Health Care Suspicions? Better Call a Fraud Examiner

Health Care Suspicions? Better Call a Fraud Examiner

In an episode of the popular television crime drama “Better Call Saul,” a lawyer stumbles upon a case of health care fraud. In real life, fraud examiners are leading the fight against these types of widespread fraud schemes by gathering evidence, analyzing documents and separating fact from fiction.

Irene Landry hears a knock at the door. To her delight it's her charming lawyer, Jimmy McGill, paying a visit at her nursing home, Sandpiper Crossing. They spend the afternoon drafting her will while they snack on Hydrox cookies. A few signatures and they call it a day — a $140 day, that is. Irene counts the bills folded in her yellow purse and walks over to a tin can resting on the book shelf. She uncomfortably laughs. She only has $43 until her allowance next week. Jimmy laughs, too — also uncomfortably. He’s confused as to why she’s on an allowance because he’s well aware of her Social Security and pension benefits. She explains the checks go directly to Sandpiper, which then distributes the money to her in a monthly allowance of $500 after fees and expenses. She pulls out a statement and hands it to Jimmy. He’s troubled by what he sees and asks Irene for more statements. He can’t believe the prices are correct.

Lo and behold, Sandpiper was systematically overcharging its residents and depriving them of their well-earned and deserved retirement money. Fortunately, this drama wasn’t unfolding in a real nursing home. It was the storyline of an episode of “Better Call Saul,” a popular TV show. This doesn’t happen in real life — or does it?

Recent Health Care Fraud Developments

According to The Department of Justice Health Care Fraud and Abuse Control Program Annual Report for Fiscal Year 2017[1], the U.S. Department of Justice (DOJ) opened 967 new criminal health care fraud investigations, 948 new civil health care fraud investigations and had approximately 1,100 civil matters pending, as of September 30, 2017, the end of that fiscal year. (The 2017 report contains the latest DOJ health care fraud statistics.)

Likewise, the U. S. federal government won or negotiated more than $2.4 billion in health care fraud judgments and settlements during fiscal year 2017. These astonishing figures don’t reflect the efforts and success of other health care fraud-fighting institutions such as the Department of Health and Human Services (HHS), HHS Office of the Inspector General, the FBI and the Food and Drug Administration.

In June 2018, the DOJ announced a national health care fraud takedown of 601 individuals responsible for an estimated $2 billion in fraud losses. According to a June 28, 2018, DOJ press release, “National Health Care Fraud Takedown Results in Charges Against 601 Individuals Responsible for Over $2 Billion in Fraud Losses”[2], “the defendants allegedly participated in schemes to submit claims to Medicare, TRICARE, and private insurance companies for treatments that were medically unnecessary and often never provided.”

The vast majority of the alleged schemes involved recruiters, beneficiaries and other co-conspirators whom were paid cash kickbacks for their participation. The number of medical professionals charged is alarming because the schemes generally required corrupt medical professionals willing to submit false billing claims to Medicare or Medicaid.

Examining Various Schemes

Health care fraud occurs in many channels such as clinics, home health providers, nursing homes, ambulance and transportation services, diagnostic companies and dental care providers, among others. The schemes include, but aren’t limited to:

- Billing for services not rendered

- Billing non-covered services as covered services

- Misrepresenting dates and/or locations of service

- Upcoding and/or unbundling

- Corruption (kickbacks and/or bribery)

- False or unnecessary prescription of drugs

Knowledge of health care fraud schemes and where they might exist is an important piece in prevention and detection because it provides the “what” and the “where.” However, with our specialized skills and knowledge, fraud examiners play a major role by providing the “how.” We can assist both the prosecution and defense in criminal matters by leveraging knowledge of accounting, anti-fraud skills and data analytics. Two such examples require fraud examiners to utilize bank statements and claims information.

Analysis of Bank Account Information

We generally can obtain bank account information via subpoena. This includes statements, deposit slips, copies of canceled checks and other bank records for the defendant and other related parties and entities. Fraud examiners who have access to personal and/or corporate bank account information can provide critical evidence to help establish facts in cases of health care fraud allegations.

More specifically, fraud examiners should review and analyze bank account information to identify:

- Payment and expense trends

- Flow of funds between related accounts

- Indicia of money-laundering activities

- Additional bank accounts and involved players not previously known

- Significant cash inflows/outflows

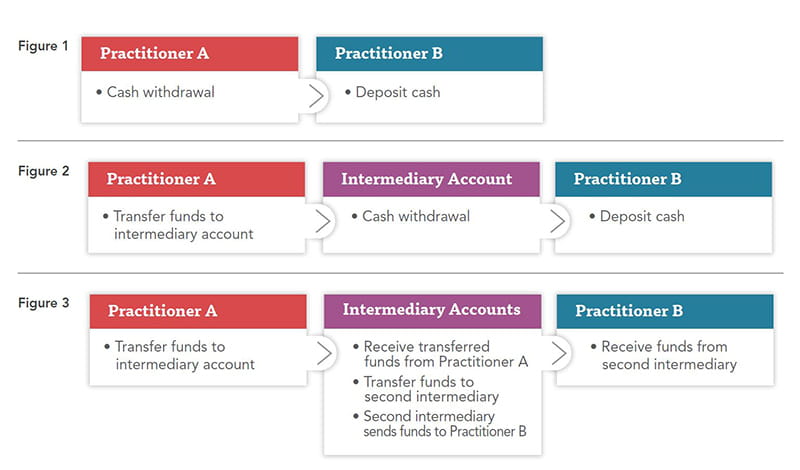

Typically, individuals committing health care fraud use multiple accounts to shift money around — attempting to hide the initial origin of the funds and avoid a clear transaction trail. Analyzing the flow of funds between related accounts can facilitate the identification of the origin of the funds, which enables a fraud examiner to trace those funds between related accounts — an indicia of money-laundering activities. For example, Practitioner B receives a kickback for referring patients to Practitioner A. There are several ways in which Practitioner A might pay Practitioner B, such as (but not limited to) the methods in Figures 1, 2 and 3.

Figure 1 presents the challenge of an obscure and limited transaction trail because the source of the deposited cash is unknown. Practitioner A might with-draw cash from their bank, use an ATM machine or get cash back on a purchase. However, a fraud examiner’s analysis of the bank records related to Practitioner A and Practitioner B could identify a cash withdrawal from Practitioner A’s account and a cash deposit to Practitioner B’s account in close date proximity.

Figures 2 and 3 provide more in-depth transaction trails. Often the recipient of the initial wire will be an account and/or individual other than Practitioner B. In these instances, it’s crucial to have all bank ac-count information to leverage data such as the transaction date, transaction amount, location of transaction and so forth.

Analysis of Claims Data

In addition to bank statements, fraud examiners can assist in conducting analyses of health care claims information. Claims data provides a profile of a patient’s history, which might be gathered from Medicare, Medicaid, private insurance companies and other sources. With this data, fraud examiners can assist in:

- Verifying or refuting the source of deposits to the bank accounts of individual defendants

- Analyzing Diagnostic Related Group code trends

- Identifying instances of potential upcoding

- Identifying instances of billing for unrendered services and/or products

Applying data mining to claims data makes it possible to identify patterns and anomalies. For example, Dentist A and Dentist B work at the same office, and the claims history for year one was produced in litigation alleging improper upcoding by Dentist A. In year one, Dentist A was associated with 1,000 claims that included DRG 157, “dental & oral disease with major complications or comorbidities,” and 500 claims that included DRG 159, “dental & oral diseases without major complications or comorbidities.”

In the same year, Dentist B was associated with 50 claims that included DRG 157 and 1,450 claims that included DRG 159. In this example, the contrast between the claims of the two dentists raises a red flag that should lead to additional investigation of the claims submitted by Dentist A.

If the prosecution alleges that the defendant improperly utilized the costlier DRGs, an analysis of the frequency of those DRGs as compared to the less expensive codes could be used to either support the prosecution or vindicate the defendant. As fraud examiners, we can’t provide opinions relating to the legitimacy of the claims. But we can inform the prosecution or defense of data trends, such as the vast differences between practitioners, which can lead to additional investigation and support for the legal argument.

Beneficial to Patients, Not the Bottom Line

Fraud examiners can play a major role in health care fraud cases by applying specialized skills and knowledge. While many physicians and health care practitioners conduct themselves profession-ally, honestly and fair, we live in an era in which health care fraud is rampant.

However, with the relentless pursuit by governing agencies, investigative bodies and fraud examiners, the prevention, detection, and prosecution of such fraud is becoming more prevalent every day. Thanks to our diligence and hard work, the Irene Landrys of the world might one day have confidence in knowing that the Sandpiper Crossings of the world are administering care that’s most beneficial to patients — not the company’s bottom line.

Co-authored by:

Rachel Brooks, CPA, CFE

Associate, Dispute Consulting

+1.312.752.3367

rbrooks@stout.com

Republished with permission from the May/June 2019 issue of Fraud Magazine, a publication of the Association of Certified Fraud Examiners, copyright 2019