Purchase Accounting 101: Intangible Asset Lives and Contingent Consideration

Purchase Accounting 101: Intangible Asset Lives and Contingent Consideration

Introduction

Under Accounting Standards Codification (“ASC”) 805 (formerly SFAS 141R), companies are required to use purchase accounting for business combinations. ASC 805 defines a business combination as “a transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ also are business combinations” The acquirer must allocate the purchase price (including any assumption of debt) among all the assets acquired for financial reporting purposes. Typically, the purchase price is assigned to tangible assets (including cash, net working capital, and net property, plant, and equipment) and intangible assets (including trade names, customer relationships, technology, etc., depending on the assets acquired). All of the assets and liabilities acquired need to be recognized on the opening balance sheet at Fair Value with limited exceptions outlined in the ASC 805.

This article provides a brief overview of select intangible asset categories and contingent consideration, discusses the applicable accounting guidance, and details three examples to illustrate the potential impact on net income (given several categories of intangible assets, different assumed lives for intangible assets, and various outcomes for contingent consideration payments).

Overview of Certain Identifiable Intangible Assets and Contingent Consideration

According to ASC 805, an asset is identifiable if it either:

“(1) Is separable, that is, capable of being separated or divided from the entity and sold, transferred, licensed, rented, or exchanged, either individually or together with a related contract, identifiable asset, or liability, regardless of whether the entity intends to do so; or (2) Arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.” An intangible asset is an asset that lacks physical substance. Below is a list of five broad intangible asset categories and examples of the types of intangible assets included in each broad category.

- Marketing-related: Trademarks, trade/brand names, service marks, logos, and non-compete agreements

- Customer-related: Customer contracts and relationships, customer lists, databases, open purchase orders, distributors, and sales routes

- Contract-based: Franchise and licensing agreements, permits and contracts, and supplier contracts

- Technology-based: Process and product patents, patent applications, proprietary processes and technology, engineering drawings, technical documentation, computer software and copyrights, formulas, and recipes

- Artistic-related: Musical composition, literary composition, and film copyrights

ASC 805 describes contingent consideration as “an obligation of the acquirer to transfer additional assets or equity interests to the former owners of an acquiree as part of the exchange for control of the acquiree if specified future events occur or conditions are met. However, contingent consideration also may give the acquirer the right to the return of previously transferred consideration if specified conditions are met.”

Contingent consideration can be employed as a form of purchase consideration in deal structures when material uncertainties exist with respect to the target’s performance subsequent to closing. Purchase consideration contingent on achieving a desired outcome aides in “closing the gap” in the valuation expectations of buyers and sellers and is dependent on the analysis of risk from the perspective of the counterparties in a negotiated transaction. The structure of contingent consideration can vary, which allows it to be customized for each transaction.

Applicable Accounting Guidance

The accounting literature pertaining to initial recognition of intangible assets and contingent consideration is covered in Financial Accounting Standards Board (“FASB”) ASC Topic 805, Business Combinations. Further, any asset that is measured at Fair Value must adhere to FASB ASC Topic 820, Fair Value Measurements and Disclosures (“FASB ASC 820”).

Any intangible asset assigned an indefinite life, such as certain trademarks, trade names, F.C.C. licenses, etc., is subject to annual impairment testing. Generally, there are few categories of intangible assets that meet the criteria of indefinite lived as the useful life of an intangible asset should only be considered indefinite if no legal, regulatory, contractual, competitive, economic, or other factors limit its useful life to the business. Financial Accounting Standards Board (“FASB”) ASC Topic 350, Intangibles-Goodwill and Other (“ASC 350”) provides guidance on the accounting for tangible and intangible assets subsequent to a business combination or asset acquisition.

As outlined in FASB ASC 805, the acquirer shall recognize the acquisition-date Fair Value of contingent consideration as part of the consideration transferred in exchange for the target company. Additionally, FASB ASC 805 provides that contingent consideration must be classified as an asset if the contingency is a clawback. If the contingency is an earnout, it must be classified as a liability if the settlement of the liability is tied to the issuance of a variable number of shares of common stock or is settled in cash. If the earnout is to be settled by a fixed number of shares, it is classified as equity. Because the asset or liability is required to be recognized at Fair Value, the amount initially recorded on the opening balance sheet will typically not tie to the amount specified in the purchase agreement.

The balance sheet classification of contingent consideration, as outlined in FASB ASC 805, determines whether it must be re-measured at each reporting period subsequent to initial recognition. Contingent consideration classified as equity does not require re-measurement and settlement is accounted for within the equity account. Contingent consideration classified as an asset or liability requires re-measurement at Fair Value at each reporting date until the contingency is extinguished. In this circumstance, changes in Fair Value are recognized on the income statement as a gain or loss.

Hypothetical Transaction Overview

In order to illustrate the potential impact that intangible assets and contingent consideration can have on a company’s future income statements, let’s assume Company A (the “Acquirer”), a leading multinational medical device company with revenues exceeding $5 billion, acquires 100% of Company B (the “Target”), a medical device company that focuses on medical robotic technology for a purchase price of approximately $850 million (which includes cash paid and assumption of debt, but excludes Fair Value of contingent consideration) on July 15, 2011 (the “Transaction Date”). As part of the purchase negotiations, Acquirer and Target did not initially agree on the purchase price as the Target’s owner felt the Target was worth more than the $850 million the acquirer offered for the Target. After negotiations, Acquirer agreed to pay an earnout 24 months after the Transaction Date in cash to Target’s owner if the Target achieved specified earnings before interest, taxes, depreciation, and amortization (“EBITDA”) for the next 24 months following the Transaction Date.

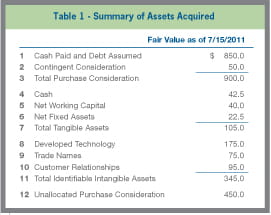

After performing due diligence and discussions with management, developed technology, trade names, and customer relationships are identified as identifiable intangible assets that will be valued and recognized on the opening balance sheet at Fair Value. Additionally, the contingent consideration is valued using a probability weighted DCF analysis as well as a Monte Carlo simulation. The Fair Value of the contingent consideration is included in the purchase consideration and recognized as a liability on the opening balance sheet. On the following page is a summary of the purchase consideration, tangible assets, and identifiable intangible assets of the Target.

Scenario One

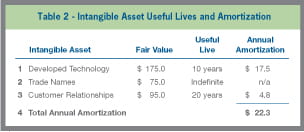

Let’s assume for Scenario One that management determined that the useful lives for the developed technology, trade names, and customer relationships is 10 years, indefinite lived, and 20 years, respectively. Based on the Fair Values of the intangible assets and the assigned useful lives, the annual amortization would be $22.3 million for the first 10 years and would impact future net income every year until all the long-lived intangible assets were fully amortized.

Scenario Two

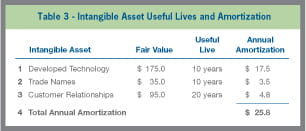

Similar to Scenario One, let’s assume in Scenario Two that management determined that the useful lives for the developed technology and customer relationships is 10 years and 20 years, respectively. In this scenario, management decided they would phase out use of the acquired trade name over the next 10 years as they transition all the acquired products and future products to the trade names previously owned by the Acquirer. Based on discussions with their valuation professionals and auditors, it is determined that market participants would follow a similar strategy. Let’s assume the trade names in this scenario have a Fair Value of $35 million. As summarized in the table below, the annual amortization would be $25.8 million for the first 10 years in this scenario and again would impact net income until all the intangible assets were fully amortized.

Scenario Three

Let’s assume it is 24 months since the Transaction Date and the performance of the Target has exceeded the specified EBITDA to trigger the earnout payment. Based on the earnout payout schedule in the purchase agreement, the Target’s former owners will be paid an earnout of $60 million. As the Fair Value of the earnout was $50 million as of the Transaction Date, the Acquirer’s will book a $10 million loss on the income statement (the difference in valuing being recognized at each reporting period based on the determination of Fair Value at that point in time as compared to the booked amount).

Conclusion

The complexity of valuing intangible assets and contingent consideration is significant and SRR continues to provide technical articles on each of these topics with varying degrees of granularity. In this article, we simply illustrate the high level importance of establishing useful lives of intangible assets, which can be based both on economic and qualitative factors. As illustrated, such assumptions can have a very significant impact from an earnings per share basis and is thus critical with respect to the capital markets. The introduction of recognizing contingent consideration as a liability adds a complex layer with respect to preparing your financial statements to conform to U.S. GAAP. An accurate assessment of the Fair Value of the liability is critical at the onset of a transaction as the changes in Fair Value are recognized at each reporting period until the contingency is resolved. Such changes in value conclusions are deemed to be future cash events reflecting the expectation of future payments, given the facts and circumstances known and available at the time. As such, careful consideration is warranted to ensure an accurate financial picture when communicating to the capital markets and investors.