Tire Distribution & Manufacturing Industry Update Q2 2018

Subscribe to Industry UpdatesTire Distribution & Manufacturing Industry Update Q2 2018

Subscribe to Industry UpdatesActive Second Quarter Sees Continued Structural Changes Within the Industry

The second quarter was another strong one for tire industry mergers and acquisitions (M&A), approaching activity level highs seen during the past four years. It is our view that the wholesale segment received the spotlight given the Tirehub, LLC joint venture formed between Bridgestone and Goodyear. On the heels of the Michelin/Sumitomo partnership in the first quarter, this is a huge move, as the leading manufacturers consolidate their national passenger/light truck networks and go head-to-head with certain independent wholesalers (both customers and former customers).

Key Takeaways:

- Strong consolidation trends at the top of the wholesale segment as manufacturers combine and focus on growing distribution networks

- Active M&A engagement both domestically and abroad, with a majority of activity coming from strategic players

- Positive macroeconomic trends, despite pockets of turbulence concerning tariffs

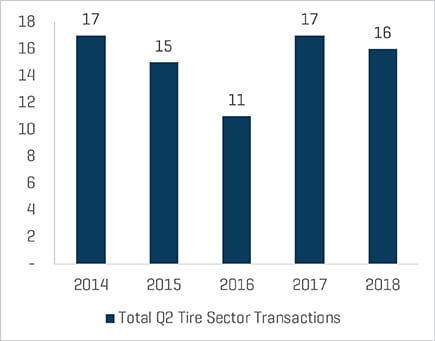

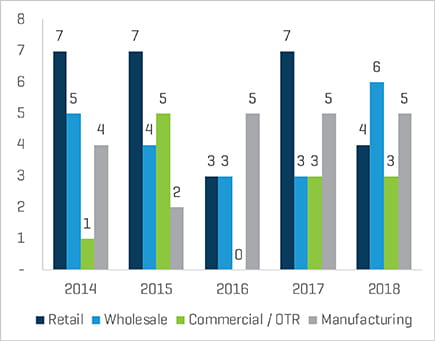

Historical M&A Trends by Period / Sector

Total Transaction Count

Transactions per Sector

Retail

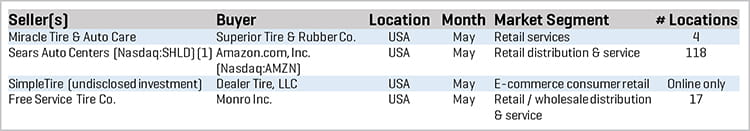

Retail M&A Transactions - Q2 2018

Monro Inc.

In May, Monro Inc. acquired 99-year-old Free Service Tire Co., a Johnson City, TN-based tire dealer. The deal includes Free Service’s 12 retail and commercial stores, four wholesale distribution centers, and one retread facility. Monro’s acquisition expands its footprint in Tennessee, North Carolina, and Virginia, adding to the company’s 130-plus locations in those states (Monro’s total footprint now consists of 1,166 company-owned stores, 98 franchise locations, nine wholesale locations, and three retread facilities across 27 states). Management expects the acquisition to add approximately $47 million in annual sales, representing a sales mix of 15% service and 85% tires.

Sears Auto Centers (Nasdaq:SHLD), Amazon.com, Inc. (Nasdaq:AMZN)

Combining the surging trends in e-commerce with the physical infrastructure needed to provide the full range of customer services, Sears Auto Centers and Amazon have formed a joint venture, through which customers can order tires on www.amazon.com and have them shipped to a Sears Auto Center for installation. Sears originally announced that Amazon would ship tires to 47 local Sears Auto Center locations; however, that list of stores has been extended to 118, representing nearly one-fourth of all Sears department stores. The joint venture points first, toward a growing need for e-tailing capabilities, and second, toward the value of integrating e-commerce with brick-and-mortar customer servicing.

Wholesale

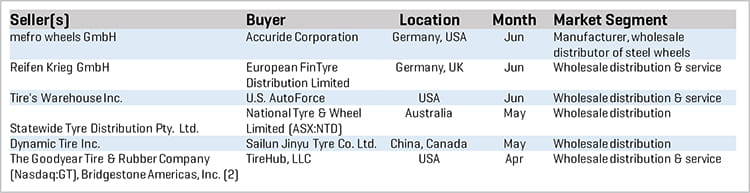

Wholesale M&A Transactions - Q2 2018

The Goodyear Tire & Rubber Company (Nasdaq:GT), Bridgestone Americas, Inc.

In April, Goodyear and Bridgestone announced the formation of TireHub, LLC, one of the largest distribution joint ventures in the United States. TireHub will combine Goodyear’s company-owned wholesale distribution network with Bridgestone-owned Tire Wholesale Warehouse. TireHub is headquartered in Atlanta, and consists of more than 80 distribution warehouses throughout the nation.

U.S. AutoForce

U.S. AutoForce announced its acquisition of Tire’s Warehouse Inc., in a move that expands its reach into Arizona, California, and Nevada. The June 2018 transaction encompasses Tire Warehouse's eight West Coast warehouses and gives U.S. AutoForce access to new resources, brands, and channels. U.S. AutoForce is the fifth-largest wholesale tire distributor in the United States.

Commercial / OTR

Commercial / OTR M&A Transactions - Q2 2018

Purcell Tire & Rubber Co.

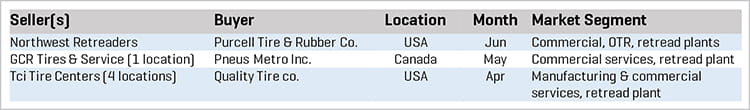

In a transaction that further consolidates the OTR retreading sector, Purcell Tire announced its acquisition of Northwest Retreaders, a division of NRI, Inc. Management touts strategic geographic expansion as the underlying rationale for the transaction, and expects the combined businesses will solidify Purcell’s position as a market leader in OTR retreading, as well as other niche markets where Northwest has had success.

Quality Tire Co.

In April, Salt Lake City-based Quality Tire Co. acquired threeTCi Tire Center commercial service locations, as well as an MRT retread plant, all of which are located in Colorado. The transaction is expected to boost Quality Tire’s annual sales by approximately 50%, to $60 million, and will bring its total employee count to nearly 150. This most recent Michelin divestiture brings the TCi network of commercial tire centers down to five remaining locations. Michelin has divested more than 50 TCi locations, and at least eight retread plants in the past year alone.

Manufacturing

Manufacturing M&A Transactions - Q2 2018

Qingdao Doublestar Tire Co. Ltd.

Kumho Tire Co. Inc. announced in April that management had agreed to sell a controlling stake in the company to China’s Doublestar. While Kumho did not release financial details relating to the transactions, numerous publications have reported that Doublestar would acquire a 45% stake in Kumho through a private placement of shares valued at approximately $630 million. Doublestar has guaranteed that Kumho’s management team will continue to operate the tire manufacturer and build its brand. Furthermore, Doublestar has promised to “invest a substantial amount of capital in the company to get it back on track and profitable.”

Accuride Corporation

In June, Accuride Corp. announced its acquisition of Germany-based mefro wheels GmbH (“Mefro”). Mefro, a privately owned manufacturer and supplier of steel wheels, maintains manufacturing operations in Germany, France, Turkey, Russia, and China, and employs more than 3,000 people across Europe and Asia. The transaction expands Accuride’s position as a premiere wheel-end solutions supplier to the global commercial vehicle industry, and furthers its global growth initiative under the ownership of Crestview Partners.