Don't Overlook These Critical Impairment Testing Considerations

Don't Overlook These Critical Impairment Testing Considerations

As companies move into the fourth quarter, testing assets for impairment will be top of mind, especially given the current state of the economy. Two Stout professionals weighed in on the key aspects companies should consider when approaching impairment testing for their assets:

- Matthew Kantor, Director in the Accounting & Reporting Advisory practice of the Transaction Advisory group

- Jason Muraco, Managing Director in the Valuation Advisory group and the co-leader of Stout's Business Valuation practice

Does impairment testing need to be performed in a specific order?

Kantor: When I ask clients about their impairment testing process, the most common response is to jump directly to goodwill. Similar to how most of our parents and friends think CPAs only prepare tax returns, a complete and accurate impairment analysis can involve much more work.

Generally speaking, assets that require adjustments to their carrying values (e.g., inventory) are the first part of the process (even if not technically associated with impairment). These adjustments naturally occur first as part of a client’s recurring close processes, so we don’t see a lot of complexity in this area. However, significant adjustments uncovered during year-end audits can have a material impact on the carrying value of the asset groups and/or reporting units used for long-lived assets and goodwill testing.

Indefinite-lived intangible assets (e.g., trademarks) are next up, and testing is usually performed at the individually identified asset level. Since these assets and goodwill are usually tested together using similar fair value methodologies, it is easy to complete this testing in the incorrect sequence. However, similar to above, impairment charges for these assets could have a material impact on the carrying values used in long-lived asset and goodwill testing procedures.

Long-lived assets (e.g., property, plant, and equipment or amortizing intangible assets) are tested after indefinite-lived intangibles. A key difference with these assets is that testing is performed at the asset group level (i.e., the testing unit of account). Asset groups are identified based on independent cash inflows and outflows and can include more than just a single asset. The adoption of ASC 842 – Leases means the associated right-of-use assets are an additional class of assets that must be tested in this step. A new consideration this year is that complete and accurate impairment testing could be impacted if the adoption of the new leasing standard is not timely completed.

Finally, goodwill must be tested last at the reporting unit level. A reporting unit is more closely aligned with an asset group in that it is likely made up of a combination of assets (and liabilities). However, while an asset group is identified based on independent cash inflows and outflows, a reporting unit is identified based on how the business is managed, and it must contain financial operating results that are regularly reviewed by business leadership. Reporting units are typically larger than asset groups, but not always.

Goodwill must also be tested last because of the impact an impairment charge from testing the other units of account has on its reporting units. If goodwill is not tested last, the carrying value of a specific reporting unit could be overstated, resulting in an inaccurate analysis. Given that companies commonly perform goodwill testing prior to their balance sheet date (e.g., during Q4), it is even more crucial to properly complete all other impairment testing steps in a timely way. As mentioned above, remember to update your goodwill testing procedures for any significant carrying value adjustments identified during year-end audits.

What complexities surrounding triggering events and impairment indicators should companies consider (or not) heading into Q4?

Kantor: Indefinite-lived intangible assets and goodwill must be tested at least annually, or more frequently if a triggering event exists. Long-lived assets are tested only if a triggering event exists.

An entity has the freedom to choose an appropriate date to perform its annual impairment tests. However, for annual goodwill testing, companies are required to perform the test for each reporting unit at the same time every year unless significant events or circumstances warrant a change (which could require a “Preferability Letter” analysis). In practice, we typically see all impairment procedures done on the same testing date (e.g., near the beginning of fiscal Q4). Additionally, the more common events that lead to an interim test are related to business decisions (such as the decision to shut down certain operations or key assets) or major shifts in the asset group’s market.

For indefinite-lived intangible assets and goodwill, ASC 350-20 and 350-30 list examples related to the qualitative factors that should be considered in determining whether it is more likely than not that the related fair value is below its carrying amount. For long-lived assets, ASC 360-10 provides examples of such events or changes in circumstances that could indicate that its carrying value is not recoverable and thus an impairment may be present. The guidance specifically states that the examples are not all inclusive, and each entity must consider all relevant events and circumstances that could affect the significant inputs used to determine fair values.

The complexity from a technical accounting perspective is correctly identifying and attributing the appropriate triggers to the relevant assets and units of account. This adds complexity because the trigger-based testing thresholds differ. For example, long-lived assets are tested if an indicator is present where the carrying value “may not be recoverable.” Indefinite-lived intangible assets and goodwill are tested if an indicator is present where the carrying value “is more likely than not” impaired.

Adding more confusion is the fact that there are not bright-line rules for the number of impairment indicators required to trigger quantitative impairment testing. It is possible for a single indicator to result in additional testing, but equally possible that multiple indicators may not require additional testing.

Even if these triggers are properly identified and attributed to the relevant assets, the next step in the testing process differs depending on the nature of the asset. The next step for indefinite-lived intangible assets and goodwill is a quantitative fair value test. For long-lived assets, Step 1 is an undiscounted cash flow “recoverability” assessment based on factors specific to management’s own estimates. Should Step 1 fail, a quantitative fair value test is performed based on market participant factors.

What methodology is used for impairment valuation?

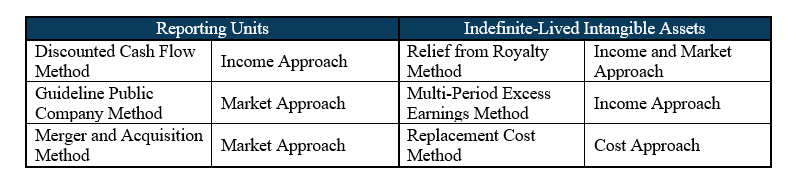

Muraco: As with any valuation, the traditional methods considered in determining the fair value of a subject asset(s) or reporting unit include the Income Approach, Market Approach, and Cost Approach. In practice, the most common methodologies for determining the fair value of a reporting unit or an indefinite-lived intangible asset are noted below, although the appropriate methodology for an indefinite-lived intangible asset can be very asset-specific.

The methodologies used for long-lived asset testing (ASC 360) reflect the same traditional methods noted above, but the initial step for long-lived asset testing is a recoverability test with unique considerations. Specifically, a recoverability test determines whether the recoverable value of an asset group is above its carrying value. If so, no second step is needed, as the asset group is not impaired. This recoverability analysis is often implemented by examining future cash flows (similar to a Discounted Cash Flow Method). Crucially, a recoverability test for ASC 360 is unique in that it considers only projected cash flows over a defined period (which aligns with the remaining useful life of the asset group’s primary asset). It's also typically done on a pre-tax undiscounted basis, unlike when an Income Approach is used to determine the fair value of the asset group.

Ultimately, if the asset group fails the recoverability analysis, then a quantitative fair value assessment is required of the asset group to identify the amount of any impairment, which may require an independent valuation of each asset within the asset group.

What pitfalls do companies commonly face in handling impairment valuation?

Muraco: The biggest cause of any issues that we see with impairment testing is a company’s overall timeline and the availability of key information within that timeline. For indefinite-lived intangible assets and goodwill, most companies select an annual testing date at the beginning of fiscal Q4, presumably to allow enough time to work through the impairment testing process before submitting year-end financial statements. However, it is very common for companies to still be finalizing annual budgets and long-term plans during the final quarter such that the key input for valuing subject reporting units and subject assets (i.e., projected cash flows) is not available as of the testing date. This can result in an insufficient amount of time to complete the impairment valuation or make it necessary for the company to alter the annual reporting calendar.

The timeline issue is further exacerbated when a company determines that goodwill is impaired and has not already performed a long-lived asset impairment test for the related asset group(s). This can happen due to the previously discussed threshold differences, but it often occurs because companies are more focused on goodwill impairment testing, as it is more straightforward; public companies are required to test it once a year, and they know their test date. Long-lived assets are tested only when triggering events occur, and triggering events can be qualitative.

Because a quantitative determination of goodwill impairment can suggest that a long-lived asset impairment triggering event may, in fact, exist, we often see situations in which the long-lived asset test is a last-minute exercise. This can lead to a sprint to value multiple assets (particularly if the asset group fails the recoverability test) in a very truncated time period. Companies should adjust their timelines, especially if there's a realistic risk of failing the recoverability test.

Companies can also go astray by missing some of the nuances of the recoverability test for long-lived assets, such as what should or should not be included in the cash flow projection as well as the appropriate time period over which to perform the recoverability test. Crucially, the ideal advisor can help to ensure the valuations are carried out in both a timely and a proper manner.