-

Mergers & Acquisitions

-

Purchase Accounting and Goodwill Impairment Testing

-

Internal Tax Reorganizations and Restructurings

-

Privatizations

-

Joint Ventures

-

Transfer Pricing

International Cost of Equity: The Science Behind the Art

International Cost of Equity: The Science Behind the Art

The trend toward globalization has resulted in increased demand for valuations of companies located in all corners of the world, including both developed and emerging markets. It is important to recognize that the level of risk faced by buyers and sellers can be vastly different based upon the location of a company’s business operations. That is, investors require investment returns by considering the risk associated with the location of the business operations as opposed to the location of the capital sources. Country-specific risk factors include differences in inflation, macroeconomic volatility, capital controls, political stability, government regulations, contract and investor rights, and accounting controls.

Measuring and capturing these country specific risk factors continues to be a challenging undertaking as there is disparate consensus amongst industry practitioners and academics on how to appropriately capture the risk associated with emerging and undeveloped countries in a valuation context. Furthermore, many methodologies involve making subjective adjustments based on personal opinions and little empirical evidence. Based thereon, the uncertainty involved in calculating the risk appropriate for a specific entity (particularly those located in undeveloped or emerging markets) may result in a valuation that is “all art and no science,” unless quantitative measures such as those discussed herein are considered and applied appropriately.

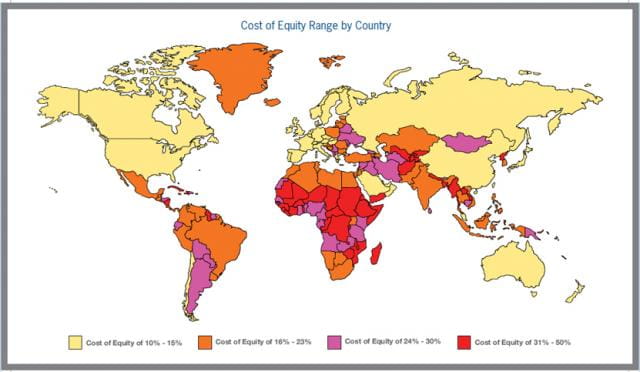

Various methodologies are used to estimate an appropriate cost of equity for foreign countries. Outlined in this article are some of the methods used by industry participants and the benefits and detriments of each. (Please see the following map which illustrates the cost of equity by country across the world. It should be noted that the cost of equity for each country presented in this article is based on the arithmetic average of the studies contained herein. Actual concluded results by country may differ given the issues addressed with respect to each approach and the applicability to each country.)

Purposes for Computing an International Cost of Equity Return

While it may be challenging to capture the risk associated with emerging markets, there are many purposes for this type of analysis. Multinational and U.S. based companies have increasingly shifted business operations to countries with low costs of labor and high rates of growth. As such, the frequency of international mergers and acquisitions and international joint ventures has increased dramatically in recent years. The task of estimating a cost of equity in an international setting is required in several common situations whereby a valuation is performed. The following list presents situations in which the computation of an international cost of equity may be required.

Current Methodologies

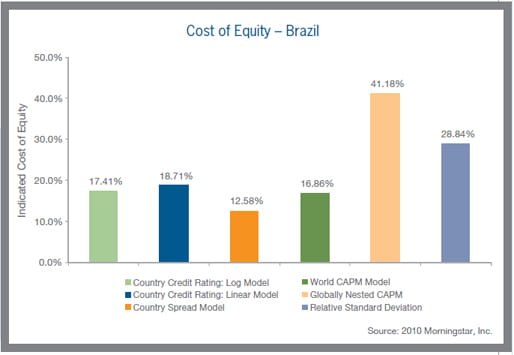

There are remarkably diverse methodologies that can be utilized to calculate the risk associated with the location of a company’s business operations. As an example, the graph below illustrates the computed cost of equity capital for a company with operations (and corresponding revenue generating activities) located in Brazil. A description of several of the more commonly used methods is presented herein.

World Capital Asset Pricing Model1

A traditional approach that is used to calculate the cost of equity is the Sharpe, Lintner, and Black Capital Asset Pricing Model (the “World CAPM”). Within this model, beta is the factor utilized to measure systematic risk. The premise of the World CAPM method is that the cost of equity capital is dependent on an investment’s impact on the volatility of a well-diversified portfolio. The formula for the World CAPM model is as follows:

Cost of Equity = Risk-Free Rate of Return + Beta * World Risk Premium

Through the above formula, the CAPM is converted to a country-specific international format so that beta is specific to the country being analyzed and the equity risk premium is calculated on a worldwide basis. Furthermore, beta is measured using the world equity market as the market benchmark.

Advantages to this Methodology:

-

The World CAPM is based on a fairly simple formula.

-

Studies have shown that the World CAPM has merit when applied to a company with operations located in a developed market.

Disadvantages to this Methodology:

-

This model makes the assumption that world financial markets are integrated. That is, foreign investors can freely invest in the domestic market, and domestic investors can freely invest in foreign markets.

-

Studies indicate that this approach does not have merit when applied to a company with operations located in an emerging market. Specifically, one study performed by Campbell R. Harvey, Ph.D. (1995) suggests that in the context of an emerging market and a world market portfolio, there is no relationship between expected returns and betas. As such, the use of the World CAPM may provide unreliable results in smaller, less liquid markets.

-

The beta and equity risk premium that are included in the World CAPM model are based on limited data.

Goldman Sachs – Integrated Model and Country-Spread Model 2,3,4,5

As discussed above, the World CAPM model often indicates expected returns that are insufficient in the context of a company operating in an emerging market. In an attempt to remedy this problem, the Goldman Sachs–Integrated Model was developed. In this model, a sovereign yield spread is added to the World CAPM model. The sovereign yield spread is computed as the yield on a U.S. denominated bond issued by the subject country less the yield on a U.S. treasury bond of the same maturity. This spread inherently captures “country risk.” The premise behind this methodology is that default risk premiums are correlated with equity risk premiums and are representative of the risk attributable to the subject country. That is, as changes occur in sovereign yield spreads, there will theoretically be corresponding changes in the country-specific equity risk. The formula for the Goldman Sachs–Integrated Model is illustrated below.

Cost of Equity = Sovereign Yield Spread + Risk-Free Rate of Return + (Beta * U.S. Equity Risk Premium)

Advantages to this Methodology:

-

The Goldman Sachs-Integrated Model is relatively simplistic and easy to apply.

-

This model was developed by a respected market maker.

Disadvantages to this Methodology:

-

This methodology can only be utilized if a sovereign yield spread is available.

-

There is a lack of international data pertaining to risk-free rates and U.S. denominated foreign government bonds. Furthermore, this methodology is only applicable to countries that have equity capital markets.

The Goldman Sachs-Integrated Model is a form of the Country-Spread Model. The application of the Country-Spread Model involves adding a country-specific spread to a cost of equity that is derived through traditional methods. In most forms of the Country-Spread Model, a cost of equity is computed based on U.S. data and then a spread is added to incorporate the risk specific to the subject country.

Damodaran Model 6,7

Aswath Damodaran, of the Stern School of Business at New York University, has developed a unique method to estimate the equity risk premium in emerging markets. The general theory behind the Damodaran model is to adjust the country risk rating to make it more like an equity premium rather than a bond premium. Based on the Damodaran model, the cost of equity for a firm operating in an emerging market can be estimated by using the following formula:

Cost of Equity = Risk-Free Rate of Return + (Beta * Mature Market Equity Risk Premium) + Country Equity Risk Premium

Furthermore, the Damodaran model computes the country equity risk premium through the following formula:

Country Equity Risk Premium = Country Default Spread * (Equity Standard Deviation / Country Bond Standard Deviation)

According to Damodaran, the U.S. market can be used to estimate the base premium for a mature equity market. Furthermore, as noted above, the country default spread is utilized to measure country risk. Although the country default spread measures default risk rather than equity risk, sovereign bonds are impacted by many of the same factors that drive equity risk. These factors include a country’s political and currency stability, as well as its budget and trade balances. However, the fact remains that sovereign bonds measure the premium for default risk rather than equity risk. Intuitively, one would likely expect that a country’s equity risk premium would be greater than its default risk spread. To address this issue, Damodaran suggests multiplying the country default spread by the ratio of the volatility of the subject country’s equity market to the volatility of its bond market.

Advantages to this Methodology:

-

The Damodaran model attempts to quantify equity

risk that may not be accurately captured in the public debt markets.

Disadvantages to this Methodology:

-

In order to apply this model, a country is required to

have both an equity market and a U.S. dollar sovereign bond market.

Country Risk Rating Model 8,9

The Country Risk Rating Model is based on the approach that inferences can be made about expected returns in emerging markets based on the country credit ratings and financial returns of developed markets. It is important to note that unlike most models used to compute cost of equity capital, this model does not require capital market data as it is based on country credit ratings.

Country credit ratings generally represent the probability that a country will default on its loans. Country credit ratings are available for many countries back to 1979 on a semiannual basis. The most frequently used source to determine country credit ratings is Institutional Investor’s semiannual survey of bankers. This survey represents the responses of between 75 and 100 bankers and provides a forward-looking measure of risk for an extensive sample of markets. Respondents to the survey rate each country on a scale of 0 to 100, with 100 representing the smallest risk of default. Further, Institutional Investor weights the responses based on each bank’s level of global prominence and credit analysis sophistication.

As discussed above, the Country Risk Rating Model is based on the risk ratings and financial returns of developed market economies. A regression analysis is performed using the return as the dependant variable and the country credit rating for the prior period as the independent variable.

It is important to note that there are two versions of the Country Risk Rating Model. One version is calculated on a linear scale and the other version is calculated on a non-linear scale. The linear model assumes that risk increases in a linear fashion with the risk rating. Alternatively, the logarithmic model assumes that risk increases in a non-linear fashion with the risk rating.

Advantages to this Methodology:

-

The Country Risk Rating Model can be used in countries without equity markets, including both developed and emerging markets.

-

In contrast to most traditional methodologies which rely on historical data, the Country Risk Rating Model is forward-looking in nature given that the country credit ratings are forward-looking measures of risk.

Disadvantages to this Methodology:

-

The Country Credit Risk Rating Model is based on country credit ratings which are subjective in nature.

Globally Nested CAPM10

Another common methodology is the Globally Nested CAPM. This method is based on the premise that it is appropriate to incorporate a regional risk factor when the subject market is not fully integrated into world markets. Specifically, the regional risk factor represents the residual regional risk that is not included in the world’s risk. As shown below, the associated formula measures a country’s sensitivity to both world and regional risk factors. It should be noted that Beta1 represents the subject country’s covariance with world market risk, while Beta2 represents the subject country’s covariance with regional risk.

Cost of Equity = Risk-Free Rate of Return + (Beta1 * World Risk Premium) + (Beta2 * Regional Risk Factor)

Advantages to this Methodology:

-

The Globally Nested CAPM incorporates additional risk factors to account for the fact that many local equity markets are not perfectly integrated into world equity markets.

Disadvantages to this Methodology:

-

The accuracy of this methodology is dependent on the quality of the regional benchmarks against which it is measured.

Relative Standard Deviation Model11

The Relative Standard Deviation Model is a basic method in which to compute an international cost of equity return. In this method, the standard deviation of the subject international market is compared to the standard deviation of the U.S. market to yield the relative standard deviation. Based on this analysis, a higher expected equity risk premium is applied to countries with a higher standard deviation than the U.S. The formula for the Relative Standard Deviation Model is illustrated below.

Cost of Equity = Risk-Free Rate of Return + (Relative Standard Deviation * U.S. Equity Risk Premium)

Advantages to this Methodology:

-

This model is relatively simplistic and easy to apply.

Disadvantages to this Methodology:

-

This model generates extremely high measures of the equity risk premium for many international markets. As a result, the computed cost of equity may be considerably higher when compared to other methods.

Emerging Issues and Other Methodologies

In certain instances, due to various limitations in the models discussed above, it may not be possible to compute the risk associated with investing in a specific country by directly calculating an international cost of equity. Two examples of alternative methods to incorporate country risk include:

Probability Weighted Scenarios12

As published in the “McKinsey Quarterly,” McKinsey & Company stated that its preferred practice when measuring the risk of business operations located in an emerging market is to model the risks within the discounted cash flows, rather than including an additional risk premium within the cost of equity. Specifically, in this method, discounted cash flows are utilized in conjunction with probability-weighted scenarios. As per the published article, the major macroeconomic variables that must be forecasted are inflation, growth in gross domestic product, foreign-exchange rates, and, often, interest rates. A global cost of equity which includes an inflation adjustment, but no country risk premium, is utilized to discount the cash flows under this methodology.

Developing scenarios involves constructing a comprehensive set of assumptions predicting how the future may evolve and the associated impact on an industry’s profitability and financial performance. Once all of the applicable scenarios are completed, each scenario receives a weighting that reflects the likelihood that it will actually occur.

The Downside Risk Approach13

As noted previously, studies suggest that there is no relationship between betas and stock returns of emerging markets. The Downside Risk Approach was developed to solve the problem of estimating a cost of equity capital in emerging markets. The premise of the Downside Risk Approach is that stock returns of emerging markets are correlated with the downside risk of the local market. Downside risk incorporates the downward swings in financial markets that investors attempt to avoid. The formula for this methodology is presented below:

Cost of Equity = Risk-Free Rate of Return + (Downside Risk * World Market Risk Premium)

Furthermore, the downside risk variable is calculated through the following formula:

Downside Risk = Semi Standard Deviation of Returns with Respect to the Mean in the Local Market /

Semi Standard Deviation of Returns with Respect to the Mean in the World Market

There are several advantages to this methodology compared with the traditional methods which incorporate beta as a measure of risk. First, since emerging markets are often volatile in nature, it captures the downside risk that investors attempt to avoid. Second, studies have shown that this method generates results that are generally between those of integrated markets and segmented markets. This is consistent with the idea that emerging markets are partially-integrated.

Limitations 14,15

The various models and methods presented herein represent a small sample of the options available to measure international costs of equity capital. It should be noted, however, that there are many limitations that may be encountered when attempting to apply these methods in practice. Following are a few examples of the limitations commonly encountered.

Lack of Data

Among others, one limiting factor with international data is the historical time period over which data is available. Equity risk premium factors should cover a long historical time period. However, data for many international markets is only available for short time periods. Using a limited data period can significantly understate or overstate the actual required equity risk premium.

Size of Market

Additionally, it is important to consider the size of the market being analyzed. In the U.S. market, it is possible to examine the returns on thousands of publicly traded entities diversified across multiple industries. In comparison, many international markets are much smaller and much less diversified.

Cost of Equity of the Buyer v. Cost of Equity of the Seller

In an international setting, it may not be readily apparent which country’s cost of equity to calculate for inclusion in a valuation, that of the most likely acquirer of the firm, that of the target firm, or, more broadly, that of the world. In general, the answer depends on whether or not one believes that world financial markets are integrated. If one believes that world financial markets are fully integrated, then a global cost of equity may be the best methodology. Conversely, if one believes that there is a certain degree of segmentation along national (or regional) borders, then it may be necessary to compute a cost of equity specific to the country in which the subject company’s operations are located. The definition of value applicable to the valuation is also relevant in this regard (i.e., Fair Market Value, Investment Value, etc.).

Conclusion

As companies continue to expand operations to locations throughout the world (including certain emerging markets), the measurement of country risk has become a key element of a valuation. However, the task of measuring country risk continues to challenge both industry practitioners and academics. Most importantly, one must avoid arbitrarily selecting a required rate of return based on personal opinion and limited evidence. As the specific facts and circumstances surrounding the subject company and country risk must be closely scrutinized.

The methodologies described in this article include only a sample of the more frequently used models and each has specific advantages and disadvantages. Therefore, when encountering international valuations, the valuation expert should carefully consider each available method and determine which method is most appropriate (based on the quality of economic and market data available) in the specific instance at hand.

Also contributing to this article:

Brian Hock

1 Harvey, Campbell R. Risk Analysis and Project Evaluation. Duke Center for International Development at the Sanford Institute. May 27-28, 2002.

2 Ibid, 1.

3 Morningstar, Inc. International Cost of Capital Report 2010.

4 Hargis, Kent and Jorge O. Mariscal. A Long-Term Perspective on Short-Term Risk. Goldman Sachs Investment Research. October 26, 1999.

5 It is important to note that Goldman Sachs has developed several cost of equity models, including the Goldman Sachs-Integrated Model discussed herein. Two additional models of note are the Goldman Sachs – Segmented Model and the Goldman Global Emerging Markets Model. The formula for the Goldman Sachs-Segmented Model is: [Cost of Equity = Sovereign Yield Spread + (Modified Beta * U.S. Equity Risk Premium)]. In this model, the modified beta represents the ratio of the volatility of the local equity capital market to the volatility of the U.S. equity capital market(s) and is calculated by dividing the standard deviation of the local market in U.S. dollars by the standard deviation of the U.S. market. Alternatively, the formula for the Goldman Global Emerging Markets Model is: [Cost of Equity = Sovereign Yield Spread + Risk-Free Rate of Return + (Modified Beta * U.S. Equity Risk Premium)*(Double Counting Adjustment)]. In this model, the double counting adjustment is calculated by subtracting the correlation of dollar returns between the equity capital markets and the sovereign bond.

6 Ibid, 5.

7 Damodaran, Aswath. Measuring Company Exposure to Country Risk: Theory and Practice. September 2003.

8 Ibid, 7.

9 Erb, Claude B., Campbell R. Harvey, and Tadas E. Viskanta. Expected Returns and Volatility in 135 Countries. Spring

10 Ibid, 7.

11 Ibid, 8.

12 James, Mimi and Timothy M. Koller. Valuation in Emerging Markets. The McKinsey Quarterly. 2000 Number 4: Asia Revalued.

13 Estrada, Javier. The Cost of Equity in Emerging Markets: A Downside Risk Approach. IESE. August 2000.

15 Ibid, 12.