Valuation The Cornerstone of the Bankruptcy Process

Valuation The Cornerstone of the Bankruptcy Process

From the initial bankruptcy filing through the eventual emergence, valuation plays a critical role in multiple scenarios.

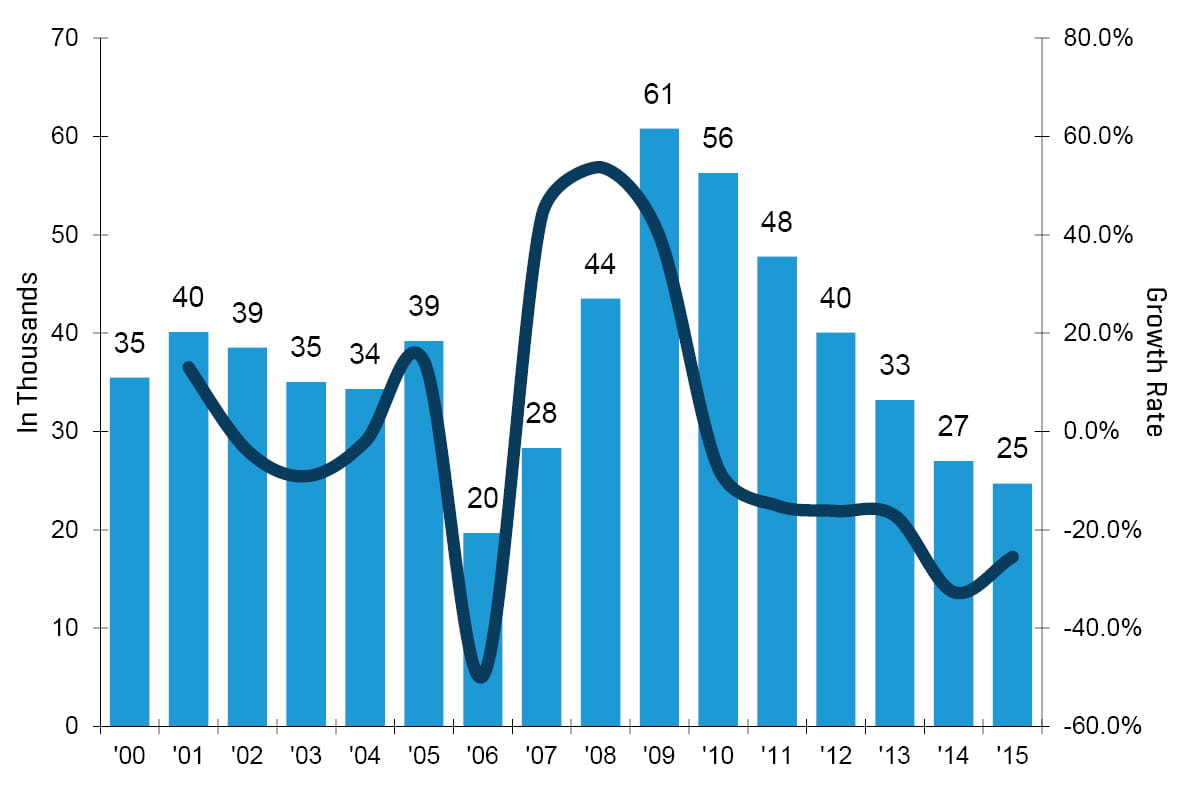

The number of business bankruptcies is highly cyclical, tied closely to the health of the overall economy. Over the past 15 years, business bankruptcy filings in the U.S. have seen some significant peaks and valleys (Figure 1). After bottoming out in 2006, business bankruptcies more than tripled by the peak in 2009 during the Great Recession. However, since 2009, bankruptcies have declined in every single year, as the economy has experienced a period of sustained growth in an extremely low interest rate environment.

Figure 1: Business Bankruptcy Filing Trends1

A bankruptcy case begins with the filing of a petition, which can be either voluntary or involuntary. Depending on the status of the filing company (i.e., the debtor), the petition is filed under either Chapter 7 or Chapter 11 of the Bankruptcy Code (the “Code”). A company typically elects to file for bankruptcy under Chapter 7 of the Code when continued business operations cannot be supported by the income the company is generating. If a company elects to file a Chapter 7 bankruptcy petition, a trustee is appointed, and the debtor then discontinues its operations and all assets are liquidated on an orderly basis. The proceeds from this liquidation are then distributed to the claimholders and creditors in order of priority. If a company chooses to file bankruptcy under Chapter 11 of the Code, then the debtor is allowed to attempt to reorganize the business and continue operations. The filing of a Chapter 11 bankruptcy creates an “estate,” and all of the debtor’s assets become the property of that estate. The filing company is permitted to retain and use the property of the estate as a “debtor in possession.”

Throughout the entire bankruptcy process, the practical and strategic implications of valuation play key roles. Every constituent to the bankruptcy will make decisions based on the value of the debtor and its assets. There are specific situations whereby valuation issues are of critical importance – from the filing of a petition under Chapter 11 through the subject debtor’s eventual emergence. Some of the most critical areas include: adequate protection; claims determination; plan confirmation; and recovery actions.

Adequate Protection

When a company files for bankruptcy, the bankruptcy petition automatically enjoins all creditor activity and operates as a stay. This automatic stay prevents creditors with liens from enforcing them. In order for a secured creditor to repossess its collateral, the creditor must bring forward a motion for relief from the stay. Under Section 362(d)(2) of the Code, the bankruptcy court will grant relief from the stay if: (i) the debtor does not have equity in the property; and (ii) the property is not necessary to an effective reorganization. In deciding whether to give the creditor relief from the automatic stay, the court must weigh the danger to interests of creditors against the necessity of the property to the debtor’s reorganization. While the second item is somewhat subjective and up to the decision of the judge (i.e., how necessary the property is), the determination of whether the debtor has equity in the property is clearly an area where a valuation expert can provide testimony as to the value of the asset relative to the associated lien.

If the previous argument fails, the creditor can still ask for relief by arguing that it is not adequately protected. Under Section 362(d)(1) of the Code, the lack of adequate protection for a creditor’s property interest is cause for granting relief from the automatic stay. In order to assess this, the current value of the collateral securing a creditor’s lien must be determined by a valuation expert. In addition to determining the current value of the collateral, it is important to determine the extent to which the collateral has recently declined in value or will likely decline in value in the future. In addressing the valuation issues in this regard, a going concern premise of value, as opposed to a liquidation premise of value, is typically assumed, unless the business is not expected to reorganize.2 Depending on the facts and circumstances of each situation, all traditional valuation methods (i.e., the income, market, and asset approaches) should be considered.

Once the applicable assets have been valued, the value of the collateral in excess of the creditor’s lien can be determined. This excess value is sometimes called an equity cushion. However, this term may be misleading, as the creditor’s position does not entitle it to any portion of value above and beyond the amount of the lien. In addition, it may not truly be an equity cushion, as there could still be junior creditors that have a further claim on the asset(s). Thus, it may be more appropriate to think of this excess value as a value cushion rather than an equity cushion. Although the determination as to whether a creditor is adequately protected is largely based on the facts and circumstances of each case, the following general guidelines are often cited in court decisions:3

- If the value cushion is greater than 20%, the creditor’s lien is adequately protected.

- If the value cushion is between 11% and 20%, the determination of adequate protection will be based on the specific facts and circumstances of the case (e.g., trends in value indications and projections regarding the subject market).

- If the value cushion is below 11%, the creditor’s lien is not adequately protected.

In a situation where the debtor’s collateral does not adequately protect the creditor’s lien, the debtor may provide adequate protection by other means. One option is for the debtor to make periodic payments to the creditor equal to the expected depreciation in value of the collateral securing the creditor’s position. Alternatively, the debtor may grant the creditor an additional lien on other unencumbered property.

The determination of the existence of adequate protection, as well as the remedy if adequate protection does not exist, is an area where a valuation expert is critical to the process for the various stakeholders in a bankruptcy.

Claims Determination

In the event a creditor’s secured claim is not adequately protected and lacks a value cushion (i.e., it is undersecured), Section 506(a) of the Code creates a process of bifurcating the total allowed claim into a secured portion and an unsecured portion. Specifically, when the value of the collateral is not sufficient to pay the entire secured claim, a creditor is seen as having two claims: (i) a secured claim to the extent of the collateral value; and (ii) an unsecured claim to the extent of the claim that exceeds the collateral value.

As an alternative to the bifurcation of claims, a creditor may choose to have its entire claim treated as a secured claim by making an election under Section 1111(b) of the Code. If a Section 1111(b) election is made, the creditor forgoes any recourse that it may have as an unsecured creditor for the value of its claim in excess of the value of the collateral, and the creditor is treated as holding a secured claim for the full allowed claim. In other words, under Section 1111(b), an undersecured creditor may elect to have its entire claim treated as a nonrecourse secured claim, thereby foregoing any unsecured deficiency claim. It should be noted that this election is not an option for a creditor with a lien that is determined to have “inconsequential value” in a hearing under Section 506(a) of the Code. In addition, this election is not available in a situation whereby a debtor sells its assets pursuant to a Section 363 sale.

Depending on the situation, it may be beneficial for either a debtor or a creditor to call a Section 506(a) hearing at some point during the bankruptcy process. The debtor may call for this hearing in order to present the court with evidence supporting the “inconsequential value” of a claim secured by collateral in order to make the Section 1111(b) election unavailable to a creditor. On the other hand, a creditor may call for this hearing to get more clarity with respect to the court’s view of the value of the collateral so as to make a more informed decision with regard to whether or not to make a Section 1111(b) election. In either case, a valuation expert’s opinion as to the value of the collateral at issue is a critical component of the hearing.

Section 1111(b) was originally enacted to protect the interests of secured creditors following the decision reached in In re Pine Gate Associates, Ltd., 2 B.C.D. 1478 (Bankr. N.D. Ga. 1976). Pine Gate Associates (PGA) used loans from two lenders to construct an apartment complex. Both loans were nonrecourse loans and were secured by first priority mortgages on portions of the complex. In 1975, PGA filed for bankruptcy and proposed a plan of reorganization whereby PGA would make a cash payment to the two lenders for the appraised value of their collateral (portions of the apartment buildings). As such, the lenders’ secured claims were limited to the appraised value of their collateral, which was found to be less than the outstanding indebtedness owed by PGA. Despite contention from the lenders, the court held that the proposed treatment of the secured claims was sufficient and approved the plan of reorganization.

In effect, the decision approved a plan of reorganization whereby “a debtor could file bankruptcy proceedings during a period when real property values were depressed, propose to repay secured indebtedness only to the extent of the value of the collateral at that time, and preserve all potential future appreciation of that property solely for the benefit of the debtor.”4 Under these terms, the secured creditor would bear all of the risk of undervaluation by the court. Section 1111(b) was, in essence, Congress’ attempt to address the inequitable result that arose under the Pine Gate decision.

The class of creditors making a Section 1111(b) election retains full security interest in the underlying asset and has the right to receive payment in full over time for the face amount of its claims. However, not all of the possible valuation disputes go away by making such an election. Under a Section 1111(b) election, the present value of the payments to be received in satisfaction of the claim is required only to equal the value of the creditor’s interest in the collateral as of the effective date of the plan of reorganization. The value of these deferred payments is largely dependent on an assessment of the appropriate market rate of return to use in the calculation of the present value equivalent of these cash flows, which often requires testimony from a valuation expert.

A creditor typically considers making a Section 1111(b) election only when it believes that the collateral is being undervalued by the debtor and the expectation is that there will be little to no value available for the unsecured creditors. During periods of depressed real estate values, secured creditors may be more inclined to make a Section 1111(b) election with the goal of maintaining a security interest in an asset that has the potential to appreciate in value, compared with bifurcating the claim and accepting an unsecured claim for that portion of the total claim in excess of the current value of the collateral. A solid understanding of the current state of the real estate market relative to its prospects and the likely ranges of impairment for the unsecured class are required in order to properly assess whether a secured creditor should make a Section 1111(b) election.

Valuation is a critical part of the claims determination process. The value of the collateral securing a claim must be determined in order for both the debtor and the creditor(s) to make the best strategic decisions with respect to the elections available during the bankruptcy process, and, ultimately, to present evidence during plan confirmation hearings.

When determining the value of specific collateral, there are sometimes two different premises of value put forth that can lead to very different conclusions. One value premise is to determine the value of the collateral by assessing the amount a creditor would receive by reselling the collateral, net of any resale costs. The alternative premise is to determine the value of the collateral by assessing the amount a debtor would have to pay to replace the collateral, in which case, the resale costs are irrelevant. Either valuation approach may be more appropriate depending on the facts and circumstances of each case. In the Associates Commercial Corp v. Rash decision, the Supreme Court supported the latter of the two methods. However, some ambiguities in this decision have left room for other interpretations.5

Plan Confirmation

In order for a company to emerge from Chapter 11 bankruptcy, a plan of reorganization must be submitted to the court and approved. Under Section 1121 of the Code, the debtor in possession initially has the exclusive right to file a proposed plan of reorganization, typically for a period of at least 120 days. A plan of reorganization places creditors and other interest holders into classes and states what each class will receive upon the company’s emergence from bankruptcy.

Valuation is an integral part of the plan confirmation process, from the original proposal, to negotiations, through plan confirmation. In order for a debtor (or any other constituent for that matter) to propose a plan, a reorganization value of the company must be determined. The reorganization value is the starting point to determine what each of the stakeholders will receive when the debtor emerges from bankruptcy (i.e., it represents the business enterprise “pie” that needs to be divided fairly into “slices” for the various stakeholders). Various classes of secured and unsecured creditors, as well as equity holders, must review the proposed plan and vote for or against it. In order to make an informed decision, the creditors must know both the value of their collateral as well as the reorganization value of the company.

In addition, it is also necessary to value any deferred payments or securities being offered to stakeholders in satisfaction of their claims. In many bankruptcy cases, valuation issues are a significant point of contention between the various stakeholders.

A closely related topic to the valuation issues that arise during plan confirmation is whether the plan is feasible. The court does not want to approve a plan only to have the debtor re-file for bankruptcy shortly after emergence. As such, in addition to valuation arguments, the various stakeholders will also present evidence – often by the same valuation expert – as to the feasibility of the proposed plan. Significant due diligence is completed with respect to a review of management’s forecasts inherent in the plan, market trends, and the debtor’s historical performance versus past projections. To the extent management’s projections are divergent from industry sources or consensus estimates, it is imperative for the valuation expert to be able to bridge the gap to prove that the projections, on which the plan of reorganization is based, are realistic. Further, if management has historically had a poor track record of hitting projections, increased scrutiny is likely warranted, especially in situations when the same management team performs the same budgeting/forecasting process each year and consistently misses the actual financial performance at the same rate.

Based on Section 1129 of the Code, if a dissenter votes against the plan, but the dissenter’s class accepts the plan, the plan may still be confirmed assuming the “best interests” test is met. The best interests test states that the value to be received by a dissenter within an impaired class under a plan of reorganization must be equal to or greater than what the dissenter would have received if the debtor were liquidated in a Chapter 7 bankruptcy. If that test is not met, then a plan of reorganization cannot be confirmed, even if only one dissenter exists.

Another portion of Section 1129 of the Code describes the process of confirming a plan if an entire impaired class does not accept the reorganization plan (oftentimes described as a “cramdown”). If an impaired class does not accept the plan, then not only must the “best interests” test be met, but the plan must also: (i) be “fair and equitable” with respect to the dissenting class; and (ii) not “unfairly discriminate” against the dissenting class in favor of other classes. This rule requires that no class of creditors or equity holders can receive value through the reorganization until all classes that are senior have received full compensation of their claims. This concept is often referred to as the “absolute priority rule.” Given the ambiguity of the relevant conditions described in this section, as well as the determination of the total value of the assets that are to be distributed, it is very important for all stakeholders to have a very good understanding of the value of the assets and the company in question in order to make informed decisions and present reasonable, well-substantiated positions at a plan confirmation hearing.

It is not unusual for proposed plans to satisfy the claims of certain classes of creditors based on deferred payments over time. In order to calculate the value of such deferred payments, it is necessary to estimate an interest rate (sometimes referred to as a “discount rate”) that properly reflects the economic characteristics (e.g., investment risk, duration, and time value of money) of the deferred cash payments during the expected timeline. In “cramdown” situations, this interest rate should be estimated using market evidence of relevant interest rates and investment rates of return on comparable assets or businesses. In order for a plan to be confirmable, when the cramdown rate has been properly estimated and applied, the value of the deferred cash payments will be equivalent to the value of the claim. The Code provides no specific guidance regarding how the cramdown rate should be determined. Over the years, bankruptcy courts have accepted a variety of methods for determining cramdown rates, and this disparate treatment has resulted in more than a fair amount of controversy and litigation.6

A court case in which the valuation of the debtor played an important role in the plan confirmation process is In re Bush Industries.7 In this case, the debtor’s plan proposed to cancel pre-petition equity holders, as the debtor concluded that the reorganization value of the company was below the equity hurdle. The equity committee asserted that the value of the debtor was greater than the amount of outstanding claims, thus the equity of the company had value. Both the debtor and the creditor hired valuation experts to testify on their behalf. After reviewing each of the experts’ testimony, the court ruled that the value of the company did not exceed the equity hurdle, and thus the pre-petition equity could have no value upon emergence.

In addition to the valuations performed by the experts in Bush, other market evidence involving arm’s length transactions was cited by the court in support of its opinion. For example, several creditors liquidated their pre-petition positions at a discount, which implied that they accepted less than face value while holding a claim that was senior to the old equity holders. In addition, one of the secured creditors negotiated a deal with the other secured creditors whereby it was able to opt out of the plan. This creditor negotiated a deal whereby it elected not to participate in the plan and receive new stock in the reorganized company, but rather, to accept a dollar amount that was less than the face amount of its claim. These two market transactions whereby parties, which were senior to the old equity holders, accepted less than the face amount of their claims, buttressed the debtor’s valuation conclusions presented at trial supporting a value below the equity hurdle.

Recovery Actions

In the ordinary course of business, solvent, well-capitalized companies can transfer property and incur obligations as they choose, assuming that they are not restricted by credit agreements. However, when a company becomes insolvent or inadequately capitalized, the creditors have a stake in the company that is recognized by the Code and state law with regard to transfers of property and incurring obligations.

A debtor is granted broad powers under Section 547(b) of the Code to recover certain transfers made prior to the filing of a bankruptcy petition. In general, transfers of property 90 days prior to a bankruptcy filing for purposes of satisfying a debt are voidable. From a creditor’s perspective, transfers may be voided when the debtor enters into a transaction with the intent to defraud a creditor. The solvency of the debtor is irrelevant under such circumstances.

Under Section 548 of the Code, if constructive fraud is found, a debtor is able to void any transfer of an interest in property, or any obligation incurred by the debtor, within two years of the date of the filing of a bankruptcy petition regardless of intent. Constructive fraud occurs when the debtor receives less than reasonably equivalent value in exchange for such transfer or obligation and is insolvent on the date of such transfer or becomes insolvent as a result of such transfer or obligation.

Insolvency in the context described above is shown when the debtor:

- Has debts that exceed the value of its liabilities (i.e., balance sheet test);

- Incurred debt that was beyond its ability to pay as the debt matured (i.e., cash flow test); or

- Was engaged in a business with unreasonably small capital (i.e., capital adequacy test).

The test for insolvency in a bankruptcy proceeding is virtually identical to the process undertaken for issuing a solvency opinion with respect to a contemporaneous transaction (i.e., it is effectively a retrospective solvency opinion). Under either scenario, if the company fails any of the three tests, it is determined to be insolvent.

Under the first test, if the market value of the company’s assets exceeds the value of the liabilities, the balance sheet test is passed. In other words, the total enterprise value of the company must be greater than the net debt of the business in order to be deemed solvent from a balance sheet test perspective.

The second test measures the ability of the company to generate cash flow sufficient to pay its debts as they mature and come due. Typically, the projections that are used to value the company under the balance sheet test are analyzed to ensure that the cash flows will be adequate to cover future principal and interest payments on the company’s post-emergence debt, after meeting all the standard cash flow items such as capital expenditures and increases in working capital.

Under the third test, unreasonably small capital refers to the inability of a company to generate profits to sustain operations. This test typically includes a stress test of the proposed plan, assessing how sensitive the feasibility of the plan is to small changes in the underlying assumptions. Essentially, the purpose of this test is to measure the “margin for error” in the underlying projections. This test and the cash flow test are premised on financial results that are reasonably foreseeable as of the date of the transaction being questioned, and they should include all sources of operating funds and consider the likelihood of obtaining additional financing.

Valuation and solvency analyses are important in recovery actions in order to evaluate the issue of reasonably equivalent value and solvency in a transaction that a trustee is attempting to void. This situation may arise when a buyer of a company files for bankruptcy shortly after the purchase and attempts to void the transaction under the guise that it paid more than a reasonably equivalent value. Alternatively, a company may file for bankruptcy shortly after selling a division and may attempt to void the transaction under the guise that it received less than a reasonably equivalent value.

One case in which the creditors challenged a transaction as constructively fraudulent was VFB LLC v. Campbell Soup Co.8 The transaction occurred when Campbell Soup sold its Vlasic and Swanson product lines to a new company, Vlasic Foods International, Inc. (VFI), the purchase of which was funded by a bank loan. Shares of VFI, the stock of which was publicly traded, were distributed to Campbell Soup shareholders as an in-kind dividend. Three years after the transaction, VFI filed a bankruptcy petition. In order to prove its case, the trustee of VFI hired valuation experts to testify that the transaction took place at more than reasonably equivalent value and that it resulted in an insolvent company. Part of VFI’s position relied on claims that the financial information of VFI was misstated, and, thus, the market stock price of VFI was not reliable. The court ultimately ruled in favor of Campbell Soup. In addition to the testimony of valuation experts supporting the position that the transaction did not take place at more than reasonably equivalent value, the court pointed to the financial market’s positive pricing of VFI’s stock subsequent to the transaction, even after the market had knowledge through public disclosures that VFI’s earnings were misstated prior to the spin-off.

Know the Valuation Issues

As summarized in this article, valuation issues permeate the entire bankruptcy process and impact each of the stakeholders along the way. The issues range from asset/collateral valuation matters, to disputes as to the value of the company as a whole, to fairness issues related to the valuation of securities and cash flow streams being proposed to settle the claims of various stakeholders.

An awareness of these issues early in the process, along with knowledge as to how valuation applies to each, will greatly assist each stakeholder throughout the bankruptcy process.

This is an updated version of an article published in the Fall 2009 issue of The Journal.

- American Bankruptcy Institute, Quarterly Business Bankruptcy Filings for 1994-2015. http://s3.amazonaws.com/abi-org/Newsroom/Bankruptcy_Statistics/QUARTERLY-BUSINESS-1980-PRESENT.pdf

- Newton, Grant W., Paul N. Shields, and James F. Hart, Business Valuation in Bankruptcy: A Nonauthoritative Guide, American Institute of Certified Public Accountants, 2002.

- In re McKilips, 81 B.R. 545 Bankr. N.D. Ill. (1987).

- The 1111(b)(2) Election: A Primer, BANKR. DEV. J. (Vol. 13, Winter 1996), Steven R. Haydon, Steven R. Owens, Thomas J. Salerno, and Craig D. Hansen.

- Associates Commercial Corp v. Rash, 117 S. Ct. 1897 (1997).

- Reference should be made to the decision in Till v. SCS Credit Corp., 541 US 465, (2004) for a suggested framework to apply in estimating an appropriate cramdown rate, often referred to as a “formula approach.” It is beyond the scope of this article to discuss the shortcomings of this approach.

- In re Bush Industries, 315 B.R. 292 43 Bankr.Ct. Dec. 188 (2004).

- VFB LLC v. Campbell Soup Co., 482 F.3d 624, 48 Bankr.Ct. Dec. 3 (2007).