The Right of Publicity: An Often Overlooked Asset in Estate Planning and Tax Compliance

The Right of Publicity: An Often Overlooked Asset in Estate Planning and Tax Compliance

In recent years, the right of publicity has come under a great deal of scrutiny related to its use and value. In perhaps the most high-profile dispute related to the value of the right of publicity, the United States (“U.S.”) Internal Revenue Service and the estate of famous pop singer Michael Jackson valued Jackson’s right of publicity at more than $400 million and as little as $2,105 respectively. The U.S. Tax Court ultimately concluded that Jackson’s right of publicity was worth approximately $4.2 million. Similarly, upon her death, the estate of pop star Whitney Houston valued the singer’s right of publicity at just under $200,000, while the IRS claimed it was worth more than $11.7 million. Finally, after his passing, the IRS valued the name, image, and likeness for the musician Prince at $6.2 million, nearly double the value that his estate claimed. The parties in the Whitney Houston and Prince disputes ultimately settled with the IRS prior to going to court.

Outside of estate tax controversies, the right of publicity has been subject to various other significant disputes. For example, a variety of celebrities, including Kim Kardashian, Sofia Vergara, and Katherine Heigl, have successfully pursued legal action against the unauthorized use of their right of publicity by companies engaging in social media marketing, which suggested false endorsements of the brands.

Further, in April 2020, after years of litigation and legislative hearings, the National Collegiate Athletic Association (“NCAA”) Board of Governors announced that beginning in 2021, student athletes will be able to earn money from the use of their right of publicity. Since these new rules have come into effect, hundreds, if not thousands, of student athletes have earned income from their name, image, and likeness.

As a result of the recent increase in disputes related to the use and value of the right of publicity, along with expanding opportunities to profit from this intangible asset, estate practitioners are increasingly considering the right of publicity for the purposes of planning and tax compliance.

What Is the Right of Publicity?

In general terms, the right of publicity is the right of an individual to control whether and how their identity is used for commercial purposes, e.g., in an advertisement or promotion of a product or service. The right of publicity is not explicitly protected by federal law – rather, it is a matter of state law. Currently, most states recognize the right of publicity either through statue or common law rights. Not surprisingly, as each state’s laws have developed independently from one another, there are often significant differences in the various states’ application of the right. However, every state that recognizes the right of publicity protects, at a minimum, an individual’s name and either his or her likeness or picture. New York and California, as home to more celebrities than any other state, receive the greatest amount of interest and attention. The New York statute protects an individual’s “name, portrait, picture, or voice,” while the California statute protects a person’s “name, voice, signature, photograph, or likeness.”

As an identifiable and legal form of property, the right of publicity is freely transferable or licensable under any conditions that two or more parties agree upon. The right is also divisible, such that specific components of the right can be assigned while others retained. For instance, someone could sell the right of publicity to his or her name to an individual (or entity) while maintaining the right to control his or her image and likeness. In addition, if an individual’s right of publicity is infringed upon, they may seek compensatory damages and punitive or exemplary damages in addition to injunctive relief. Stated simply, the right of publicity relates to the business value of the very identity or persona of an individual as a human being, and commercial damage may ensue if that identity is used in an unauthorized manner in ways that bring harm to the image and reputation of the individual.

Legally, the right of publicity applies to every individual, not just those who are famous (or infamous). However, as a practical matter, disputes over the right of publicity usually involve celebrities since it is their name, image, and likeness that is typically used in advertising and selling products or services. Since celebrities invest considerable time, energy, and money into developing their public image, the right of publicity recognizes that it would be unfair not to compensate a celebrity for the use of his or her image or likeness to increase the sales, profits, or profile of a product or service.

The right of publicity in the U.S. was first recognized as a separate and distinct right in the 1953 case Haelan Laboratories Inc. v. Topps Chewing Gum, in which Judge Jerome Frank coined the phrase “right of publicity” by distinguishing it from the “right of privacy.” The U.S. Supreme Court later acknowledged the right of publicity as a separate and distinct commercial tort in the 1977 case Zacchini v. Scripps Howard Broadcasting Co. Two of the more famous cases involving the right of publicity involved the actress Marilyn Monroe. Upon her death in 1962, Monroe left the majority of her estate to her acting coach, Lee Strasberg. When he died 20 years later, Strasberg left the bulk of his estate to his third wife, Anna. Ms. Strasberg subsequently asserted her exclusive right to control Monroe’s likeness and image in two separate cases brought in California and New York. In each case, Strasberg sued corporations established by the surviving family members of photographers who took photographs of Monroe during her life, including her famous Playboy spread and the publicity photograph for her film The Seven Year Itch, in which Monroe stands on a New York subway grate wearing a flowing white dress. Ultimately, the courts ruled against Ms. Strasberg in both cases. This outcome prompted California’s recognition of postmortem publicity rights.

Other famous individuals who have asserted their rights of publicity in various lawsuits include television personalities Johnny Carson and Vanna White, actors Dustin Hoffman and Woody Allen, singers Bob Marley and James Brown, and athletes Muhammad Ali and Michael Jordan.

Estate Planning Implications

Up until the landmark 1994 case Estate of Andrews v. United States, the common thinking in the estate planning community was that a decedent’s right of publicity was of no value for the purposes of calculating federal estate taxes due upon death, and therefore, did not need to be reported on the form 706 estate tax return. Andrews, however, changed this thinking considerably.

V. C. Andrews was an international bestselling author of paperback novels in the “children in jeopardy” genre. At the time of her death in 1986, there was a signed and executed contract for Andrews to produce two manuscripts that provided $3 million in advanced royalty payments. At first, Andrews’ descendants decided not to use a ghostwriter to fulfill the contract due to fears that an unsuccessful ghostwriting effort would adversely affect sales of her previously published books, thereby reducing the anticipated stream of royalty income. Later, the estate did choose to use a ghostwriter to publish a book under the name V.C. Andrews, which turned out to be an enormous commercial success. Several other ghostwritten books followed, all of which were commercial successes in their own right.

However, when Andrews died, her estate did not list her name as among its assets and, consequently, none of the estate taxes it paid were based on the value of her name. The IRS did not agree with this position. It determined that the name V.C. Andrews and her likeness had measurable value based on the prior earnings of the decedent and the contract signed shortly before her death. The Internal Revenue Code (“IRC”) defines the value of the gross estate as “the value at the time of… death of all property, real or personal, tangible or intangible, whatever situated.” Under the broad definition in the IRC, the right of publicity qualifies as an intangible property right.

In November 1990, the IRS issued a notice of deficiency, asserting that Andrews’ name was an asset of the estate with a value of $1,244,910.84 on the date of death, and thereupon assessed deficient taxes in the amount of $649,201.77. The IRS valuation in this case centered around the known (i.e., already contracted) and potential income from the novels that could be produced and written under Andrews’ name. The estate subsequently agreed that the right of publicity was a valid asset that should have been included in Andrews’ estate upon death, but they put forth a much lower valuation of the asset in response to the IRS’ notice of deficiency. Ultimately, the court adopted elements of both the IRS’ and the estate’s valuation in its findings and concluded upon a value for Andrews’ name at date of death of approximately $700,000.

The Andrews case demonstrated that a descendible right of publicity should be included in a decedent’s gross estate for federal estate tax purposes. Moreover, a celebrity’s estate needs to acknowledge the asset in the estate, or it may not be able to exercise it later. However, doing so can present complications when this right, which is a highly illiquid asset, is the estate’s primary asset and the value equals or exceeds the liquid assets available to pay the corresponding estate taxes. This could lead to the difficult circumstance in which the estate is either forced to use all of its liquid assets to pay the estate tax or – even worse for those estates that do not wish to exploit their postmortem rights of publicity – sell or license the right in order to generate funds to pay the tax. If a celebrity knows that her descendants may not wish to exploit the right of publicity, she may be able to transfer or sell those rights prior to death. Alternatively, the celebrity could make gifts to heirs early in his or her career when the value of the right is significantly lower. Any subsequent appreciation in the value of the right would thus escape the reach of a transfer tax.

The late actor Robin Williams implemented a unique and creative strategy related to the use of his right of publicity upon his death. Before his death, Mr. Williams put in place a restriction on his image, or any likeness of his image, for 25 years after his death. More specifically, Williams filed a deed which states that his image cannot be used in any film or publicity until 2039 and also passed on the rights to his name, signature, photograph, and likeness to the Windfall Foundation, set up in his name.

Valuation Issues Surrounding the Right of Publicity

Even if beneficiaries choose not to exploit a celebrity’s right of publicity, descendible property rights to postmortem publicity is an asset that still needs to be valued for federal estate tax purposes at its Fair Market Value at the time of death. The “highest and best use” standard measures the full market potential of an asset regardless of how the beneficiaries will actually use the publicity rights. In valuing such assets, the practitioner should consider the three main approaches to valuation: the Income Approach, the Market Approach, and the Cost Approach. In most cases, the Income Approach and the Market Approach will be the most appropriate methods to estimate the Fair Market Value of publicity rights. The Cost Approach, which relies on the underlying concept that an investor would pay no more for an asset than it would cost to recreate a similar asset from scratch or replace the asset with an acceptable, non-infringing alternative, is generally inappropriate because it would be nearly impossible to calculate the amount “invested” by an individual to establish and support his or her personal brand during his or her lifetime. Further, the notion that a right of publicity asset can be recreated or replaced with an acceptable, non-infringing alternative may not be realistic.

The most common method to value a celebrity’s persona involves a combination of the Income Approach and the Market Approach. Under this methodology, the value of a celebrity’s persona is based on the present value of the stream of income that could be realized from this right. This is determined by projecting the expected future benefits from the ability to continue to exploit the celebrity’s persona and discounting these benefits back to their present value using a rate of return that reflects the risk involved in realizing the benefits. These benefits may involve streams of income from both existing contracts, licensing, and sponsorship agreements, as well as anticipated agreements. The latter source of income is far more difficult to estimate as it is both potentially long lasting and subject to changing consumer preferences. Numerous assumptions will need to be made in attempting to project the future benefits, including the amount of income to be expected and the duration of the income. The amount of income will be influenced by the appropriate royalty rate, which will depend on both the celebrity’s popularity and the item involved (e.g., photographs, clothing, reproductions). In many cases, future royalty rates may be estimated based on rates achieved by the celebrity in past deals or similar agreements achieved by other celebrities. By considering actual royalty rates or comparable rates in the determination of future rates, the valuation also incorporates the application of the Market Approach.

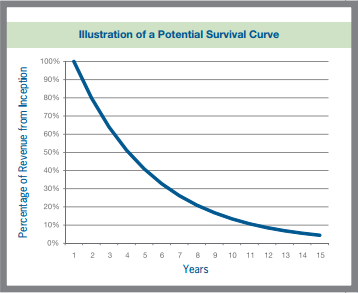

Of even greater difficulty may be estimating the post-mortem duration of income from the celebrity’s status. Although beyond the scope of this article, this may be accomplished through the use of a “lifing” or “survival” curve, which estimates the remaining useful economic life of an asset, or the amount of time the asset is expected to survive and continue producing income. To estimate remaining useful life, appraisers often study the lives of similar intangible assets by selecting a population of comparable assets and analyzing the turnover, or “decay,” of these assets over time. For instance, for licensing agreements involving a celebrity’s likeness, the appraiser may look at the pattern of royalty income over time. An illustration of this type of analysis is presented below..

In addition, as we have noted previously, the recognition, application, and protection of the right of publicity varies greatly from state to state. As such, the legal landscape must be considered in making assumptions and estimates for use in the valuation analysis. For instance, the appraiser must consider whether the rights in question are actually descendible in the individual’s state of residence and, if so, how long they last post-mortem. Not all states recognize a post-mortem right of publicity, and for those that do recognize it, the number of years that post-death rights are recognized varies significantly. Indiana and Oklahoma, for instance, provide recognition of the right of publicity for 100 years following the death of an individual, while Tennessee limits the right to just 10 years. Kentucky, Nevada, and Texas all recognize the right for 50 years post-death, and California for 70 years.

Finally, it may be necessary to consider that death may actually cause a surge in an entertainer’s popularity and the associated income from the licensing of their image or likeness. This phenomenon was most clearly illustrated with the estate of Michael Jackson, which received an intense amount of interest (and a large surge in income) following his death.

Summary

A celebrity’s name, image and likeness may produce considerable income for the individual both during life and after death. As such, the right to commercially exploit this persona can be an extremely valuable asset. In the relatively recent past, it was common practice to ignore this right in determining the value of a decedent’s estate for federal estate tax reporting purposes. However, since the Andrews decision, estate practitioners must consider the value of this asset and do what they can to protect the estate from the potentially unwelcome circumstance of needing to use liquid assets to pay taxes on the value of illiquid property or having to sell or license the property against their will in order to generate cash to satisfy the taxes. More recent estate tax disputes related to the value of Michael Jackson’s, Whitney Houston’s, and Prince’s right of publicity have brought the issue of right of publicity valuation into an even brighter spotlight. Whether it be through the gifting of the right of publicity to beneficiaries before death, or determination of the value of this asset upon death, estate practitioners should consider a well-documented and supportable valuation of this right to be a critical component of the pre-death estate planning strategy and the post-death federal estate tax reporting requirements of a celebrity client.

Christopher P. Casey, CPA, CFA, ASA