CLO Valuation A Primer on the Valuation of CLO Equity for Financial Reporting

CLO Valuation A Primer on the Valuation of CLO Equity for Financial Reporting

We outline the assumptions used to value a CLO’s equity tranche and provide a sample valuation analysis highlighting the sensitivity of these instruments’ value to changes in the underlying model inputs.

The collateralized loan obligation (CLO) market has flourished in the 10 years following the credit crisis. CLOs are fixed-income securities that provide investors with a diversified and structured exposure to the syndicated corporate loan market. CLO vehicles have generated favorable returns for debt and equity investors in a post-crisis environment characterized by benign corporate defaults coupled with stabilized or generally tightening credit spreads. CLOs are currently a significant source of financing for middle market corporations and act as the largest buyer of leveraged loans. CLO securities also represent an important asset class for alternative-asset managers, business development companies, financial institutions, and other fixed income investors.

Considering the popularity and market significance of CLOs, we provide a primer on the fair value measurement of the most illiquid class of CLO investments in the context of financial reporting. From a valuation perspective, the equity or residual tranche of a CLO provides the greatest challenge, as these financial instruments are the most sensitive to the performance of the underlying collateral. We provide an overview of the mechanics of CLO vehicles and summarize the methods and assumptions used by market practitioners and independent advisors to value the CLO equity tranche.

CLO Overview

CLOs are a class of structured credit products that repackage and transfer the risk of syndicated bank loans into the capital markets. CLOs are securitizations in which pools of loans are transferred into a special-purpose vehicle, which in turn issues debt and equity securities to investors.

CLOs have a number of defining structural features. To begin, the ultimate performance of CLOs is directly related to the characteristics of the collateral pool, consisting of broadly syndicated corporate bank loans. These leveraged loans represent the (heretofore LIBOR-based) floating-rate debt of corporate obligors with below-investment-grade or high-yield credit ratings. The loans typically represent first-lien instruments secured by the assets of the company. The loan maturities range from five to seven years; however, the principal may be called or prepaid by the borrowers at par, typically without a penalty.

CLOs are designed to meet the requirements of a variety of investors. CLO vehicles employ the mechanics of asset-backed securitization in order to convert the cash flows from a portfolio of collateral assets (leveraged loans) into classes of securities (CLO debt and equity tranches). CLOs use a senior/subordinate structure in which a so-called waterfall or priority of payments directs cash flows from the collateral assets to the various classes in the deal’s capital structure. Senior tranches benefit from preferred treatment of principal and interest payments in the cash flow waterfall as well as from structural credit enhancement and deal-performance triggers. Common triggers include asset-coverage tests and interest-coverage tests that, when breached, serve to divert cash flows to senior tranches in periods when there is sufficient deterioration in the collateral pool.

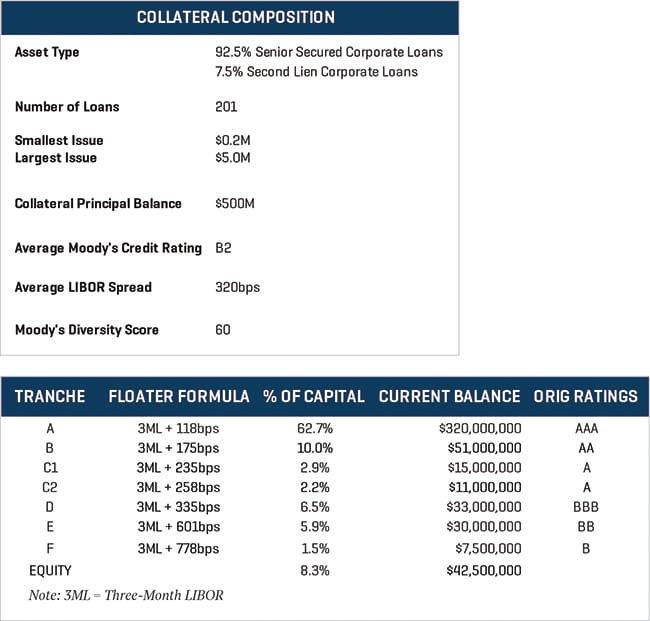

The credit enhancement and structural protection provided to the senior tranches means that these securities receive higher ratings (AAA/AA/A) than the average credit profile of the underlying collateral pool (BB/B). The trade-off for senior security investors is that senior CLO bonds receive lower coupons in the form of floating-rate interest payments. The debt tranches of CLOs are floating-rate securities indexed to LIBOR. Mezzanine tranches (rated BBB/BB/B) provide a credit profile that is similar to a theoretical investment in the collateral pool, with expected returns and coupons that tend to be relatively close to the weighted average credit spread of the collateral pool. Finally, the equity slice of the CLO capital structure represents the highest-risk profile and the potential to generate the highest nominal return to the investor. A representative CLO structure is shown in Figure 1. We will use this generic new-issue CLO transaction to demonstrate the tenets of valuation for the equity tranche of the securitization.

Figure 1. Sample Deal Summary

As noted in Figure 1, CLO vehicles are cash flow instruments from which the principal and interest payments from a pool of underlying loans are distributed to security holders. In contrast to many other structured credit products, CLOs are actively managed rather than static investment vehicles. The pool of collateral assets is managed by an asset management company (CLO manager). The CLO manager is responsible for sourcing the collateral assets during the asset-acquisition or ramp-up period, for reinvesting the proceeds of scheduled loan principal and interest payments, and for loan prepayment of the principal during the reinvestment period of the transaction. Because the manager is reinvesting collateral proceeds, the CLO debt instruments are expected to have a longer life than the underlying collateral pool at the origination date of the transaction. This structure also provides more certainty to investors regarding the duration of the CLO debt tranches. Furthermore, the CLO manager’s asset purchases and sales decisions over the life of the deal play an important role in the determination of the deal’s realized performance. In particular, the manager determines how collateral proceeds are reinvested into new loans during reinvestment and is responsible for risk mitigation for distressed and nonperforming loans.

The performance of the collateral pool and the composition of the deal’s capital structure are the primary factors that drive CLO equity tranche returns. The equity tranche represents the most leveraged credit exposure to the collateral pool. Typically, for new-issue transactions, the CLO debt tranches are collectively 10 times the size of the notional amount of the equity interest. The equity tranche represents a first loss exposure to credit losses in the collateral pool, and therefore its value is the most sensitive to the performance of the underlying corporate loans. An investor purchasing an (unhedged) residual interest is taking the most bullish position on the performance of the collateral pool. The post-crisis market, characterized by low nominal yields and a tightening credit spread, has generated interest in subordinate CLO debt instruments from new classes of investors. Today, CLO equity investors include traditional investors in alternative assets (such as hedge funds and business development companies), family offices, and investment funds targeting a mix of institutional investors and high net worth retail clients.

CLO Equity Valuation

We provide an illustrative example in order to highlight the inputs and assumptions used for the fair value measurement of CLO equity tranches. In addition, our example analysis highlights the so-called mark-to-market risks for CLO equity investors. The standard of value in the context of financial reporting is the generally accepted accounting principles (GAAP) definition set forth in ASC 820, “Fair Value Measurements.” For CLO securities, as for most structured credit products, the valuation approach is typically a form of the Income Approach, especially for residual interests. For the debt tranches of CLOs, the valuation process is similar to the approach used for corporate bonds, in which the contractual principal and interest payments are projected and then discounted to a present value using a market rate of return. The discount rate for senior and mezzanine CLO debt tranches can be determined by a matrix-pricing or benchmarking approach in which the observed prices for new-issuance or secondary-market bonds can be used to derive implied credit spreads. As is the case with corporate bonds, the following factors are often used to select comparable sales: the duration of the security, the nature of the collateral, the credit enhancement, and the credit rating. The valuation of a CLO equity tranche is more complex, as the security’s expected cash flows are much more sensitive to the underlying assumptions about the collateral performance.

The standard application of the Income Approach for structured products is to forecast the cash flows on the underlying collateral pool and then allocate those collateral cash flows to the respective CLO securities using the transaction waterfall provided in the transaction’s governing documents. In the case of a CLO transaction, key assumptions include the expected credit performance of the collateral pool, loan voluntary-prepayment rates, and expectations for the deal call option, as well as assumptions regarding the anticipated behavior of the collateral manager during the reinvestment period. A robust valuation often involves using multiple cash flow scenarios to assess the sensitivity of the subject bond’s cash flows to changes in the collateral-performance assumptions. Finally, the tranche cash flows are discounted to a present value using discount rates (spreads, discount margins, yields) that are observed from new-issuance pricing and secondary-market transactions. Below, we provide a summary of each of the significant assumptions for the CLO collateral portfolio.

Prepayment Assumptions

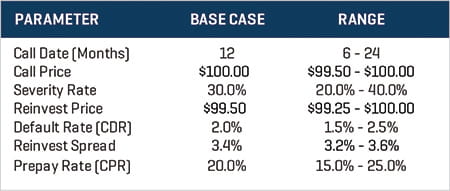

While the typical leveraged loan has a term of approximately five years, the expected average life of a loan is generally shorter due to prepayment. A constant prepayment rate (CPR) is a loan prepayment rate equivalent to the proportion of a loan’s principal that is assumed to be prepaid annually. As presented in Figure 2, we analyzed various scenarios with a base case of 20% CPR and a sensitivity analysis with a CPR range varying between 15% and 25%. This range of CPR is consistent with assumptions used to price seasoned CLO interests based on empirical analyses of loan repayment rates and commentary from market participants.

Default Assumptions

The CLO collateral portfolio in this example consists primarily of senior secured leveraged loans rated between B and BB (S&P scale). In developing assumptions with respect to expected default rates, practitioners may rely on data obtained from Moody’s and S&P that measure historical corporate loan defaults by rating category as well as assumptions typically employed by market participants to project future defaults when pricing CLO interests. The default modeling inputs are therefore a function of the composition of the collateral pool (rating/industry sector/market price) and the market expectations for corporate debt performance based on prevailing economic conditions. A constant default rate (CDR) is a loan default rate equivalent to the proportion of a loan’s principal that is assumed to be defaulted in each period. As shown in Figure 2, we analyzed various scenarios with a base case of 2% CDR and a sensitivity analysis with a CDR range varying between 1.5% and 2.5%.

Loss Given Default Assumptions

The loss given default is the amount of losses incurred by lenders conditioned upon the default of a loan as a percentage of principal payments due. This is also referred to as the severity rate, where (1 – severity rate) could equivalently be referred to as a recovery rate. In developing these assumptions, analysts consider data obtained from Moody’s and S&P that are related to historical corporate loan losses as well as forward-looking estimates of loss. In our sample analysis, we run various scenarios with a base case severity rate of 30% and a sensitivity analysis with a severity range varying between 20% and 40%.

Recovery Lag Assumptions

Next, the recovery lag assumption is used to model the expected time from the date of an assumed default until the receipt of the assumed recovery amount on defaulted assets. For the purpose of this analysis, we used a 12-month recovery lag in all scenarios. In practice, the recovery lag assumption is determined based on a review of historical performance and expectations for leveraged loans in the current environment.

Reinvestment Assumptions

The reinvestment spread and reinvestment price are used to represent the prices at which the CLO manager will be able to reinvest loan proceeds into new loans in the future. These assumptions are meant to capture the behavior of CLO managers as they replace loans that have paid off during the reinvestment period. We show diverse scenarios with a base case reinvestment spread of 3.4% and a sensitivity analysis with a reinvestment spread varying between 3.2% and 3.6%. In all cases, we assume a reinvestment loan price of 99.5% of par. These assumptions are based on analysis of the historical time series of B rated corporate credit spreads and are generally consistent with assumptions used to price seasoned CLO interests based on commentary from market participants.

CLO Call Date Assumptions

CLOs generally have an optional redemption feature whereby a majority of the equity holders can call or redeem the deal after the expiry of the reinvestment period. For the purpose of this analysis, we used a call date base case assumption of one year after the end of the reinvestment period.

CLO Call Price

The CLO call price represents the expected weighted average asset price at the time when the transaction is called. For the purpose of this analysis, we used an assumed collateral call price of $100. We note, however, that the market price of the loan collateral is an important factor that drives the decision of the CLO equity holders as to whether to call the transaction, as the investor will compare the value of the expected liquidation proceeds with the value of the expected cash flows from continuing the life of the transaction and receiving the residual payments.

CLO Equity Valuation Example: Price Sensitivities

We use a stylized example based on a recently issued CLO to demonstrate the equity tranche valuation process. We use a set of assumptions that reflect current market trends as well as individual deal characteristics in order to determine the fair value of the subject interests.

In Figure 2, we provide the base case for each significant input as well as a sensitivity range for each model assumption.

Figure 2. Input Assumptions

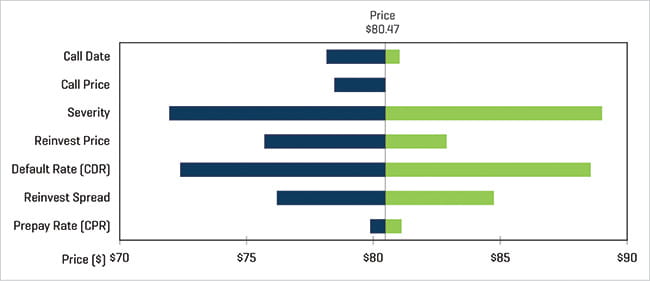

In Figure 3, we show the sensitivity to the range of the model assumptions based on unilateral changes to each of the inputs from the low end to the high end of the range for each variable. In each case, we calculate the fair value of the equity tranche cash flows using a midpoint discount rate of 10%. The price graph expresses the range of market values for the tranche using the price of the base case variable settings, which is 80.47% of face value, or $80.47. Not surprisingly, changes to the credit-performance variables (such as default rate and severity) and collateral-reinvestment variables (such as reinvest price and reinvest spread) exhibit the largest swing in market values.

Figure 3. Sensitivity Analysis

The equity tranche’s cash flow and fair value are disproportionality affected by defaults in the collateral pool due to its first-loss position in the capital structure. The equity tranche also represents a leveraged exposure to the spread margin or express spread in the deal. All else being equal, equity tranche cash flows benefit from a widening of collateral-asset and CLO debt liability spreads that occurs when the CLO manager can acquire relatively cheaper collateral loans with wider par credit spreads. Conversely, the equity cash flows will suffer in an environment where reinvestment asset spreads tighten while the CLO debt spreads remain constant. One important caveat is that, in this example, we are assuming that the price/spread of the collateral is unrelated to assumptions regarding the ultimate credit performance of the collateral. In this hypothetical case, the equity investor benefits from deal-spread margin increases without any degradation to the credit quality of the portfolio.

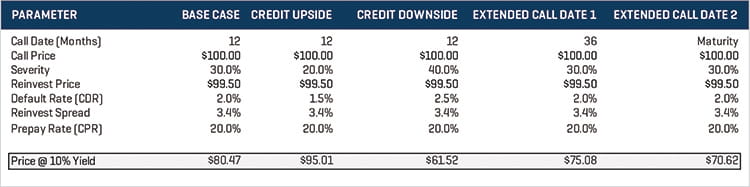

In Figure 4, we show the sensitivity to the range of scenario assumptions that are intended to capture a distribution of performance expectations for the collateral pool. In these scenarios, we model a full set of assumptions to represent a bullish and a bearish view of the portfolio performance versus the base case set of model inputs. For each scenario, we provide the resulting model price that is determined using a 10% assumed discount rate. The results highlight the sensitivity of the residual interest to changes in credit-performance inputs. The equity tranche value is calculated to be $95.01 of par in a reasonable credit upside scenario modeled with a 1.5% annual default rate and a 20% loss severity (80% recovery rate). This compares with a calculated value of $61.52 for a credit downside scenario with defaults modeled at 2.5% CDR and a 40% severity or loss given default. The large variance in the values indicated for these scenarios demonstrates the potential mark-to-market volatility caused by changing expectations regarding corporate debt performance.

Figure 4. Scenario Inputs

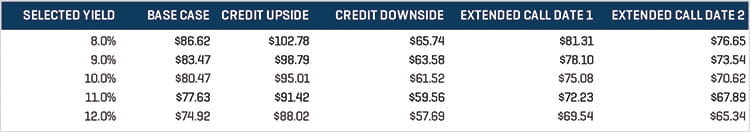

Last, in Figure 5, we extend the scenario analysis results to show a range of fair values for each case, allowing for changes to the assumed discount rate. In practice, the market discount rate for CLO equity tranches and other residual-interest structured products is not directly observable. For the purposes of asset valuation, the discount rate input is often supported by reference to observed tranches in the capital structure (building up from coupons/yields on the lowest-rated debt tranches) or by citing market surveys or dealer research reports. As a best practice, we recommend using a form of calibration to estimate the discount rate.

Market discount rates may be inferred from observed prices on primary and secondary market transactions for comparable CLO equity tranches. The market implied discount rate is the rate of interest that results in a net present value equal to the observed price of the bond using a specific set of parameter inputs. Borrowing from our sample results shown in Figure 3, if we were to observe a bone fide trade for this bond at $80.47, the 10% rate would represent the market implied discount rate under the base case set of scenario assumptions. By obtaining multiple observed transactions for comparable bonds around the time of the valuation measurement date and calibrating to a range of reasonable model scenarios, the analyst can develop a supportable estimate for the discount rate that can be documented with contemporaneous market data.

Figure 5. Scenario Range of Values

Guidance for Investment Managers

In this primer, we covered the structure of CLOs and outlined the methods and assumptions used to value the equity tranche, which represents the most credit-sensitive and illiquid instrument in a CLO issuance. We provided a stylized example of a valuation exercise to highlight the salient features of CLO equity as an investment and the sensitivity of CLO equity tranche fair values to model assumptions. CLO equity securities are a class of financial instrument that can offer attractive potential returns to investors. In our sample valuation analysis, we demonstrated that CLO equity instruments are highly sensitive to the model inputs used in a discounted cash flow approach. Investment managers seeking to benefit from the yield enhancement offered by these assets should be prepared to perform a comprehensive credit analysis on the collateral pool, conduct a detailed review of the collateral manager, and complete a thorough analysis of the CLO documents that govern the priority of payments, reinvestment terms, cash flow triggers, and call provisions among structural provisions. Similarly, holders should be cognizant of the mark-to-market volatility inherent in these financial instruments.