult to complete. While the specific regulatory revisions to tighten restrictions on U.S. corporations attempting an inversion remain unclear, the question remains whether or not the potential legislative revisions will result in one last run on inversions as companies attempt to complete inversions before the proposed legislation is enacted.

History of Corporate Inversions

A corporate inversion is the migration of a U.S. corporation to a foreign jurisdiction through a merger & acquisition transaction. Inversion transactions can be structured several ways, with the most common involving a U.S. company merging with a foreign target and redomiciling the combined company in the jurisdiction of the target.

Corporate inversions became prominent during the late 1990s and early 2000s for three primary reasons:

- High U.S. corporate income tax rates

- The U.S. policy of taxing a multi-national company’s worldwide income

- The ease with which a corporate inversion could be accomplished

The beginning of the U.S. Internal Revenue Service’s (“IRS”) battle against corporate inversions may be directly traced to the inversion transaction completed by Helen of Troy in 1993. Helen of Troy, a publicly traded U.S. cosmetics company, engaged in an inversion transaction whereby a newly formed Bermuda shell corporation became the parent of the U.S. corporation. At the time, the transaction was completely tax-free to both Helen of Troy and its shareholders. The U.S. IRS viewed the deal as a completely tax-motivated transaction having the sole purpose of U.S. tax avoidance and in response issued a notice, on a prospective basis, that U.S. shareholders of a U.S. corporation would be subject to taxation in certain inversion transactions. This notice was followed by the issuance of Section 367(a), the first comprehensive set of anti-inversion guidance, in 1996. However, because Section 367(a) only imposed taxation on U.S. shareholders of the inverted corporation, it was not effective in preventing publicly traded U.S. multinational corporations from completing inversion transactions.

Following a series of high profile corporate inversions in the late 1990s and early 2000s, Congress enacted Internal Revenue Code section 7874 (“Section 7874”) in 2004 as part of the American Jobs Creation Act of 2004 to introduce a more effective deterrent in corporate inversion transactions. Essentially, there are three key requirements that must be satisfied under Section 7874: 1) Ownership Test; 2) Asset Test; and 3) Business Activities Test.

Under the Ownership Test, the inverting U.S. company will be treated as a foreign corporation for U.S. tax purposes if the percentage of the new foreign parent company’s stock owned by the former U.S. company’s shareholders after the transaction is 60% or more but less than 80%. If after the transaction the percentage of ownership is 80% or more, and other requirements are met, the inversion is disregarded entirely and the new foreign parent will be treated as a U.S. corporation for U.S. tax purposes. If ownership is less than 60%, Section 7874 does not apply. Under the Asset Test, the new foreign parent must

acquire directly or indirectly “substantially all” the assets of the inverting U.S. company to be captured by Section 7874. The Substantial Business Activities Test looks at the level of business activities of the inverting U.S. company that is conducted in the new foreign parent company’s country of incorporation. The test looks at the combined activities of the inverting U.S. company and the new foreign parent.

Subsequent to the enactment of Section 7874 in 2004, Temporary Treasury Regulations under Section 7874 issued in 2006 provided additional rules that interpreted the Substantial Business Activities Test. The 2006 regulations provided that the determination of whether a multinational corporation has substantial business activities in a jurisdiction is based on all of the facts and circumstances. Additionally, the 2006 regulations contained a substantial business activities safe harbor, which was generally satisfied if at least 10% of the multinational company’s employees, assets, and sales were located in or derived from the relevant foreign jurisdiction. In 2009, Temporary Treasury Regulations under Section 7874 retained the facts and circumstances test for substantial business activities, but eliminated the safe harbor.

In June 2012, the U.S. Treasury Department and IRS issued new temporary Treasury Regulations under Section 7874 that impose tighter restrictions on corporate inversions. The 2012 regulations eliminated the facts and circumstances test and adopted a new, bright-line test for determining whether a multinational corporation has substantial business activities in the respective foreign jurisdiction for purposes of Section 7874. Specifically, the 2012 regulations provide that a multinational corporation will have substantial business activities in the jurisdiction of the new foreign parent company only if at least 25% of the company’s employees and assets are located in, and at least 25% of the company’s income is derived from, that jurisdiction.

While Section 7874 does not prevent firms from inverting, it was enacted to deter such transactions by either eliminating the tax benefits associated with inverting or increasing the tax cost of a corporate inversion. In the first case, Section 7874 ignores the inversion for tax purposes, and says the firm will continue to be taxed as a U.S. corporation. In the second case, it recognizes the inversion, but may increase the tax bill that is triggered by the transaction by denying some tax deductions that can reduce the taxable gain realized as a result of the inversion.

Motivating Factors Behind Corporate Inversions

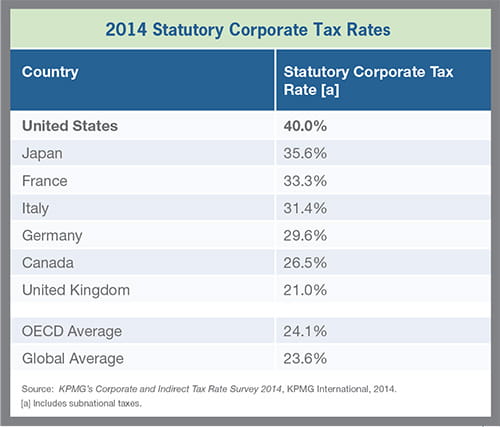

U.S. legislators and tax officials were considered successful in eliminating corporate inversions following the enactment of Section 7874 as these types of transactions became less frequent. However, U.S. corporations’ motivation to invert was not thwarted. In fact, U.S. corporations view their competitive situation relative to global competitors less favorable since the enactment of Section 7874 due to the continued increase in U.S. corporate tax rates (which is now the highest among developed countries) relative to other developed countries, the continued U.S. taxation of foreign earnings when repatriated to the U.S., and the empty promise of broader tax reform legislation thus far. Accordingly, there has been a resurgence in corporate inversion transactions since 2008, and especially within the past two years, as U.S. corporations attempt to realize several benefits including:

- a lower effective tax rate on future earnings

- the ability to access its non-U.S. cash reserves more tax-efficiently

- a more favorable profile for future acquisition activity

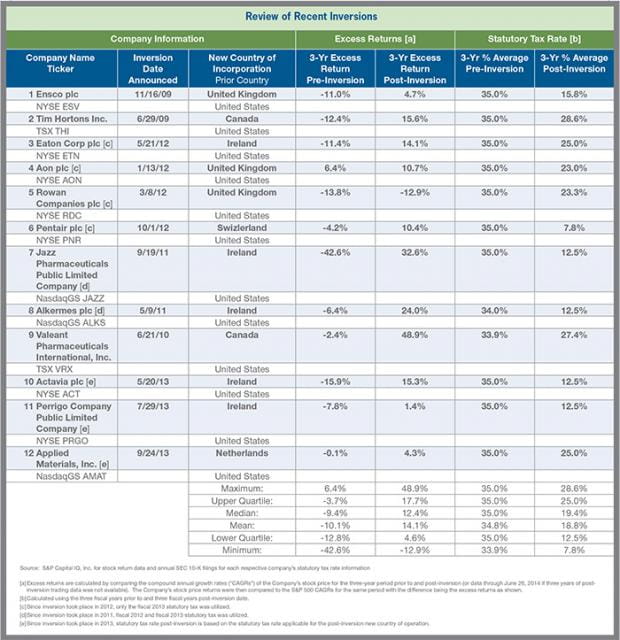

In order to exhibit the impact a corporate inversion transaction can have on a company and its annual tax liability, we researched a sample of 12 companies that have recently completed an inversion. As displayed in the following table, these companies have been able to significantly decrease their statutory income tax rate following their respective inversion transactions. Specifically, these companies yielded a median three-year average statutory tax rate of 35% prior to inversion versus a median three-year average statutory rate of approximately 19% post-inversion. This represents an approximate 45% decrease in median statutory tax rate over this time period.

In addition to the reduction in income tax liability, we noticed the sample companies’ stock returns relative to the S&P 500 generally exhibited a substantial increase in the three-year period post-inversion as compared to the three-year period pre-inversion, which may suggest that the inversion transactions and their resulting improved tax rate environments have contributed to the companies’ improved earnings and return metrics. However, it is important to note that an improved tax environment is not the sole motivating factor behind public companies deciding to pursue transactions with foreign companies. Most of the firms within the sample group also articulated a number of operational benefits generated by their transactions, which may also play a part in the improved stock return dynamics post-inversion. Nevertheless, the improved stock return trend, combined with the tax benefits previously discussed, may influence other companies to seek similar inversion transactions if an opportunity presents itself.

Recent Anti-Inversion Chatter

Although U.S. companies involved in an inversion transaction may be motivated by operational benefits or other non-tax synergies, the U.S. government continues to view these transactions as a tax-motivated action. As a result, U.S. government officials have proposed several new regulations including the Stop Corporate Inversions Act of 2014 introduced on May 20, 2014, by a group of 14 senators in an effort to deter these transactions and the loss of further income tax revenue. The Stop Corporate Inversions Act of 2014, which is broadly similar to a proposal in President Obama’s 2015 budget submission, increases the needed percentage change in stock ownership from 20% to 50% and provides that the merged company will nevertheless continue to be treated as a domestic U.S. company for tax purposes if management and control of the merged company remains in the U.S. and either 25% of its employees or sales or assets are located in the U.S. Additionally, the Stop Corporate Inversions Act of 2014 provides a two-year moratorium on inversions that do not meet its stricter tests so that Congress can consider a long-term solution as part of its general corporate tax reform process1.

The future surrounding corporate inversion transactions is currently very uncertain. What legislative revisions will be enacted to attempt to deter inversion transactions and protect corporate tax revenues? Will there be an increase in inversion announcements as companies race to complete inversion transactions before the new legislation becomes effective? Will the new legislation be effective in actually limiting corporate inversions? Only time will provide answers to these questions. However, the controversy surrounding corporate inversions is just another example of the need for broader tax reform to allow U.S. companies to be more competitive relative to global companies that operate in a more favorable tax environment.