Oil Prices Continue to Decline, but What About Market Multiples?

Oil Prices Continue to Decline, but What About Market Multiples?

Oil prices can impact the values of and yields on investments in royalties and publicly traded royalty trusts in several ways:

- Direct Revenue Impact: Royalty trusts often derive their income from the sale of oil and gas. Therefore, when oil prices rise, the revenues for these trusts generally increase, leading to higher distributions or yields for investors. Conversely, when oil prices fall, revenues and distributions can decrease.

- Valuation of Assets: Higher oil prices can increase the value of the oil reserves that the trust holds. This can lead to an increased valuation of the trust itself, potentially attracting more investors and positively affecting its market performance.

- Production Decisions: Oil prices can influence the decision to start or halt production on certain wells. When prices are high, it may become economically viable to extract from more costly or less productive wells, increasing overall production and thus revenues. On the other hand, low prices might lead to a decrease in production.

- Hedging and Contracts: Some royalty trusts may engage in hedging strategies to lock in prices for their oil production. The effectiveness of these strategies can be influenced by oil price volatility, impacting the trust’s revenue stability and yields.

- Investor Sentiment: The perception of the oil industry’s health can affect investor sentiment toward royalty trusts. High oil prices often signal robust demand and a strong energy sector, potentially increasing investor interest in royalty trusts.

- Inflation and Economic Conditions: Oil prices are often linked to broader economic conditions and inflation. High oil prices can signal rising inflation, which might affect interest rates. This, in turn, could influence the relative attractiveness of royalty trusts compared to other investment vehicles, like bonds.

On September 27, 2023, spot prices for WTI oil hit their high mark for the year, at $93.67 per barrel. For comparison, oil prices had fallen to $72.73 per barrel on December 4, 2023, a decline of approximately 22%.

Below, this is compared to the implied multiples supported by market data, as demonstrated in the pricing of public royalty trusts. Royalty trusts for the comparable group analysis were selected from S&P’s Capital IQ database.

Market Multiples Analyses

In one of the three approaches to valuation, the Market Approach, the value of a company or asset is determined by taking market multiples for publicly traded assets and then applying them to the historical results of an underlying subject company, asset, or portfolio of royalties in this case.

The market approach uses current market values and then compares them to historical results for the publicly traded companies to determine market-based multiples of revenues, net income, EBITDA, etc. Although valuation is a forward-looking exercise, forward-looking market expectations are exactly what is reflected in the current securities prices. By then comparing these securities prices to known historical financial results, multiples can be determined for valuing an asset that is not publicly traded.

September 27, 2023: High Spot Price for WTI of $93.67

For the group of royalty trusts described above, we calculated multiples based on current pricing, historical earnings before interest, taxes, depreciation, and exploration costs (EBITDAX) and the dividends paid by these trusts. Summary tables from the analyses follow:

Royalty Portfolio as of 9/27/2023 - Implied Pricing Multiples

(In Millions of U.S. Dollars, Except Dividends per Share)

Royalty Trusts |

Ticker |

Enterprise Value ("EV") [a] |

LTM EBITDAX |

LTM Dividends Per Share |

|

|---|---|---|---|---|---|

|

Chesapeake Granite Wash Trust |

CHKR |

$47.1 |

$13.9 |

$0.29 |

|

|

Cross Timbers Royalty Trust |

CRT |

120.6 |

13.7 |

2.28 |

|

|

Marine Petroleum Trust |

MARP.S |

9.8 |

1.6 |

0.86 |

|

|

Mesa Royalty Trust |

MTR |

26.5 |

4.1 |

2.01 |

|

|

Permian Basin Royalty Trust |

PBT |

1,012.5 |

54.5 |

1.17 |

|

|

Permianville Royalty Trust |

PVL |

83.9 |

15.6 |

0.46 |

|

|

Sabine Royalty Trust |

SBR |

979.2 |

126.4 |

8.64 |

|

|

|

|

|

|

|

|

Royalty Trusts |

Ticker |

|

EV/LTM EBITDAX |

LTM Dividend Yield |

EV/LTM Dividends |

|

Chesapeake Granite Wash Trust |

CHKR |

|

3.4x |

27.1% |

3.7x |

|

Cross Timbers Royalty Trust |

CRT |

|

8.8x |

11.2% |

8.9x |

|

Marine Petroleum Trust |

MARP.S |

|

6.3x |

16.1% |

6.2x |

|

Mesa Royalty Trust |

MTR |

|

6.5x |

13.4% |

7.5x |

|

Permian Basin Royalty Trust |

PBT |

|

18.6x |

5.4% |

18.6x |

|

Permianville Royalty Trust |

PVL |

|

5.4x |

17.7% |

5.7x |

|

Sabine Royalty Trust |

SBR |

|

7.7x |

12.8% |

7.8x |

|

|

|

|

|

|

|

Analysis of Multiples |

|

|

EV/LTM EBITDAX |

LTM Dividend Yield |

EV/LTM Dividends |

|

Maximum |

|

|

18.6x |

27.1% |

18.6x |

|

Upper Quartile |

|

|

8.3x |

16.9% |

8.4x |

|

Median |

|

|

6.5x |

13.4% |

7.5x |

|

Mean |

|

|

8.1x |

14.8% |

8.4x |

|

Lower Quartile |

|

|

5.8x |

12.0% |

5.9x |

|

Minimum |

|

|

3.4x |

5.4% |

3.7x |

Source: S&P Capital IQ, Inc.

This information was used to develop the following table, which shows the resulting median multiples for the group to apply to trailing EBITDAX and dividends paid by our subject royalty.

Royalty Portfolio as of 9/27/2023 - Concluded Multiples

(In Thousands of U.S. Dollars)

Measure of Performance |

Range of Indicated Multiples [a] |

Median Multiples [b] |

||||

|---|---|---|---|---|---|---|

Minimum |

Lower Quartile |

Median |

Upper Quartile |

Maximum |

||

|

EV/LTM EBITDAX |

3.4x |

5.8x |

6.5x |

8.3x |

18.6x |

6.5x |

|

LTM Dividend Yield |

5.4% |

12.0% |

13.4% |

16.9% |

27.1% |

7.5x |

As shown, when prices for oil were at their highest levels for the year, the EBITDAX and dividend multiples concluded were 6.5x and 7.5x, respectively.

December 4, 2023: WTI Spot Price of $72.73

Next, we developed the same analysis for the group of royalty trusts as of a current date. Summary tables from the analyses follow:

Royalty Portfolio as of 12/8/2023 - Implied Pricing Multiples

(In Millions of U.S. Dollars, Except Dividends per Share)

Royalty Trusts |

Ticker |

Enterprise Value ("EV") [a] |

LTM EBITDAX |

LTM Dividends Per Share |

|

|---|---|---|---|---|---|

|

Chesapeake Granite Wash Trust |

CHKR |

$32.8 |

$13.9 |

$0.29 |

|

|

Cross Timbers Royalty Trust |

CRT |

109.5 |

13.7 |

2.28 |

|

|

Marine Petroleum Trust |

MARP.S |

7.7 |

1.6 |

0.86 |

|

|

Mesa Royalty Trust |

MTR |

29.0 |

4.1 |

2.01 |

|

|

Permian Basin Royalty Trust |

PBT |

709.1 |

54.5 |

1.17 |

|

|

Permianville Royalty Trust |

PVL |

62.4 |

15.6 |

0.46 |

|

|

Sabine Royalty Trust |

SBR |

1,022.1 |

126.4 |

8.64 |

|

|

|

|

|

|

|

|

Royalty Trusts |

Ticker |

|

EV/LTM EBITDAX |

LTM Dividend Yield |

EV/LTM Dividends |

|

Chesapeake Granite Wash Trust |

CHKR |

|

2.4x |

37.7% |

2.7x |

|

Cross Timbers Royalty Trust |

CRT |

|

8.0x |

12.3% |

8.1x |

|

Marine Petroleum Trust |

MARP.S |

|

5.0x |

19.8% |

5.0x |

|

Mesa Royalty Trust |

MTR |

|

7.1x |

12.8% |

7.8x |

|

Permian Basin Royalty Trust |

PBT |

|

13.0x |

7.7% |

13.0x |

|

Permianville Royalty Trust |

PVL |

|

4.0x |

23.6% |

4.2x |

|

Sabine Royalty Trust |

SBR |

|

8.1x |

12.2% |

8.2x |

|

|

|

|

|

|

|

Analysis of Multiples |

|

|

EV/LTM EBITDAX |

LTM Dividend Yield |

EV/LTM Dividends |

|

Maximum |

|

|

13.0x |

37.7% |

13.0x |

|

Upper Quartile |

|

|

8.0x |

21.7% |

8.1x |

|

Median |

|

|

7.1x |

12.8% |

7.8x |

|

Mean |

|

|

6.8x |

18.0% |

7.0x |

|

Lower Quartile |

|

|

4.5x |

12.3% |

4.6x |

|

Minimum |

|

|

2.4x |

7.7% |

2.7x |

Source: S&P Capital IQ, Inc.

This information was used to develop the following table, which shows the resulting median multiples for the group to apply to trailing EBITDAX and dividends paid by our subject royalty.

Royalty Portfolio as of 12/8/2023 - Concluded Multiples

(In Thousands of U.S. Dollars)

Measure of Performance |

Range of Indicated Multiples [a] |

Median Multiples [b] |

||||

|---|---|---|---|---|---|---|

Minimum |

Lower Quartile |

Median |

Upper Quartile |

Maximum |

||

|

EV/LTM EBITDAX |

2.4x |

4.5x |

7.1x |

8.0x |

13.0x |

7.1x |

|

LTM Dividend Yield |

7.7% |

12.3% |

12.8% |

21.7% |

37.7% |

7.8x |

As shown above, with current oil prices down over 20% from their high marks several months earlier, the EBITDAX and dividend multiples for the group of comparable companies both increased to 7.1x and 7.8x, respectively.

Key Takeaways

Given that market multiples increased at the same time as oil prices fell, this could indicate the market expects higher future prices for oil, as compared to their current rates. However, given that royalty trusts are viewed as an income producing asset, the recent decline in interest rates, lowering the attractiveness of bonds, could also be a driver behind the increase in the observed market multiples for oil and gas royalty portfolios.

WTI Strip Prices Decrease

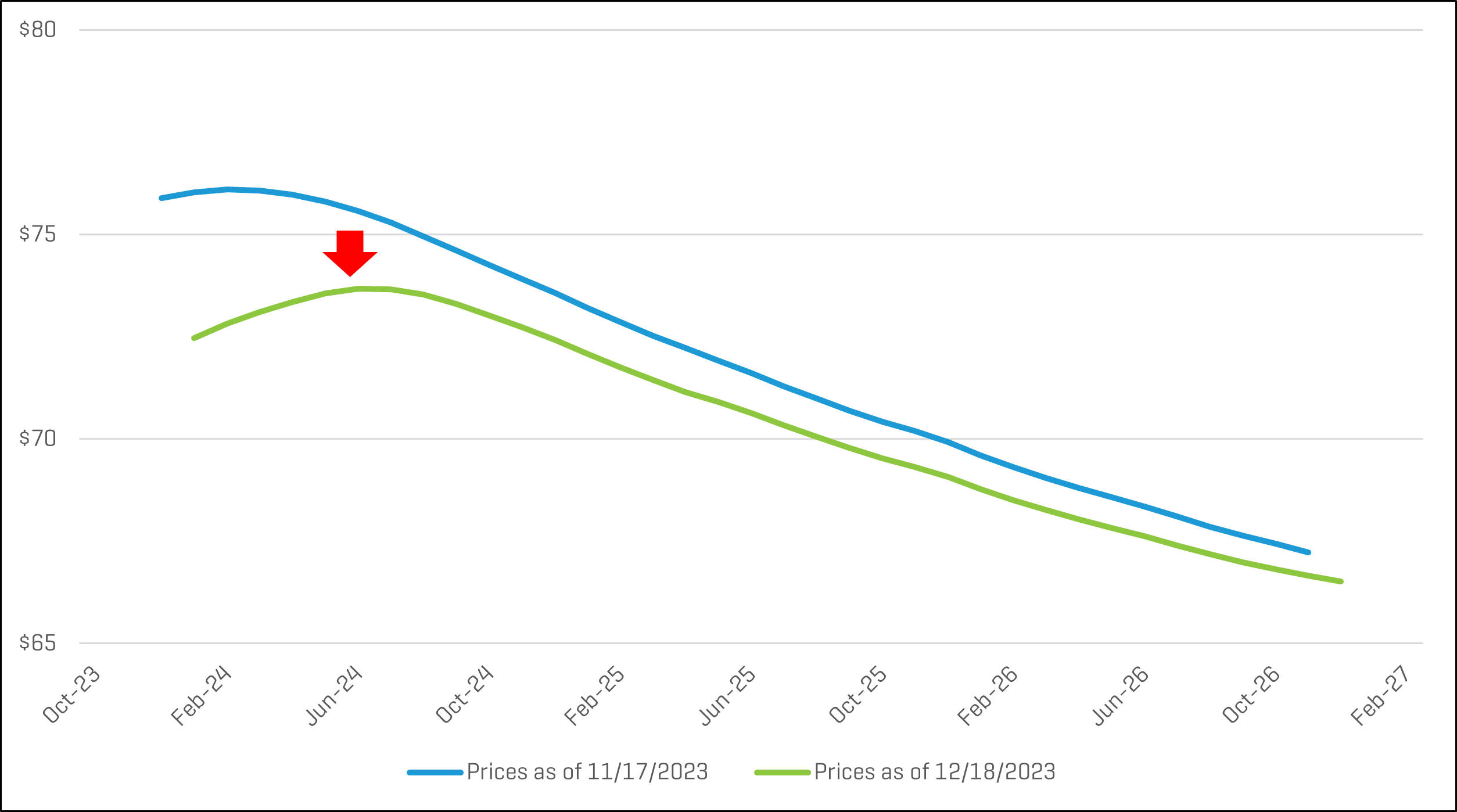

Over the last month, spot prices and futures prices for the West Texas Intermediate (WTI) contract decreased by approximately $3.50 per barrel in the near term and decreased approximately $0.50 over the longer term.

WTI Strip Prices - One Month Change

As shown, the oil price curve remains in a state of “backwardation,” reflecting the market’s expectation of lower future spot prices.

Oil Price Outlook

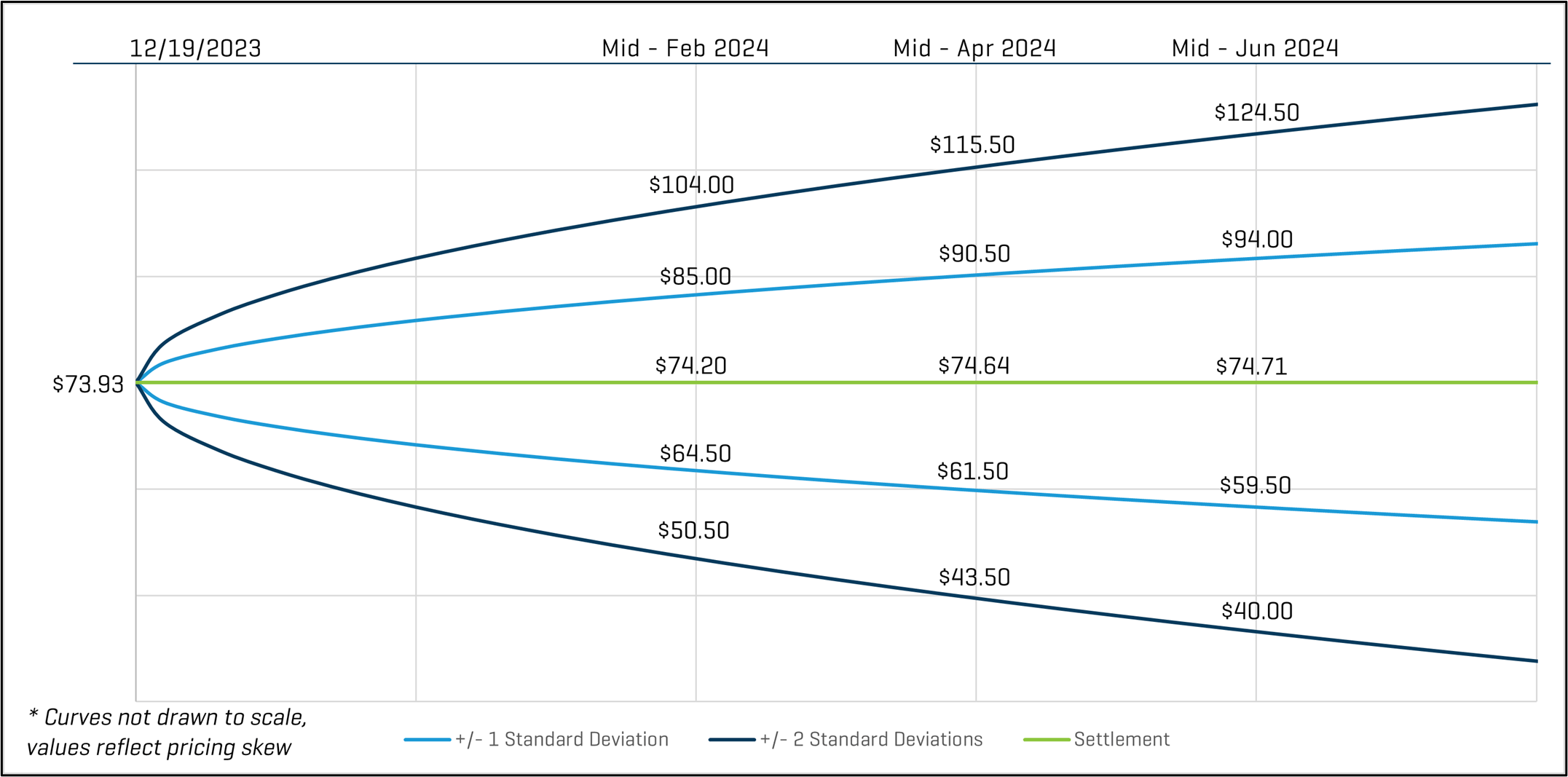

The price distribution below shows the crude oil spot price on December 19, 2023, as well as the predicted crude oil prices based on options and futures markets. Light blue lines are within one standard deviation (σ) of the mean, and dark blue lines are within two standard deviations.

WTI Crude Oil $/BBL

Based on these current prices, the markets indicate there is a 68% chance oil prices will range from $61.50 and $90.50 per barrel in mid-April 2024. Likewise, there is roughly a 95% chance that prices will be between $43.50 and $115.50. By mid-June 2024, the one-standard deviation (1σ) price range is $59.50 to $94.00 per barrel, and the two-standard deviation (2σ) range is $40.00 to $124.50 per barrel.

Key Takeaways

Remember that option prices and models reflect expected probabilities, not certain outcomes, but that does not make them any less useful. Throughout most of 2023, crude oil spot prices fluctuated within the range of $70 to $80 per barrel, but for their elevated levels in September of 2023. As spot prices have recently trended towards the $70 to $80 per barrel range, futures price volatilities have begun to decrease, as evidenced by the futures price ranges observed. For mid-June 2024 pricing as of December 19, 2023, the 1σ range had a spread of $34.50 per barrel, and the 2σ range has a spread of $84.50 per barrel. For comparison, in 2022 we observed 1σ and 2σ price ranges in excess of $65.00 and $150.00, respectively.