How to Prepare for Potential Climate Change Disclosure Requirements

How to Prepare for Potential Climate Change Disclosure Requirements

The Securities and Exchange Commission proposed climate change disclosure requirements for both U.S. public companies and foreign private issuers in March. Companies should assess whether they are capable of complying with these proposed rules and identify where resources will need to be invested for compliance should the proposed rules become official.

The proposed rules are in part based on (but not identical to) the frameworks published by the Task Force on Climate-related Financial Disclosures and the Greenhouse Gas Protocol, and the requirements of the proposed rules would apply to:

- Annual reports on Forms 10-K and 20-F, with material changes to be reported quarterly on Form 10-Q

- IPO statements

- Spin-off statements

- Merger registration statements

Rather than creating a new standalone reporting form, as some corporate commenters had urged, the commission has proposed amending Regulation S-K and Regulation S-X to create a climate change reporting framework within existing Securities Act and Exchange Act forms.

Proposed Disclosures

The proposed climate change framework is prescriptive, detailed and extensive. For these reasons, compliance costs are expected to be significant. The SEC estimates that annual direct costs to comply with the proposed rules (including both internal and external resources) would range from $490,000 (smaller reporting companies) to $640,000 (non-smaller reporting companies) in the first year and $420,000 to $530,000 in subsequent years. However, these costs assume that companies already have the internal personnel and infrastructure/systems in place.

The proposed rule changes would also require a registrant to disclose information about:

- The registrant’s governance of climate-related risks and relevant risk management processes

- How any climate-related risks identified by the registrant have had or are likely to have a material impact on its business and consolidated financial statements, which may manifest over the short, medium or long term

- How any identified climate-related risks have affected or are likely to affect the registrant’s strategy, business model and outlook

- The impact of climate-related events (such as severe weather events and other natural conditions) and transition activities on the line items of a registrant’s consolidated financial statements, as well as on the financial estimates and assumptions used in the financial statements

- The registrant’s direct GHG emissions (Scope 1) and indirect GHG emissions from purchased electricity and other forms of energy (Scope 2), separately disclosed, expressed both by disaggregated constituent greenhouse gasses and in the aggregate, and in absolute terms, not including offsets, and in terms of intensity (per unit of economic value or production)

- Indirect emissions from upstream and downstream activities in a registrant’s value chain (Scope 3), if material, or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions, in absolute terms, not including offsets, and in terms of intensity, and others

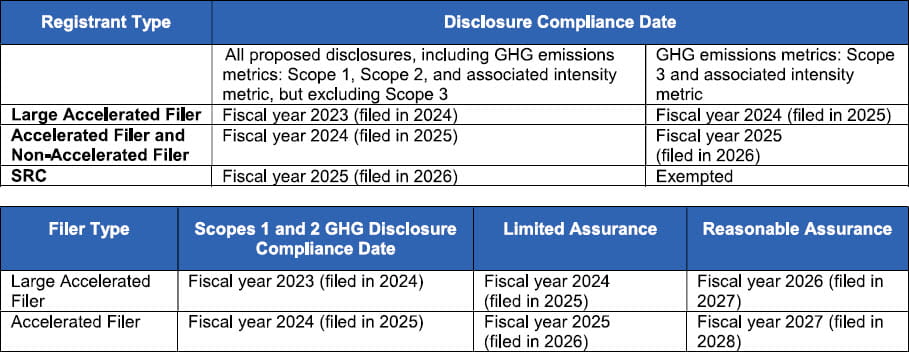

The proposed rule includes a phase-in period, depending on the registrant’s filer status.1

The proposed disclosure requirements would be in a new Article 14 of Regulation S-X and would require disclosure of three types of information surrounding certain climate-related items in a separate footnote to a filer’s annual audited financial statements: (1) financial impact metrics; (2) expenditure/cost metrics; and (3) financial estimates and assumptions.

The disclosures would only be required for filings that include audited financial statements. As such, quarterly reports on Form 10-Q would not require the disclosures. In addition, as the information would be included in the audited financial statements, it would come within scope of an independent, registered public accounting firm’s audit of the financials as well as a company’s internal control over financial reporting and related CEO and CFO certifications.

Relevance of the Proposed Rules

While the current focus is on the specific disclosure requirements and the proposal is quite prescriptive and lengthy, there are many questions that companies should be considering.

- How would the company track the required information? Are there current systems that can be utilized or will a new software need to be implemented?

- What controls and processes would need to be put into place? What controls, if any, are currently in place to gather the data? Where are the gaps in the data process? What controls and processes will need to be added to ensure complete and accurate reporting?

- Who should be the process owner with oversight of the controls and processes? Typically, these types of disclosures fall under the purview of the legal or compliance team. However, the disclosures will require an audit trail, proper documentation of process, and controls for Sarbanes-Oxley requirements. Companies should consider where the ownership of the information will best reside. Is it best housed in the controllership team, who may have the knowledge and skill set concerning controls over data to ensure consistency and accuracy of reporting? Should a separate governance committee be created?

- What is a climate event? While the proposed disclosure provides some examples, such as rising sea levels or extreme weather patterns, it is still quite ambiguous. Hurricanes and earthquakes would be easy climate events to identify, but would building a new warehouse be considered a climate event (since it takes natural resources to build and will require additional energy consumption)? Would knocking down a wooded grove to build the warehouse be considered a climate event?

- How does materiality fit into the disclosure requirements? The proposed disclosure standard currently is silent on materiality and how it applies to the standard, other than specific metrics and emission disclosures. How will materiality impact the disclosure requirements for the areas the guidance is silent on?

- With the new requirements, should companies revisit the disaggregation of line items on the statement of profit and loss and other comprehensive income? Under the current proposal, the climate-related financial metrics would need to be disclosed if the absolute value of the climate-related impacts or expenditures/costs represents at least 1% of that line item. Investors currently have been pushing for more disaggregated financial statements. However, with the 1% threshold, this would incentivize companies to have more aggregate financial statements to reduce the probability of the 1% threshold being met, which runs contrary to current investor desires. Finding the right balance may be tricky for companies, and many will have to prioritize and analyze what method is more meaningful for their investors and also balances additional costs of tracking.

Potential Responses to the Rule

Although the rules are only proposals at this stage, it’s not too early to start thinking about the potential implications of the proposed rules. Some items companies should start considering now are:

- Creating an oversight committee responsible for responding to formal climate change disclosure rules. The committee should consist of key stakeholders, including but not limited to the finance, manufacturing, production, IT and legal departments. The legal department holds an especially important role as it oversees much of a company’s compliance.

- Conducting a gap analysis against current or existing disclosures. Companies should start looking at what disclosures, if any, they include surrounding climate-related events, including in SEC filings and on their websites and compare them to the requirements of the proposed ruling. What gaps are noted? What potential software or controls might need to be put in place to close the gap?

- Assessing their current internal resources. Given the significant disclosure and tracking requirements, companies should assess if they currently have the internal resources in place. If not, companies should begin considering if they should hire additional internal resources or external service providers. Companies should start gathering information necessary for budgeting and organizational planning purposes. Companies should also begin assessing their current data collection practices, identifying the data that could be leveraged for the disclosure.

- Assessing their existing disclosure controls and procedures. This should also include internal control over financial reporting as it relates to the proposed Regulation S-X rules.

- Assessing their existing practices concerning evaluating climate-related risks. Companies should also consider whether any enhancements are warranted in how the board oversees them (e.g., whether at the full board level or a committee, frequency of monitoring, etc.) and how these risks are managed internally before the practices are subject to disclosure. Additional committees and procedures may need to be put in place.

- Considering the potential significance of Scope 3 emissions. That includes taking into consideration the company’s value chain.

- Discussing the implications with their outside auditors sooner rather than later. The right audit partner will help guide companies through their climate change disclosures and account for them on the balance sheet.

Implementing systems to collect, analyze, and account for climate-change-related data will likely not be a quick process, especially for companies that will need to build those systems from the ground up. Bottom line: Companies should begin assessing and identifying where in their organization gaps and resources are missing to begin aligning with the proposed rules.

Reprinted with permission from Accounting Today.

- Fact Sheet, “Enhancement and Standardization of Climate-Related Disclosures,” U.S. Securities and Exchange Commission.