Differences in PPA Procedures Financial Reporting vs Tax Reporting

Differences in PPA Procedures Financial Reporting vs Tax Reporting

Purchase price allocation methodologies may have a common approach, but financial and tax reporting regulations vary and can dramatically impact conclusions.

Mergers and acquisitions trigger many financial and tax reporting requirements. One common requirement for both purposes is acquisition accounting, that is, a purchase price allocation (PPA). A PPA is an allocation of the purchase price paid to the assets and liabilities included in a transaction. Although a PPA performed for financial versus tax purposes may be very similar, there are several key differences to understand and consider in a valuation analysis.

Financial Reporting Versus Tax Reporting

In the United States, guidance pertaining to completing a PPA is contained in Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 805, Business Combinations (FASB ASC 805) and Topic 350, Intangibles – Goodwill and Other (FASB ASC 350). In 2014, FASB ASC 805 and FASB ASC 350 were amended in order to provide privately held companies with accounting alternatives aimed at simplifying the accounting and reporting process for PPAs. Under Accounting Standards Update (ASU) 2014-18 and ASU 2014-02, privately held companies have the option to elect certain accounting alternatives related to the recognition and measurement of certain intangible assets (the Intangibles Accounting Alternative) and the amortization and impairment testing of goodwill (the Goodwill Accounting Alternative). This recent guidance for private companies is a result of efforts of the Private Company Council (PCC) and resulting FASB endorsements.

Subsequent to all transactions that involve a change in control, companies are required to complete a PPA (regardless of whether the transaction is structured as an asset deal or a stock deal) for financial reporting purposes. Sections 1060 and 338 of the Internal Revenue Code (IRC) detail procedures for completing PPAs for U.S. tax reporting purposes. Section 754 of the IRC provides similar guidance for organizations structured as limited liability companies or partnerships.

In contrast to financial reporting guidelines, U.S. tax regulations include PPA requirements only for transactions that are structured as an asset deal (or as a deemed asset sale in the instance in which a transaction is structured as a stock deal, but an election is taken under Section 338(h)(10) or Section 754 of the IRC).

However, it is important to note that even in the case of a pure stock deal, a separate PPA for tax reporting purposes may be required for transactions involving overseas operations/foreign legal entities given the tax reporting requirements of other countries.

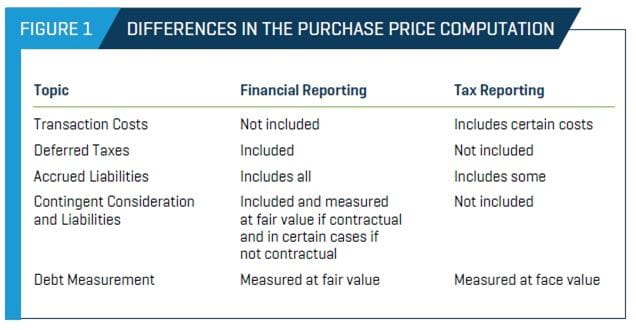

Key differences that may exist between financial reporting and tax reporting PPA valuations are differences in the computed purchase price, standard of value, and valuation methodology/analysis procedures. First, significant differences may arise in the computed purchase price paid in a transaction as a result of the inclusion or exclusion of certain transaction costs, deferred taxes, and accrued liabilities; the inclusion and measurement of contingent consideration and liabilities; and the measurement of assumed debt. These differences are summarized in Figure 1.

Second, the appropriate standard of value is different for PPA valuations performed for financial versus tax reporting purposes. For financial reporting purposes, the standard of value is “fair value,” which is defined as the price that would be received to sell an asset or be paid to transfer a liability in an orderly transaction between market participants at the measurement date (FASB ASC 820-10-20). However, the appropriate standard of value from a U.S. tax law perspective is “fair market value,” which is defined as the price at which property would exchange between a willing buyer and a willing seller, when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both having reasonable knowledge of the relevant facts (Treas. Regs. §20.2031-1(b) and §25.2512-1; Rev. Rul. 59-60, 1959-1 C.B. 237). Although there are specific (and often subtle) differences between the fair value and fair market value standards, often the value of an asset valued under these premises is very similar (but in certain cases may differ materially).

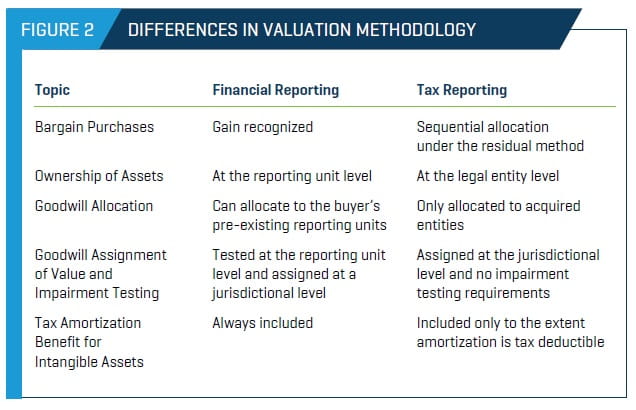

Finally, differences in the valuation methodology and procedures employed in a PPA may arise in valuation analyses performed for financial versus tax reporting purposes. Key differences include the treatment of bargain purchase transactions, the assignment of goodwill and other asset values (and subsequent impairment testing), and the consideration of the tax benefit of intangible asset amortization. These differences are summarized in Figure 2 and detailed in the following paragraphs.

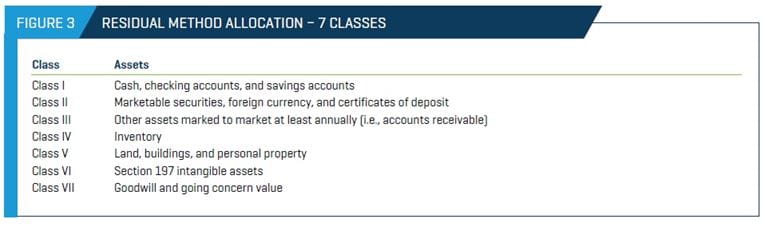

First, in a valuation analysis completed for financial reporting purposes, a gain on a bargain purchase is recorded in instances in which the fair value of the net assets acquired exceeds the consideration paid. (The gain is calculated by subtracting the consideration paid from the concluded fair value of the assets acquired.) In contrast, in a valuation analysis completed for tax reporting purposes, there are no bargain purchase procedures. Rather, the consideration paid is allocated among the net assets acquired based on a class system of asset categories in a process known as the residual method. If the aggregate purchase price allocable to a particular class of assets is less than the aggregate fair market value of the assets within the class (which would occur in the case of a bargain purchase), each asset in such class is allocated an amount in proportion to its fair market value, with nothing allocated to any junior class. See Figure 3 for further detail as it relates to the different classes involved in the allocation of assets under the residual method for tax reporting purposes.

With respect to the assignment of goodwill and other asset values, valuations for financial reporting purposes involve the allocation of asset values at the reporting unit level, and the acquired assets can be added to an acquirer’s existing reporting units (as opposed to the creation of a new reporting unit(s)). In contrast, tax reporting requirements limit the allocation of asset values to the legal entities acquired in a transaction. Furthermore, asset impairment tests are performed at the reporting unit level for financial reporting purposes, while there are no impairment testing requirements for U.S. tax purposes. Finally, the tax benefit of amortization is always included in the concluded fair value of an intangible asset for financial reporting purposes (regardless of the transaction structure). For tax reporting purposes, the tax benefit of amortization is included in the fair market value of an intangible asset only to the extent that the amortization of the asset is in fact tax deductible for the acquirer.

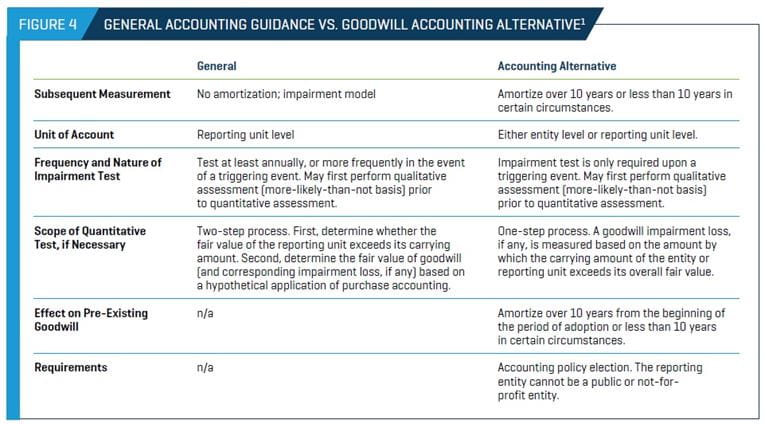

It is important to note that key differences also exist for companies that adopt the private company accounting alternatives and those that do not. For companies that elect the Goodwill Accounting Alternative, for example, goodwill is subject to impairment testing only upon the occurrence of a triggering event, compared with the general accounting treatment which requires impairment testing to occur at least on an annual basis. The main provisions of the Goodwill Accounting Alternative are outlined and contrasted against the general accounting guidance in Figure 4.

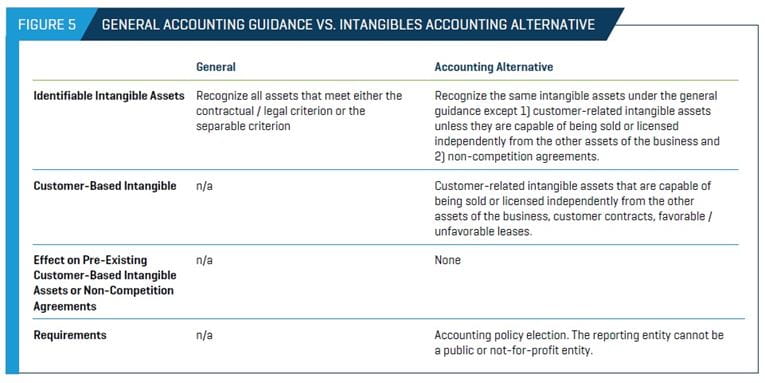

There are also differences related to the recognition of certain identifiable intangible assets in a PPA between entities that elect the Intangibles Accounting Alternative and those that do not or are not eligible to do so. In general, companies that adopt the Intangibles Accounting Alternative will recognize fewer intangible assets in a business combination compared with entities following the general accounting guidance. The main provisions of the Intangibles Accounting Alternative are outlined in Figure 5.

Illustrative Example of a PPA for Financial Reporting and Tax Purposes

In the following example, assume that an acquirer (the “Acquirer”) consummated a business combination (the “Transaction”) under a Share Purchase Agreement (the “Agreement”) on December 31, 2016, acquiring the business and substantially all the assets of ABC Company (“ABC”, or the “Company”). The Transaction was structured as an asset purchase for tax purposes through a Section 338(h)(10) election and involved $300 million in initial purchase consideration, plus the fair value of contingent consideration (structured as an earnout for purposes of this example). Stout has been engaged to estimate the fair value of the earnout as well as certain tangible and intangible assets acquired and liabilities assumed in the Transaction for financial reporting purposes under the general guidelines (i.e., not under private company GAAP).

In addition, ABC’s tax department intends to utilize the results of the valuation analysis to satisfy tax reporting requirements. For this hypothetical example, with the exception of the contingent consideration, we assume that the purchase price is the same under each purpose (in reality, this is unlikely to be true given the differences in the purchase price computation noted previously). As noted previously, under financial reporting guidelines, contingent consideration is measured at fair value and recognized at the acquisition date as part of the purchase consideration, whereas contingent consideration is not recognized for tax reporting.

Valuation of ABC for Financial Reporting Purposes

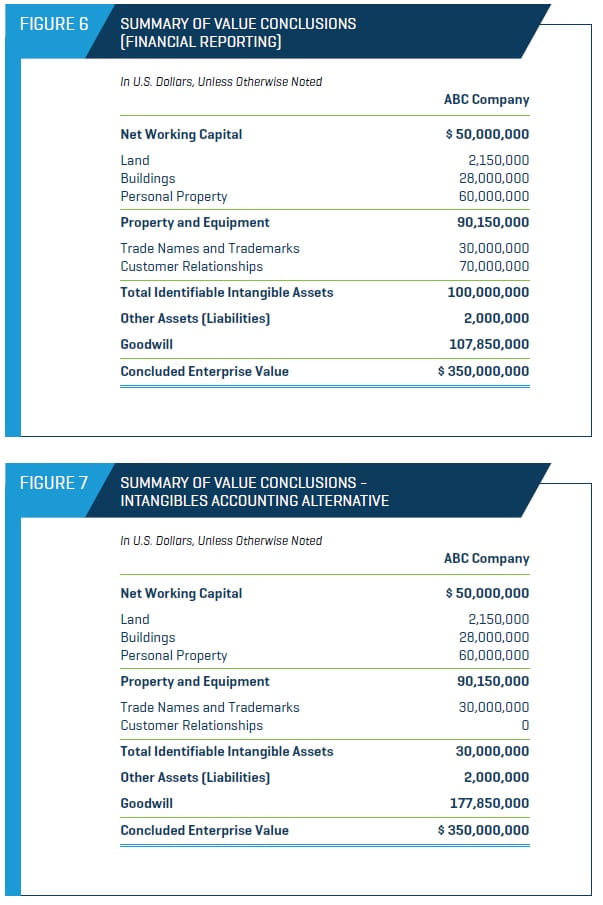

In regard to the financial reporting requirements, it is determined that ABC is to be accounted for by the Acquirer as a single reporting unit. The Company’s intangible assets include trade names and trademarks as well as customer relationships. Figures 6 and 7 present the estimation of the fair values of the tangible and intangible assets acquired, as of December 31, 2016, pursuant to the guidelines set forth in FASB ASC 805. For purposes of this example, the fair value of the contingent consideration liability was determined to be $50.0 million.2

Valuation of ABC for Tax Reporting Purposes

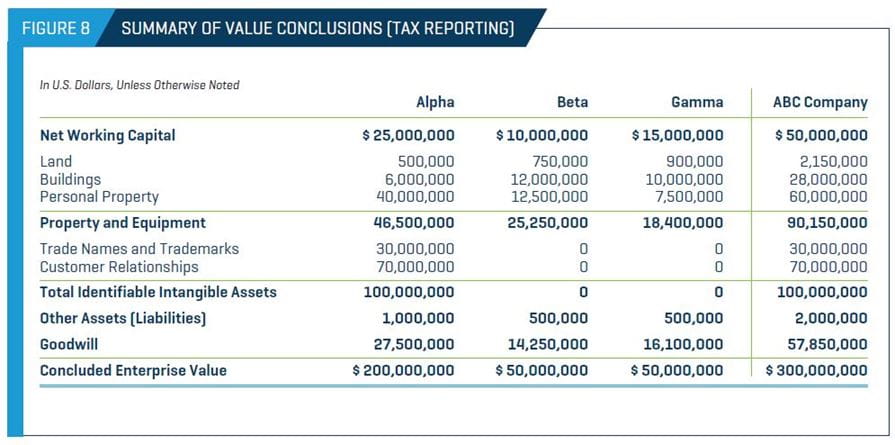

In regard to the tax reporting requirements, it is understood by Stout that ABC is composed of three legal entities (Alpha, Beta, and Gamma). As a first step, the overall consideration paid in the Transaction is allocated to each legal entity based on Stout’s independent analysis of the enterprise value of each business. It should be noted that the sum of the enterprise values allocated to each legal entity must reconcile to the total consideration paid in every transaction (excluding contingent consideration). Next, net working capital and other assets (liabilities) are allocated to each legal entity based on the respective balance sheets of the legal entities, and property and equipment values are allocated to the legal entity that owns these assets.

Next, with respect to intangible assets, Company management represents to Stout that the trade names and trademarks and customer relationships of ABC are legally owned by the Alpha legal entity. The Beta and Gamma legal entities compensate the Alpha legal entity for their use of these intangible assets through the payment of intercompany royalties (which are determined to represent arm’s-length transfer pricing arrangements). As a result, the overall values of these intangible assets reside with the Alpha legal entity.

Finally, goodwill is allocated to each legal entity based on the residual value remaining after deducting the values of the net working capital, property and equipment, identified intangible assets, and other assets (liabilities) from each legal entity’s enterprise value. Given the existence of the contingent consideration for financial reporting purposes, the goodwill of the consolidated company is different for financial reporting versus tax reporting purposes (as the goodwill allocated for tax reporting purposes is limited by the initial consideration paid for the Company). Figure 8 presents the estimation of the fair market values of the tangible and intangible assets acquired by a legal entity, as of December 31, 2016, pursuant to the guidelines set forth in IRC Sections 1060 and 338.

Cost Savings Through Coordination

Despite numerous similarities, several key differences exist in valuation requirements for PPAs completed for financial versus tax reporting purposes, and between entities that adopt the private company accounting alternatives and those that do not. Given the differences described herein, involving members from both a company’s financial reporting group and its tax group in the valuation process can create synergistic savings for the company in relation to the scope of the valuation analyses required subsequent to a transaction. Without coordination among these groups, each group may end up completing separate valuation analyses (which could be costly and inefficient), or the same analysis might be used for each purpose (which could be flawed based on the differences noted). A coordinated effort between each group will help keep costs at a minimum, ensure consistency among the valuation analyses, and result in conclusions that are appropriate with the respective accounting and tax regulations.

This is an updated version of an article published in the Spring 2012 issue of the Stout Journal.

- It should be noted that the FASB recently eliminated Step 2 from the goodwill impairment test in an effort to simplify accounting. Under the amendments, an entity should perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. An entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value, but the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. SEC filers are required to adopt the new standard for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Public business entities that are not SEC filers should adopt the standard for annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2020. All other entities, including not-for-profits, that are adopting the amendments should do so for their annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2021. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates on or after January 1, 2017.

- Please see the following articles for more information on valuation methods and the subsequent accounting treatment of contingent consideration instruments:

Cory Thompson, “M&A Facilitators: The Value of Earnouts,” The Journal, Spring 2011.

Ryan A. Gandre, “Risk and Reward: Valuing Contingent Consideration,” The Journal, Spring 2012.