Improved Supply/Demand Dynamics Support Higher Expected Oil Prices

Improved Supply/Demand Dynamics Support Higher Expected Oil Prices

After crossing $80 per barrel last month, oil prices have continued to climb almost another 10% this last month. These higher prices are not deemed an anomaly, but more of a forward indicator of things to come. In response, investment banking analysts are raising their longer-term forecasts for commodity prices to reflect the current supply/demand dynamics in the global petroleum markets.

In a recent industry report,1 Wells Fargo equity analysts presented a compelling case for their views on global supply and demand inputs, and the resulting impact on future prices. In this report, they noted that year to date:

- Thus far, the U.S. has avoided recession

- OPEC+ has cut oil production by 1.2 million barrels of oil per day

- Inventories are stable

- China’s outlook is murkier

- Oil prices are near where they began the year.

Global Supply Recap

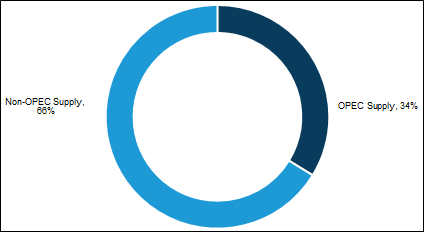

As shown in the chart below, OPEC is expected to produce 34% of the world’s oil supply for 2023.

2023E — Oil Supply Breakdown

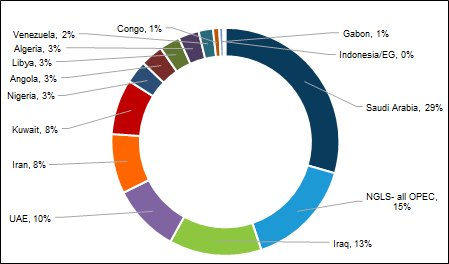

Within OPEC, Saudi Arabia is the largest producer, at 29% of OPEC’s production, followed by Iraq, the UAE, and Iran.

2023E — OPEC Oil Supply

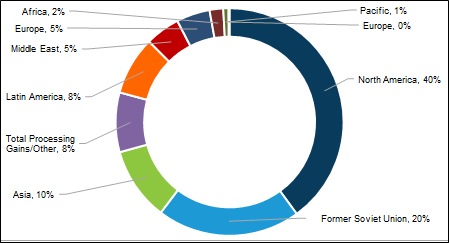

Outside of OPEC, North America is expected to produce 40% of the world’s oil supply for 2023, followed up by the former Soviet Union countries and Asia.

2023E — Non-OPEC Oil Supply

Demand Analysis

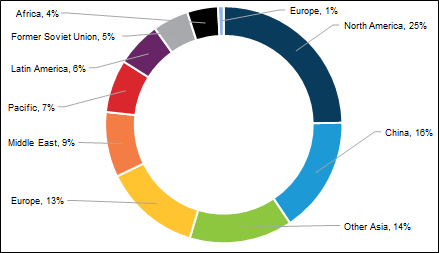

Although it is one of the largest producers of oil outside of OPEC, North America is also the biggest consumer of oil and related products, at 25% of global demand, followed up by China, other Asian countries, and Europe.

2023E — Oil Demand

Inflation Impact

Higher prices contribute to inflation, and energy prices affect many different sectors of the overall economy. Increased demand and reduced supplies both contribute to inflation. This relationship will continue to be watched closely by the Federal Reserve as it tries to reduce the rate of inflation by raising interest rates in the future, anticipated to ease demand and bring down commodity prices, and overall levels of inflation.

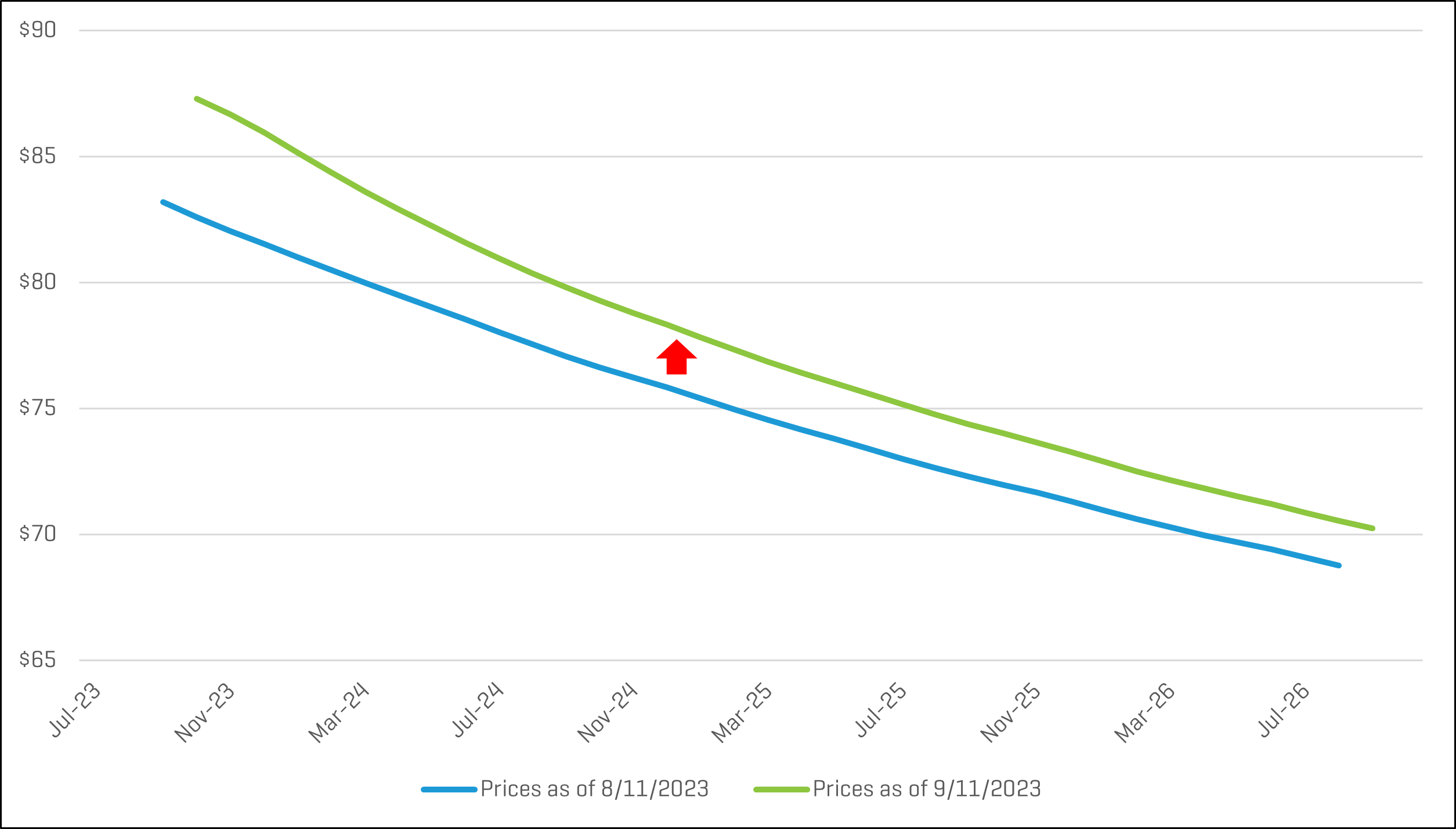

WTI Strip Prices Increase

Spot prices and futures prices for the West Texas Intermediate (WTI) contract increased by approximately $5.00 per barrel in the near term and increased approximately $2.00 over the longer term.

WTI Strip Prices — One Month Change

As shown, the oil price curve remains in a state of “backwardation,” reflecting the market’s expectation of lower future spot prices.

Oil Price Outlook

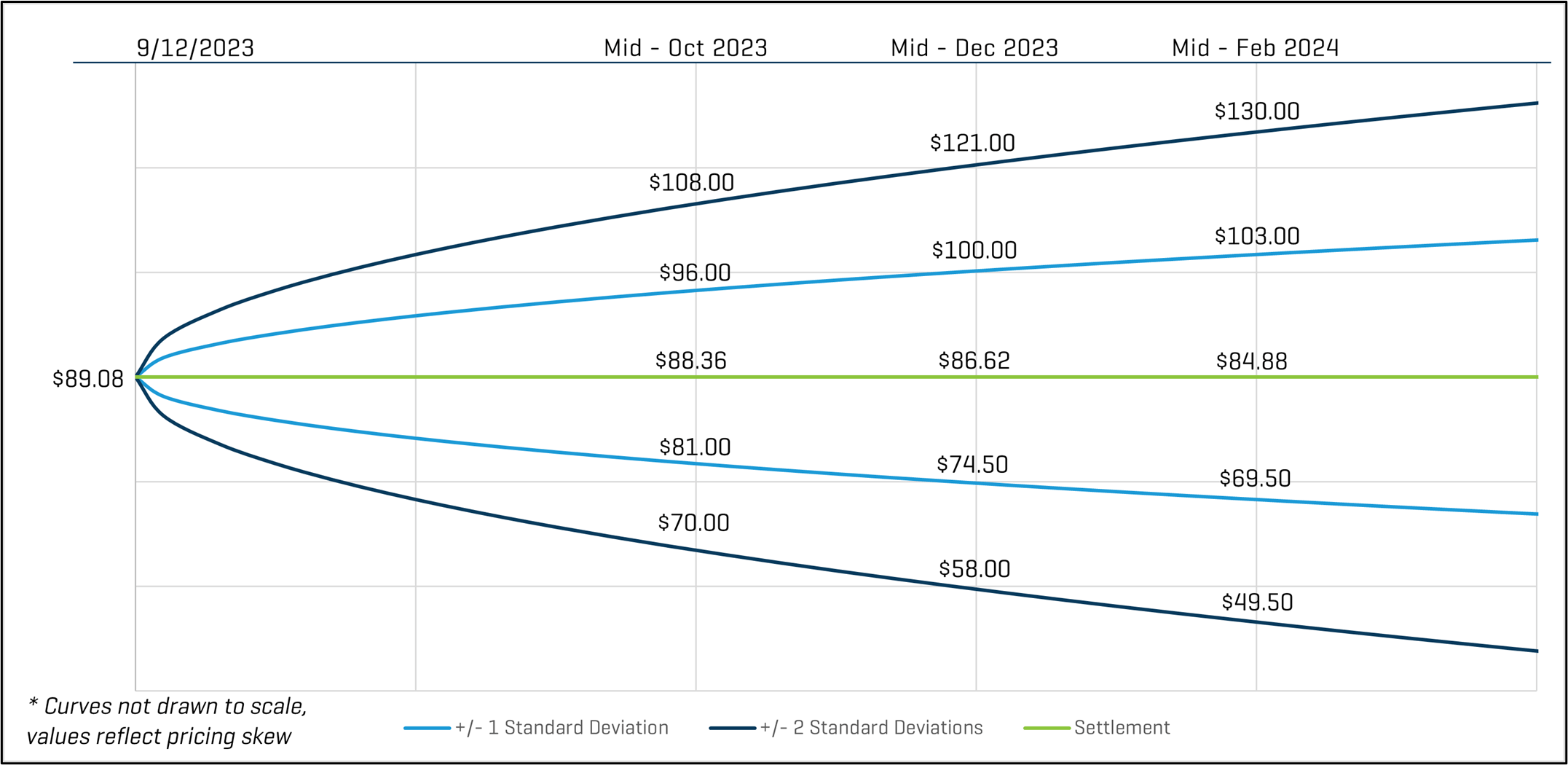

The price distribution below shows the crude oil spot price on September 12, 2023, as well as the predicted crude oil prices based on options and futures markets. Light blue lines are within one standard deviation (σ) of the mean, and dark blue lines are within two standard deviations.

WTI Crude Oil $/BBL

Based on these current prices, the markets indicate there is a 68% chance oil prices will range from $74.50 and $100.00 per barrel in mid-December 2023. Likewise, there is roughly a 95% chance that prices will be between $58.00 and $121.00. By mid-February 2024, the one-standard deviation (1σ) price range is $69.50 to $103.00 per barrel, and the two-standard deviation (2σ) range is $49.50 to $130.00 per barrel.

Key Takeaways

Remember that option prices and models reflect expected probabilities, not certain outcomes, but that does not make them any less useful. Throughout most of 2023, crude oil spot prices fluctuated within the range of $70 to $80 per barrel. Over the past month, we have observed spot prices primarily above that range, with a year-to-date high as of this report around $89.00 per barrel. With the recent increase in prices, volatility in futures prices have increased slightly, as evidenced by the increase in futures price ranges. Comparing the four-months futures prices (February 2024 prices of this report vs. January 2024 prices of last month’s report), the spread for the 1σ range increased $2.50 per barrel and the spread for the 2σ range increased $5.50 per barrel. Despite these recent increases, futures price ranges are still significantly lower compared to 2022. For mid-February 2024 pricing as of September 12, 2023, the 1σ range had a spread of $33.50 per barrel, and the 2σ range has a spread of $80.50 per barrel. For comparison, in 2022 we observed 1σ and 2σ price ranges in excess of $65.00 and $150.00, respectively.

- “Oil Macro: Adjusting 2023 and 2024 Price Decks,” Equity Research, Industry Update — August 21, 2023, Wells Fargo.